The S&P 500® undergoes quarterly updates—more colloquially known as rebalances—after the close of the third Friday in March, June, September and December. These updates typically affect the S&P 500's composition and have turnover implications for investors tracking the index.Basic Info. S&P 500 1 Year Return is at 20.78%, compared to 27.86% last month and 0.91% last year. This is higher than the long term average of 6.75%. The S&P 500 1 Year Return is the investment return received for a 1 year period, excluding dividends, when holding the S&P 500 index.Although the S&P 500 overseers stated belief is "turnover in index membership should be avoided when possible”, the historical turnover rate is 4.4 percent annually, or approximately 22 changes each year.

How many down years has the SP500 had : The average total return during those 63 profitable years was 21.5%. The average total return during the 24 down years was not as bad: -13.6%. The index has endured only four multi-year slumps in this 87-year period: 1930-31, 1940-41, 1973-74 and 2000-02.

Is S and P 500 guaranteed

There are never any guarantees when investing, but an S&P 500 index fund is about as close as you can get to guaranteed positive long-term returns. In fact, analysts at Crestmont Research examined the S&P 500's rolling 20-year total returns to find out how many of those periods resulted in positive total gains.

How often do people beat the S&P 500 : From 2010 through 2021, anywhere from 55 percent to 87 percent of actively managed funds that invest in S&P 500 stocks couldn't beat that benchmark in any given year. Compared with that, the results for 2022 were cause for celebration: About 51 percent of large-cap stock funds failed to beat the S&P 500.

These seven low-risk but potentially high-return investment options can get the job done:

Money market funds.

Dividend stocks.

Bank certificates of deposit.

Annuities.

Bond funds.

High-yield savings accounts.

60/40 mix of stocks and bonds.

12.63% 5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

10 years (2014-2023)

11.02%

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

25 years (1999-2023)

7.18%

How overvalued is the S&P 500

Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 88% to 149%, depending on the indicator, down from last month's 92% to 154%.S&P 500 10 Year Return is at 167.3%, compared to 180.6% last month and 161.0% last year.For the 94 years ended December 31, 2019, the S&P 500 Index posted positive calendar year returns 73% of the time and negative calendar year returns 27% of the time, with an average calendar year return of 21% over the positive years and -13% over the negative years. Think long term, diversification, and balance. In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How safe is the S and P 500 : It's safe to buy stocks, but the market environment warrants caution. To summarize, the S&P 500 moved much higher over the past year, and the index currently trades at a material premium to its historical valuation.

Has Warren Buffett beaten the S&P 500

Over the course of the past few years, Warren Buffett's Berkshire Hathaway (NYSE: BRK. A) (NYSE: BRK.B) has measurably outperformed the S&P 500 (SNPINDEX: ^GSPC). That's not exactly news, of course. The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.Currently, top bond funds are offering robust yields. The Vanguard High-Yield Corporate Fund Investor Shares (VWEHX) delivers a 6% trailing-12-month yield for a low 0.23% expense ratio.

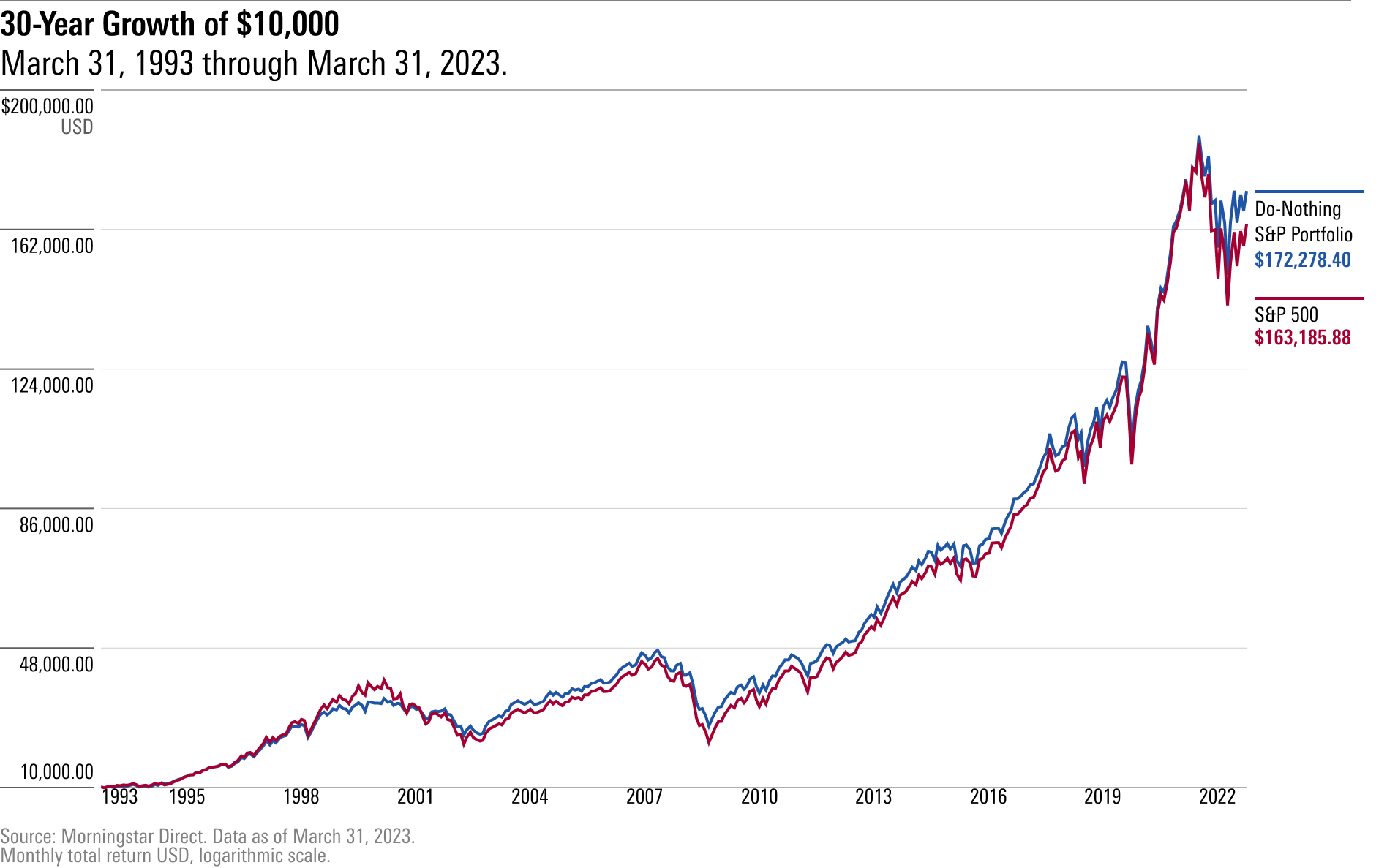

What is the 30 year average return on the S&P 500 : Looking at the S&P 500 for the years 1993 to mid-2023, the average stock market return for the last 30 years is 9.90% (7.22% when adjusted for inflation).

Antwort How often is S&P 500 positive? Weitere Antworten – How often do the S and P 500 change

quarterly

The S&P 500® undergoes quarterly updates—more colloquially known as rebalances—after the close of the third Friday in March, June, September and December. These updates typically affect the S&P 500's composition and have turnover implications for investors tracking the index.Basic Info. S&P 500 1 Year Return is at 20.78%, compared to 27.86% last month and 0.91% last year. This is higher than the long term average of 6.75%. The S&P 500 1 Year Return is the investment return received for a 1 year period, excluding dividends, when holding the S&P 500 index.Although the S&P 500 overseers stated belief is "turnover in index membership should be avoided when possible”, the historical turnover rate is 4.4 percent annually, or approximately 22 changes each year.

How many down years has the SP500 had : The average total return during those 63 profitable years was 21.5%. The average total return during the 24 down years was not as bad: -13.6%. The index has endured only four multi-year slumps in this 87-year period: 1930-31, 1940-41, 1973-74 and 2000-02.

Is S and P 500 guaranteed

There are never any guarantees when investing, but an S&P 500 index fund is about as close as you can get to guaranteed positive long-term returns. In fact, analysts at Crestmont Research examined the S&P 500's rolling 20-year total returns to find out how many of those periods resulted in positive total gains.

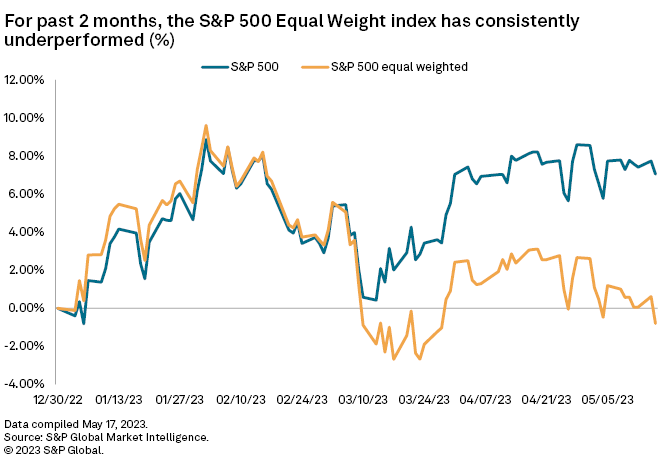

How often do people beat the S&P 500 : From 2010 through 2021, anywhere from 55 percent to 87 percent of actively managed funds that invest in S&P 500 stocks couldn't beat that benchmark in any given year. Compared with that, the results for 2022 were cause for celebration: About 51 percent of large-cap stock funds failed to beat the S&P 500.

These seven low-risk but potentially high-return investment options can get the job done:

12.63%

5-year, 10-year, 20-year and 30-year S&P 500 returns

How overvalued is the S&P 500

Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 88% to 149%, depending on the indicator, down from last month's 92% to 154%.S&P 500 10 Year Return is at 167.3%, compared to 180.6% last month and 161.0% last year.For the 94 years ended December 31, 2019, the S&P 500 Index posted positive calendar year returns 73% of the time and negative calendar year returns 27% of the time, with an average calendar year return of 21% over the positive years and -13% over the negative years. Think long term, diversification, and balance.

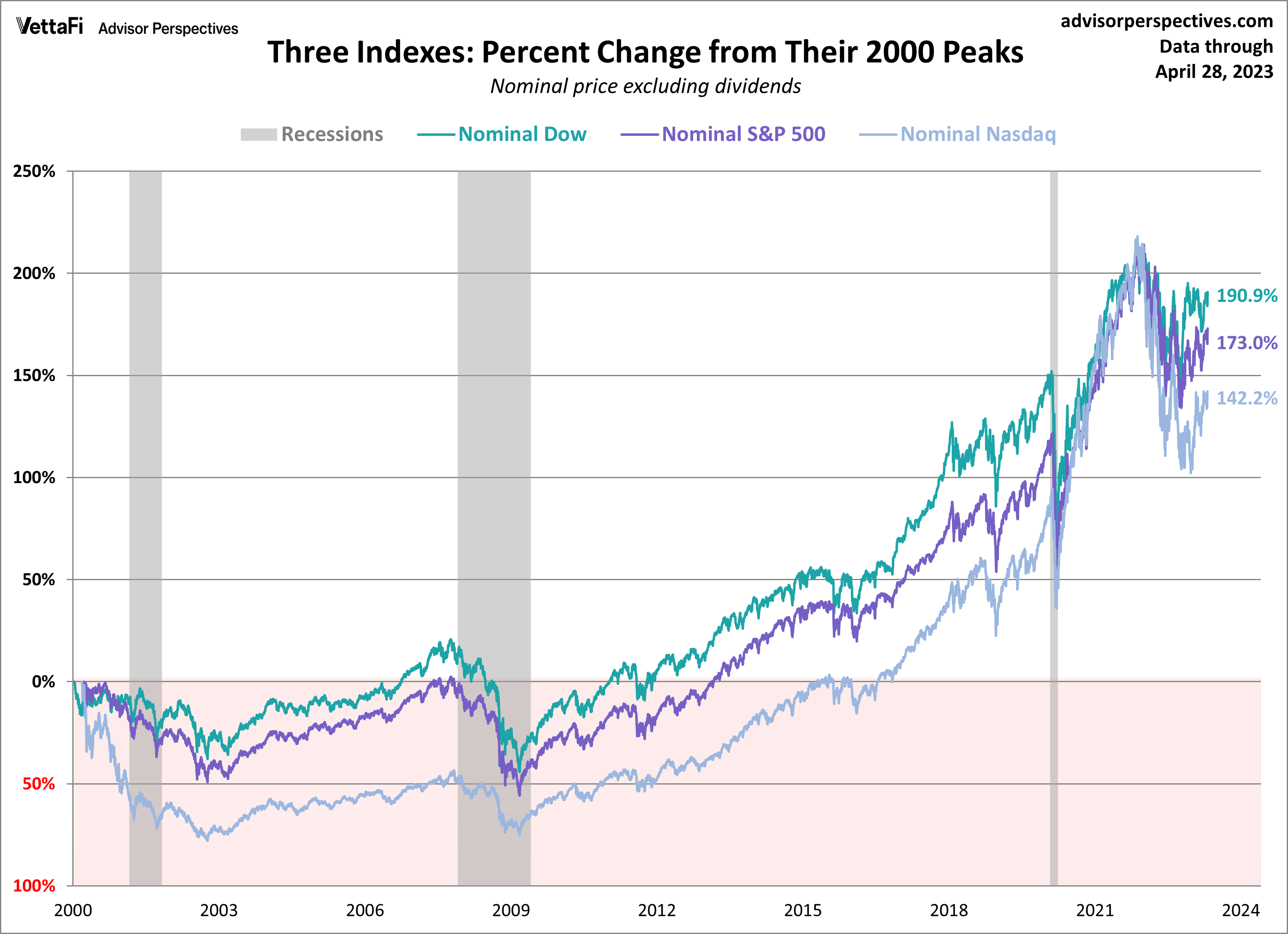

In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How safe is the S and P 500 : It's safe to buy stocks, but the market environment warrants caution. To summarize, the S&P 500 moved much higher over the past year, and the index currently trades at a material premium to its historical valuation.

Has Warren Buffett beaten the S&P 500

Over the course of the past few years, Warren Buffett's Berkshire Hathaway (NYSE: BRK. A) (NYSE: BRK.B) has measurably outperformed the S&P 500 (SNPINDEX: ^GSPC). That's not exactly news, of course.

The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.Currently, top bond funds are offering robust yields. The Vanguard High-Yield Corporate Fund Investor Shares (VWEHX) delivers a 6% trailing-12-month yield for a low 0.23% expense ratio.

What is the 30 year average return on the S&P 500 : Looking at the S&P 500 for the years 1993 to mid-2023, the average stock market return for the last 30 years is 9.90% (7.22% when adjusted for inflation).