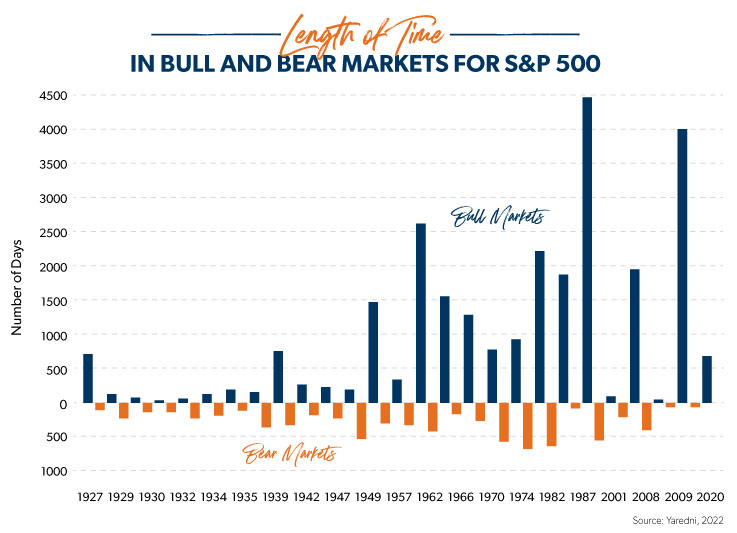

The duration of bear markets can vary, but on average, they last approximately 289 days, equivalent to around nine and a half months. It's important to note that there's no way to predict the timing of a bear market with complete certainty, and history shows that the average bear market length can vary significantly.With stock indexes at all-time highs, it seems we are in the midst of a new bull market. While much of the market's recent gains have come from a handful of stocks, the rally has begun to broaden in recent months. Expectations of an earnings rebound in 2024 suggest earnings could continue to drive the market higher.The longest bear market lingered for three years, from 1946 to 1949. Taking the past 12 bear markets into consideration, the average length of a bear market is about 14 months. How bad has the average bear been The shallowest bear market loss took place in 1990, when the S&P 500 lost around 20%.

How often do bull markets occur : Bear markets are the opposite phenomenon to bull markets. A bear market is a period when the S&P 500 pulls back 20% or more from its last all-time high. There have been 12 bull markets since the S&P 500 launched back in 1957, meaning a new one has started roughly once every 5.5 years.

What is the 3 day rule in stocks

The 3-Day Rule in stock trading refers to the settlement rule that requires the finalization of a transaction within three business days after the trade date. This rule impacts how payments and orders are processed, requiring traders to have funds or credit in their accounts to cover purchases by the settlement date.

How do you survive a bear market : Keep investing consistently.

By investing a fixed amount of money at regular intervals regardless of market conditions, you're more likely to be able to purchase equities at more affordable prices and potentially see the shares rise in value once the market rebounds.

Heading into 2024, investors are optimistic the same macroeconomic tailwinds that fueled the stock market's 2023 rally will propel the S&P 500 to new all-time highs in 2024. After a spectacular 2023, stocks are off to the races again in 2024. YTD, the Dow is up 2.72%, the S&P is up 7.28%, and the Nasdaq is up 6.41%. (And that's on top of last year's 13.7%, 24.2%, and 43.4% respectively.) And the outlook is for another fantastic year.

When was the worst bear market

The Four Bad Bears in U.S. history are:

The Crash of 1929, which eventually ushered in the Great Depression,

The Oil Embargo of 1973, which was followed by a vicious bout of stagflation,

The Tech Bubble crash and,

The Financial Crisis following the (then) record high in October 2007.

Start and End Date

% Price Decline

Length in Days

3/24/2000–9/21/2001

-36.77

546

1/4/2002–10/9/2002

-33.75

278

10/9/2007–11/20/2008

-51.93

408

1/6/2009–3/9/2009

-27.62

62

Start and End Date

% Price Decline

Length in Days

1/4/2002–10/9/2002

-33.75

278

10/9/2007–11/20/2008

-51.93

408

1/6/2009–3/9/2009

-27.62

62

2/19/2020–3/23/2020

-33.92

33

“This new bull market can last for another seven to nine years, as AI is expected to drive significant productivity gains for companies across the board, which will strengthen corporate earnings.”

What is 90% rule in trading : While it can be a lucrative venture for some, it is also known to be a high-risk activity. This is where the 90 rule in Forex comes into play. The 90 rule in Forex is a commonly cited statistic that states that 90% of Forex traders lose 90% of their money in the first 90 days.

What is the 80% rule in day trading : Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area.

What not to do in a bear market

Avoid knee-jerk reactions.

By selling when the market has fallen steeply, you're at risk of locking in a permanent loss of capital. To optimize your potential over the long term, what's crucial is time in the market, not market timing. Don't try to catch the bottom: Trying to time the market is generally a losing battle. One thing to keep in mind during bear markets is that you aren't going to invest at the bottom. Buy stocks because you want to own the business for the long term, even if the share price goes down a little more after you buy.The U.S. equity strategist now expects the S & P 500 will rise to 5,400 by the second quarter of 2025. He previously said the index would slide to 4,500 by the end of this year. The new outlook represents roughly a 2% rise from Friday's close of 5,303.27.

Is 2024 a good year to buy stocks : Economists agree — 2024 may be a strong year for U.S. stocks. The S&P 500 rose 24% in 2023, according to MarketWatch, and recently crossed the 5,000 mark, according to Barron's. This year, we may see a “stock-pickers paradise,” according to Savita Subramanian, head of equity and quant strategy for Bank of America.

Antwort How often do bear markets occur? Weitere Antworten – How long does a bear market usually last

approximately 289 days

The duration of bear markets can vary, but on average, they last approximately 289 days, equivalent to around nine and a half months. It's important to note that there's no way to predict the timing of a bear market with complete certainty, and history shows that the average bear market length can vary significantly.With stock indexes at all-time highs, it seems we are in the midst of a new bull market. While much of the market's recent gains have come from a handful of stocks, the rally has begun to broaden in recent months. Expectations of an earnings rebound in 2024 suggest earnings could continue to drive the market higher.The longest bear market lingered for three years, from 1946 to 1949. Taking the past 12 bear markets into consideration, the average length of a bear market is about 14 months. How bad has the average bear been The shallowest bear market loss took place in 1990, when the S&P 500 lost around 20%.

How often do bull markets occur : Bear markets are the opposite phenomenon to bull markets. A bear market is a period when the S&P 500 pulls back 20% or more from its last all-time high. There have been 12 bull markets since the S&P 500 launched back in 1957, meaning a new one has started roughly once every 5.5 years.

What is the 3 day rule in stocks

The 3-Day Rule in stock trading refers to the settlement rule that requires the finalization of a transaction within three business days after the trade date. This rule impacts how payments and orders are processed, requiring traders to have funds or credit in their accounts to cover purchases by the settlement date.

How do you survive a bear market : Keep investing consistently.

By investing a fixed amount of money at regular intervals regardless of market conditions, you're more likely to be able to purchase equities at more affordable prices and potentially see the shares rise in value once the market rebounds.

Heading into 2024, investors are optimistic the same macroeconomic tailwinds that fueled the stock market's 2023 rally will propel the S&P 500 to new all-time highs in 2024.

After a spectacular 2023, stocks are off to the races again in 2024. YTD, the Dow is up 2.72%, the S&P is up 7.28%, and the Nasdaq is up 6.41%. (And that's on top of last year's 13.7%, 24.2%, and 43.4% respectively.) And the outlook is for another fantastic year.

When was the worst bear market

The Four Bad Bears in U.S. history are:

“This new bull market can last for another seven to nine years, as AI is expected to drive significant productivity gains for companies across the board, which will strengthen corporate earnings.”

What is 90% rule in trading : While it can be a lucrative venture for some, it is also known to be a high-risk activity. This is where the 90 rule in Forex comes into play. The 90 rule in Forex is a commonly cited statistic that states that 90% of Forex traders lose 90% of their money in the first 90 days.

What is the 80% rule in day trading : Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area.

What not to do in a bear market

Avoid knee-jerk reactions.

By selling when the market has fallen steeply, you're at risk of locking in a permanent loss of capital. To optimize your potential over the long term, what's crucial is time in the market, not market timing.

Don't try to catch the bottom: Trying to time the market is generally a losing battle. One thing to keep in mind during bear markets is that you aren't going to invest at the bottom. Buy stocks because you want to own the business for the long term, even if the share price goes down a little more after you buy.The U.S. equity strategist now expects the S & P 500 will rise to 5,400 by the second quarter of 2025. He previously said the index would slide to 4,500 by the end of this year. The new outlook represents roughly a 2% rise from Friday's close of 5,303.27.

Is 2024 a good year to buy stocks : Economists agree — 2024 may be a strong year for U.S. stocks. The S&P 500 rose 24% in 2023, according to MarketWatch, and recently crossed the 5,000 mark, according to Barron's. This year, we may see a “stock-pickers paradise,” according to Savita Subramanian, head of equity and quant strategy for Bank of America.