Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.The annualized return of the last 10 years has been 12.31% (updated at Apr 30, 2024).

How much does the S&P 500 grow each year : Bottom Line. Since 1957, the S&P 500's average annual rate of return has been approximately 10.5% (through March 2023) and around 6.6% after adjusting for inflation.

What is the 10 year return on spy stock

Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.

What is the 10 year average return on the Nasdaq : Average returns

Period

Average annualised return

Total return

Last year

35.7%

35.7%

Last 5 years

19.3%

141.7%

Last 10 years

21.0%

574.9%

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498. The S&P 500 has returned 1,800% over the last three decades, compounding at 10.3% annually. That period encompasses enough different market conditions that similar returns are likely over the next three decades. That does not mean the S&P 500 always goes up.

What is the S&P 500 10 year yield

Basic Info. S&P 500 10 Year Return is at 167.3%, compared to 180.6% last month and 161.0% last year. This is higher than the long term average of 114.6%.While 10% might be the average, the returns in any given year are far from average. In fact, between 1926 and 2024, returns were in that “average” band of 8% to 12% only eight times. The rest of the time they were much lower or, usually, much higher.Overall, the S&P 500 grew at a compound annual growth rate of 13.8% over the last 15 years. Adjusting for inflation, the index grew 11.2% per year during that period. SPDR S&P 500 (SPY): Historical Returns

In the last 30 Years, the SPDR S&P 500 (SPY) ETF obtained a 10.35% compound annual return, with a 15.12% standard deviation.

Is SPY a good stock to hold : SPY has a conensus rating of Moderate Buy which is based on 401 buy ratings, 99 hold ratings and 4 sell ratings. What is SPY's price target The average price target for SPY is $583.29. This is based on 504 Wall Streets Analysts 12-month price targets, issued in the past 3 months.

What is a good ROI over 10 years : 5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

10 years (2014-2023)

11.02%

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

25 years (1999-2023)

7.18%

What is the S&P 500 2 year return

S&P 500 2 Year Return is at 21.87%, compared to 15.98% last month and -0.28% last year. Now, let's consider how our calculations change if the time horizon is 10 years. If you are starting from scratch, you will need to invest about $4,757 at the end of every month for 10 years. Suppose you already have $100,000. Then you will only need $3,390 at the end of every month to become a millionaire in 10 years.This means that your $1,000 10 years ago — technically, $1,002 — would have bought 60 shares of Tesla. As of Mar. 3, 2024, those 60 shares of Tesla would be worth $12,158.40. That marks a 28.342% annual rate of return.

Does the S&P 500 double every 7 years : According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time. In some cases, like 1952 to 1955 or 1995 to 1998, the value of the investment doubled in only three years.

Antwort How much has the S&P 500 grown in the last 10 years? Weitere Antworten – What is the S&P 500 last 10 years return

Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.The annualized return of the last 10 years has been 12.31% (updated at Apr 30, 2024).

How much does the S&P 500 grow each year : Bottom Line. Since 1957, the S&P 500's average annual rate of return has been approximately 10.5% (through March 2023) and around 6.6% after adjusting for inflation.

What is the 10 year return on spy stock

Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.

What is the 10 year average return on the Nasdaq : Average returns

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

The S&P 500 has returned 1,800% over the last three decades, compounding at 10.3% annually. That period encompasses enough different market conditions that similar returns are likely over the next three decades. That does not mean the S&P 500 always goes up.

What is the S&P 500 10 year yield

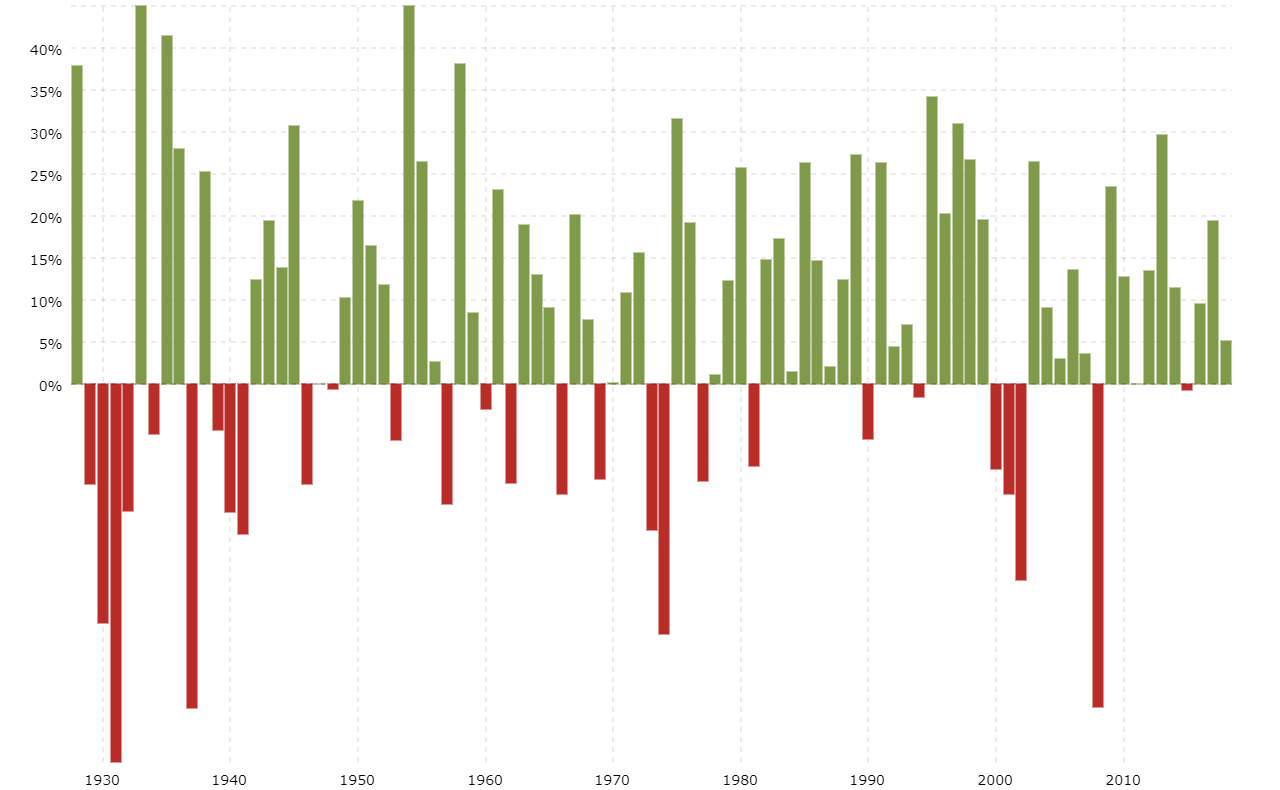

Basic Info. S&P 500 10 Year Return is at 167.3%, compared to 180.6% last month and 161.0% last year. This is higher than the long term average of 114.6%.While 10% might be the average, the returns in any given year are far from average. In fact, between 1926 and 2024, returns were in that “average” band of 8% to 12% only eight times. The rest of the time they were much lower or, usually, much higher.Overall, the S&P 500 grew at a compound annual growth rate of 13.8% over the last 15 years. Adjusting for inflation, the index grew 11.2% per year during that period.

:max_bytes(150000):strip_icc()/download2-44e25c07e2a14b0c90ce2dd0570a5dc3.png)

SPDR S&P 500 (SPY): Historical Returns

In the last 30 Years, the SPDR S&P 500 (SPY) ETF obtained a 10.35% compound annual return, with a 15.12% standard deviation.

Is SPY a good stock to hold : SPY has a conensus rating of Moderate Buy which is based on 401 buy ratings, 99 hold ratings and 4 sell ratings. What is SPY's price target The average price target for SPY is $583.29. This is based on 504 Wall Streets Analysts 12-month price targets, issued in the past 3 months.

What is a good ROI over 10 years : 5-year, 10-year, 20-year and 30-year S&P 500 returns

What is the S&P 500 2 year return

S&P 500 2 Year Return is at 21.87%, compared to 15.98% last month and -0.28% last year.

Now, let's consider how our calculations change if the time horizon is 10 years. If you are starting from scratch, you will need to invest about $4,757 at the end of every month for 10 years. Suppose you already have $100,000. Then you will only need $3,390 at the end of every month to become a millionaire in 10 years.This means that your $1,000 10 years ago — technically, $1,002 — would have bought 60 shares of Tesla. As of Mar. 3, 2024, those 60 shares of Tesla would be worth $12,158.40. That marks a 28.342% annual rate of return.

Does the S&P 500 double every 7 years : According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time. In some cases, like 1952 to 1955 or 1995 to 1998, the value of the investment doubled in only three years.