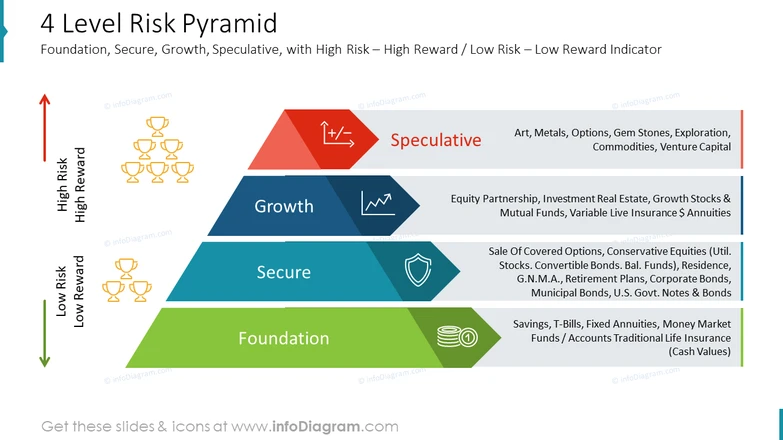

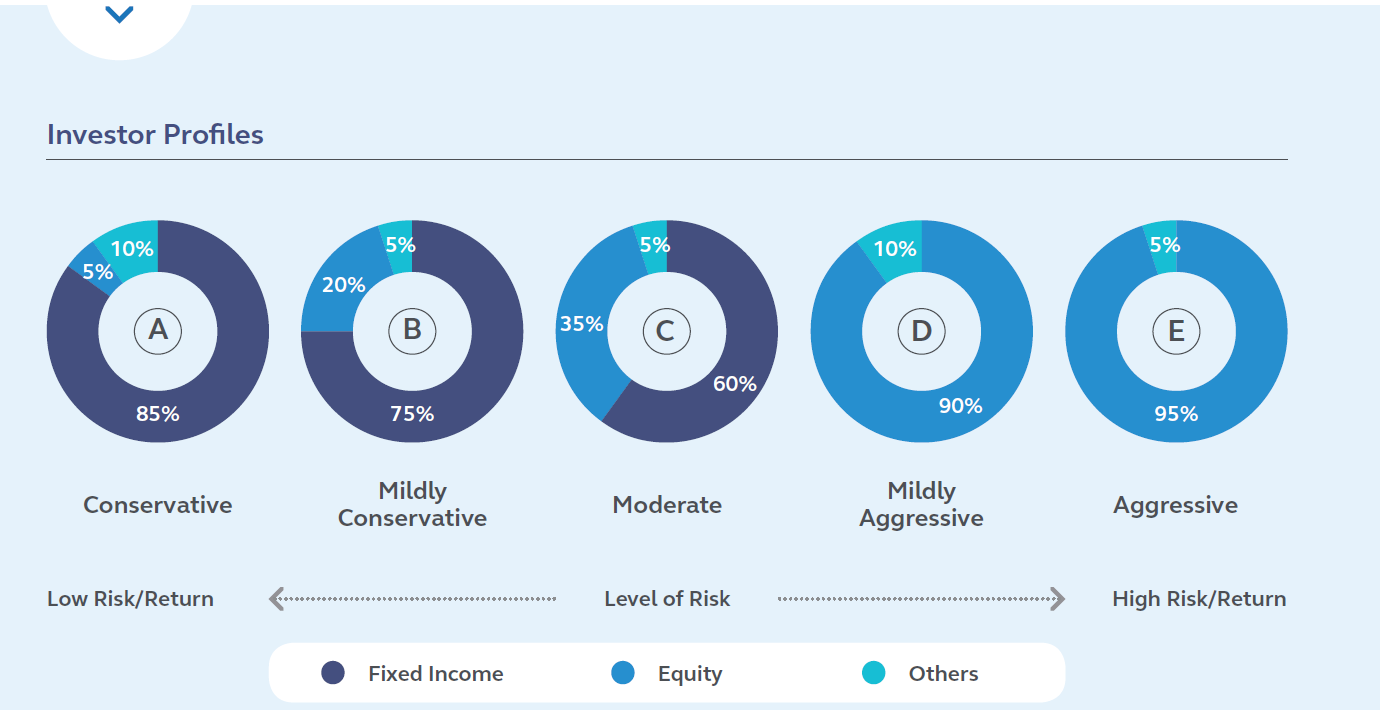

Most sources cite a low-risk portfolio as being made up of 15-40% equities. Medium risk ranges from 40-60%. High risk is generally from 70% upwards. In all cases, the remainder of the portfolio is made up of lower-risk asset classes such as bonds, money market funds, property funds and cash.Equities are generally considered the riskiest class of assets. Dividends aside, they offer no guarantees, and investors' money is subject to the successes and failures of private businesses in a fiercely competitive marketplace.Investment Products

All have higher risks and potentially higher returns than savings products. Over many decades, the investment that has provided the highest average rate of return has been stocks. But there are no guarantees of profits when you buy stock, which makes stock one of the most risky investments.

Are equity shares risky : Risks associated with equity shares

Even if it is not all your money you may face major losses when the company fails to make profits or overall negative market sentiments. There are a few points to be made clear about investing in equity shares to avoid any risks associated with this form of investment.

Which trading is low risk

Money Market Mutual Funds

This type of investment offers plenty of liquidity, and because of the types of investments they make, they are considered to be very safe with very little risk of losing money. But unlike savings bond or CDs, they are not backed by the sovereign guarantee.

Are equities riskier than bonds : Stock risks

Given the numerous reasons a company's business can decline, stocks are typically riskier than bonds. However, with that higher risk can come higher returns. The market's average annual return is about 10%, not accounting for inflation.

Low-risk investing involves buying assets that have a low probability of incurring losses. While you're less likely to see losses with a low-risk investment, you're also less likely to earn a significant return. Details of Best Low Risk Mutual Fund Schemes

Quant Multi Asset Fund. The Quant Multi Asset Fund is an open-ended multi-asset allocation scheme from Quant Mutual Fund.

ICICI Prudential Equity & Debt Fund.

ICICI Prudential Multi Asset Fund.

Edelweiss Aggressive Hybrid Fund.

Baroda BNP Paribas Aggressive Hybrid Fund.

Are equities riskier than debt

Debt instruments are essentially loans that yield payments of interest to their owners. Equities are inherently riskier than debt and have a greater potential for significant gains or losses.Potential Risks

The main one with equity funds is market risk, which is that economic downturns, geopolitical events, or changes in investor sentiment can cause prices to decline. During market turbulence, equity fund prices can fluctuate significantly, potentially leading to short-term losses for investors.Equity financing may be less risky than debt financing because you don't have a loan to repay or collateral at stake. Debt also requires regular repayments, which can hurt your company's cash flow and its ability to grow. Examples include stocks of volatile companies, cryptocurrencies, startup investments, future contracts, forex trading and investing in emerging markets. In this article, let us learn about the high-risk and high-return investments in India. Why we need your mobile number

Which trading has highest risk : The 10 Riskiest Investments

Options. An option allows a trader to hold a leveraged position in an asset at a lower cost than buying shares of the asset.

Futures.

Oil and Gas Exploratory Drilling.

Limited Partnerships.

Penny Stocks.

Alternative Investments.

High-Yield Bonds.

Leveraged ETFs.

Which is better, bond or equity : Stocks offer an opportunity for higher long-term returns compared with bonds but come with greater risk. Bonds are generally more stable than stocks but have provided lower long-term returns.

What is riskier than bonds

Stocks are much more variable (or volatile) because they depend on the performance of the company. Thus, they are much riskier than bonds. When you buy a stock, it is hard to estimate what return you will receive over time (if any). Nonetheless, the greater the risk, the greater the return. low–risk. adjective. Britannica Dictionary definition of LOW–RISK. 1. : not likely to result in failure, harm, or injury : not having a lot of risk.The concept of the "safest investment" can vary depending on individual perspectives and economic contexts, but generally, cash and government bonds, particularly U.S. Treasury securities, are often considered among the safest investment options available. This is because there is minimal risk of loss.

What is a low risk fund : Low risk fund. This is the lowest risk fund in the range with an emphasis towards low risk assets, such as bonds. The low risk fund invests at least 70% of its value in bonds.

Antwort Is equity low risk? Weitere Antworten – Are equities high or low risk

Most sources cite a low-risk portfolio as being made up of 15-40% equities. Medium risk ranges from 40-60%. High risk is generally from 70% upwards. In all cases, the remainder of the portfolio is made up of lower-risk asset classes such as bonds, money market funds, property funds and cash.Equities are generally considered the riskiest class of assets. Dividends aside, they offer no guarantees, and investors' money is subject to the successes and failures of private businesses in a fiercely competitive marketplace.Investment Products

All have higher risks and potentially higher returns than savings products. Over many decades, the investment that has provided the highest average rate of return has been stocks. But there are no guarantees of profits when you buy stock, which makes stock one of the most risky investments.

Are equity shares risky : Risks associated with equity shares

Even if it is not all your money you may face major losses when the company fails to make profits or overall negative market sentiments. There are a few points to be made clear about investing in equity shares to avoid any risks associated with this form of investment.

Which trading is low risk

Money Market Mutual Funds

This type of investment offers plenty of liquidity, and because of the types of investments they make, they are considered to be very safe with very little risk of losing money. But unlike savings bond or CDs, they are not backed by the sovereign guarantee.

Are equities riskier than bonds : Stock risks

Given the numerous reasons a company's business can decline, stocks are typically riskier than bonds. However, with that higher risk can come higher returns. The market's average annual return is about 10%, not accounting for inflation.

Low-risk investing involves buying assets that have a low probability of incurring losses. While you're less likely to see losses with a low-risk investment, you're also less likely to earn a significant return.

Details of Best Low Risk Mutual Fund Schemes

Are equities riskier than debt

Debt instruments are essentially loans that yield payments of interest to their owners. Equities are inherently riskier than debt and have a greater potential for significant gains or losses.Potential Risks

The main one with equity funds is market risk, which is that economic downturns, geopolitical events, or changes in investor sentiment can cause prices to decline. During market turbulence, equity fund prices can fluctuate significantly, potentially leading to short-term losses for investors.Equity financing may be less risky than debt financing because you don't have a loan to repay or collateral at stake. Debt also requires regular repayments, which can hurt your company's cash flow and its ability to grow.

Examples include stocks of volatile companies, cryptocurrencies, startup investments, future contracts, forex trading and investing in emerging markets. In this article, let us learn about the high-risk and high-return investments in India. Why we need your mobile number

Which trading has highest risk : The 10 Riskiest Investments

Which is better, bond or equity : Stocks offer an opportunity for higher long-term returns compared with bonds but come with greater risk. Bonds are generally more stable than stocks but have provided lower long-term returns.

What is riskier than bonds

Stocks are much more variable (or volatile) because they depend on the performance of the company. Thus, they are much riskier than bonds. When you buy a stock, it is hard to estimate what return you will receive over time (if any). Nonetheless, the greater the risk, the greater the return.

low–risk. adjective. Britannica Dictionary definition of LOW–RISK. 1. : not likely to result in failure, harm, or injury : not having a lot of risk.The concept of the "safest investment" can vary depending on individual perspectives and economic contexts, but generally, cash and government bonds, particularly U.S. Treasury securities, are often considered among the safest investment options available. This is because there is minimal risk of loss.

What is a low risk fund : Low risk fund. This is the lowest risk fund in the range with an emphasis towards low risk assets, such as bonds. The low risk fund invests at least 70% of its value in bonds.