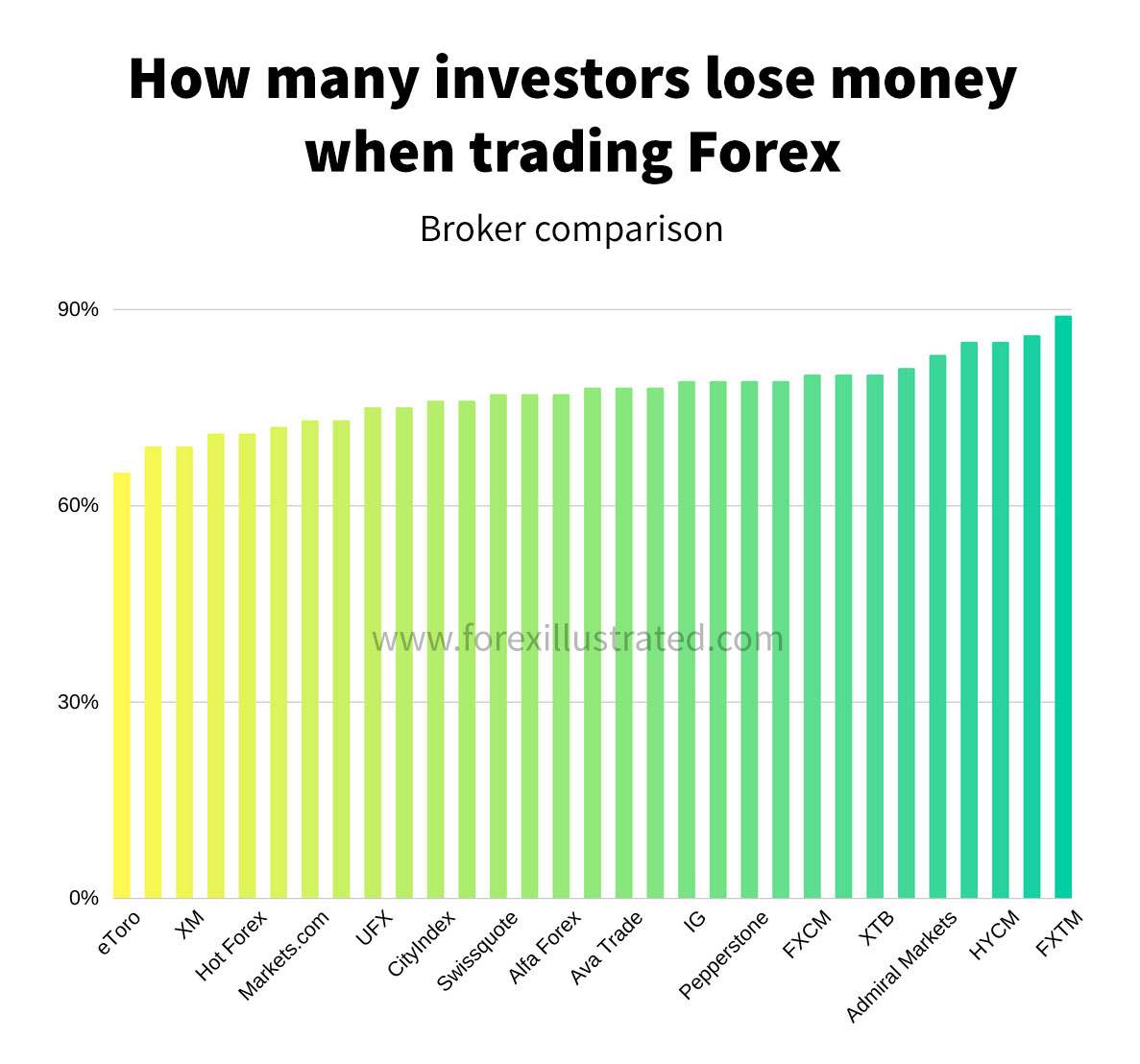

According to various studies and reports, between 70% to 90% of retail traders lose money every quarter. This article will discuss the main reasons retail traders lose money and how they can enhance their performance and profitability.It is a high-stakes game where many are lured by the promise of quick riches but ultimately face harsh realities. One of the harsh realities of trading is the “Rule of 90,” which suggests that 90% of new traders lose 90% of their starting capital within 90 days of their first trade.A report from the investment platform eToro suggests that 80% of its users lost money over a 12-month period. Other reports offer slightly different numbers, but none come close to suggesting that a majority of traders net a profit over long periods of time. Day trading is a dangerous game.

Why do 90% of people lose money in the stock market : Staggering data reveals 90% of retail investors underperform the broader market. Lack of patience and undisciplined trading behaviors cause most losses. Insufficient market knowledge and overconfidence lead to costly mistakes.

Why 99% of traders fail

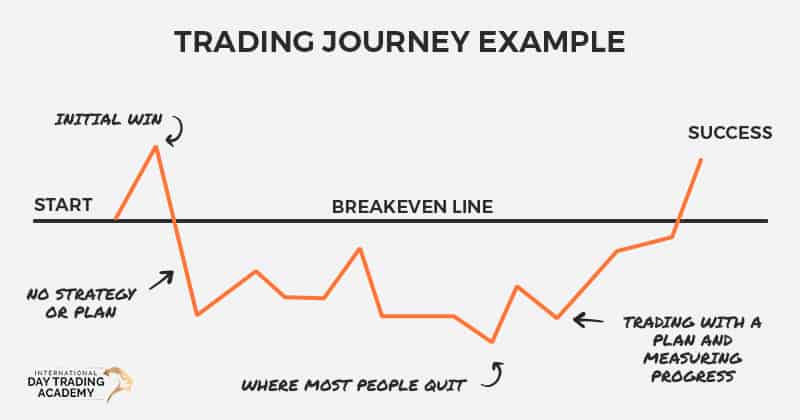

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices.

Why 95% of traders fail : The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses.

While it can be a lucrative venture for some, it is also known to be a high-risk activity. This is where the 90 rule in Forex comes into play. The 90 rule in Forex is a commonly cited statistic that states that 90% of Forex traders lose 90% of their money in the first 90 days.

The Rule of 90, also known as the 90/90/90 rule, is a sobering reality that exposes the unforgiving nature of trading. This rule states that 90% of inexperienced traders will suffer significant losses within the first 90 days of trading, resulting in a staggering 90% loss of their initial investment.

What is the 80% rule in day trading

Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area.The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses.The reason many forex traders fail is that they are undercapitalized in relation to the size of the trades they make. It is either greed or the prospect of controlling vast amounts of money with only a small amount of capital that coerces forex traders to take on such huge and fragile financial risk.

The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses.

Why 90% of forex traders fail : The reason many forex traders fail is that they are undercapitalized in relation to the size of the trades they make. It is either greed or the prospect of controlling vast amounts of money with only a small amount of capital that coerces forex traders to take on such huge and fragile financial risk.

Do 97 day traders lose money : However, the harsh reality is that the vast majority of day traders lose money. In fact, studies have shown that a staggering 97% of day traders end up in the red. This statistic is not only staggering, but it's also incredibly disheartening for those who are considering day trading as a means of making a living.

Why do 99 traders lose money

The ones that try to squeeze the market for disproportionate returns only end up loosing money and in turn creating those very inefficiencies. This is one of the most important reasons why most people fail to make money in the markets. Unrealistic expectations. First of all, you're misquoting Zerodha (Nithin).

Achieving a consistent 20% monthly profit in forex is possible but highly challenging. It requires aggressive trading strategies, excellent risk management, strong emotional control, and a deep understanding of market conditions. High returns often involve higher risk and leverage, which can lead to substantial losses.But most traders may also sustain considerable losses because they have do not have enough initial capital to get them through to the potential next win. For the majority of professional traders, the average Forex monthly return is between 1 to 10 per cent per month.

What is the 9090 rule : What Is the 90/90 Rule Created by Joshua Fields Millburn and Ryan Nicodemus of The Minimalists, the 90/90 rule is a decluttering process that requires you to ask yourself two questions about objects you're not sure about: Have you used it in the past 90 days And if not, will you use it in the 90 days ahead

Antwort Is it true that 90% of traders lose money? Weitere Antworten – Do 90% of traders lose money

According to various studies and reports, between 70% to 90% of retail traders lose money every quarter. This article will discuss the main reasons retail traders lose money and how they can enhance their performance and profitability.It is a high-stakes game where many are lured by the promise of quick riches but ultimately face harsh realities. One of the harsh realities of trading is the “Rule of 90,” which suggests that 90% of new traders lose 90% of their starting capital within 90 days of their first trade.A report from the investment platform eToro suggests that 80% of its users lost money over a 12-month period. Other reports offer slightly different numbers, but none come close to suggesting that a majority of traders net a profit over long periods of time. Day trading is a dangerous game.

Why do 90% of people lose money in the stock market : Staggering data reveals 90% of retail investors underperform the broader market. Lack of patience and undisciplined trading behaviors cause most losses. Insufficient market knowledge and overconfidence lead to costly mistakes.

Why 99% of traders fail

The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices.

Why 95% of traders fail : The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses.

While it can be a lucrative venture for some, it is also known to be a high-risk activity. This is where the 90 rule in Forex comes into play. The 90 rule in Forex is a commonly cited statistic that states that 90% of Forex traders lose 90% of their money in the first 90 days.

The Rule of 90, also known as the 90/90/90 rule, is a sobering reality that exposes the unforgiving nature of trading. This rule states that 90% of inexperienced traders will suffer significant losses within the first 90 days of trading, resulting in a staggering 90% loss of their initial investment.

What is the 80% rule in day trading

Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area.The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses.The reason many forex traders fail is that they are undercapitalized in relation to the size of the trades they make. It is either greed or the prospect of controlling vast amounts of money with only a small amount of capital that coerces forex traders to take on such huge and fragile financial risk.

The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses.

Why 90% of forex traders fail : The reason many forex traders fail is that they are undercapitalized in relation to the size of the trades they make. It is either greed or the prospect of controlling vast amounts of money with only a small amount of capital that coerces forex traders to take on such huge and fragile financial risk.

Do 97 day traders lose money : However, the harsh reality is that the vast majority of day traders lose money. In fact, studies have shown that a staggering 97% of day traders end up in the red. This statistic is not only staggering, but it's also incredibly disheartening for those who are considering day trading as a means of making a living.

Why do 99 traders lose money

The ones that try to squeeze the market for disproportionate returns only end up loosing money and in turn creating those very inefficiencies. This is one of the most important reasons why most people fail to make money in the markets. Unrealistic expectations. First of all, you're misquoting Zerodha (Nithin).

Achieving a consistent 20% monthly profit in forex is possible but highly challenging. It requires aggressive trading strategies, excellent risk management, strong emotional control, and a deep understanding of market conditions. High returns often involve higher risk and leverage, which can lead to substantial losses.But most traders may also sustain considerable losses because they have do not have enough initial capital to get them through to the potential next win. For the majority of professional traders, the average Forex monthly return is between 1 to 10 per cent per month.

What is the 9090 rule : What Is the 90/90 Rule Created by Joshua Fields Millburn and Ryan Nicodemus of The Minimalists, the 90/90 rule is a decluttering process that requires you to ask yourself two questions about objects you're not sure about: Have you used it in the past 90 days And if not, will you use it in the 90 days ahead