As a tax resident of Norway, you must pay tax on income that you've earned during a calendar year. You'll be liable for tax on your salary and other income, including interest income, income from the letting of property and income from shares. The income tax rate is 22 percent.The tax level in Norway has fluctuated between 40 and 45% of GDP since the 1970s. The relatively high tax level is a result of the large Norwegian welfare state. Most of the tax revenue is spent on public services such as health services, the operation of hospitals, education and transportation.In general, foreign workers living in Norway must pay taxes to Norway. As a foreign worker in Norway, you can choose between two different ways of paying tax: the PAYE (Pay As You Earn) scheme and the general tax scheme.

What is the wealth tax in Norway : Norway levies a net wealth tax. of 1 percent on individuals' wealth stocks exceeding NOK 1.7 million (EUR 150,000 or USD 160,000), with 0.7 percent going to municipalities and 0.3 percent to the central government. Norway's net wealth tax dates to 1892.

What is a good salary in Norway

The average salary in Norway is a reflection of the country's high standard of living and its well-developed welfare system. As of the latest data, the typical monthly income for a full-time worker in Norway is around 47,000 NOK (approximately 4,700 USD) before taxes.

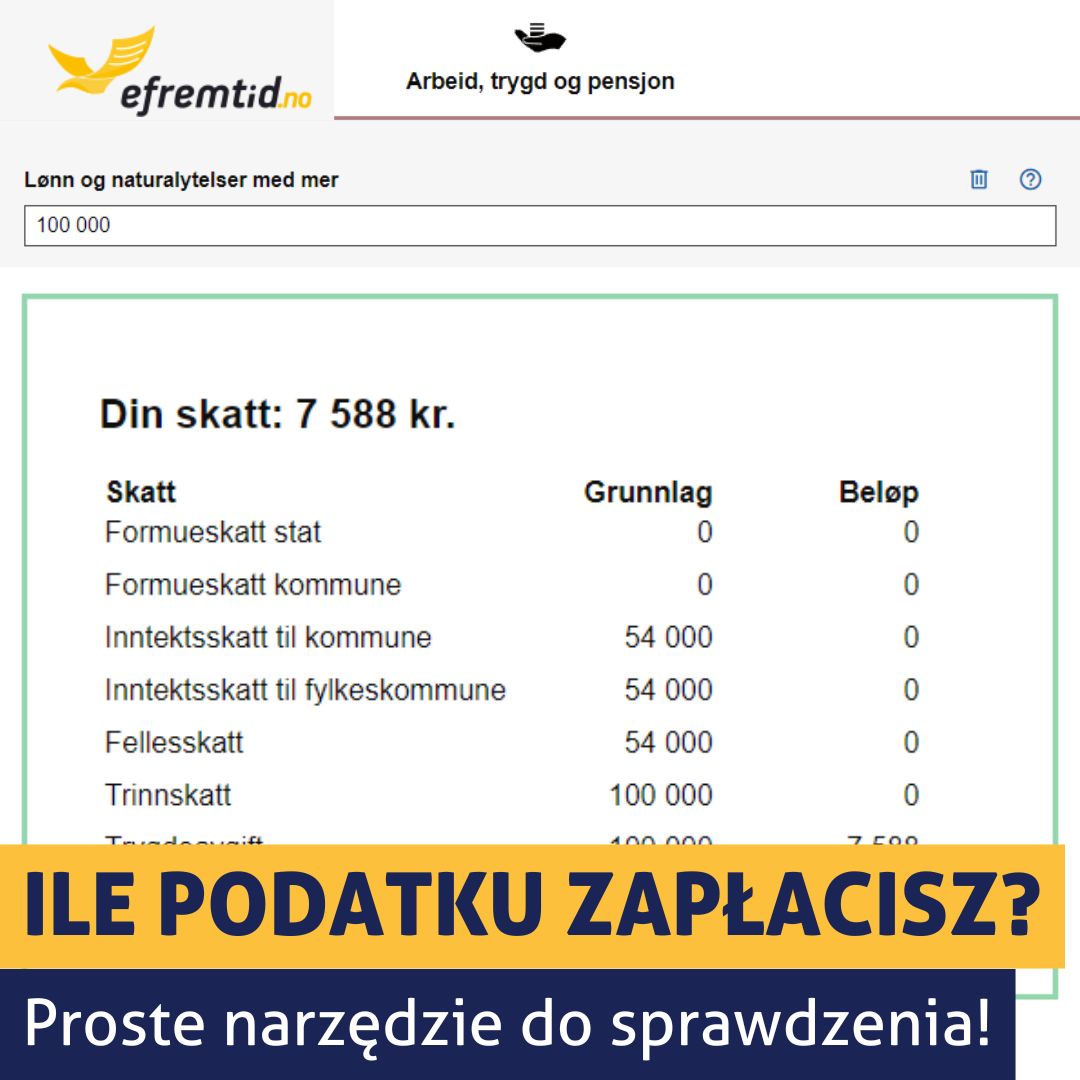

How much is 100000 after tax in Norway : If you make 100,000 kr a year living in Norway, you will be taxed 8,000 kr. That means that your net pay will be 92,000 kr per year, or 7,667 kr per month. Your average tax rate is 8.0% and your marginal tax rate is 8.0%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

“Norwegians get a lot for their money. Norway is so expensive because it has productive workers who can be used for work that produces many valuable products in a short time. Hourly rates of pay in Norway are high. Because most products and services entail the application of manpower, labour costs are high in Norway. Norway has very large supplies of oil off it's coast, which has secured them riches for long time ahead. The government turned it into a national fund, that is not overspent. It's not private companies who profit, but the entire nation prospers due to it.

What is the 183 day rule in Norway

Individuals who stay in Norway for more than 183 days during any twelve-month period, will become tax resident in Norway. The same applies to individuals who stay in Norway for more than 270 days during any thirty-six month period.According to Statistics Norway, the average salary in Norway is 637,800 NOK per year or 52,150 NOK per month. However, it's important to keep in mind that these salary averages are not absolute, and your actual earnings may vary significantly depending on your individual circumstances.» Norway had the 10th highest tax wedge in the OECD for an average married worker with two children at 32.9% in 2023, which compares with the OECD average of 25.7%. The country occupied the same position in 2022. Oil, gas, seafood, and products from energy-intensive industry are among our main export commodities. Our sea areas are six times the size of our land area, and our ocean-based industries account for almost 40 % of our total value creation, and 70 % of our exports.

Is 500k NOK good : However, according to the figures in Numbeo, a single person (living outside of Oslo) should be comfortable on a 500,000 – 600,000 NOK salary per year, while a family (living outside of Oslo) should be comfortable on an 800,000 – 1,000,000 NOK annual salary.

Why are Norwegian salaries so high : Norway is known for its strong economy, powered by natural resources such as oil and gas, which contribute to higher wages in those related industries. Additionally, public sector jobs, which are quite prevalent in Norway, tend to offer competitive salaries.

Is 1 million NOK a good salary in Norway

However, according to the figures in Numbeo, a single person (living outside of Oslo) should be comfortable on a 500,000 – 600,000 NOK salary per year, while a family (living outside of Oslo) should be comfortable on an 800,000 – 1,000,000 NOK annual salary. As of the latest data, the typical monthly income for a full-time worker in Norway is around 47,000 NOK (approximately 4,700 USD) before taxes. Annually, this amounts to an average salary of about 564,000 NOK (or roughly 56,400 USD).Is it expensive to live in Norway Yes, Norway is extremely expensive. However, higher salaries offset these prices. The average cost of living in Norway will depend on the lifestyle you lead and where in the country you choose to settle.

Which is the richest Nordic country : Norway

Surprisingly, Norway, the richest country, seems to be the technologically least advanced of the Nordics, ranking closer to Albania than to its neighbours. This is because of the high dependency of Norway's (and Albania's) real GDP on natural resource extraction.

Antwort How much is tax in Norway? Weitere Antworten – How much tax do I pay in Norway

Income tax

As a tax resident of Norway, you must pay tax on income that you've earned during a calendar year. You'll be liable for tax on your salary and other income, including interest income, income from the letting of property and income from shares. The income tax rate is 22 percent.The tax level in Norway has fluctuated between 40 and 45% of GDP since the 1970s. The relatively high tax level is a result of the large Norwegian welfare state. Most of the tax revenue is spent on public services such as health services, the operation of hospitals, education and transportation.In general, foreign workers living in Norway must pay taxes to Norway. As a foreign worker in Norway, you can choose between two different ways of paying tax: the PAYE (Pay As You Earn) scheme and the general tax scheme.

What is the wealth tax in Norway : Norway levies a net wealth tax. of 1 percent on individuals' wealth stocks exceeding NOK 1.7 million (EUR 150,000 or USD 160,000), with 0.7 percent going to municipalities and 0.3 percent to the central government. Norway's net wealth tax dates to 1892.

What is a good salary in Norway

The average salary in Norway is a reflection of the country's high standard of living and its well-developed welfare system. As of the latest data, the typical monthly income for a full-time worker in Norway is around 47,000 NOK (approximately 4,700 USD) before taxes.

How much is 100000 after tax in Norway : If you make 100,000 kr a year living in Norway, you will be taxed 8,000 kr. That means that your net pay will be 92,000 kr per year, or 7,667 kr per month. Your average tax rate is 8.0% and your marginal tax rate is 8.0%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

“Norwegians get a lot for their money. Norway is so expensive because it has productive workers who can be used for work that produces many valuable products in a short time. Hourly rates of pay in Norway are high. Because most products and services entail the application of manpower, labour costs are high in Norway.

Norway has very large supplies of oil off it's coast, which has secured them riches for long time ahead. The government turned it into a national fund, that is not overspent. It's not private companies who profit, but the entire nation prospers due to it.

What is the 183 day rule in Norway

Individuals who stay in Norway for more than 183 days during any twelve-month period, will become tax resident in Norway. The same applies to individuals who stay in Norway for more than 270 days during any thirty-six month period.According to Statistics Norway, the average salary in Norway is 637,800 NOK per year or 52,150 NOK per month. However, it's important to keep in mind that these salary averages are not absolute, and your actual earnings may vary significantly depending on your individual circumstances.» Norway had the 10th highest tax wedge in the OECD for an average married worker with two children at 32.9% in 2023, which compares with the OECD average of 25.7%. The country occupied the same position in 2022.

Oil, gas, seafood, and products from energy-intensive industry are among our main export commodities. Our sea areas are six times the size of our land area, and our ocean-based industries account for almost 40 % of our total value creation, and 70 % of our exports.

Is 500k NOK good : However, according to the figures in Numbeo, a single person (living outside of Oslo) should be comfortable on a 500,000 – 600,000 NOK salary per year, while a family (living outside of Oslo) should be comfortable on an 800,000 – 1,000,000 NOK annual salary.

Why are Norwegian salaries so high : Norway is known for its strong economy, powered by natural resources such as oil and gas, which contribute to higher wages in those related industries. Additionally, public sector jobs, which are quite prevalent in Norway, tend to offer competitive salaries.

Is 1 million NOK a good salary in Norway

However, according to the figures in Numbeo, a single person (living outside of Oslo) should be comfortable on a 500,000 – 600,000 NOK salary per year, while a family (living outside of Oslo) should be comfortable on an 800,000 – 1,000,000 NOK annual salary.

As of the latest data, the typical monthly income for a full-time worker in Norway is around 47,000 NOK (approximately 4,700 USD) before taxes. Annually, this amounts to an average salary of about 564,000 NOK (or roughly 56,400 USD).Is it expensive to live in Norway Yes, Norway is extremely expensive. However, higher salaries offset these prices. The average cost of living in Norway will depend on the lifestyle you lead and where in the country you choose to settle.

Which is the richest Nordic country : Norway

Surprisingly, Norway, the richest country, seems to be the technologically least advanced of the Nordics, ranking closer to Albania than to its neighbours. This is because of the high dependency of Norway's (and Albania's) real GDP on natural resource extraction.