The sharp declines in stock prices that occur during a crisis or recession may present good opportunities to invest. Some companies may be undervalued by the market. Others may have a business model that makes them more resilient to an economic downturn.As a general rule, it's safer to double down and invest when the market as a whole is down instead of trying to snatch up individual stocks that are bottoming out. Down markets offer a unique blend of risk and reward. But as any savvy investor will tell you, market conditions should not dictate investment strategy.Another way to make money on a crisis is to bet that one will happen. Short-selling stocks or short equity index futures is one way to profit from a bear market. A short seller borrows shares they don't already own to sell them and, hopefully, repurchase them at a lower price.

Should I buy stocks when they are low or high : The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With that in mind, buying a stock when it is down may be a good idea – and better than buying a stock when it is high.

Do I lose all my money if the stock market crashes

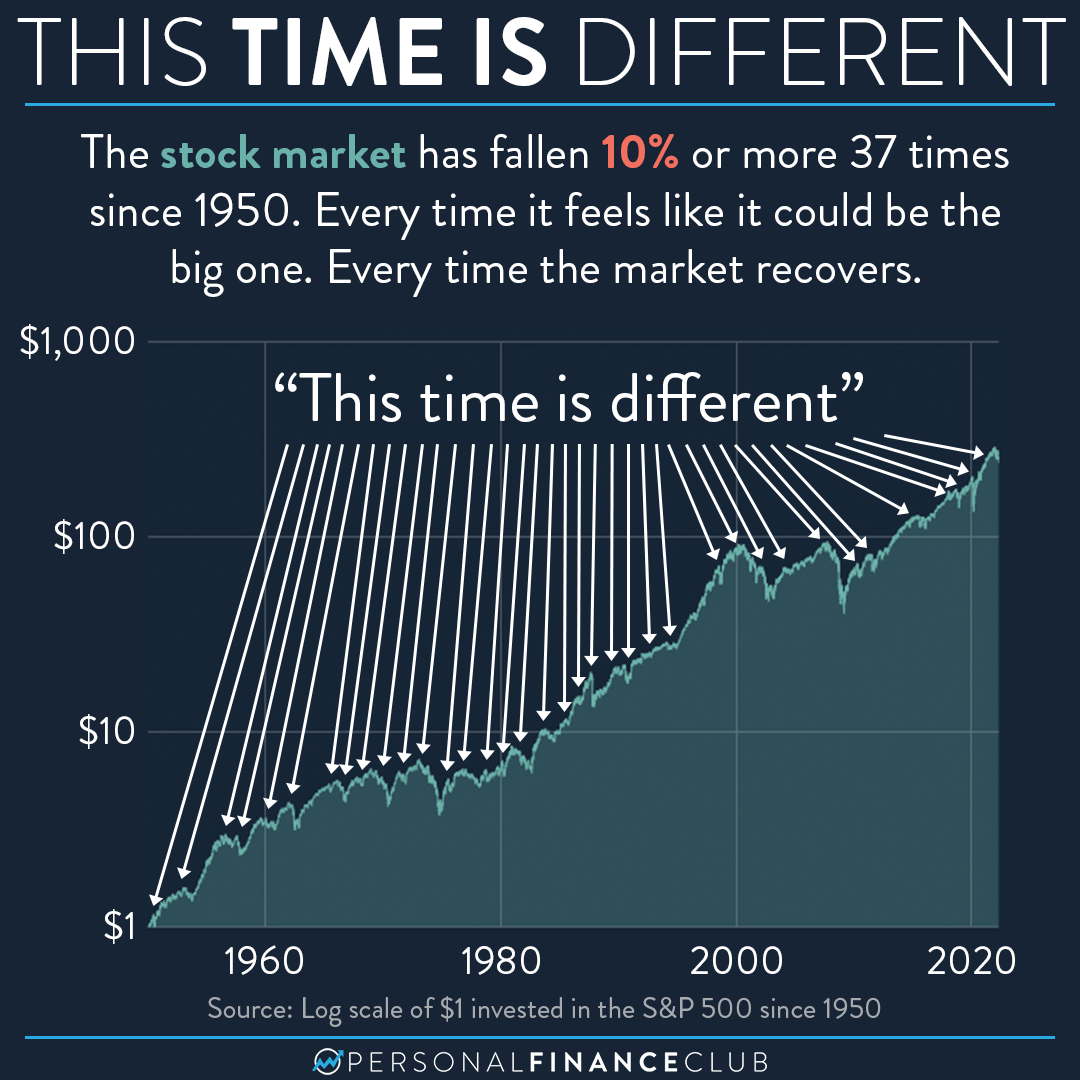

Even if your brokerage account suffers a loss of value, you have a chance to regain and even exceed the loss as the stock price recovers—as long as you don't sell your shares.

Should I sell before a crash : The top strategist explained that selling stocks well before they crash can yield outsized returns. Dietrich predicted a mild US recession this year based on multiple warning signs and threats.

While selling stocks during a market downturn might make you feel better temporarily, doing so reactively because stocks are tumbling isn't a good long-term investment strategy. Volatility is a normal part of investing in the stock market, so occasional market selloffs should be expected. Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Is 20% a market crash

A bear market is a pullback of at least a 20% decline from a recent high.If the stock price falls, the short seller profits by buying the stock at the lower price and closing out the trade. The net difference between the sale and buy prices is settled with the broker. The offers that appear in this table are from partnerships from which Investopedia receives compensation.Traders that follow the 10 a.m. rule think a stock's price trajectory is relatively set for the day by the end of that half-hour. For example, if a stock closed at $40 the previous day, opened at $42 the next, and reached $43 by 10 a.m., this would indicate that the stock is likely to remain above $42 by market close. On many tickers, colors are also used to indicate how the stock is trading. Here is the color scheme most platforms use: Green indicates the stock is trading higher than the previous day's close. Red indicates the stock is trading lower than the previous day's close.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Why do 90% of people lose money in the stock market : Staggering data reveals 90% of retail investors underperform the broader market. Lack of patience and undisciplined trading behaviors cause most losses. Insufficient market knowledge and overconfidence lead to costly mistakes.

What is the 3-5-7 rule in trading

The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade. Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.Analysts project 11.5% earnings growth and 5.5% revenue growth for S&P 500 companies in 2024.

Will stock market bounce back in 2024 : Earnings Rebound

Analysts are projecting S&P 500 earnings growth will accelerate to 9.7% in the second quarter and S&P 500 companies will report an impressive 10.8% earnings growth for the full calendar year in 2024.

Antwort Is it good to buy during a market crash? Weitere Antworten – Is it good to invest during a market crash

Reasons to invest more—or not

The sharp declines in stock prices that occur during a crisis or recession may present good opportunities to invest. Some companies may be undervalued by the market. Others may have a business model that makes them more resilient to an economic downturn.As a general rule, it's safer to double down and invest when the market as a whole is down instead of trying to snatch up individual stocks that are bottoming out. Down markets offer a unique blend of risk and reward. But as any savvy investor will tell you, market conditions should not dictate investment strategy.Another way to make money on a crisis is to bet that one will happen. Short-selling stocks or short equity index futures is one way to profit from a bear market. A short seller borrows shares they don't already own to sell them and, hopefully, repurchase them at a lower price.

Should I buy stocks when they are low or high : The best time to buy a stock is when an investor has done their research and due diligence, and decided that the investment fits their overall strategy. With that in mind, buying a stock when it is down may be a good idea – and better than buying a stock when it is high.

Do I lose all my money if the stock market crashes

Even if your brokerage account suffers a loss of value, you have a chance to regain and even exceed the loss as the stock price recovers—as long as you don't sell your shares.

Should I sell before a crash : The top strategist explained that selling stocks well before they crash can yield outsized returns. Dietrich predicted a mild US recession this year based on multiple warning signs and threats.

While selling stocks during a market downturn might make you feel better temporarily, doing so reactively because stocks are tumbling isn't a good long-term investment strategy. Volatility is a normal part of investing in the stock market, so occasional market selloffs should be expected.

Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Is 20% a market crash

A bear market is a pullback of at least a 20% decline from a recent high.If the stock price falls, the short seller profits by buying the stock at the lower price and closing out the trade. The net difference between the sale and buy prices is settled with the broker. The offers that appear in this table are from partnerships from which Investopedia receives compensation.Traders that follow the 10 a.m. rule think a stock's price trajectory is relatively set for the day by the end of that half-hour. For example, if a stock closed at $40 the previous day, opened at $42 the next, and reached $43 by 10 a.m., this would indicate that the stock is likely to remain above $42 by market close.

On many tickers, colors are also used to indicate how the stock is trading. Here is the color scheme most platforms use: Green indicates the stock is trading higher than the previous day's close. Red indicates the stock is trading lower than the previous day's close.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Why do 90% of people lose money in the stock market : Staggering data reveals 90% of retail investors underperform the broader market. Lack of patience and undisciplined trading behaviors cause most losses. Insufficient market knowledge and overconfidence lead to costly mistakes.

What is the 3-5-7 rule in trading

The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade.

Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.Analysts project 11.5% earnings growth and 5.5% revenue growth for S&P 500 companies in 2024.

Will stock market bounce back in 2024 : Earnings Rebound

Analysts are projecting S&P 500 earnings growth will accelerate to 9.7% in the second quarter and S&P 500 companies will report an impressive 10.8% earnings growth for the full calendar year in 2024.