The overall 2018 results show that foreign sales as a percentage of total S&P 500 sales decreased to 42.90% from 43.62% in 2017 (2016 was 43.16%, 2015 was 44.35%, and 2014 was 47.82%).To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes.It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.

Does the S&P have international exposure : 40% of sales generated by S&P 500 companies come from outside the U.S. As a result, one school of thought believes investors can achieve adequate international exposure from their domestic investments.

How much of S&P 500 earnings come from abroad

Approximately 62% of total revenue came from foreign countries, with a notable increase to China (10%). In contrast, the domestic index exposure to the U.S. stayed true to the name; nearly all of the revenue comes from U.S. (99.9%).

Is the S&P 500 All American : The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding. Even though this may not seem like much it is inevitable that exchange rates of US plays a part in the prices of stock for S&P.

Can I invest in S&P 500 from anywhere in the world

By utilizing options such as trading S&P 500 CFDs or investing in S&P 500 ETFs, UAE traders and investors can easily participate in the index's potential growth and enjoy the benefits of diversification. With region's brokers like amana, people from almost anywhere in the world can tap into the S&P 500 Index.In general, Vanguard recommends that at least 20% of your overall portfolio should be invested in international stocks and bonds. However, to get the full diversification benefits, consider investing about 40% of your stock allocation in international stocks and about 30% of your bond allocation in international bonds.Composed of 500 companies that are domiciled in the U.S., the index captures approximately 82%[1] of the total U.S. equity market value. An index of U.S. companies may lead one to assume that the index is only reliant on the health and growth of the U.S. economy. In reality, the index is much more global than that. S&P 500 Dividend Yield is at 1.35%, compared to 1.47% last month and 1.66% last year. This is lower than the long term average of 1.84%.

Can non American buy S&P 500 : How to invest in S&P500 Index as a non-US resident. As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index.

Who owns most of the S&P 500 : It's Vanguard. Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

How much of the total US stock market is S&P 500

approximately 80%

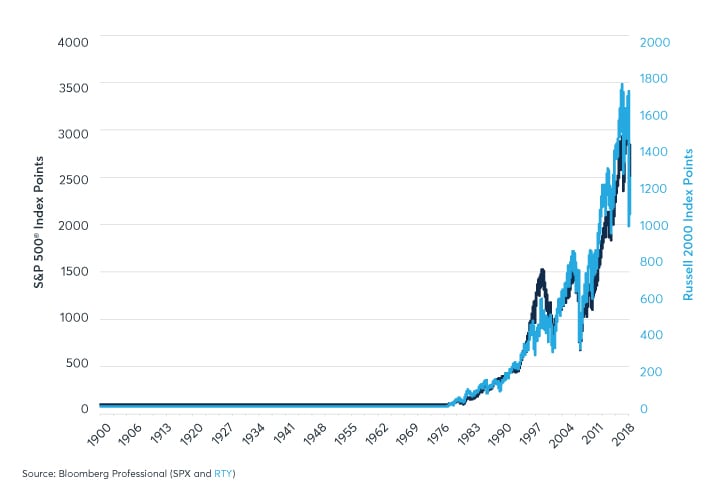

Bloomberg Ticker: SPX

The index includes 500 leading companies and covers approximately 80% of available market capitalization. As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index. Similar to stocks, ETFs are also traded in the stock market.Off. This is because your investment can keep growing over time thanks to something called compounding returns.

Why doesn’t everyone invest in the S&P 500 : Dominated by large-cap companies: since mainly large-cap companies dominate the S&P 500, it won't provide exposure to many small-cap or mid-cap stocks, even when investing in S&P index funds.

Antwort How much of the S&P 500 is foreign? Weitere Antworten – How much of the S&P 500 is foreign

The overall 2018 results show that foreign sales as a percentage of total S&P 500 sales decreased to 42.90% from 43.62% in 2017 (2016 was 43.16%, 2015 was 44.35%, and 2014 was 47.82%).To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes.It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.

Does the S&P have international exposure : 40% of sales generated by S&P 500 companies come from outside the U.S. As a result, one school of thought believes investors can achieve adequate international exposure from their domestic investments.

How much of S&P 500 earnings come from abroad

Approximately 62% of total revenue came from foreign countries, with a notable increase to China (10%). In contrast, the domestic index exposure to the U.S. stayed true to the name; nearly all of the revenue comes from U.S. (99.9%).

Is the S&P 500 All American : The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.

Even though this may not seem like much it is inevitable that exchange rates of US plays a part in the prices of stock for S&P.

Can I invest in S&P 500 from anywhere in the world

By utilizing options such as trading S&P 500 CFDs or investing in S&P 500 ETFs, UAE traders and investors can easily participate in the index's potential growth and enjoy the benefits of diversification. With region's brokers like amana, people from almost anywhere in the world can tap into the S&P 500 Index.In general, Vanguard recommends that at least 20% of your overall portfolio should be invested in international stocks and bonds. However, to get the full diversification benefits, consider investing about 40% of your stock allocation in international stocks and about 30% of your bond allocation in international bonds.Composed of 500 companies that are domiciled in the U.S., the index captures approximately 82%[1] of the total U.S. equity market value. An index of U.S. companies may lead one to assume that the index is only reliant on the health and growth of the U.S. economy. In reality, the index is much more global than that.

S&P 500 Dividend Yield is at 1.35%, compared to 1.47% last month and 1.66% last year. This is lower than the long term average of 1.84%.

Can non American buy S&P 500 : How to invest in S&P500 Index as a non-US resident. As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index.

Who owns most of the S&P 500 : It's Vanguard. Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

How much of the total US stock market is S&P 500

approximately 80%

Bloomberg Ticker: SPX

The index includes 500 leading companies and covers approximately 80% of available market capitalization.

As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index. Similar to stocks, ETFs are also traded in the stock market.Off. This is because your investment can keep growing over time thanks to something called compounding returns.

Why doesn’t everyone invest in the S&P 500 : Dominated by large-cap companies: since mainly large-cap companies dominate the S&P 500, it won't provide exposure to many small-cap or mid-cap stocks, even when investing in S&P index funds.