Invesco S&P 500 High Dividend Low Volatility ETF (SPHD)

iShares Asia Pacific Dividend UCITS ETF (IAPD.

iShares Core US Aggregate Bond ETF (AGG)

JPMorgan Ultra-Short Income ETF (JPST)

You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance.The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

What companies are in the S&P 500 : Sector*

Microsoft Corp. Symbol. MSFT. Sector* Information Technology.

Apple Inc. Symbol. AAPL. Sector*

Nvidia Corp. Symbol. NVDA. Sector*

Amazon.com Inc. Symbol. AMZN. Sector*

Alphabet Inc A. Symbol. GOOGL. Sector*

Meta Platforms, Inc. Class A. Symbol. META.

Alphabet Inc C. Symbol. GOOG. Sector*

Berkshire Hathaway B. Symbol. BRK.B. Sector*

Can I just buy S&P 500

You can't directly invest in the index itself, but you can buy individual stocks of S&P 500 companies, or buy a S&P 500 index fund through a mutual fund or ETF.

What is the cheapest way to buy the S&P 500 : An index fund or exchange-traded fund (ETF) that benchmarks to the S&P 500 allows investors to gain exposure to all those stocks. ETFs focus on passive index replication, giving investors access to every security within a particular index. Index ETFs are generally low-cost and trade throughout the day just like stocks.

STOXX Europe 600 index

The equivalent of the S&P 500 in Europe is the STOXX Europe 600 index, as it represents the performance of European companies across various sectors.

We're currently offering non-complex ETFs that are registered in the European Union. Some common types of ETFs include: Market indices: These ETFs track the performance of a particular stock exchange or the overall market, such as the S&P 500 or the Dow Jones Industrial Average.

Should I invest $10,000 in S&P 500

Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.Have You Missed the Best Time to Invest We're only a few months into 2024, but the S&P 500 (SNPINDEX: ^GSPC) has started off the year with a bang. The index is currently up by more than 8% this year alone and it's soared by a whopping 44% from its lowest point in October 2022.S&P 500 3 Year Return is at 20.44%, compared to 32.26% last month and 43.16% last year. This is lower than the long term average of 23.24%. The S&P 500 3 Year Return is the investment return received for a 3 year period, excluding dividends, when holding the S&P 500 index.

Stock Market Average Yearly Return for the Last 20 Years

The historical average yearly return of the S&P 500 is 9.88% over the last 20 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average stock market return (including dividends) is 7.13%.

How should a beginner invest in the S&P 500 : For new investors, the best way is through an ETF or mutual fund. While there are some differences between the two that we'll explain below, funds are a low-cost way to gain exposure to the S&P 500 and provide instant diversification to your portfolio.

Is S&P 500 still worth it : Ever since the S&P 500 index was devised, it has built an impeccable track record of earning positive returns over time. In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook.

Is it smart to invest in the S&P 500

Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

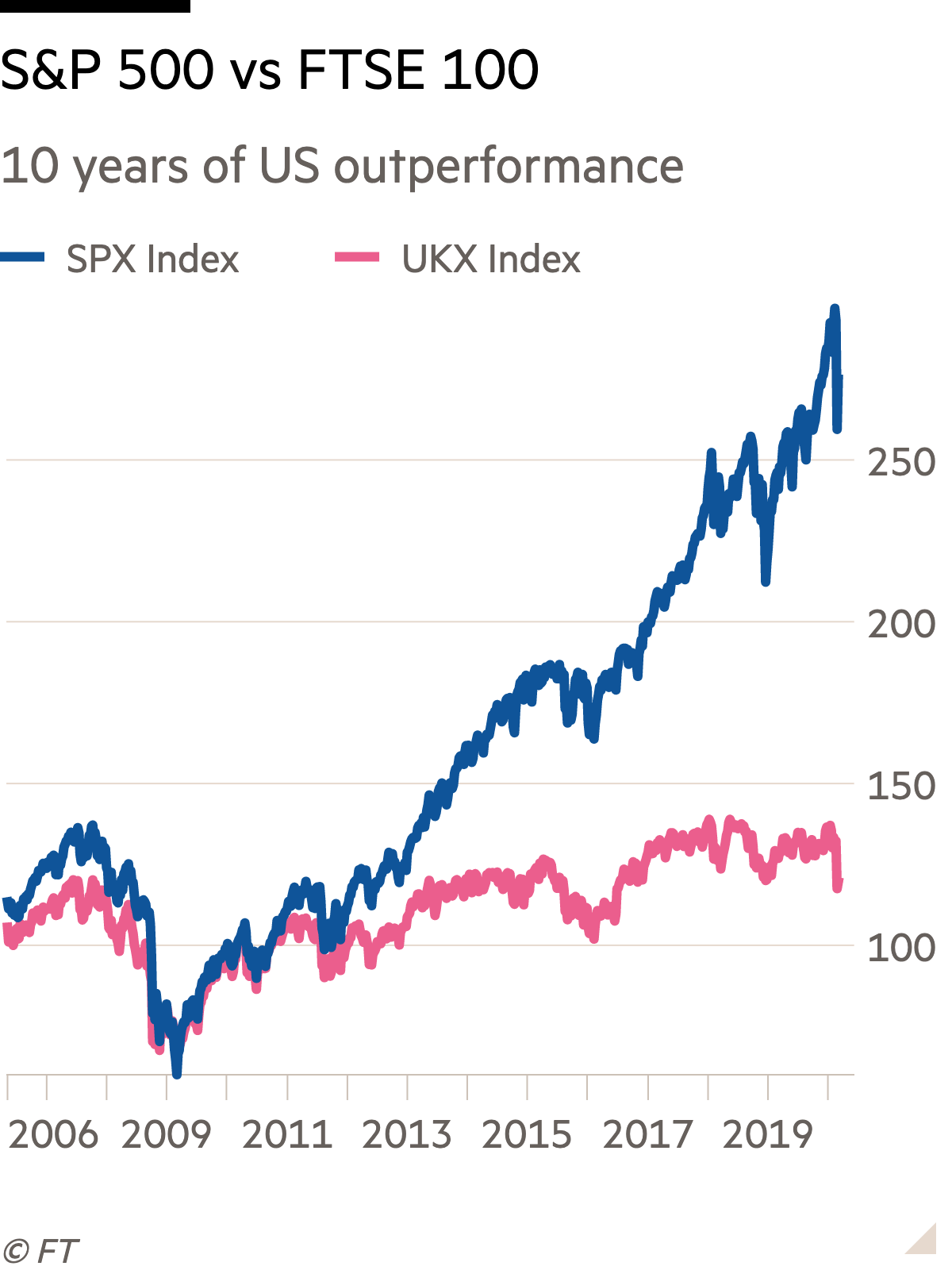

The equivalent of the S&P 500 in the UK is the FTSE 100, which tracks the performance of the 100 largest companies on the London Stock Exchange. Like the S&P 500, the FTSE 100 is also used as a general yardstick to measure the relative health and performance of the UK stock market and wider economy.Buying in euro or in usd would have no impact for a standard S&P500; the holdings are still in usd, and you would get the same actual performance. You can find a S&P500 eur Hedged, that would protect you from FX fluctuations.

What is the cheapest S&P 500 ETF UK : The cheapest S&P 500 fund is the Invesco S&P 500 UCITS ETF, which has a 0.05% total expense ratio (TER). This means if you invested £1,000, you'd be charged 50p in annual fees each year.

Antwort How to invest in S and P 500 UK? Weitere Antworten – Which S&P 500 to buy in the UK

S&P 500 index funds you can buy here in the UK

You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance.The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

What companies are in the S&P 500 : Sector*

Can I just buy S&P 500

You can't directly invest in the index itself, but you can buy individual stocks of S&P 500 companies, or buy a S&P 500 index fund through a mutual fund or ETF.

What is the cheapest way to buy the S&P 500 : An index fund or exchange-traded fund (ETF) that benchmarks to the S&P 500 allows investors to gain exposure to all those stocks. ETFs focus on passive index replication, giving investors access to every security within a particular index. Index ETFs are generally low-cost and trade throughout the day just like stocks.

STOXX Europe 600 index

The equivalent of the S&P 500 in Europe is the STOXX Europe 600 index, as it represents the performance of European companies across various sectors.

We're currently offering non-complex ETFs that are registered in the European Union. Some common types of ETFs include: Market indices: These ETFs track the performance of a particular stock exchange or the overall market, such as the S&P 500 or the Dow Jones Industrial Average.

Should I invest $10,000 in S&P 500

Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.Have You Missed the Best Time to Invest We're only a few months into 2024, but the S&P 500 (SNPINDEX: ^GSPC) has started off the year with a bang. The index is currently up by more than 8% this year alone and it's soared by a whopping 44% from its lowest point in October 2022.S&P 500 3 Year Return is at 20.44%, compared to 32.26% last month and 43.16% last year. This is lower than the long term average of 23.24%. The S&P 500 3 Year Return is the investment return received for a 3 year period, excluding dividends, when holding the S&P 500 index.

Stock Market Average Yearly Return for the Last 20 Years

The historical average yearly return of the S&P 500 is 9.88% over the last 20 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average stock market return (including dividends) is 7.13%.

How should a beginner invest in the S&P 500 : For new investors, the best way is through an ETF or mutual fund. While there are some differences between the two that we'll explain below, funds are a low-cost way to gain exposure to the S&P 500 and provide instant diversification to your portfolio.

Is S&P 500 still worth it : Ever since the S&P 500 index was devised, it has built an impeccable track record of earning positive returns over time. In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook.

Is it smart to invest in the S&P 500

Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

The equivalent of the S&P 500 in the UK is the FTSE 100, which tracks the performance of the 100 largest companies on the London Stock Exchange. Like the S&P 500, the FTSE 100 is also used as a general yardstick to measure the relative health and performance of the UK stock market and wider economy.Buying in euro or in usd would have no impact for a standard S&P500; the holdings are still in usd, and you would get the same actual performance. You can find a S&P500 eur Hedged, that would protect you from FX fluctuations.

What is the cheapest S&P 500 ETF UK : The cheapest S&P 500 fund is the Invesco S&P 500 UCITS ETF, which has a 0.05% total expense ratio (TER). This means if you invested £1,000, you'd be charged 50p in annual fees each year.