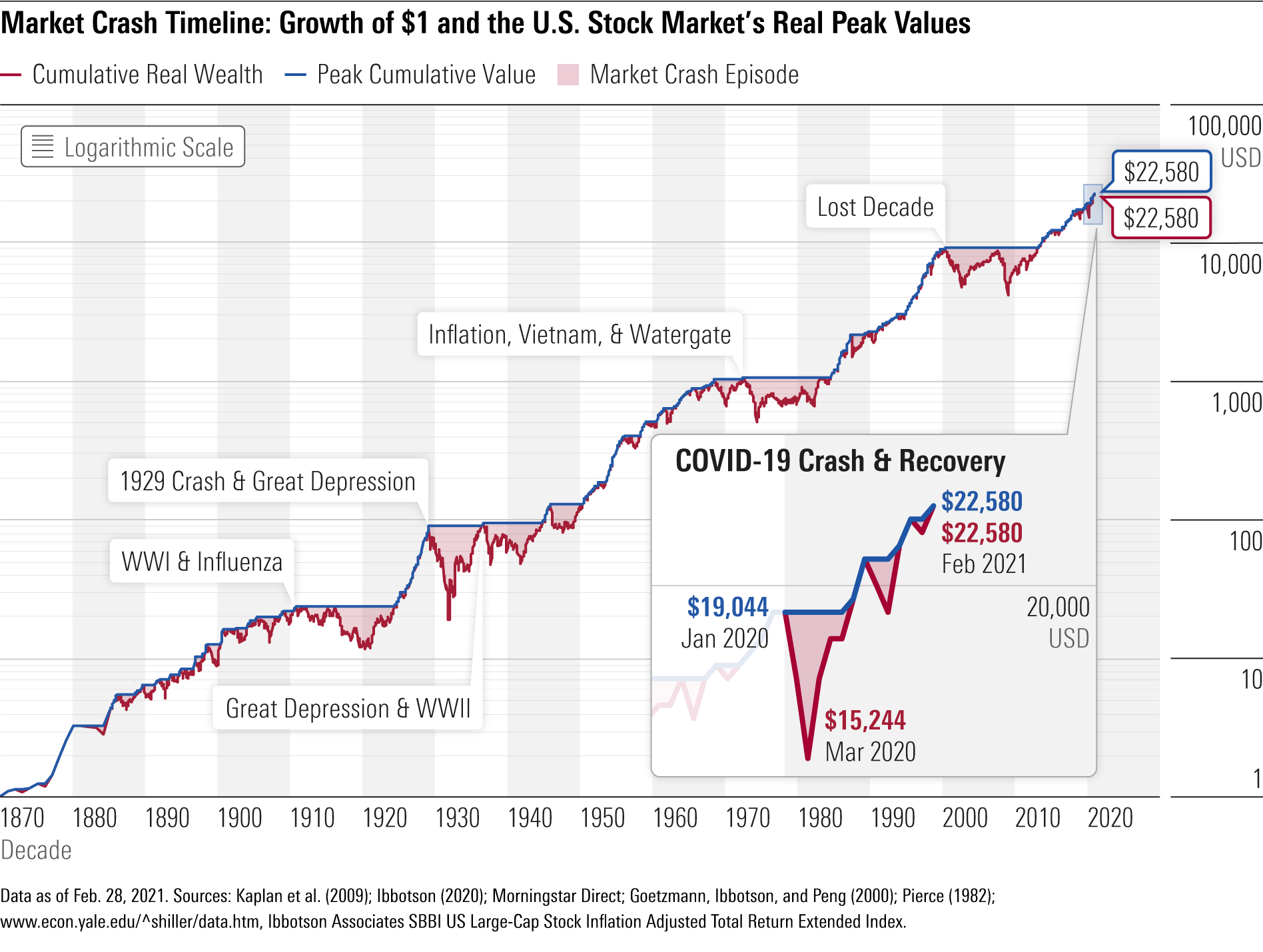

The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.Since 1950, the S&P 500 index has declined by 20% or more on 12 different occasions. The average stock market price decline is -33.38% and the average length of a market crash is 342 days. However, and this part is critical, the bull markets that follow these crashes tend to be strong and last much longer.The stock market 'correction' is not over yet, JPMorgan's Kolanovic says.

Why is market crash bad : A stock market crash can result in a bear market, which occurs when the market falls by 10% or more after a correction, for a total drop of 20% or more. A stock market fall might cause a recession. If stock prices fall substantially, corporations will have less capacity to grow, resulting in insolvency.

Should I pull my money out of the stock market in 2024

Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Where to invest now in 2024 : Overview: Best investments in 2024

High-yield savings accounts. Overview: A high-yield online savings account pays you interest on your cash balance.

Long-term certificates of deposit.

Long-term corporate bond funds.

Dividend stock funds.

Value stock funds.

Small-cap stock funds.

REIT index funds.

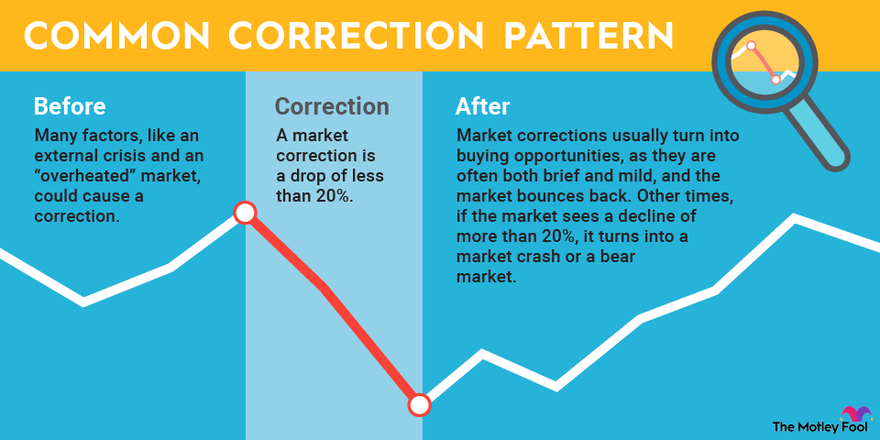

Stock market corrections are not uncommon

As you can see in the chart below, a decline of at least 10% occurred in 10 out of 20 years, or 50% of the time, with an average pullback of 15%. And in two additional years, the decline was just short of 10%. How Common Are 20% Declines in the Stock Market 20% drops in the S&P 500 are still common. Expect one to two within a five-year period. That said, most 20% declines are great long-term buying opportunities because there are relatively a small number of 20% declines that drop beyond 30% (but it does happen).

Is now good time to invest

Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024.Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost. That suggests the S&P 500 could trade to 6,000 by August 2025, and to as high as 6,150 by November 2025. But in the short-term, amid the ongoing weakness in stocks, Suttmeier said investors should keep an eye on potential support levels for the S&P 500 at 5,000 as well as a range from 4,600 to 4,800.

Is it wise to get out of the stock market : While holding or moving to cash might feel good mentally and help avoid short-term stock market volatility, it is unlikely to be wise over the long term.

Where to invest $50,000 for 3 years : The safest way to invest $50,000 would be to put it into a savings account or CD. However, you could also invest in stocks or real estate, start or add to a retirement account, and more. Your goals, risk tolerance, and time horizon until retirement will determine the right choice for you.

Where to put 10k

How to invest $10,000: 10 proven strategies

Pay off high-interest debt.

Build an emergency fund.

Open a high-yield savings account.

Build a CD ladder.

Get your 401(k) match.

Max out your IRA.

Invest through a self-directed brokerage account.

Invest in a REIT.

How Common Are 20% Declines in the Stock Market 20% drops in the S&P 500 are still common. Expect one to two within a five-year period. That said, most 20% declines are great long-term buying opportunities because there are relatively a small number of 20% declines that drop beyond 30% (but it does happen).Stock A trading at Rs 100 per share today has a 20% circuit. That means that the share price cannot drop by more than 20% and also cannot increase by more than 20% in the trading session.

What is a 20% stock market decline called : One definition of a bear market says markets are in bear territory when stocks, on average, fall at least 20% off their high. But 20% is an arbitrary number, just as a 10% decline is an arbitrary benchmark for a correction. Another definition of a bear market is when investors are more risk-averse than risk-seeking.

Antwort Is 20% a market crash? Weitere Antworten – Will the market correct in 2024

The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.Since 1950, the S&P 500 index has declined by 20% or more on 12 different occasions. The average stock market price decline is -33.38% and the average length of a market crash is 342 days. However, and this part is critical, the bull markets that follow these crashes tend to be strong and last much longer.The stock market 'correction' is not over yet, JPMorgan's Kolanovic says.

Why is market crash bad : A stock market crash can result in a bear market, which occurs when the market falls by 10% or more after a correction, for a total drop of 20% or more. A stock market fall might cause a recession. If stock prices fall substantially, corporations will have less capacity to grow, resulting in insolvency.

Should I pull my money out of the stock market in 2024

Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Where to invest now in 2024 : Overview: Best investments in 2024

Stock market corrections are not uncommon

As you can see in the chart below, a decline of at least 10% occurred in 10 out of 20 years, or 50% of the time, with an average pullback of 15%. And in two additional years, the decline was just short of 10%.

How Common Are 20% Declines in the Stock Market 20% drops in the S&P 500 are still common. Expect one to two within a five-year period. That said, most 20% declines are great long-term buying opportunities because there are relatively a small number of 20% declines that drop beyond 30% (but it does happen).

Is now good time to invest

Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024.Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

That suggests the S&P 500 could trade to 6,000 by August 2025, and to as high as 6,150 by November 2025. But in the short-term, amid the ongoing weakness in stocks, Suttmeier said investors should keep an eye on potential support levels for the S&P 500 at 5,000 as well as a range from 4,600 to 4,800.

Is it wise to get out of the stock market : While holding or moving to cash might feel good mentally and help avoid short-term stock market volatility, it is unlikely to be wise over the long term.

Where to invest $50,000 for 3 years : The safest way to invest $50,000 would be to put it into a savings account or CD. However, you could also invest in stocks or real estate, start or add to a retirement account, and more. Your goals, risk tolerance, and time horizon until retirement will determine the right choice for you.

Where to put 10k

How to invest $10,000: 10 proven strategies

How Common Are 20% Declines in the Stock Market 20% drops in the S&P 500 are still common. Expect one to two within a five-year period. That said, most 20% declines are great long-term buying opportunities because there are relatively a small number of 20% declines that drop beyond 30% (but it does happen).Stock A trading at Rs 100 per share today has a 20% circuit. That means that the share price cannot drop by more than 20% and also cannot increase by more than 20% in the trading session.

What is a 20% stock market decline called : One definition of a bear market says markets are in bear territory when stocks, on average, fall at least 20% off their high. But 20% is an arbitrary number, just as a 10% decline is an arbitrary benchmark for a correction. Another definition of a bear market is when investors are more risk-averse than risk-seeking.