Once you've opened an investment account, you'll need to decide: Do you want to invest in individual stocks included in the S&P 500 or a fund that is representative of most of the index Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky.Index fund investing has several benefits that make it perfect for beginners. They often charge low fees, require little maintenance and may provide built-in diversification. Plus, a simple portfolio of two to three index funds often provides enough diversification for the average investor.6 Even if you own an S&P 500 index fund, it is not necessarily a diversified portfolio. You should also include other low-correlation asset classes, including bonds, as well as modest allocations to commodities, real estate, and alternative investments, among others.

Should I invest in international funds : The takeaway is clear: International diversification is key. Enduring a decade of flat returns is a tough pill to swallow for any investor, so having stocks from outside the U.S. can help buffer against potential stagnation and potentially reap above-average returns.

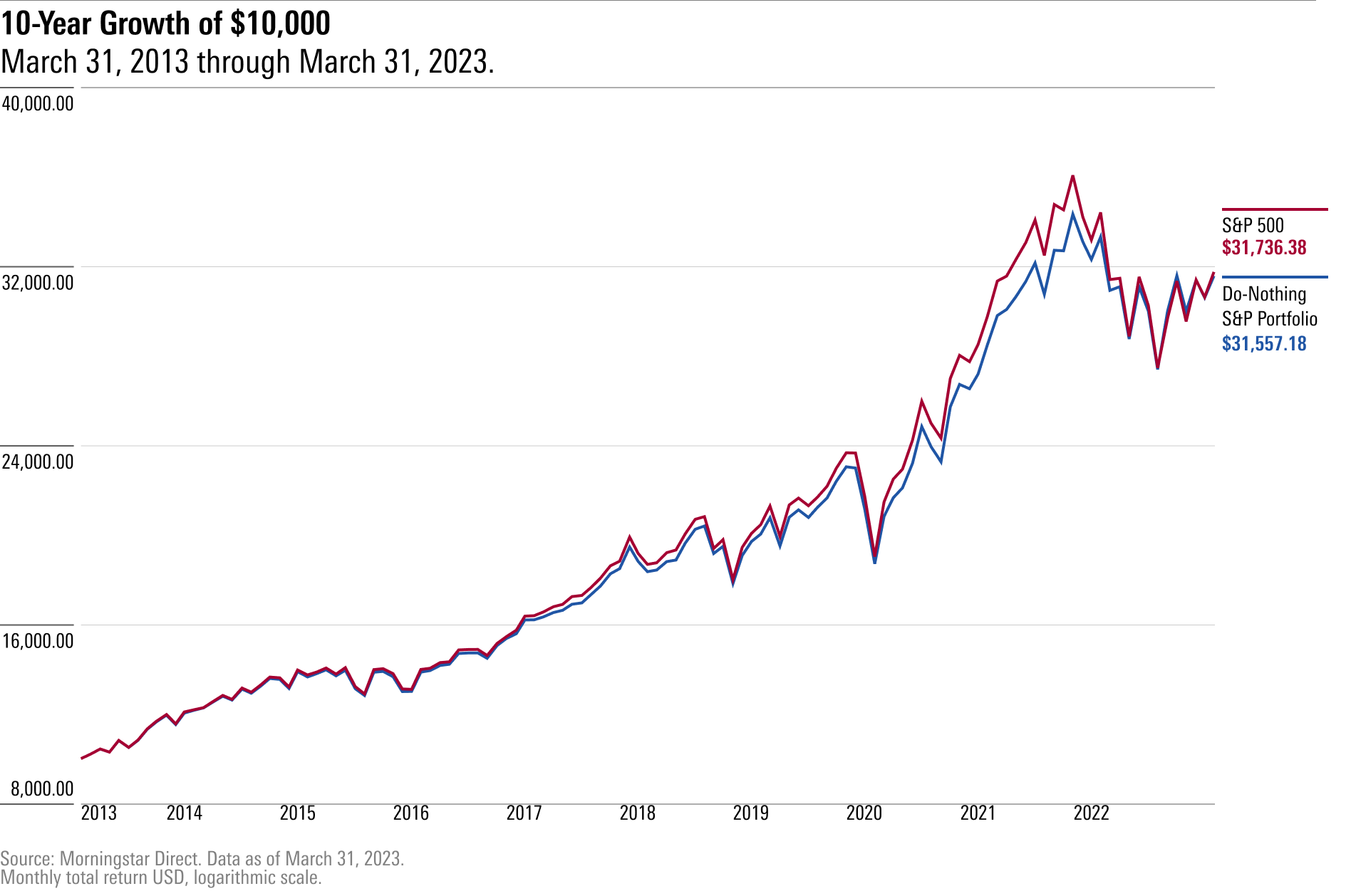

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is it smart to buy S&P 500 : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

While they offer advantages like lower risk through diversification and long-term solid returns, index funds are also subject to market swings and lack the flexibility of active management. Lower risk: Because they're diversified, investing in an index fund is lower risk than owning a few individual stocks. That doesn't mean you can't lose money or that they're as safe as a CD, for example, but the index will usually fluctuate a lot less than an individual stock.

How to become a millionaire with the S&P 500

Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time. $500 a month, for example, is less than 10% of the median U.S. household's monthly income.The 60/40 portfolio dictates a simple split of your assets— 60% for stocks and 40% for bonds. This asset allocation is simple to apply and understand, which may appeal to investors who prefer more of a hands-off approach.How much should be invested internationally In general, Vanguard recommends that at least 20% of your overall portfolio should be invested in international stocks and bonds. Investors can choose these funds that invest in countries outside their country. Investing in international funds comes with the risk of currency volatility and changing economic or political environments, especially in emerging markets.

How much will the S&P 500 grow in 10 years : Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

How much will S&P be worth in 10 years

Stock market forecast for the next decade

Year

Price

2027

6200

2028

6725

2029

7300

2030

8900

Indexes are set portfolios. If an investor buys an index fund, they have no control over the individual holdings in the portfolio. You may have specific companies that you like and want to own, such as a favorite bank or food company that you have researched and want to buy.Another reason some investors don't invest in index funds is that they may have a preference for investing in a particular industry or sector. Index funds are designed to provide exposure to broad market indices, which may not align with an investor's specific interests or values.

Is the S&P 500 safe long term : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

Antwort Is it a bad idea to only invest in the S&P 500? Weitere Antworten – Should I invest in S&P 500 or individual stocks

Once you've opened an investment account, you'll need to decide: Do you want to invest in individual stocks included in the S&P 500 or a fund that is representative of most of the index Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky.Index fund investing has several benefits that make it perfect for beginners. They often charge low fees, require little maintenance and may provide built-in diversification. Plus, a simple portfolio of two to three index funds often provides enough diversification for the average investor.6 Even if you own an S&P 500 index fund, it is not necessarily a diversified portfolio. You should also include other low-correlation asset classes, including bonds, as well as modest allocations to commodities, real estate, and alternative investments, among others.

Should I invest in international funds : The takeaway is clear: International diversification is key. Enduring a decade of flat returns is a tough pill to swallow for any investor, so having stocks from outside the U.S. can help buffer against potential stagnation and potentially reap above-average returns.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is it smart to buy S&P 500 : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

While they offer advantages like lower risk through diversification and long-term solid returns, index funds are also subject to market swings and lack the flexibility of active management.

Lower risk: Because they're diversified, investing in an index fund is lower risk than owning a few individual stocks. That doesn't mean you can't lose money or that they're as safe as a CD, for example, but the index will usually fluctuate a lot less than an individual stock.

How to become a millionaire with the S&P 500

Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time. $500 a month, for example, is less than 10% of the median U.S. household's monthly income.The 60/40 portfolio dictates a simple split of your assets— 60% for stocks and 40% for bonds. This asset allocation is simple to apply and understand, which may appeal to investors who prefer more of a hands-off approach.How much should be invested internationally In general, Vanguard recommends that at least 20% of your overall portfolio should be invested in international stocks and bonds.

Investors can choose these funds that invest in countries outside their country. Investing in international funds comes with the risk of currency volatility and changing economic or political environments, especially in emerging markets.

How much will the S&P 500 grow in 10 years : Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

How much will S&P be worth in 10 years

Stock market forecast for the next decade

Indexes are set portfolios. If an investor buys an index fund, they have no control over the individual holdings in the portfolio. You may have specific companies that you like and want to own, such as a favorite bank or food company that you have researched and want to buy.Another reason some investors don't invest in index funds is that they may have a preference for investing in a particular industry or sector. Index funds are designed to provide exposure to broad market indices, which may not align with an investor's specific interests or values.

Is the S&P 500 safe long term : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.