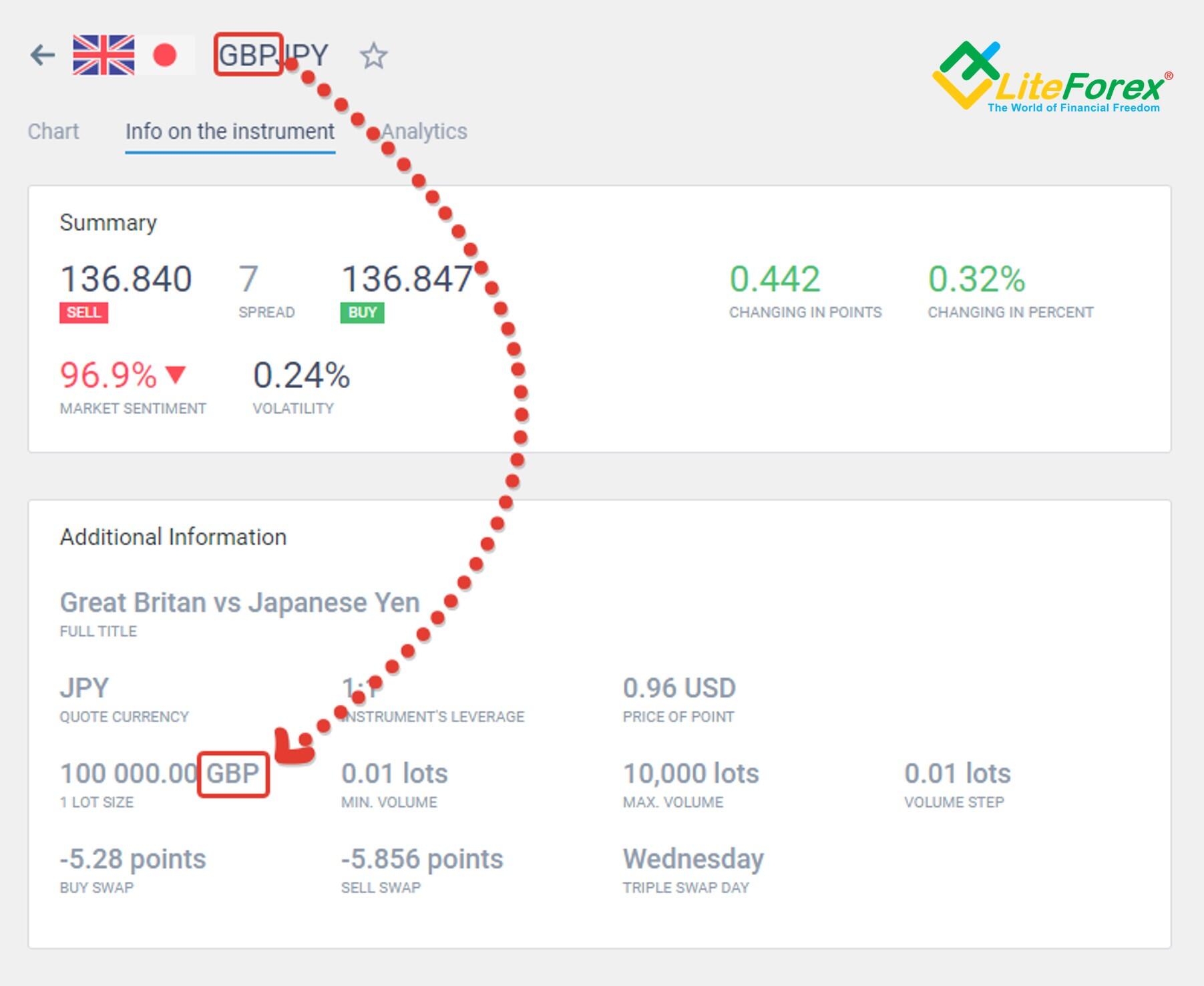

While 1 lot represents a transaction of 100,000 units of the currency mentioned first in a currency pair, the value of 1 micro lot is 1,000 units. If you are interested in the relationship between lots, micro-lots, leverage, and margin, we recommend reading the article about micro-lots we wrote on the subject.The Nasdaq-100 is often abbreviated as NDX, NDQ, NAS100 or US100 in the derivatives markets. Its corresponding futures contracts are traded on the Chicago Mercantile Exchange. The regular futures are denoted by the Reuters Instrument Code ND, and the smaller E-mini version uses the code NQ.NAS100, representing the NASDAQ 100 index, is a significant instrument in the forex market, allowing traders to speculate on the performance of major non-financial companies in the technology sector.

What is NAS100 on Exness : The NAS100 stands out as one of the most coveted stock indices in the trading world. This stock index represents a collection of a hundred of the largest non-financial companies on the NASDAQ. It offers great diversity in a single asset.

How much is 0.01 on NAS100

One pip equals 0.0001, so one unit of NAS100 is USD 0.01. In a sense, you must look at the last digit (fourth past the decimal point) to see the current pip.

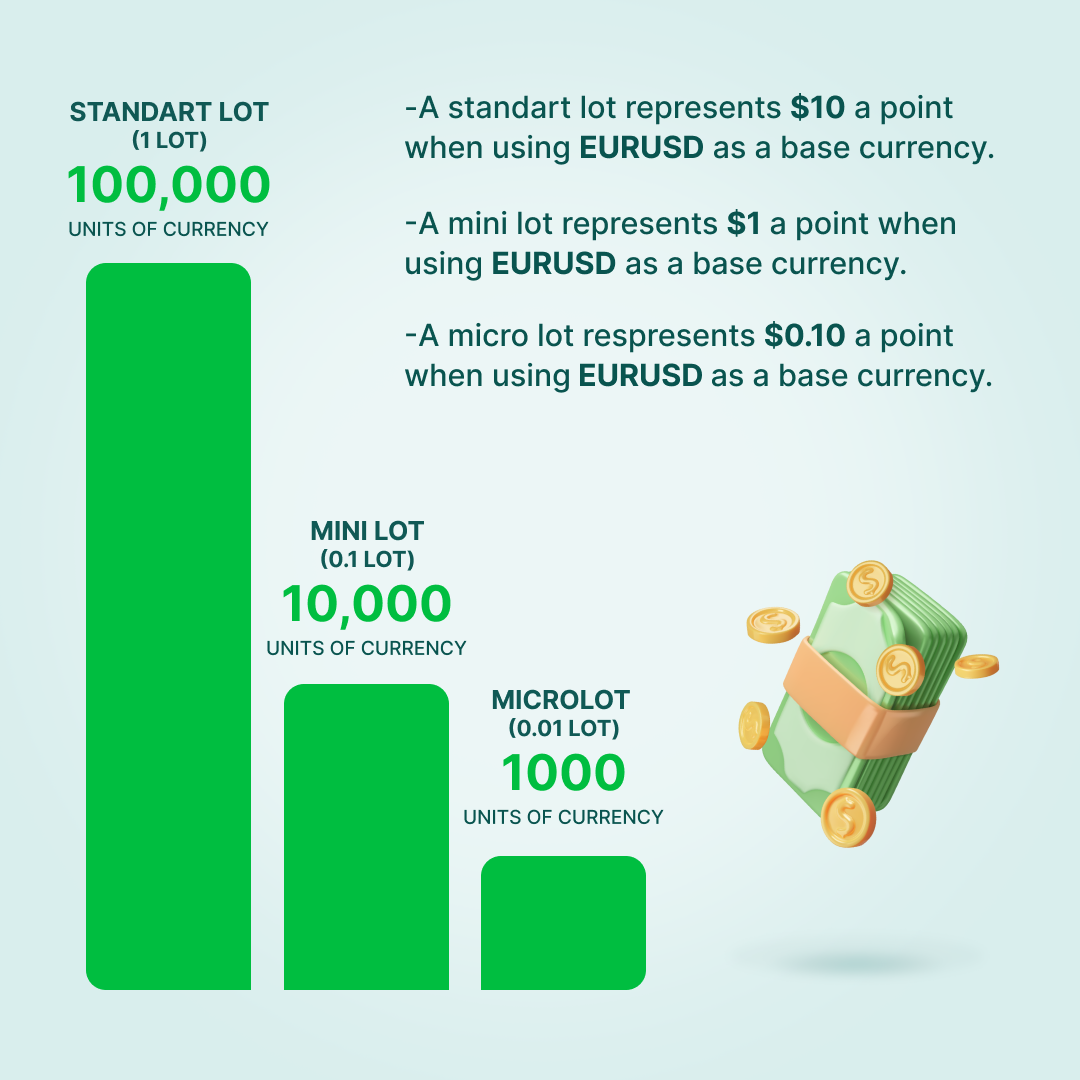

How much is 1.00 lots : 100,000 units

Standard Lot (1.00): Represents 100,000 units of the base currency. For example, trading one standard lot of EUR/USD means trading 100,000 euros. Mini Lot (0.10): Represents 10,000 units of the base currency.

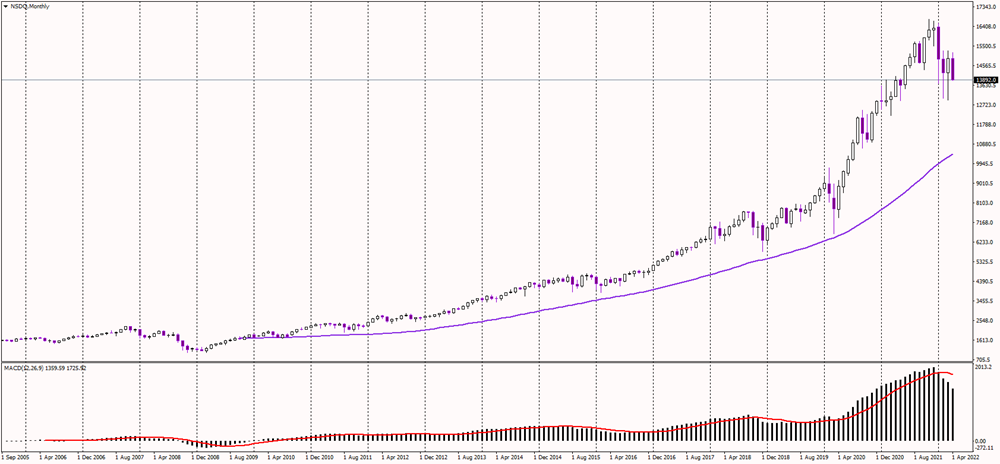

With a proven history of high index performance, the Nasdaq-100® is the best way to invest in some of the top non-financial companies listed on Nasdaq. The Nasdaq 100 Index is constructed with a modified capitalization method, which uses the individual weights of included items according to their market capitalization. 2 Weighting limits the influence of the largest companies and balances the index among all members.

What is the standard lot for NAS 100

The standard contract size for NAS100 is 1 with max lots of 150 tradeable in 0.1 lot increments.The value of the index is calculated by multiplying each security's last sale price with the aggregate value of the index share weights of each of the index securities, then dividing by an index divisor.The standard contract size for NAS100 is 1 with max lots of 150 tradeable in 0.1 lot increments. The Forex trading asset is the EURUSD pair; the exchange rate is 1.1826. One standard lot is 100,000 of base currency. If you want to enter a single trade of one lot, you should spend 118,260 USD to buy 100,000 euros.

How much is 0.01 lot : around $1,000

0.01 is a micro lot in forex which is 1,000 units of currency. So 0.01 lot size would be around $1,000. The value of the pip for a micro-lot is roughly $0.10 based on the EUR/USD. This is usually the value most beginner traders start with.

How many shares are in 0.01 lot : One standard lot is typically 100,000 currency units of account base currency. There are smaller lot sizes, including mini (0.1 of a standard lot or 10,000 units), micro (0.01 of a standard lot or 1,000 units), and nano (0.001 of a standard lot or 100 units).

What is 1 lot equal to

100,000 units

A standard lot is the largest, representing 100,000 units of the base currency. An investor is ordering 100,000 units of the currency being bought or sold when they place a forex order with a standard lot. A standard lot = $10. A mini lot = $1. A micro lot = $0.10. A nano lot = $0.01.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

Is Nasdaq 100 good for long term : Performance Of Nasdaq 100 Index

The Nasdaq 100 index has done well in recent years when compared to Indian equity markets. Nasdaq 100 TRI index has delivered a CAGR of 34.6% over the past 5 years, while the NIFTY 50 TRI index has delivered a CAGR of 18.8%.

Antwort How much is 1 lot in Nasdaq 100? Weitere Antworten – How much is 1 lot Nasdaq

100,000 units

While 1 lot represents a transaction of 100,000 units of the currency mentioned first in a currency pair, the value of 1 micro lot is 1,000 units. If you are interested in the relationship between lots, micro-lots, leverage, and margin, we recommend reading the article about micro-lots we wrote on the subject.The Nasdaq-100 is often abbreviated as NDX, NDQ, NAS100 or US100 in the derivatives markets. Its corresponding futures contracts are traded on the Chicago Mercantile Exchange. The regular futures are denoted by the Reuters Instrument Code ND, and the smaller E-mini version uses the code NQ.NAS100, representing the NASDAQ 100 index, is a significant instrument in the forex market, allowing traders to speculate on the performance of major non-financial companies in the technology sector.

What is NAS100 on Exness : The NAS100 stands out as one of the most coveted stock indices in the trading world. This stock index represents a collection of a hundred of the largest non-financial companies on the NASDAQ. It offers great diversity in a single asset.

How much is 0.01 on NAS100

One pip equals 0.0001, so one unit of NAS100 is USD 0.01. In a sense, you must look at the last digit (fourth past the decimal point) to see the current pip.

How much is 1.00 lots : 100,000 units

Standard Lot (1.00): Represents 100,000 units of the base currency. For example, trading one standard lot of EUR/USD means trading 100,000 euros. Mini Lot (0.10): Represents 10,000 units of the base currency.

With a proven history of high index performance, the Nasdaq-100® is the best way to invest in some of the top non-financial companies listed on Nasdaq.

The Nasdaq 100 Index is constructed with a modified capitalization method, which uses the individual weights of included items according to their market capitalization. 2 Weighting limits the influence of the largest companies and balances the index among all members.

What is the standard lot for NAS 100

The standard contract size for NAS100 is 1 with max lots of 150 tradeable in 0.1 lot increments.The value of the index is calculated by multiplying each security's last sale price with the aggregate value of the index share weights of each of the index securities, then dividing by an index divisor.The standard contract size for NAS100 is 1 with max lots of 150 tradeable in 0.1 lot increments.

The Forex trading asset is the EURUSD pair; the exchange rate is 1.1826. One standard lot is 100,000 of base currency. If you want to enter a single trade of one lot, you should spend 118,260 USD to buy 100,000 euros.

How much is 0.01 lot : around $1,000

0.01 is a micro lot in forex which is 1,000 units of currency. So 0.01 lot size would be around $1,000. The value of the pip for a micro-lot is roughly $0.10 based on the EUR/USD. This is usually the value most beginner traders start with.

How many shares are in 0.01 lot : One standard lot is typically 100,000 currency units of account base currency. There are smaller lot sizes, including mini (0.1 of a standard lot or 10,000 units), micro (0.01 of a standard lot or 1,000 units), and nano (0.001 of a standard lot or 100 units).

What is 1 lot equal to

100,000 units

A standard lot is the largest, representing 100,000 units of the base currency. An investor is ordering 100,000 units of the currency being bought or sold when they place a forex order with a standard lot.

A standard lot = $10. A mini lot = $1. A micro lot = $0.10. A nano lot = $0.01.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

Is Nasdaq 100 good for long term : Performance Of Nasdaq 100 Index

The Nasdaq 100 index has done well in recent years when compared to Indian equity markets. Nasdaq 100 TRI index has delivered a CAGR of 34.6% over the past 5 years, while the NIFTY 50 TRI index has delivered a CAGR of 18.8%.