If you don't use your credit card, the card issuer may close your account. You are also more susceptible to fraud if you aren't vigilant about checking up on the inactive card, and fraudulent charges can affect your credit rating and finances.The bottom line. Credit card inactivity will eventually result in your account being closed. A closed account can have a negative impact on your credit score, so consider keeping your cards open and active whenever possible.In general, NerdWallet recommends paying with a credit card whenever possible: Credit cards are safer to carry than cash and offer stronger fraud protections than debit. You can earn significant rewards without changing your spending habits. It's easier to track your spending.

Is it better to close a credit card or let it go inactive : Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.

Is it OK to never have a credit card

It's completely acceptable to avoid getting a credit card. Consumers can pay entirely with cash, check or debit card and still build a positive credit history through other types of loans.

Does it hurt to have a credit card but not use it : Bottom Line. If you don't use a particular credit card, you won't see an impact on your credit score as long as the card stays open. But the consequences to inactive credit card accounts could have an unwanted effect if the bank decides to close your card.

Visit your My NerdWallet Settings page to see all the writers you're following. If you don't use a credit card for a year or more, the issuer may decide to close the account. Keeping a zero balance is a sign that you're being responsible with the credit extended to you. As long as you keep utilization low and continue on-time payments with a zero balance, there's a good chance you'll see your credit score rise, as well.

How much should I spend on a $500 credit card

You should use less than 30% of a $500 credit card limit each month in order to avoid damage to your credit score. Having a balance of $150 or less when your monthly statement closes will show that you are responsible about keeping your credit utilization low.Key takeaways: Closing a credit card can hurt your scores because it lowers your available credit and can lead to a higher credit utilization, meaning the gap between your spending and the amount of credit you can borrow narrows. Canceling a card can also decrease the average age of your accounts.What is the 5/24 rule Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months. Closing an unused credit card will typically cause your credit score to go down, at least in the short run. There are two reasons. First, the length of your credit history (including the average ages of your credit accounts) is a factor in all major credit scoring formulas.

Can I survive without a credit card : It's definitely possible to survive without a credit card. Whether you prefer to use cash, your debit card or a combination of other strategies, there are solid work-arounds. However, having a credit card on hand for emergencies for those difficult-to-navigate purchases may be worth considering.

Is a credit card needed in life : Despite some significant cons, there are ways to build good credit and maintain a healthy financial history without signing up for a credit card: Use cash or a debit card to avoid overspending. When only cash or a debit card is available, you are limited to spending what's on hand or in your bank account.

How long can I go without using my credit card

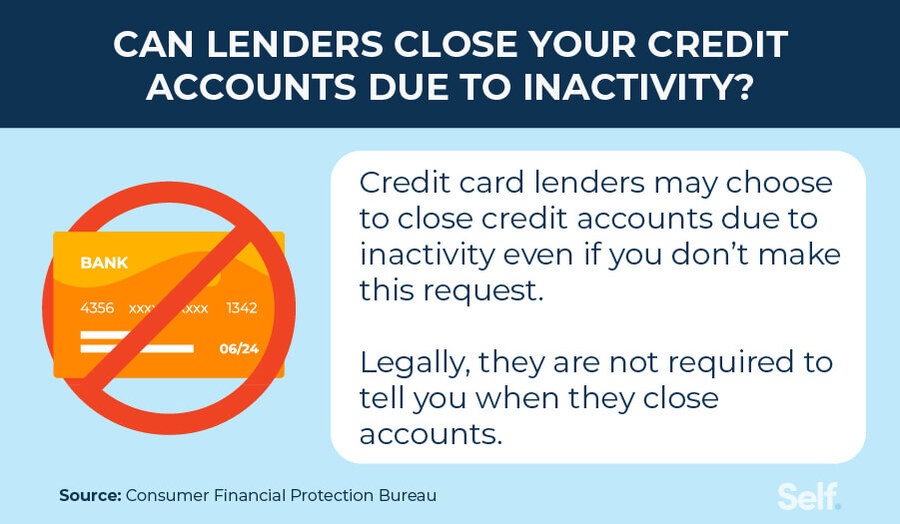

If you don't use a credit card for a year or more, the issuer may decide to close the account. In fact, inactivity is one of the most common reasons for account cancellations. When your account is idle, the card issuer makes no money from transaction fees paid by merchants or from interest if you carry a balance. What if you didn't activate your card as soon as you got it If you don't activate a credit card within a certain timeframe and don't use it, your account may be closed automatically and be reported as 'closed by credit grantor', which could have a negative impact on your credit.Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Is inactivity on a credit card bad : If you don't use a credit card for a year or more, the issuer may decide to close the account. In fact, inactivity is one of the most common reasons for account cancellations. When your account is idle, the card issuer makes no money from transaction fees paid by merchants or from interest if you carry a balance.

Antwort Is it bad to have a credit card and not use it? Weitere Antworten – What happens if you get a credit card and don’t use it

If you don't use your credit card, the card issuer may close your account. You are also more susceptible to fraud if you aren't vigilant about checking up on the inactive card, and fraudulent charges can affect your credit rating and finances.The bottom line. Credit card inactivity will eventually result in your account being closed. A closed account can have a negative impact on your credit score, so consider keeping your cards open and active whenever possible.In general, NerdWallet recommends paying with a credit card whenever possible: Credit cards are safer to carry than cash and offer stronger fraud protections than debit. You can earn significant rewards without changing your spending habits. It's easier to track your spending.

Is it better to close a credit card or let it go inactive : Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.

Is it OK to never have a credit card

It's completely acceptable to avoid getting a credit card. Consumers can pay entirely with cash, check or debit card and still build a positive credit history through other types of loans.

Does it hurt to have a credit card but not use it : Bottom Line. If you don't use a particular credit card, you won't see an impact on your credit score as long as the card stays open. But the consequences to inactive credit card accounts could have an unwanted effect if the bank decides to close your card.

Visit your My NerdWallet Settings page to see all the writers you're following. If you don't use a credit card for a year or more, the issuer may decide to close the account.

:max_bytes(150000):strip_icc()/WomanCuttingUpCreditCard_ImageSource-56a1debb5f9b58b7d0c400db.jpg)

Keeping a zero balance is a sign that you're being responsible with the credit extended to you. As long as you keep utilization low and continue on-time payments with a zero balance, there's a good chance you'll see your credit score rise, as well.

How much should I spend on a $500 credit card

You should use less than 30% of a $500 credit card limit each month in order to avoid damage to your credit score. Having a balance of $150 or less when your monthly statement closes will show that you are responsible about keeping your credit utilization low.Key takeaways: Closing a credit card can hurt your scores because it lowers your available credit and can lead to a higher credit utilization, meaning the gap between your spending and the amount of credit you can borrow narrows. Canceling a card can also decrease the average age of your accounts.What is the 5/24 rule Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months.

Closing an unused credit card will typically cause your credit score to go down, at least in the short run. There are two reasons. First, the length of your credit history (including the average ages of your credit accounts) is a factor in all major credit scoring formulas.

Can I survive without a credit card : It's definitely possible to survive without a credit card. Whether you prefer to use cash, your debit card or a combination of other strategies, there are solid work-arounds. However, having a credit card on hand for emergencies for those difficult-to-navigate purchases may be worth considering.

Is a credit card needed in life : Despite some significant cons, there are ways to build good credit and maintain a healthy financial history without signing up for a credit card: Use cash or a debit card to avoid overspending. When only cash or a debit card is available, you are limited to spending what's on hand or in your bank account.

How long can I go without using my credit card

If you don't use a credit card for a year or more, the issuer may decide to close the account. In fact, inactivity is one of the most common reasons for account cancellations. When your account is idle, the card issuer makes no money from transaction fees paid by merchants or from interest if you carry a balance.

:max_bytes(150000):strip_icc()/when-somebody-else-uses-a-credit-card-315827-color-53e79bbfcf234f9c9cd220a32d1f47a0.jpg)

What if you didn't activate your card as soon as you got it If you don't activate a credit card within a certain timeframe and don't use it, your account may be closed automatically and be reported as 'closed by credit grantor', which could have a negative impact on your credit.Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.

Is inactivity on a credit card bad : If you don't use a credit card for a year or more, the issuer may decide to close the account. In fact, inactivity is one of the most common reasons for account cancellations. When your account is idle, the card issuer makes no money from transaction fees paid by merchants or from interest if you carry a balance.