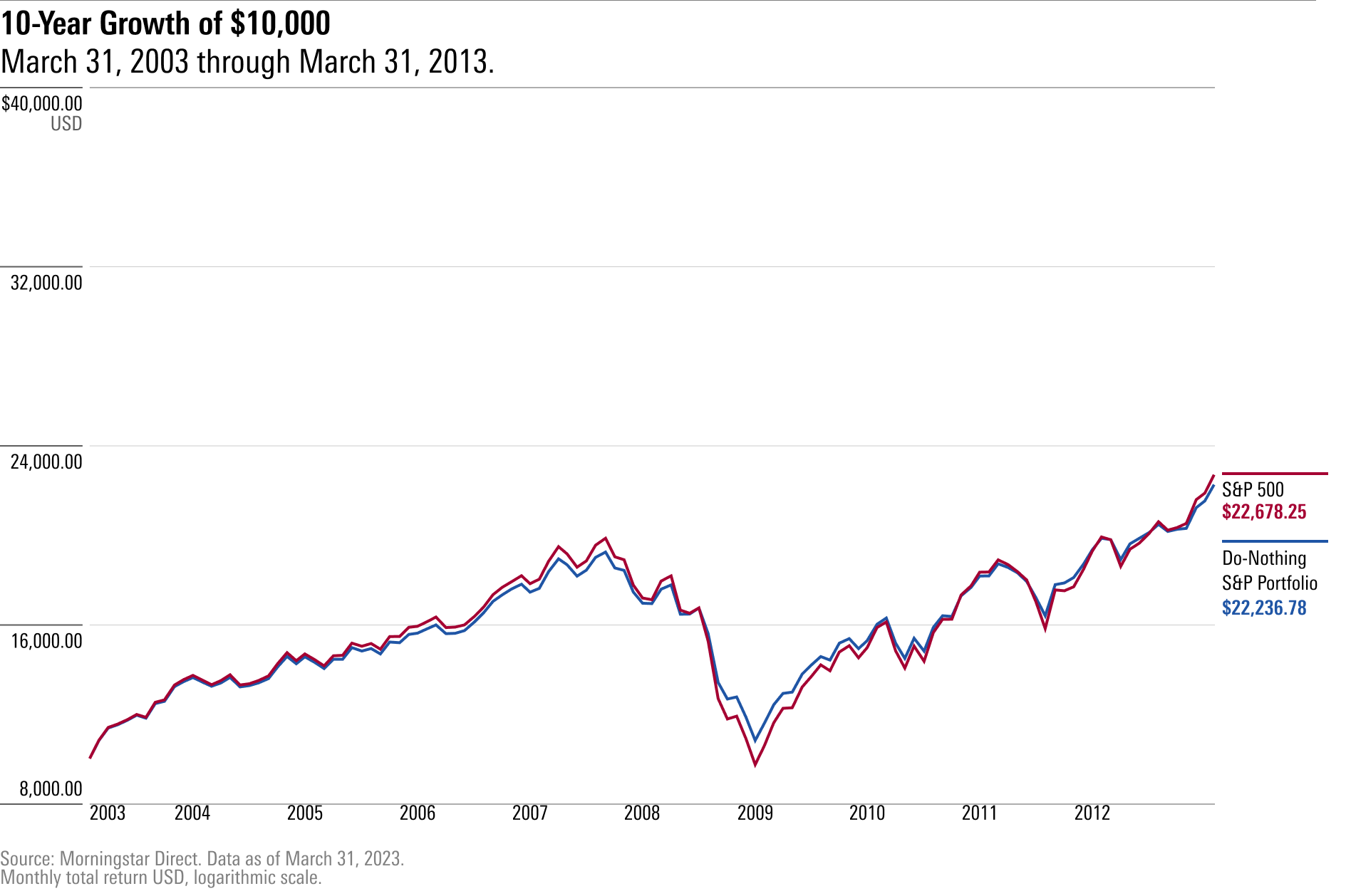

Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.As a result, the broad-market index has an excellent historical track record of generating wealth. Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

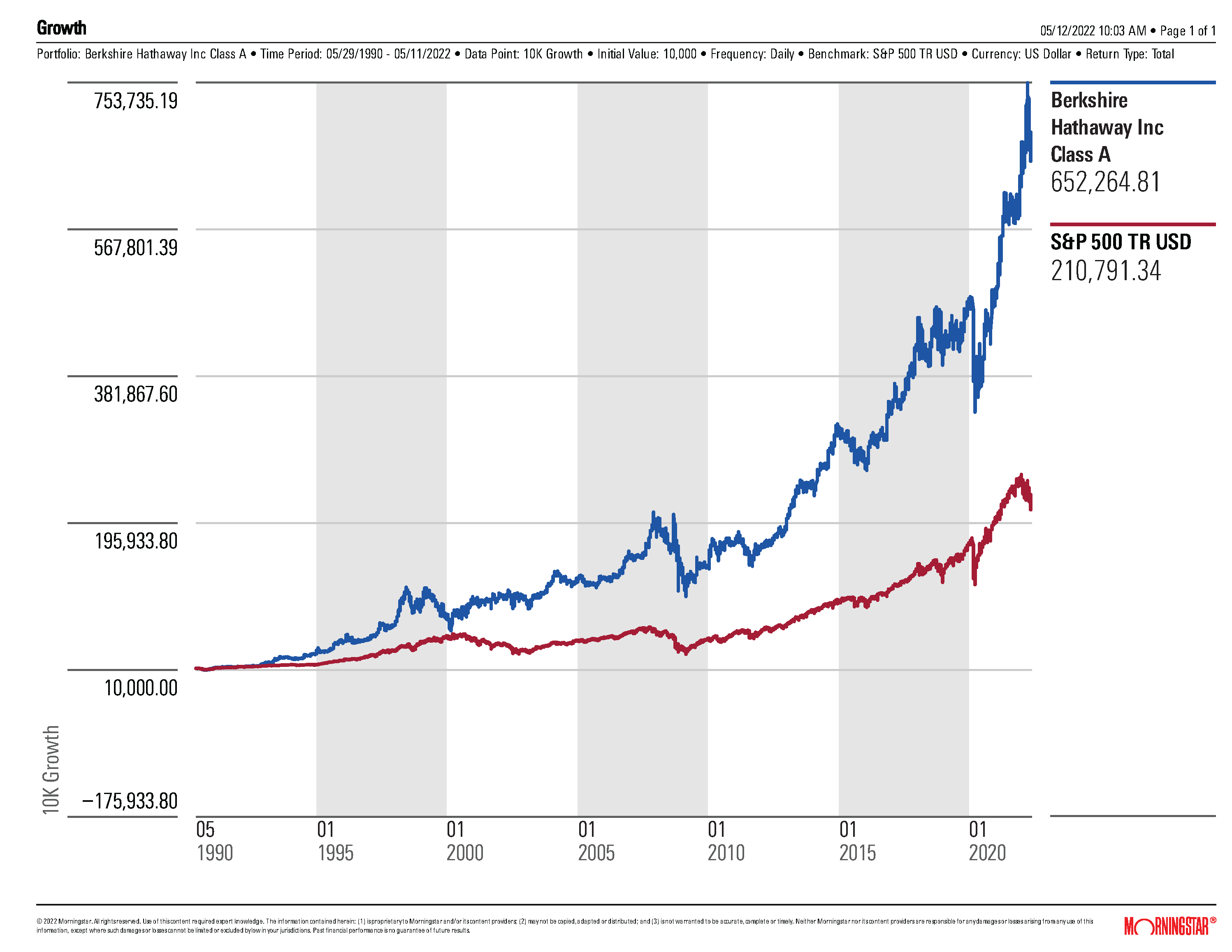

How much would $10,000 invest in the S&P 500 20 years ago : Buffett has said that he's advised his wife to invest all her money in the S&P 500 after his death. It's simple to calculate how much money you'd have today if you did just that 20 years ago with $10,000. The total would be more than $65,000, which implies a return of 555%.

How to turn $1000 into $10000 in a month

6 Ways to Turn $1000 into $10000

Invest in Real Estate.

Invest in Stocks and ETFs.

Get Out of Debt Now.

Start an Online Business.

Retail Arbitrage.

Invest in Yourself.

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation. If you take your $100,000 and put it in an S&P 500 index fund, you could end up with over $1 million within 24 years if the index produces returns in line with its historical average. If you keep saving, you can get there even faster.

How to double 10k quickly

How To Double 10K Quickly

Flip Stuff For Money. One of the more entreprenurial ways to flip 10k into 20k is to buy and resell stuff for profit.

Invest In Real Estate.

Start An Online Business.

Start A Side Hustle.

Invest In Stocks & ETFs.

Fixed-Income Investing.

Alternative Assets.

Invest In Debt.

To potentially turn $10k into $100k, consider investments in established businesses, real estate, index funds, mutual funds, dividend stocks, or cryptocurrencies. High-risk, high-reward options like cryptocurrencies and peer-to-peer lending could accelerate returns but also carry greater risks.Around the U.S., a $1 million nest egg can cover an average of 18.9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states. If you keep saving, you can get there even faster. If you invest just $500 per month into the fund on top of the initial $100,000, you'll get there in less than 20 years on average. Adding $1,000 per month will get you to $1 million within 17 years. There are a lot of great S&P 500 index funds.

How much to invest to make $1 million in 15 years : But in order to be a millionaire via investing in 15 years, you'd only have to invest $43,000 per year (assuming a 6% real rate of return, which accounts for inflation). I know, I know – only $43,000 per year. No big deal. *From this point forward, the average real rate of return we'll be assuming is 6%.

How to turn 10K into 100k fast : To potentially turn $10k into $100k, consider investments in established businesses, real estate, index funds, mutual funds, dividend stocks, or cryptocurrencies. High-risk, high-reward options like cryptocurrencies and peer-to-peer lending could accelerate returns but also carry greater risks.

How to flip 10K into 20k

How To Double 10K Quickly

Flip Stuff For Money. One of the more entreprenurial ways to flip 10k into 20k is to buy and resell stuff for profit.

Invest In Real Estate.

Start An Online Business.

Start A Side Hustle.

Invest In Stocks & ETFs.

Fixed-Income Investing.

Alternative Assets.

Invest In Debt.

If you're willing to stay the course and buy and hold investments that you're willing to be patient with, it's not impossible by any means to grow a $10,000 portfolio to $1 million or more by the time you retire.How much money you can make by investing $10,000

Year

Return

Ending balance

1

$800

$10,800

5

$4,693

$14,693

10

$11,589

$21,589

20

$36,610

$46,610

Can I retire at 45 with $3 million dollars : You can probably retire in financial comfort at age 45 if you have $3 million in savings. Although it's much younger than most people retire, that much money can likely generate adequate income for as long as you live.

Antwort How much would $10000 invested in S&P 500? Weitere Antworten – How much is $10,000 invested in the S&P 500 worth

Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.As a result, the broad-market index has an excellent historical track record of generating wealth. Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How much would $10,000 invest in the S&P 500 20 years ago : Buffett has said that he's advised his wife to invest all her money in the S&P 500 after his death. It's simple to calculate how much money you'd have today if you did just that 20 years ago with $10,000. The total would be more than $65,000, which implies a return of 555%.

How to turn $1000 into $10000 in a month

6 Ways to Turn $1000 into $10000

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

If you take your $100,000 and put it in an S&P 500 index fund, you could end up with over $1 million within 24 years if the index produces returns in line with its historical average. If you keep saving, you can get there even faster.

How to double 10k quickly

How To Double 10K Quickly

To potentially turn $10k into $100k, consider investments in established businesses, real estate, index funds, mutual funds, dividend stocks, or cryptocurrencies. High-risk, high-reward options like cryptocurrencies and peer-to-peer lending could accelerate returns but also carry greater risks.Around the U.S., a $1 million nest egg can cover an average of 18.9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states.

If you keep saving, you can get there even faster. If you invest just $500 per month into the fund on top of the initial $100,000, you'll get there in less than 20 years on average. Adding $1,000 per month will get you to $1 million within 17 years. There are a lot of great S&P 500 index funds.

How much to invest to make $1 million in 15 years : But in order to be a millionaire via investing in 15 years, you'd only have to invest $43,000 per year (assuming a 6% real rate of return, which accounts for inflation). I know, I know – only $43,000 per year. No big deal. *From this point forward, the average real rate of return we'll be assuming is 6%.

How to turn 10K into 100k fast : To potentially turn $10k into $100k, consider investments in established businesses, real estate, index funds, mutual funds, dividend stocks, or cryptocurrencies. High-risk, high-reward options like cryptocurrencies and peer-to-peer lending could accelerate returns but also carry greater risks.

How to flip 10K into 20k

How To Double 10K Quickly

If you're willing to stay the course and buy and hold investments that you're willing to be patient with, it's not impossible by any means to grow a $10,000 portfolio to $1 million or more by the time you retire.How much money you can make by investing $10,000

Can I retire at 45 with $3 million dollars : You can probably retire in financial comfort at age 45 if you have $3 million in savings. Although it's much younger than most people retire, that much money can likely generate adequate income for as long as you live.