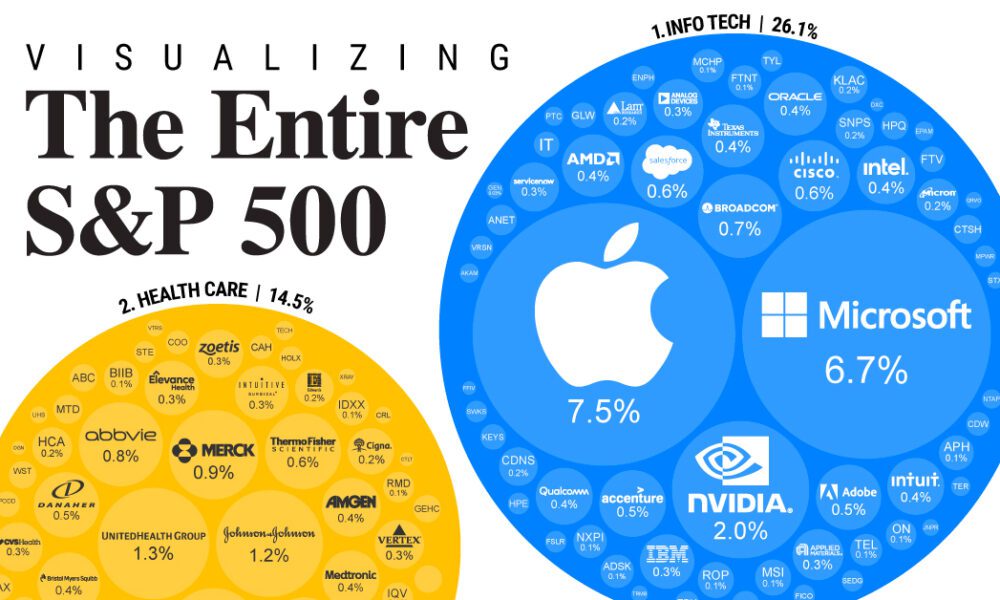

The index includes 500 leading companies and covers approximately 80% of available market capitalization.$44.471 trillion

S&P 500 Companies.

Component Returns.

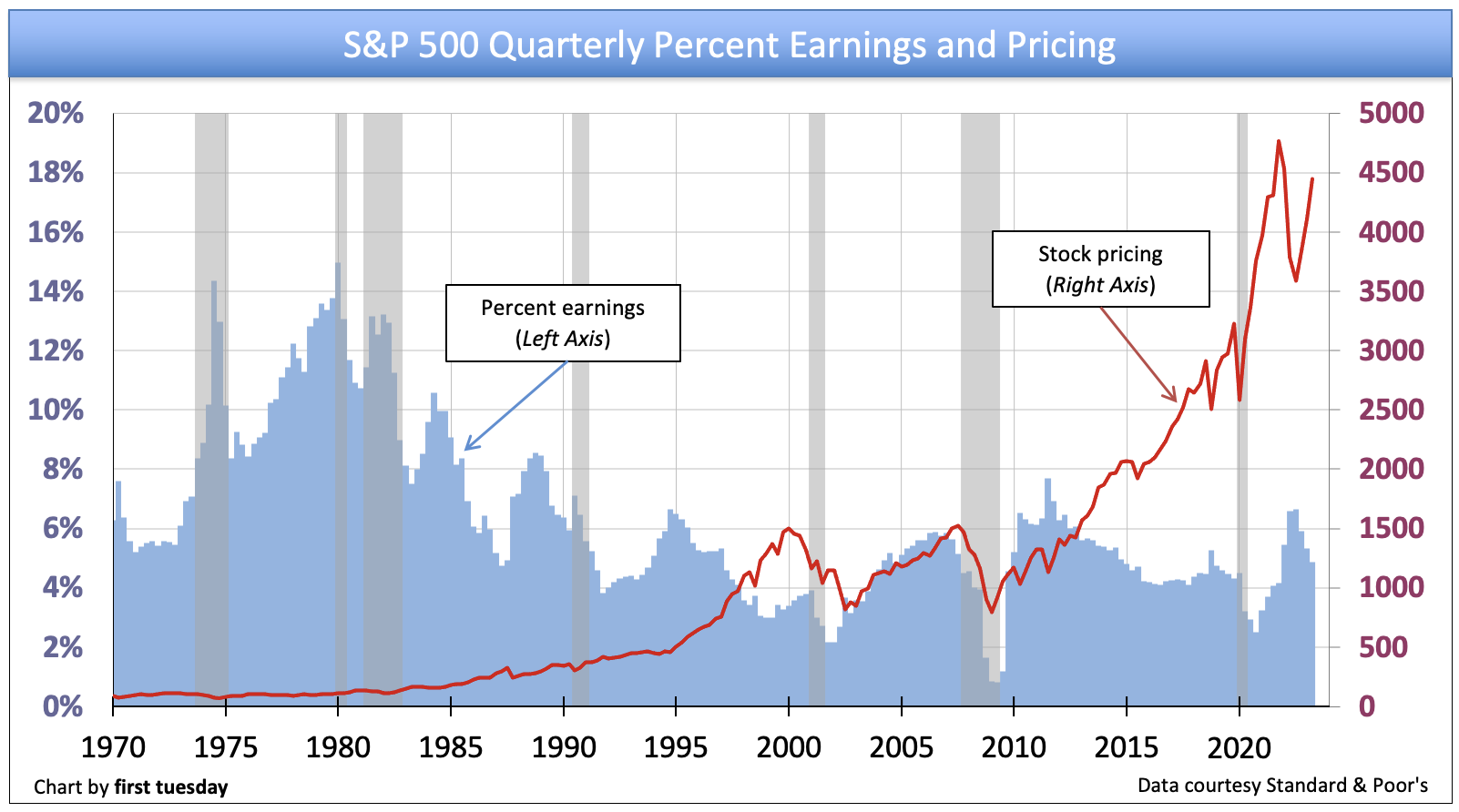

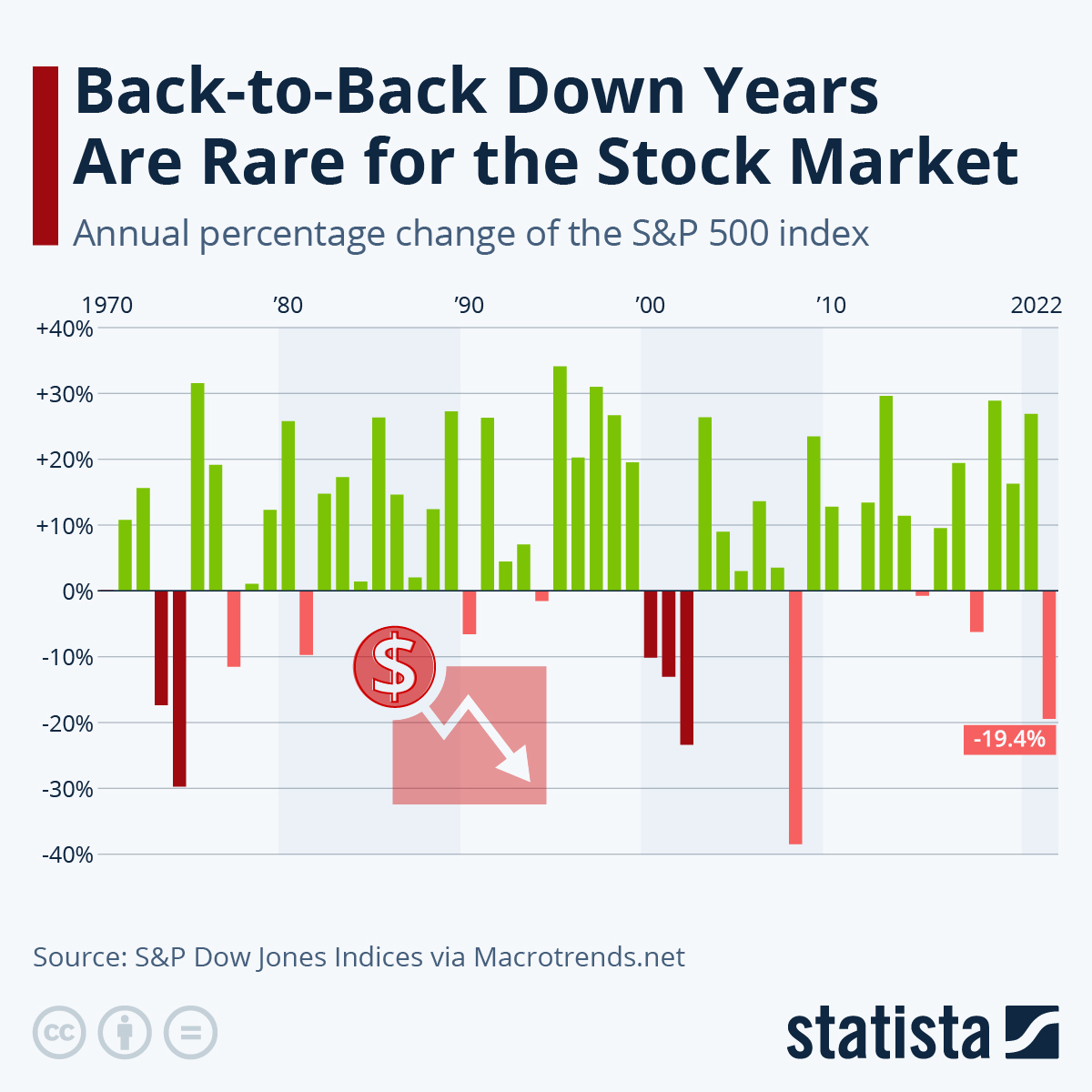

Historical Returns.

503 stocks

The index constituents and the constituent weights are updated regularly using rules published by S&P Dow Jones Indices. Although called the S&P 500, the index contains 503 stocks because it includes two share classes of stock from 3 of its component companies.

Does the S&P 500 outperform the total market : SP500 and total stock market have something like a 98% correlation, meaning that they go up about the same amount as each other over long time frames.

Is the S and P 500 the Dow Jones

But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.

What is the 10 year average return on the S&P 500 : The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

S&P 500 Index.

The S&P 500 is considered the benchmark for the U.S. stock market, even though it focuses exclusively on the large-cap market. This index tracks the performance of the 500 largest U.S. publicly traded companies across 11 different sectors. The S&P 500 is a stock market index that is viewed as a measure of how well the stock market is performing overall. It includes around 500 of the largest U.S. companies.

How much was $10,000 invested in the S&P 500 in 2000

Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.The S&P 500 total market cap is approximately $39.7 trillion as of Aug. 31, 2023, which is the sum of the market caps for all of the stocks in the index.19.Since Buffett took control of Berkshire Hathaway in 1965, the stock has trounced the S&P 500. Its compound annual gain through 2023 was 19.8% versus 10.2% for the broader index. But Buffett says those days of market-trouncing returns are behind it. Dow Jones U.S. Total Stock Market Index.

Is S&P 500 only US stocks : The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Is Dow Jones bigger than S&P : No. The Dow represents only a narrow slice of the economy. Professional investors tend to look at broader measures of the market, such as the S&P 500 index, which has nearly 17 times the number of companies within it.

What is the average return of the S&P 500 in the last 100 years

The average stock market return is about 10% per year for nearly the last century, as measured by the S&P 500 index. In some years, the market returns more than that, and in other years it returns less. Overall, the S&P 500 grew at a compound annual growth rate of 13.8% over the last 15 years. Adjusting for inflation, the index grew 11.2% per year during that period.CRSP defines mega-cap stocks as those that represent the top 70% of the U.S. market by market cap. By CRSP's definition, stocks making up the next 15% of the U.S. market's aggregate market cap are mid-cap stocks. But CRSP defines the large-cap segment as the top 85% of U.S. stocks ranked by market cap.

Who owns most of the S&P 500 : It's Vanguard. Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

Antwort How much of the total US stock market is S&P 500? Weitere Antworten – What percentage of the US stock market is the S&P 500

approximately 80%

The index includes 500 leading companies and covers approximately 80% of available market capitalization.$44.471 trillion

503 stocks

The index constituents and the constituent weights are updated regularly using rules published by S&P Dow Jones Indices. Although called the S&P 500, the index contains 503 stocks because it includes two share classes of stock from 3 of its component companies.

Does the S&P 500 outperform the total market : SP500 and total stock market have something like a 98% correlation, meaning that they go up about the same amount as each other over long time frames.

Is the S and P 500 the Dow Jones

But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.

What is the 10 year average return on the S&P 500 : The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

S&P 500 Index.

The S&P 500 is considered the benchmark for the U.S. stock market, even though it focuses exclusively on the large-cap market. This index tracks the performance of the 500 largest U.S. publicly traded companies across 11 different sectors.

The S&P 500 is a stock market index that is viewed as a measure of how well the stock market is performing overall. It includes around 500 of the largest U.S. companies.

How much was $10,000 invested in the S&P 500 in 2000

Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.The S&P 500 total market cap is approximately $39.7 trillion as of Aug. 31, 2023, which is the sum of the market caps for all of the stocks in the index.19.Since Buffett took control of Berkshire Hathaway in 1965, the stock has trounced the S&P 500. Its compound annual gain through 2023 was 19.8% versus 10.2% for the broader index. But Buffett says those days of market-trouncing returns are behind it.

Dow Jones U.S. Total Stock Market Index.

Is S&P 500 only US stocks : The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Is Dow Jones bigger than S&P : No. The Dow represents only a narrow slice of the economy. Professional investors tend to look at broader measures of the market, such as the S&P 500 index, which has nearly 17 times the number of companies within it.

What is the average return of the S&P 500 in the last 100 years

The average stock market return is about 10% per year for nearly the last century, as measured by the S&P 500 index. In some years, the market returns more than that, and in other years it returns less.

Overall, the S&P 500 grew at a compound annual growth rate of 13.8% over the last 15 years. Adjusting for inflation, the index grew 11.2% per year during that period.CRSP defines mega-cap stocks as those that represent the top 70% of the U.S. market by market cap. By CRSP's definition, stocks making up the next 15% of the U.S. market's aggregate market cap are mid-cap stocks. But CRSP defines the large-cap segment as the top 85% of U.S. stocks ranked by market cap.

Who owns most of the S&P 500 : It's Vanguard. Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.