While many banks and credit unions don't charge such a fee, others may charge between $5 and $50 to customers who don't hold onto their account for more than a few months.If you don't deposit funds as outlined in your bank's terms and conditions, they could close your account. Similarly, banks may pull the plug on your account if you fail to maintain their minimum balance requirement.When you close a bank account, your bank will likely require you to withdraw all funds before the account is considered fully closed. If your account was closed by the bank, you'll need to get in touch to ask how to access your funds.

Can a closed bank account still be charged : Generally, a recurring charge is based on an agreement between you, as the account holder, and the merchant. Because the bank was not a party to that agreement, the bank cannot cancel it for you. You need to instruct the merchant to stop debiting your account before you close the account.

How do I permanently close my bank account

Contact Your Bank

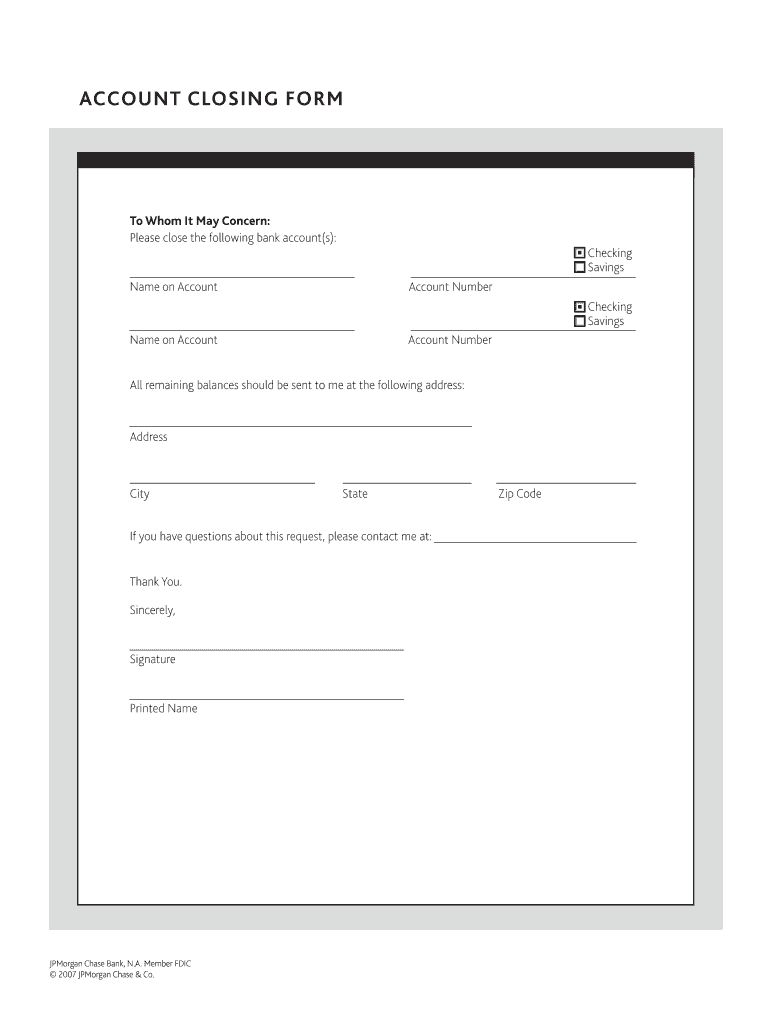

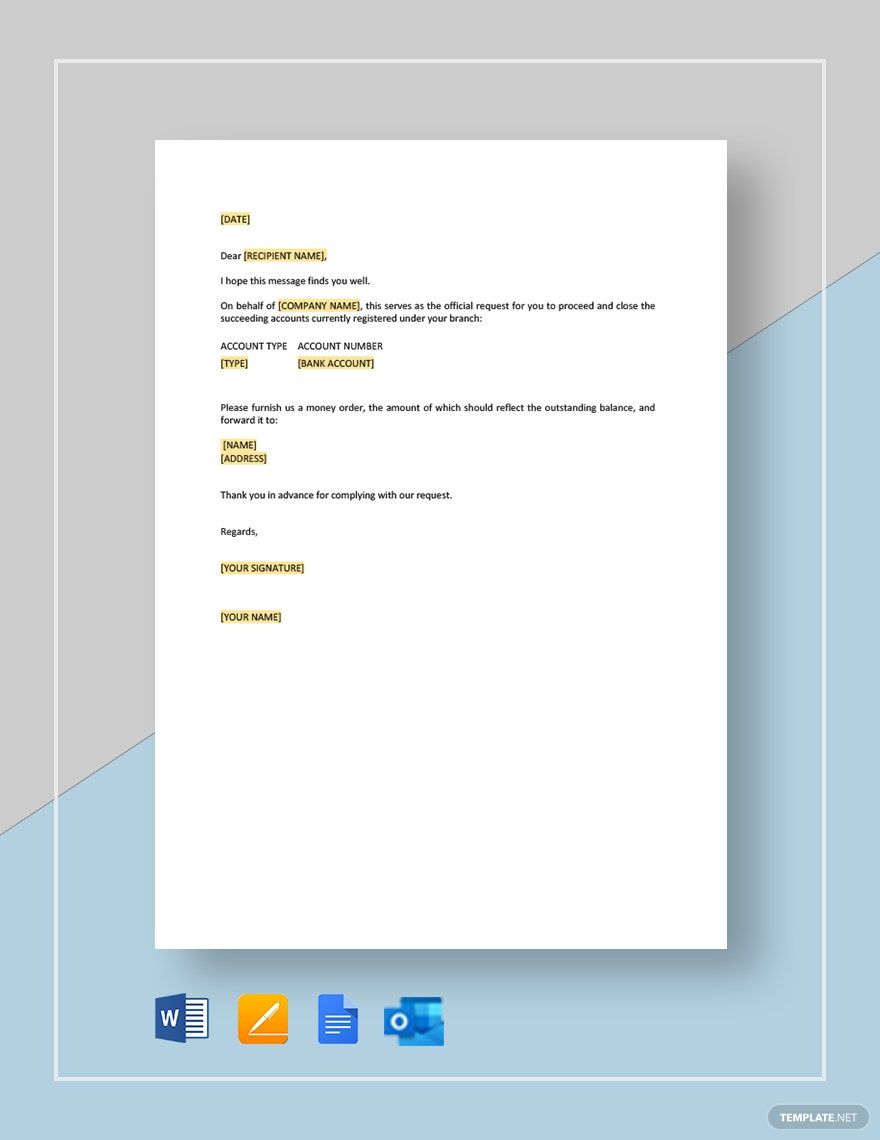

Although financial institutions allow you to do this online, they may require you to make a phone call to customer service or a visit to a local bank branch. Some banks and credit unions may require you to fill out an account closure request form or submit a written request.

What happens if you never use a bank account : Neglected bank accounts can be closed due to inactivity. If your bank doesn't have a way to contact you, it might turn your money over to your state as unclaimed funds.

Cancel your bank account. Although financial institutions allow you to do this online, they may require you to make a phone call to customer service or a visit to a local bank branch. Some banks and credit unions may require you to fill out an account closure request form or submit a written request. Accounts that have been open for a long time may have a positive impact on your credit score so if you decide to close some accounts to help your credit score, start by looking at inactive accounts that you no longer use. The general guidance is that you should aim to have fewer, well-managed credit accounts.

Can I permanently close my bank account online

Your savings account cannot be closed online. You must visit your bank's home branch where the account has been opened and request to close your account. Fill in the account closure form and enter the details requested in the account closure form correctly.You would face a penalty from the bank

As you must already know, your Savings Account needs a minimum balance or else a penalty charge is levied on it.If your account contains no money, the bank might close it. Simply because an account says there are no minimums, does not mean the account should remain empty for days or months. The time frame will vary based on your individual bank and its practices. Most accounts have to be closed either by visiting us in branch or online using the Internet Bank or Banking app.

Can you completely close a bank account : If you just want to close, contact your bank

You can usually request this: online. by phone or live chat. in person.

What happens if my bank account is zero : In a regular savings account, a penalty charge gets levied by the bank if you have no balance in your savings account. But that is not the case for a zero balance account. In a zero-balance account, no penalty gets levied if you have zero balance in your account, as you do not need to maintain a minimum balance there.

What happens if you never use a bank

Risks of being unbanked

You'll pay fees for alternative services such as check cashing and prepaid debit cards. Not having a bank-issued debit card can mean you'll need to carry cash, which might not be recovered if lost or stolen. If you don't use your account for a long period of time the bank or building society may declare it dormant, but the length of time before this happens will vary between institutions. It could be as little as 12 months for a current account, three years for a savings account, or in some cases up to 15 years.Contact Your Bank

Although financial institutions allow you to do this online, they may require you to make a phone call to customer service or a visit to a local bank branch. Some banks and credit unions may require you to fill out an account closure request form or submit a written request.

Is it bad to have empty bank accounts : Does having a dormant bank account affect my credit score Only dormant credit accounts will affect your credit score as that involves you borrowing money. A dormant savings account won't impact you credit rating.

Antwort Is it free to close a bank account? Weitere Antworten – Is there a fee to close a bank account

While many banks and credit unions don't charge such a fee, others may charge between $5 and $50 to customers who don't hold onto their account for more than a few months.If you don't deposit funds as outlined in your bank's terms and conditions, they could close your account. Similarly, banks may pull the plug on your account if you fail to maintain their minimum balance requirement.When you close a bank account, your bank will likely require you to withdraw all funds before the account is considered fully closed. If your account was closed by the bank, you'll need to get in touch to ask how to access your funds.

Can a closed bank account still be charged : Generally, a recurring charge is based on an agreement between you, as the account holder, and the merchant. Because the bank was not a party to that agreement, the bank cannot cancel it for you. You need to instruct the merchant to stop debiting your account before you close the account.

How do I permanently close my bank account

Contact Your Bank

Although financial institutions allow you to do this online, they may require you to make a phone call to customer service or a visit to a local bank branch. Some banks and credit unions may require you to fill out an account closure request form or submit a written request.

What happens if you never use a bank account : Neglected bank accounts can be closed due to inactivity. If your bank doesn't have a way to contact you, it might turn your money over to your state as unclaimed funds.

Cancel your bank account. Although financial institutions allow you to do this online, they may require you to make a phone call to customer service or a visit to a local bank branch. Some banks and credit unions may require you to fill out an account closure request form or submit a written request.

Accounts that have been open for a long time may have a positive impact on your credit score so if you decide to close some accounts to help your credit score, start by looking at inactive accounts that you no longer use. The general guidance is that you should aim to have fewer, well-managed credit accounts.

Can I permanently close my bank account online

Your savings account cannot be closed online. You must visit your bank's home branch where the account has been opened and request to close your account. Fill in the account closure form and enter the details requested in the account closure form correctly.You would face a penalty from the bank

As you must already know, your Savings Account needs a minimum balance or else a penalty charge is levied on it.If your account contains no money, the bank might close it. Simply because an account says there are no minimums, does not mean the account should remain empty for days or months. The time frame will vary based on your individual bank and its practices.

Most accounts have to be closed either by visiting us in branch or online using the Internet Bank or Banking app.

Can you completely close a bank account : If you just want to close, contact your bank

You can usually request this: online. by phone or live chat. in person.

What happens if my bank account is zero : In a regular savings account, a penalty charge gets levied by the bank if you have no balance in your savings account. But that is not the case for a zero balance account. In a zero-balance account, no penalty gets levied if you have zero balance in your account, as you do not need to maintain a minimum balance there.

What happens if you never use a bank

Risks of being unbanked

You'll pay fees for alternative services such as check cashing and prepaid debit cards. Not having a bank-issued debit card can mean you'll need to carry cash, which might not be recovered if lost or stolen.

If you don't use your account for a long period of time the bank or building society may declare it dormant, but the length of time before this happens will vary between institutions. It could be as little as 12 months for a current account, three years for a savings account, or in some cases up to 15 years.Contact Your Bank

Although financial institutions allow you to do this online, they may require you to make a phone call to customer service or a visit to a local bank branch. Some banks and credit unions may require you to fill out an account closure request form or submit a written request.

Is it bad to have empty bank accounts : Does having a dormant bank account affect my credit score Only dormant credit accounts will affect your credit score as that involves you borrowing money. A dormant savings account won't impact you credit rating.