Are rewards credit cards worth it In most cases, yes — as long as you're not carrying a balance (on which you will have to pay interest) and any annual fees charged by the card are less than the value of the rewards you earn each year. Here's what you need to consider when comparing your options.Benefits of Credit Card Reward Points

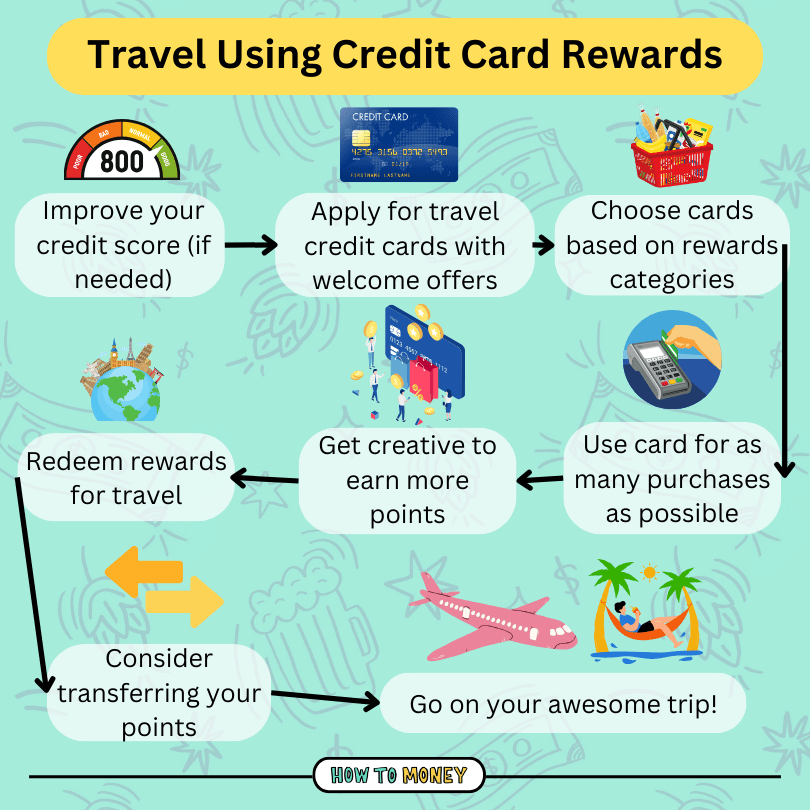

Depending on the type of card you hold, you can use your reward points to pay your annual fee. Cardholders can use their reward points to make flight or hotel bookings. Most credit cards also allow the cardholders to get a cashback using their reward points.If you're looking to reward yourself with some extra cash, it's worth considering at least one quality cash-back card to keep in your wallet. It's important to consider some of the drawbacks to cash-back cards, as well, like the cap on how much you can earn or even limited redemption options.

What are three drawbacks of having a rewards credit card : Three drawbacks of having a rewards credit card are high interest rates, potentially expensive annual fees, and terms and conditions that can be difficult to understand. While rewards credit cards are worth getting for many people, it's important to understand the potential downsides before applying for one.

Is it smart to pay with rewards

If the rewards you earn per dollar charged are only worth 2 cents each, then, no, you should not generally pay with your credit card. It's typically only worth paying a fee if the value you're earning on rewards credit card is more than the fee paid. But that math can get a little more involved on some cards.

Do you actually save money with credit cards : If you use credit cards strategically and do a little bit of research, you can actually save yourself a bit of cash in the long run. Yes, you read that right – credit cards saving you money! We've gathered up some helpful tips and information to help you get the most out of your credit cards.

around $10

1,000 reward points are worth around $10 , on average, but the exact value depends on which rewards program is offering the points and how you redeem them. In some cases, your reward points could be worth a lot more or a lot less. Currently displaying rows 1 to 2. Pro: Credit cards that offer rewards points could save you more than if you'd redeemed cash. Depending on your specific card, your credit card points could be worth more than $1 per point—offering you more value than if you'd been rewarded in cash.

Is 5% cashback worth it

If the bonus categories are in line with your spending, it can be smart to take advantage of a 5% cash-back card. The bonus rewards you earn during those periods could outweigh what you'd get using a flat-rate card that only earns 1% to 2% cash-back year-round.A 2% cash back credit card is a no-hassle, straightforward way to earn rewards. While you might earn more points on a travel card, redemption values and ways to redeem points on a travel rewards card can be more complicated. A flat-rate cash-back card can be a good choice to use as a foundation.If your spending on the flat-rate card is low because you use it only as the "everything else" card in conjunction with a bonus-category rewards card, the 1.5% card might be the better choice because you get that cash bonus quickly, assuming you earn the bonus by spending enough on the card soon after you get it. Rewards cards tend to have a higher annual percentage rate (APR) than non-rewards cards. You can avoid paying interest on your purchases if you pay off your balance in full each month. But carrying a balance will be more expensive, and a low-interest credit card could be a better alternative.

Is 1.5% rewards good : If your spending on the flat-rate card is low because you use it only as the "everything else" card in conjunction with a bonus-category rewards card, the 1.5% card might be the better choice because you get that cash bonus quickly, assuming you earn the bonus by spending enough on the card soon after you get it.

Is it better to earn cashback or points : As a general rule, credit cards earning points are geared more toward those consumers and businesses with specific redemption preferences and offer more opportunities for higher earnings in specific categories like travel, hotels or office supplies while cash-back earning credit cards usually are geared toward general …

What is the 50 30 20 rule

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. They advise against using your credit card to pay for things like rent, gas, cash advances, medical bills, buying a car, and expensive events like weddings. While it can be tempting to put everything on your debit card for budgeting purposes, there are financially savvy reasons to swipe your credit card.When it comes to air miles, a balance of 300,000 points opens up a world of destinations, from the beaches of the Seychelles to the buzz of San Francisco. Transfer your points to Avios to enjoy two return business class flights to some of British Airways most coveted US destinations.

What can 100000 points get you : Generally, 100,000 points are worth between $500 and $2,000. You'll usually see higher value with flexible rewards programs like Chase Ultimate Rewards and American Express Membership Rewards.

Antwort Is it worth it to use credit card rewards? Weitere Antworten – Are credit card rewards worth it

Are rewards credit cards worth it In most cases, yes — as long as you're not carrying a balance (on which you will have to pay interest) and any annual fees charged by the card are less than the value of the rewards you earn each year. Here's what you need to consider when comparing your options.Benefits of Credit Card Reward Points

Depending on the type of card you hold, you can use your reward points to pay your annual fee. Cardholders can use their reward points to make flight or hotel bookings. Most credit cards also allow the cardholders to get a cashback using their reward points.If you're looking to reward yourself with some extra cash, it's worth considering at least one quality cash-back card to keep in your wallet. It's important to consider some of the drawbacks to cash-back cards, as well, like the cap on how much you can earn or even limited redemption options.

What are three drawbacks of having a rewards credit card : Three drawbacks of having a rewards credit card are high interest rates, potentially expensive annual fees, and terms and conditions that can be difficult to understand. While rewards credit cards are worth getting for many people, it's important to understand the potential downsides before applying for one.

Is it smart to pay with rewards

If the rewards you earn per dollar charged are only worth 2 cents each, then, no, you should not generally pay with your credit card. It's typically only worth paying a fee if the value you're earning on rewards credit card is more than the fee paid. But that math can get a little more involved on some cards.

Do you actually save money with credit cards : If you use credit cards strategically and do a little bit of research, you can actually save yourself a bit of cash in the long run. Yes, you read that right – credit cards saving you money! We've gathered up some helpful tips and information to help you get the most out of your credit cards.

around $10

1,000 reward points are worth around $10 , on average, but the exact value depends on which rewards program is offering the points and how you redeem them. In some cases, your reward points could be worth a lot more or a lot less.

Currently displaying rows 1 to 2. Pro: Credit cards that offer rewards points could save you more than if you'd redeemed cash. Depending on your specific card, your credit card points could be worth more than $1 per point—offering you more value than if you'd been rewarded in cash.

Is 5% cashback worth it

If the bonus categories are in line with your spending, it can be smart to take advantage of a 5% cash-back card. The bonus rewards you earn during those periods could outweigh what you'd get using a flat-rate card that only earns 1% to 2% cash-back year-round.A 2% cash back credit card is a no-hassle, straightforward way to earn rewards. While you might earn more points on a travel card, redemption values and ways to redeem points on a travel rewards card can be more complicated. A flat-rate cash-back card can be a good choice to use as a foundation.If your spending on the flat-rate card is low because you use it only as the "everything else" card in conjunction with a bonus-category rewards card, the 1.5% card might be the better choice because you get that cash bonus quickly, assuming you earn the bonus by spending enough on the card soon after you get it.

Rewards cards tend to have a higher annual percentage rate (APR) than non-rewards cards. You can avoid paying interest on your purchases if you pay off your balance in full each month. But carrying a balance will be more expensive, and a low-interest credit card could be a better alternative.

Is 1.5% rewards good : If your spending on the flat-rate card is low because you use it only as the "everything else" card in conjunction with a bonus-category rewards card, the 1.5% card might be the better choice because you get that cash bonus quickly, assuming you earn the bonus by spending enough on the card soon after you get it.

Is it better to earn cashback or points : As a general rule, credit cards earning points are geared more toward those consumers and businesses with specific redemption preferences and offer more opportunities for higher earnings in specific categories like travel, hotels or office supplies while cash-back earning credit cards usually are geared toward general …

What is the 50 30 20 rule

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

They advise against using your credit card to pay for things like rent, gas, cash advances, medical bills, buying a car, and expensive events like weddings. While it can be tempting to put everything on your debit card for budgeting purposes, there are financially savvy reasons to swipe your credit card.When it comes to air miles, a balance of 300,000 points opens up a world of destinations, from the beaches of the Seychelles to the buzz of San Francisco. Transfer your points to Avios to enjoy two return business class flights to some of British Airways most coveted US destinations.

What can 100000 points get you : Generally, 100,000 points are worth between $500 and $2,000. You'll usually see higher value with flexible rewards programs like Chase Ultimate Rewards and American Express Membership Rewards.