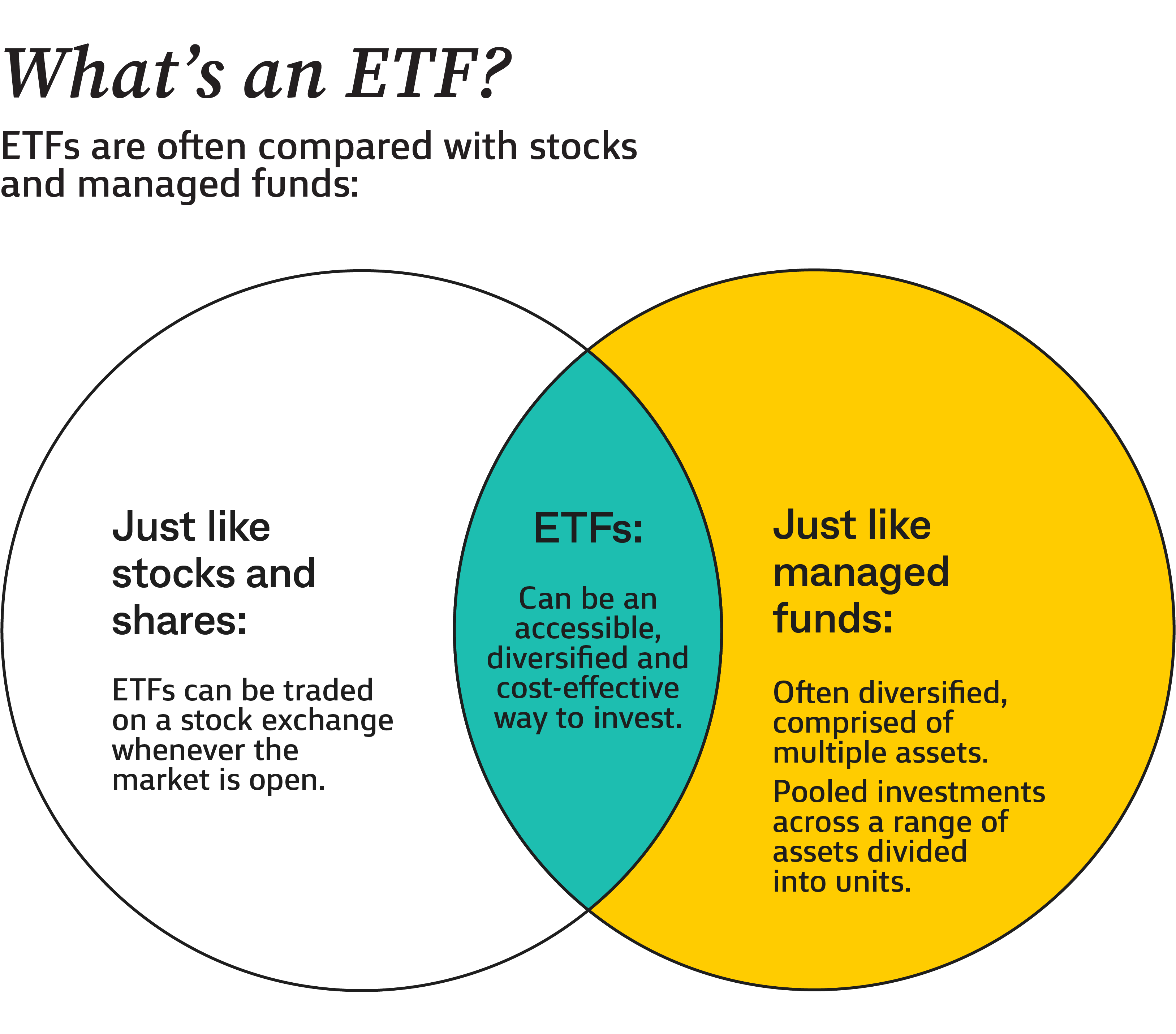

An index ETF-only portfolio can be a straightforward yet flexible investment solution. There are plenty of advantages in using exchange-traded funds (ETFs) to fill gaps in an investment portfolio, and lots of investors mix and match ETFs with mutual funds and individual stocks and bonds in their accounts.If you're looking for an easy solution to investing, ETFs can be an excellent choice. ETFs typically offer a diversified allocation to whatever you're investing in (stocks, bonds or both). You want to beat most investors, even the pros, with little effort.Generally speaking, fewer than 10 ETFs are likely enough to diversify your portfolio, but this will vary depending on your financial goals, ranging from retirement savings to income generation.

Is it risky to invest in ETFs : Key takeaways. ETFs have some structural advantages relative to mutual funds but it's important to remember that ETFs have risks like all investments. Five of the key ETF risks to consider include: market risk, tracking error, liquidity, sector concentration, and single-stock concentration.

Is it wise to only invest in the S&P 500

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Do ETFs ever go to zero : Leveraged ETF prices tend to decay over time, and triple leverage will tend to decay at a faster rate than 2x leverage. As a result, they can tend toward zero.

For most standard, unleveraged ETFs that track an index, the maximum you can theoretically lose is the amount you invested, driving your investment value to zero. However, it's rare for broad-market ETFs to go to zero unless the entire market or sector it tracks collapses entirely. For instance, some ETFs may come with fees, others might stray from the value of the underlying asset, ETFs are not always optimized for taxes, and of course — like any investment — ETFs also come with risk.

Is 5 ETFs too much

Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification. But the number of ETFs is not what you should be looking at.Holding an ETF for longer than a year may get you a more favorable capital gains tax rate when you sell your investment.There is a lesser chance of ETF share prices being higher or lower than those of underlying shares. ETFs trade throughout the day at a price close to the price of the underlying securities, so if the price is significantly higher or lower than the net asset value, arbitrage will bring the price back in line. Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is S&P 500 too risky : What are the risks associated with investing in the S&P 500 The S&P 500 carries market risk, as its value fluctuates with overall market performance, as well as the performance of heavily weighted stocks and sectors.

Why avoid ETF : Market risk

The single biggest risk in ETFs is market risk. Like a mutual fund or a closed-end fund, ETFs are only an investment vehicle—a wrapper for their underlying investment. So if you buy an S&P 500 ETF and the S&P 500 goes down 50%, nothing about how cheap, tax efficient, or transparent an ETF is will help you.

How long should I stay in an ETF

Holding an ETF for longer than a year may get you a more favorable capital gains tax rate when you sell your investment. Low Liquidity

If an ETF is thinly traded, there can be problems getting out of the investment, depending on the size of your position relative to the average trading volume. The biggest sign of an illiquid investment is large spreads between the bid and the ask.The low investment threshold for most ETFs makes it easy for a beginner to implement a basic asset allocation strategy that matches their investment time horizon and risk tolerance. For example, young investors might be 100% invested in equity ETFs when they are in their 20s.

What is the 4% rule for ETF : This is commonly referred to as The 4% Rule. The Trinity Study found that you can 'safely' sell off 4% of your total ETF investments once each year, and they 'should' last the next 30 years before you run out.

Antwort Is it OK to just invest in ETFs? Weitere Antworten – Is it OK to invest only in ETFs

An index ETF-only portfolio can be a straightforward yet flexible investment solution. There are plenty of advantages in using exchange-traded funds (ETFs) to fill gaps in an investment portfolio, and lots of investors mix and match ETFs with mutual funds and individual stocks and bonds in their accounts.If you're looking for an easy solution to investing, ETFs can be an excellent choice. ETFs typically offer a diversified allocation to whatever you're investing in (stocks, bonds or both). You want to beat most investors, even the pros, with little effort.Generally speaking, fewer than 10 ETFs are likely enough to diversify your portfolio, but this will vary depending on your financial goals, ranging from retirement savings to income generation.

Is it risky to invest in ETFs : Key takeaways. ETFs have some structural advantages relative to mutual funds but it's important to remember that ETFs have risks like all investments. Five of the key ETF risks to consider include: market risk, tracking error, liquidity, sector concentration, and single-stock concentration.

Is it wise to only invest in the S&P 500

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Do ETFs ever go to zero : Leveraged ETF prices tend to decay over time, and triple leverage will tend to decay at a faster rate than 2x leverage. As a result, they can tend toward zero.

For most standard, unleveraged ETFs that track an index, the maximum you can theoretically lose is the amount you invested, driving your investment value to zero. However, it's rare for broad-market ETFs to go to zero unless the entire market or sector it tracks collapses entirely.

For instance, some ETFs may come with fees, others might stray from the value of the underlying asset, ETFs are not always optimized for taxes, and of course — like any investment — ETFs also come with risk.

Is 5 ETFs too much

Experts agree that for most personal investors, a portfolio comprising 5 to 10 ETFs is perfect in terms of diversification. But the number of ETFs is not what you should be looking at.Holding an ETF for longer than a year may get you a more favorable capital gains tax rate when you sell your investment.There is a lesser chance of ETF share prices being higher or lower than those of underlying shares. ETFs trade throughout the day at a price close to the price of the underlying securities, so if the price is significantly higher or lower than the net asset value, arbitrage will bring the price back in line.

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is S&P 500 too risky : What are the risks associated with investing in the S&P 500 The S&P 500 carries market risk, as its value fluctuates with overall market performance, as well as the performance of heavily weighted stocks and sectors.

Why avoid ETF : Market risk

The single biggest risk in ETFs is market risk. Like a mutual fund or a closed-end fund, ETFs are only an investment vehicle—a wrapper for their underlying investment. So if you buy an S&P 500 ETF and the S&P 500 goes down 50%, nothing about how cheap, tax efficient, or transparent an ETF is will help you.

How long should I stay in an ETF

Holding an ETF for longer than a year may get you a more favorable capital gains tax rate when you sell your investment.

Low Liquidity

If an ETF is thinly traded, there can be problems getting out of the investment, depending on the size of your position relative to the average trading volume. The biggest sign of an illiquid investment is large spreads between the bid and the ask.The low investment threshold for most ETFs makes it easy for a beginner to implement a basic asset allocation strategy that matches their investment time horizon and risk tolerance. For example, young investors might be 100% invested in equity ETFs when they are in their 20s.

What is the 4% rule for ETF : This is commonly referred to as The 4% Rule. The Trinity Study found that you can 'safely' sell off 4% of your total ETF investments once each year, and they 'should' last the next 30 years before you run out.