Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Using Shiller's data, since 1971 the S&P 500 has delivered an annualized return of 7.58%—or 10.51% with dividends reinvested. Investors who keep their money at work in the S&P 500 have been able to enjoy an annualized stock market return of around 10% over the long haul.

Which stocks make up the S&P 500 : S&P 500 companies by weight

Key points. The S&P 500 index is often used as a proxy for the broader U.S. stock market.

Microsoft (MSFT) Index weight: 7.09%

Apple (AAPL) Index weight: 5.65%

Nvidia Corp. (NVDA)

Amazon.com Inc (AMZN)

Meta Platforms Class A (META)

Alphabet Class A (GOOGL)

Berkshire Hathaway Class B (BRK.B)

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

What if I invested $100 a month in S&P 500 : If you're still investing $100 per month, you'd have a total of around $518,000 after 35 years, compared to $325,000 in that time period with a 10% return. There are never any guarantees in the stock market, but with the right strategy, a little cash can go a long way.

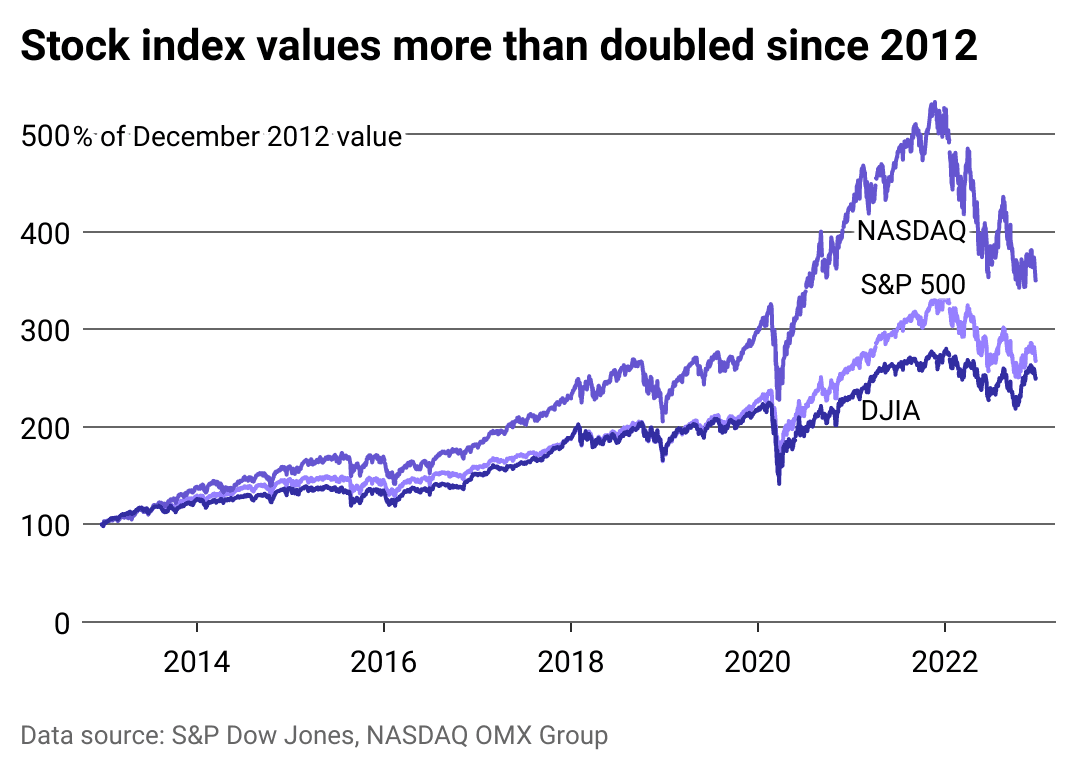

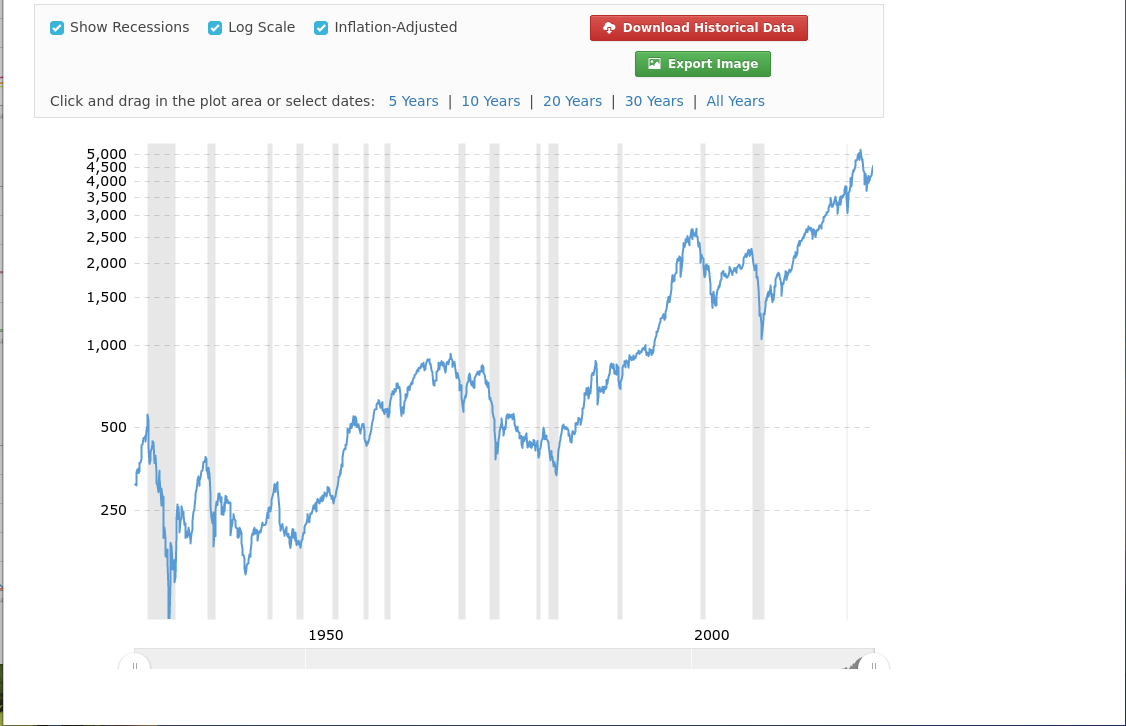

Stock market returns since 1926

This is a return on investment of 1,501,059.14%, or 10.28% per year. This lump-sum investment beats inflation during this period for an inflation-adjusted return of about 84,971.39% cumulatively, or 7.11% per year. 2024's 10 Best-Performing Stocks

Stock

2024 Return Through April 30

Super Micro Computer Inc. (SMCI)

202.1%

Alpine Immune Sciences Inc. (ALPN)

238.9%

Viking Therapeutics Inc. (VKTX)

327.6%

Janux Therapeutics Inc. (JANX)

431.2%

What is the 1 year return SP 500

Basic Info. S&P 500 1 Year Return is at 20.78%, compared to 27.86% last month and 0.91% last year.The S&P 500 returned 345% over the last two decades, compounding at 7.7% annually. But with dividends reinvested, the S&P 500 delivered a total return of 546% over the same period, compounding at 9.8% annually. Investors can get direct, inexpensive exposure to the index with a fund like the Vanguard S&P 500 ETF.A look at Price / Sales, one of the most basic valuation ratios, suggests an affirmation of the question at hand: is Nvidia overvalued. The Price / Sales ratio reflects how much you have to pay per $ of sales to own the stock. At around 40x Price / Sales, NVDA is among the most expensive companies out there. Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

What is the S&P 500 forecast for 2025 : Mike Wilson, Morgan Stanley's chief U.S. equity strategist, said he sees the S&P 500 climbing to 5,400 by the second quarter of 2025.

What if I invest $200 a month for 20 years

Investing as little as $200 a month can, if you do it consistently and invest wisely, turn into more than $150,000 in as soon as 20 years. If you keep contributing the same amount for another 20 years while generating the same average annual return on your investments, you could have more than $1.2 million. 12.63% 5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

10 years (2014-2023)

11.02%

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

25 years (1999-2023)

7.18%

Best Stocks to Invest in India 2024

S.No.

Top 5 Stocks

Industry/Sector

1.

Tata Consultancy Services Ltd

IT – Software

2.

Infosys Ltd

IT – Software

3.

Hindustan Unilever Ltd

FMCG

4.

Reliance Industries Ltd

Refineries

Will stock market bounce back in 2024 : As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.

Antwort How many times has the S&P 500 doubled? Weitere Antworten – How much was $10,000 invested in the S&P 500 in 2000

Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Using Shiller's data, since 1971 the S&P 500 has delivered an annualized return of 7.58%—or 10.51% with dividends reinvested. Investors who keep their money at work in the S&P 500 have been able to enjoy an annualized stock market return of around 10% over the long haul.

:max_bytes(150000):strip_icc()/2019-03-08-MarketMilestones-5c82eebe46e0fb00010f10bd.png)

Which stocks make up the S&P 500 : S&P 500 companies by weight

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

What if I invested $100 a month in S&P 500 : If you're still investing $100 per month, you'd have a total of around $518,000 after 35 years, compared to $325,000 in that time period with a 10% return. There are never any guarantees in the stock market, but with the right strategy, a little cash can go a long way.

Stock market returns since 1926

This is a return on investment of 1,501,059.14%, or 10.28% per year. This lump-sum investment beats inflation during this period for an inflation-adjusted return of about 84,971.39% cumulatively, or 7.11% per year.

2024's 10 Best-Performing Stocks

What is the 1 year return SP 500

Basic Info. S&P 500 1 Year Return is at 20.78%, compared to 27.86% last month and 0.91% last year.The S&P 500 returned 345% over the last two decades, compounding at 7.7% annually. But with dividends reinvested, the S&P 500 delivered a total return of 546% over the same period, compounding at 9.8% annually. Investors can get direct, inexpensive exposure to the index with a fund like the Vanguard S&P 500 ETF.A look at Price / Sales, one of the most basic valuation ratios, suggests an affirmation of the question at hand: is Nvidia overvalued. The Price / Sales ratio reflects how much you have to pay per $ of sales to own the stock. At around 40x Price / Sales, NVDA is among the most expensive companies out there.

:max_bytes(150000):strip_icc()/dotdash-what-history-sp-500-Final1-61c82a0cd2314bc281817c30498e4994.jpg)

Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

What is the S&P 500 forecast for 2025 : Mike Wilson, Morgan Stanley's chief U.S. equity strategist, said he sees the S&P 500 climbing to 5,400 by the second quarter of 2025.

What if I invest $200 a month for 20 years

Investing as little as $200 a month can, if you do it consistently and invest wisely, turn into more than $150,000 in as soon as 20 years. If you keep contributing the same amount for another 20 years while generating the same average annual return on your investments, you could have more than $1.2 million.

12.63%

5-year, 10-year, 20-year and 30-year S&P 500 returns

Best Stocks to Invest in India 2024

Will stock market bounce back in 2024 : As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.