A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.Selection criteria

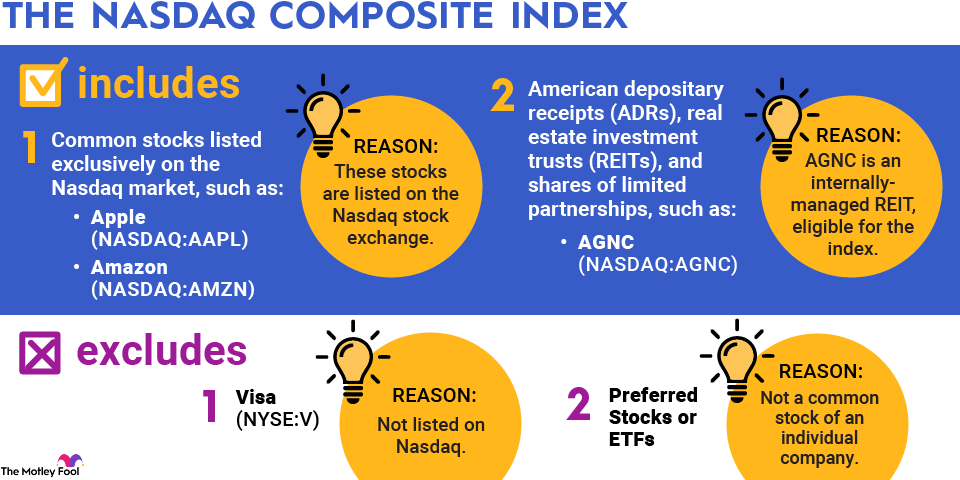

The Nasdaq has refined a series of stringent standards which companies must meet to be indexed. Those standards include: Being listed exclusively on Nasdaq in either the Global Select or Global Market tiers. Being publicly offered on an established American market for at least three months.

How do I uplist to Nasdaq : Nasdaq Uplisting Requirements

At least 100 shares and 550 shareholders. Cash flow of at least $27.5 million in the last three fiscal years. Aggregate pre-tax earnings in the prior three years of at least $11 million or pre-tax earnings in the previous two years of at least $2.2 million.

Can anyone list on Nasdaq

The Nasdaq has four sets of listing requirements. Each company must meet at least one of the four requirement sets, as well as the main rules for all companies. In addition to these requirements, companies must meet all of the criteria under a particular set of standards.

How hard is it to list on Nasdaq : General Nasdaq Listing Rules

For example, the Nasdaq minimum share price or bid price for inclusion is $4. It's possible to qualify with a bid price below that amount but that may entail meeting additional requirements. Companies must also have at least 1.25 million publicly traded shares outstanding.

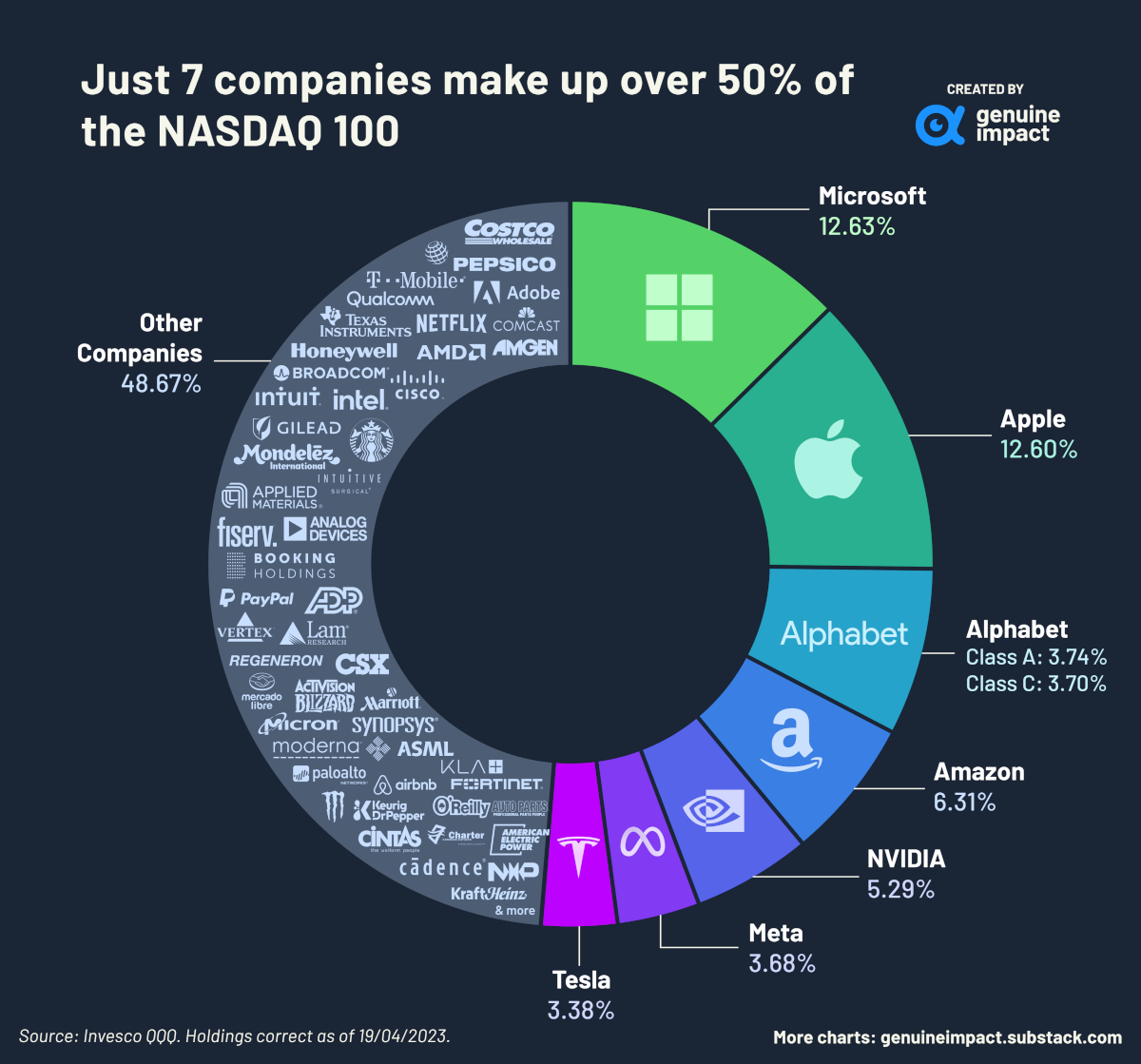

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%. In terms of annualized returns, NDX registered 14.3% returns as compared to 9.2% for S&P 500 with an annualized volatility of 23% versus 21%. Overall, the Nasdaq-100 has outperformed 11 out of the last 15 calendar years, and on pace to do so by a wide margin in 2023.

Is it easy to list on Nasdaq

Listing with Nasdaq. Nasdaq has three market tiers: the Nasdaq Global Select Market, the Nasdaq Global Market, and the Nasdaq Capital Market. Applicants must satisfy certain financial, liquidity and corporate governance requirements to be approved for listing on any of these market tiers.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies. General Nasdaq Listing Rules

For example, the Nasdaq minimum share price or bid price for inclusion is $4. It's possible to qualify with a bid price below that amount but that may entail meeting additional requirements. Companies must also have at least 1.25 million publicly traded shares outstanding.

What is the 10 minute rule for Nasdaq : If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.

Is Nasdaq-100 a good investment : In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. Looking at the 55% eye-popping returns in 2023, many Indian investors are looking at ways of investing in the NASDAQ out of sheer FOMO (Fear of Missing Out).

Do most investors beat the S&P 500

Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed. It's safe to invest in the stocks that make up the Nasdaq 100 — as long as you have a long time horizon. Historically, the Nasdaq 100 has smashed the S&P 500 in terms of returns. But tech stocks tend to be more volatile than the overall stock market and perform especially poorly during recessions.The Nasdaq is known for technology and innovation and is home to digital, biotechnology, and other companies at the cutting edge. As such, stocks listed on the Nasdaq are considered growth-oriented and more volatile. In contrast, companies that list on the NYSE are perceived as more stable and well-established.

What is the Nasdaq 20% rule : Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.

Antwort Is it hard to get listed on Nasdaq? Weitere Antworten – How to go public on Nasdaq

HOW TO LIST A COMPANY ON NASDAQ

A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.Selection criteria

The Nasdaq has refined a series of stringent standards which companies must meet to be indexed. Those standards include: Being listed exclusively on Nasdaq in either the Global Select or Global Market tiers. Being publicly offered on an established American market for at least three months.

How do I uplist to Nasdaq : Nasdaq Uplisting Requirements

At least 100 shares and 550 shareholders. Cash flow of at least $27.5 million in the last three fiscal years. Aggregate pre-tax earnings in the prior three years of at least $11 million or pre-tax earnings in the previous two years of at least $2.2 million.

Can anyone list on Nasdaq

The Nasdaq has four sets of listing requirements. Each company must meet at least one of the four requirement sets, as well as the main rules for all companies. In addition to these requirements, companies must meet all of the criteria under a particular set of standards.

How hard is it to list on Nasdaq : General Nasdaq Listing Rules

For example, the Nasdaq minimum share price or bid price for inclusion is $4. It's possible to qualify with a bid price below that amount but that may entail meeting additional requirements. Companies must also have at least 1.25 million publicly traded shares outstanding.

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

In terms of annualized returns, NDX registered 14.3% returns as compared to 9.2% for S&P 500 with an annualized volatility of 23% versus 21%. Overall, the Nasdaq-100 has outperformed 11 out of the last 15 calendar years, and on pace to do so by a wide margin in 2023.

Is it easy to list on Nasdaq

Listing with Nasdaq. Nasdaq has three market tiers: the Nasdaq Global Select Market, the Nasdaq Global Market, and the Nasdaq Capital Market. Applicants must satisfy certain financial, liquidity and corporate governance requirements to be approved for listing on any of these market tiers.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.

General Nasdaq Listing Rules

For example, the Nasdaq minimum share price or bid price for inclusion is $4. It's possible to qualify with a bid price below that amount but that may entail meeting additional requirements. Companies must also have at least 1.25 million publicly traded shares outstanding.

What is the 10 minute rule for Nasdaq : If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.

Is Nasdaq-100 a good investment : In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. Looking at the 55% eye-popping returns in 2023, many Indian investors are looking at ways of investing in the NASDAQ out of sheer FOMO (Fear of Missing Out).

Do most investors beat the S&P 500

Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed.

It's safe to invest in the stocks that make up the Nasdaq 100 — as long as you have a long time horizon. Historically, the Nasdaq 100 has smashed the S&P 500 in terms of returns. But tech stocks tend to be more volatile than the overall stock market and perform especially poorly during recessions.The Nasdaq is known for technology and innovation and is home to digital, biotechnology, and other companies at the cutting edge. As such, stocks listed on the Nasdaq are considered growth-oriented and more volatile. In contrast, companies that list on the NYSE are perceived as more stable and well-established.

What is the Nasdaq 20% rule : Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.