You take the sales growth from that business or product line, subtract the marketing costs, and then divide by the marketing cost.Return on investmentReturn on investment / Full name

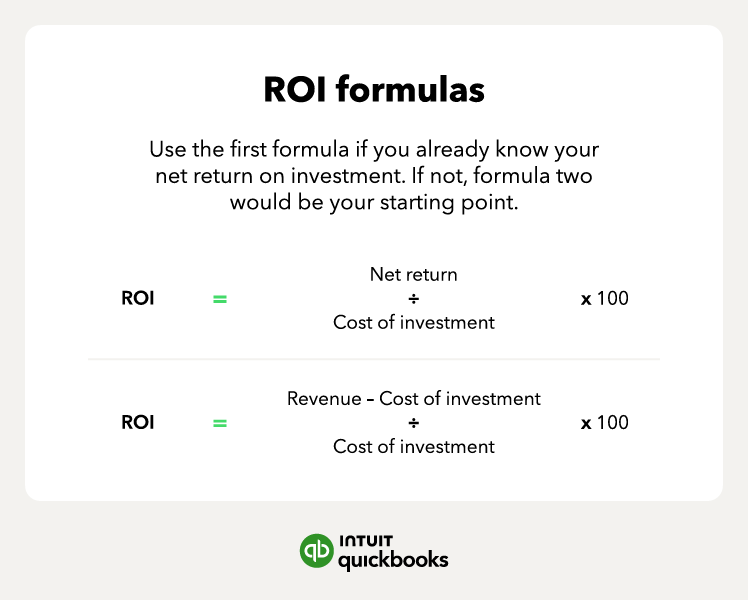

ROI is a calculation of the monetary value of an investment versus its cost. The ROI formula is: (profit minus cost) / cost. If you made $10,000 from a $1,000 effort, your return on investment (ROI) would be 0.9, or 90%. This can be also usually obtained through an investment calculator.Return on investment (ROI) is an approximate measure of an investment's profitability. ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally, multiplying it by 100.

How do you calculate real ROI : Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment. To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost.

How to calculate ROI in Excel

Calculating ROI is simple, both on paper and in Excel. In Excel, you enter how much the investment made or lost and its initial cost in separate cells, then, in another cell, ask Excel to divide the two figures (=cellname/cellname) and give you a percentage.

Is ROI over 100% : Comparing the two

One of the major differences between profit margin and ROI is that profit margin can never exceed 100%, while ROI can.

The calculation of residual income is as follows: Residual income = operating income – (minimum required return x operating assets). 5-7% General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.

How do you calculate the ROI amount

You may calculate the return on investment using the formula: ROI = Net Profit / Cost of the investment * 100 If you are an investor, the ROI shows you the profitability of your investments.Most data team ROI formulas focus on some version of the following calculation:

Lift / investment = ROI.

(Data product value – data downtime) / data investment = ROI.

Value from Analytical Data Products + Operational Data Products + Customer Facing Data Products = Data Product Return.

Measuring incremental impact.

A thirty percent return is an achievable feat for one year if you're aggressive enough (and shall I say lucky enough), AND have the stomach to ride out the volatility, but consistently performing year after year becomes an incredible challenge that no one to my knowledge has done. Is 50% a Good ROI ROI of 50% can be considered good, but there are other factors to consider to understand if your investment was a good one.

How to calculate RI in Excel : Like calculating the amount of gain or loss, use a formula to calculate the ROI in cell D2. The ROI formula divides the amount of gain or loss by the content investment. To show this in Excel, type =C2/A2 in cell D2.

What is the formula for calculating RI : RI = Net Income – Equity Charge

Simply put, the residual income is the net profit that's been altered depending on the cost of equity. The equity charge is computed by multiplying the cost of equity and the company's equity capital.

Is 7% a good ROI

A good return on investment is generally considered to be around 7% per year, based on the average historic return of the S&P 500 index, adjusted for inflation. The average return of the U.S. stock market is around 10% per year, adjusted for inflation, dating back to the late 1920s. What is a good ROI While the term good is subjective, many professionals consider a good ROI to be 10.5% or greater for investments in stocks. This number is the standard because it's the average return of the S&P 500 , an index that serves as a benchmark of the overall performance of the U.S. stock market.An ROI of 30% can be good, but it can depend on how long your ROI has been at 30% in previous years.

How do I calculate ROI in Excel : Calculating ROI is simple, both on paper and in Excel. In Excel, you enter how much the investment made or lost and its initial cost in separate cells, then, in another cell, ask Excel to divide the two figures (=cellname/cellname) and give you a percentage.

Antwort How to calculate the ROI? Weitere Antworten – How do you calculate ROI on a product

Calculating Simple ROI

You take the sales growth from that business or product line, subtract the marketing costs, and then divide by the marketing cost.Return on investmentReturn on investment / Full name

ROI is a calculation of the monetary value of an investment versus its cost. The ROI formula is: (profit minus cost) / cost. If you made $10,000 from a $1,000 effort, your return on investment (ROI) would be 0.9, or 90%. This can be also usually obtained through an investment calculator.Return on investment (ROI) is an approximate measure of an investment's profitability. ROI is calculated by subtracting the initial cost of the investment from its final value, then dividing this new number by the cost of the investment, and finally, multiplying it by 100.

How do you calculate real ROI : Return on investment (ROI) measures how much money, or profit, is made on an investment as a percentage of the cost of that investment. To calculate the percentage ROI for a cash purchase, take the net profit or net gain on the investment and divide it by the original cost.

How to calculate ROI in Excel

Calculating ROI is simple, both on paper and in Excel. In Excel, you enter how much the investment made or lost and its initial cost in separate cells, then, in another cell, ask Excel to divide the two figures (=cellname/cellname) and give you a percentage.

Is ROI over 100% : Comparing the two

One of the major differences between profit margin and ROI is that profit margin can never exceed 100%, while ROI can.

The calculation of residual income is as follows: Residual income = operating income – (minimum required return x operating assets).

:max_bytes(150000):strip_icc()/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)

5-7%

General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.

How do you calculate the ROI amount

You may calculate the return on investment using the formula: ROI = Net Profit / Cost of the investment * 100 If you are an investor, the ROI shows you the profitability of your investments.Most data team ROI formulas focus on some version of the following calculation:

A thirty percent return is an achievable feat for one year if you're aggressive enough (and shall I say lucky enough), AND have the stomach to ride out the volatility, but consistently performing year after year becomes an incredible challenge that no one to my knowledge has done.

Is 50% a Good ROI ROI of 50% can be considered good, but there are other factors to consider to understand if your investment was a good one.

How to calculate RI in Excel : Like calculating the amount of gain or loss, use a formula to calculate the ROI in cell D2. The ROI formula divides the amount of gain or loss by the content investment. To show this in Excel, type =C2/A2 in cell D2.

What is the formula for calculating RI : RI = Net Income – Equity Charge

Simply put, the residual income is the net profit that's been altered depending on the cost of equity. The equity charge is computed by multiplying the cost of equity and the company's equity capital.

Is 7% a good ROI

A good return on investment is generally considered to be around 7% per year, based on the average historic return of the S&P 500 index, adjusted for inflation. The average return of the U.S. stock market is around 10% per year, adjusted for inflation, dating back to the late 1920s.

What is a good ROI While the term good is subjective, many professionals consider a good ROI to be 10.5% or greater for investments in stocks. This number is the standard because it's the average return of the S&P 500 , an index that serves as a benchmark of the overall performance of the U.S. stock market.An ROI of 30% can be good, but it can depend on how long your ROI has been at 30% in previous years.

How do I calculate ROI in Excel : Calculating ROI is simple, both on paper and in Excel. In Excel, you enter how much the investment made or lost and its initial cost in separate cells, then, in another cell, ask Excel to divide the two figures (=cellname/cellname) and give you a percentage.