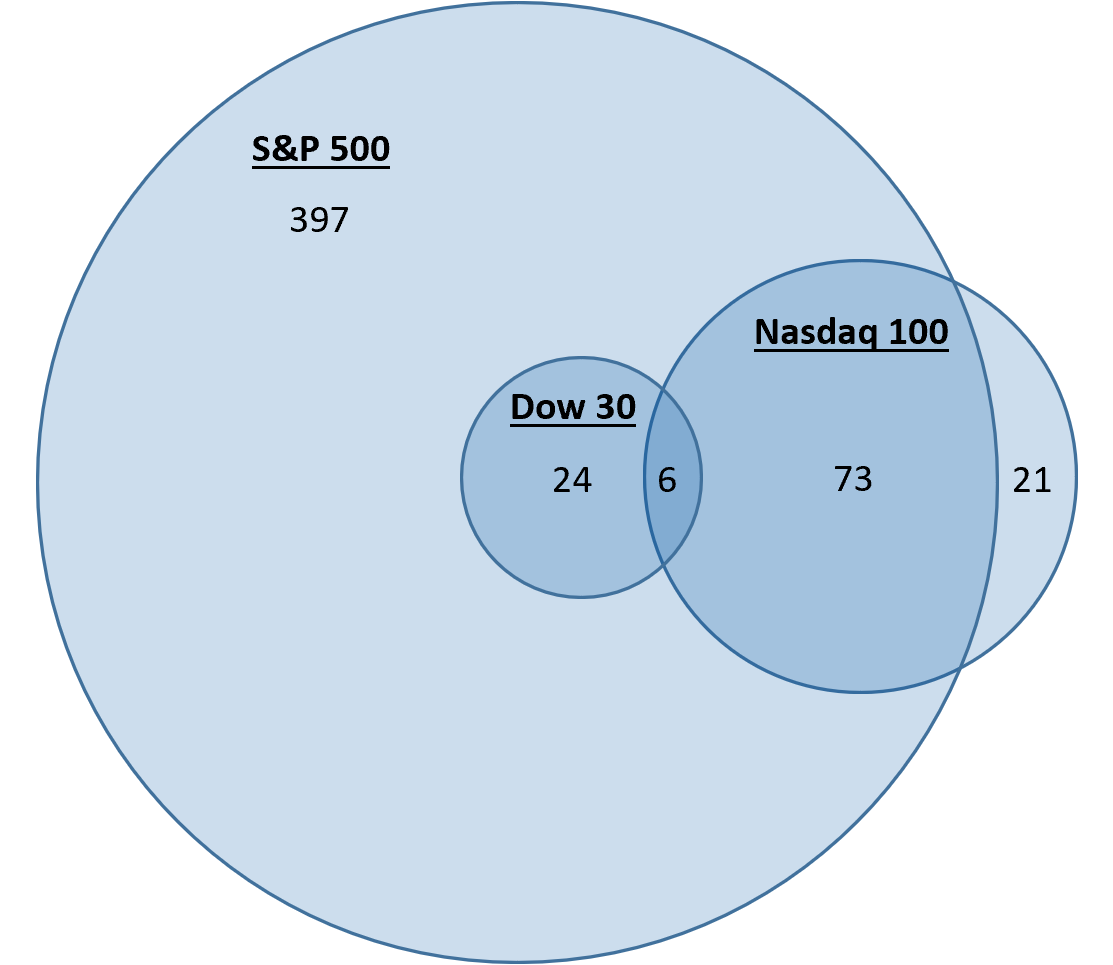

The S&P 500 consists of 500 companies that have issued a total of 503 stocks.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee.

What are the 5 largest stocks in the S&P 500 : S&P 500 ETF Components

#

Company

Symbol

2

Apple Inc.

AAPL

3

Nvidia Corp

NVDA

4

Amazon.com Inc

AMZN

5

Meta Platforms, Inc. Class A

META

How many stocks does S&P 400 have

401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

Is the S&P 500 all equity : It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average). Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)

Is it OK to only invest in S&P 500

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)If you are investing in an S&P 500 index fund:

If your index fund has no minimum, you can usually purchase in any dollar amount. If your index fund has a minimum, then you have to purchase at least the minimum amount. If your index fund has an expense ratio, you'll be charged that as a fee.Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing. Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks. 2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500.

Is S&P 400 small cap : The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index.

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Is the S&P 500 only a large cap

Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing. Although called the S&P 500, the index contains 503 stocks because it includes two share classes of stock from 3 of its component companies.The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Antwort How many stocks are in the sp500? Weitere Antworten – How many stocks are in the S&P 500

503 stocks

The S&P 500 consists of 500 companies that have issued a total of 503 stocks.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee.

What are the 5 largest stocks in the S&P 500 : S&P 500 ETF Components

How many stocks does S&P 400 have

401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

Is the S&P 500 all equity : It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)

Is it OK to only invest in S&P 500

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)If you are investing in an S&P 500 index fund:

If your index fund has no minimum, you can usually purchase in any dollar amount. If your index fund has a minimum, then you have to purchase at least the minimum amount. If your index fund has an expense ratio, you'll be charged that as a fee.Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.

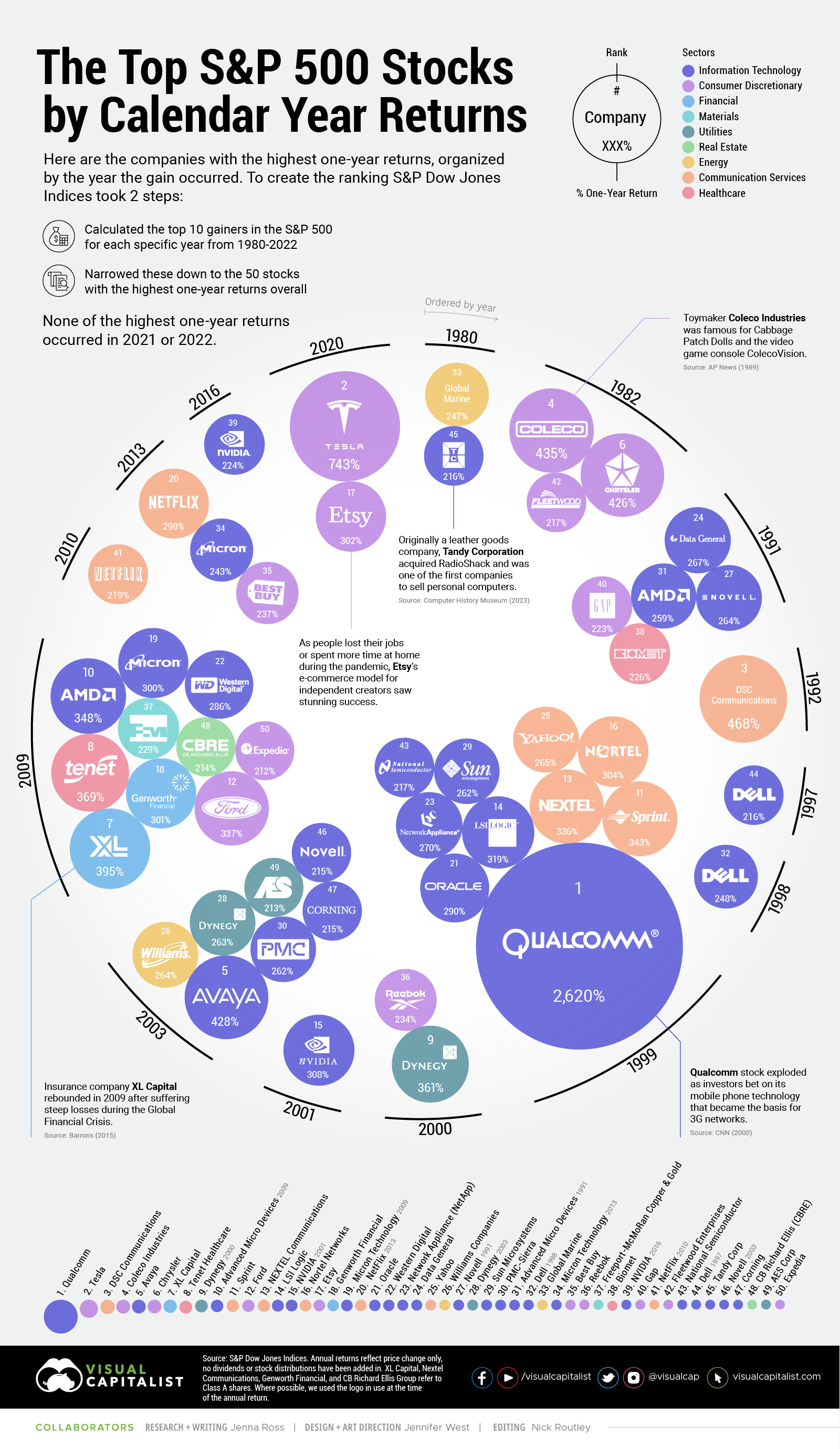

:max_bytes(150000):strip_icc()/k53KU-s-p-500-biggest-gains-and-losses-2023-07-20T170552.093-43ffa944a25b491abef4169f7631de0e.png)

Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks. 2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500.

Is S&P 400 small cap : The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index.

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Is the S&P 500 only a large cap

Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.

Although called the S&P 500, the index contains 503 stocks because it includes two share classes of stock from 3 of its component companies.The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.