The S&P 500 consists of 500 companies that have issued a total of 503 stocks.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee.

Is there more than 1 S&P 500 : If you search for S&P 500 ETFs, you may come across dozens of funds. Just because S&P 500 is in a fund's name doesn't necessarily mean it tracks the index as a whole. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index.

How many stocks does S&P 400 have

401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

Is the S&P 500 all equity : It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average). Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)

Is it OK to only invest in S&P 500

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)Ever since the S&P 500 index was devised, it has built an impeccable track record of earning positive returns over time. In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook.S&P 500 Index.

The S&P 500 is considered the benchmark for the U.S. stock market, even though it focuses exclusively on the large-cap market. This index tracks the performance of the 500 largest U.S. publicly traded companies across 11 different sectors. The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index.

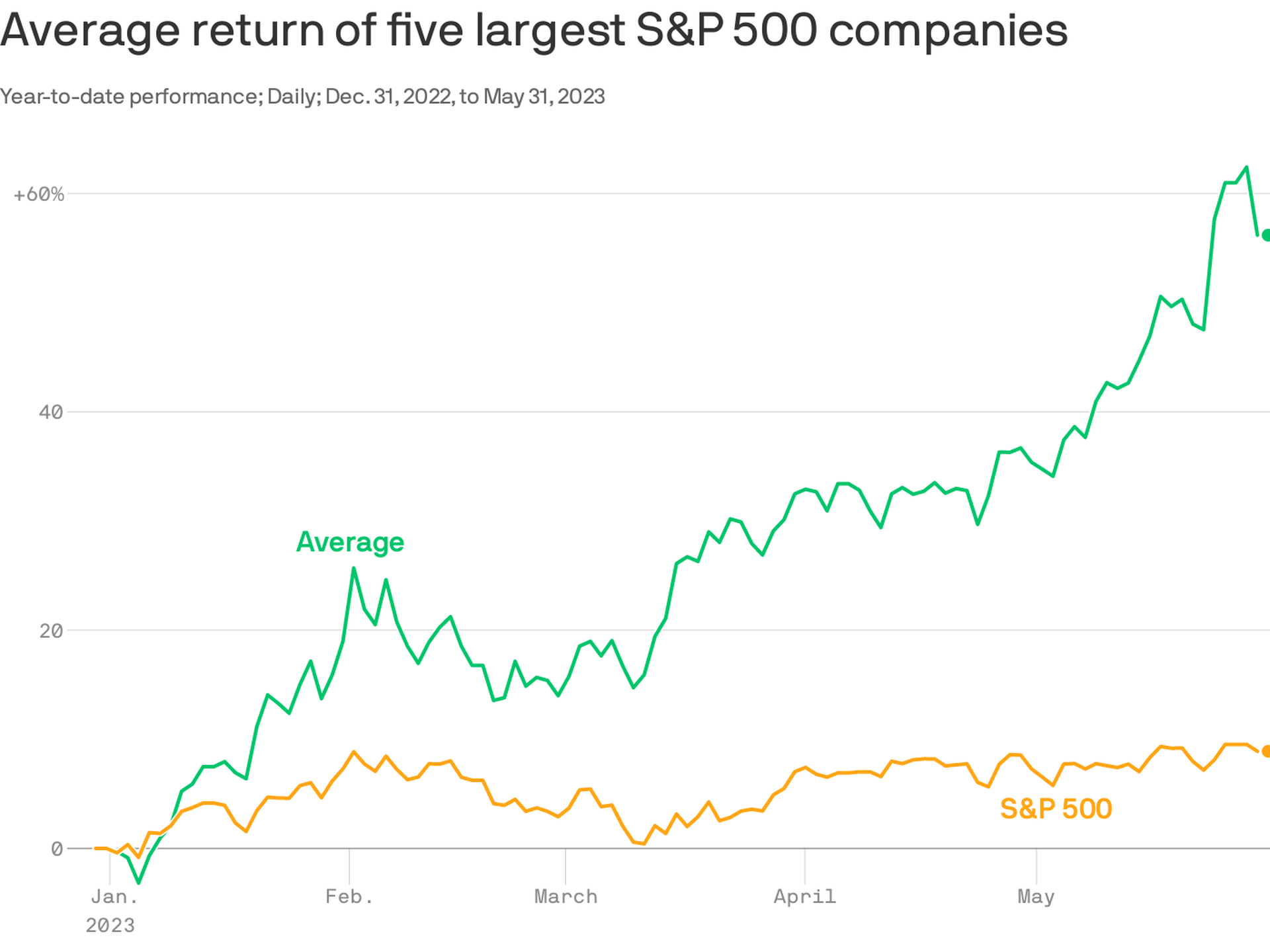

Is S&P 400 better than S&P 500 : Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks. 2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500.

How many SP 500 stocks pay dividends : Standard & Poor's debuted its first equity index in 1923, although the S&P 500 as we know it today didn't hit the street until 1957. Of the 500 constituents, more than 400 companies in the S&P 500 are dividend payers. Not all of the components, however, offer stellar yields or consecutive dividend increases.

What is the S&P 500 made up of

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 0.66%) and Alphabet Class A (GOOGL 0.49%) stock are both included in the S&P 500 index. The NASDAQ Composite is an index of more than 3,000 common equities listed on the NASDAQ stock market. The index is one of the most followed indices in the United States, alongside the Dow Jones Industrial Average and the S&P 500.Although called the S&P 500, the index contains 503 stocks because it includes two share classes of stock from 3 of its component companies.

What index is better than S&P 500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Antwort How many stocks are in sp500? Weitere Antworten – How many stocks are in the S&P 500

503 stocks

The S&P 500 consists of 500 companies that have issued a total of 503 stocks.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee.

Is there more than 1 S&P 500 : If you search for S&P 500 ETFs, you may come across dozens of funds. Just because S&P 500 is in a fund's name doesn't necessarily mean it tracks the index as a whole. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index.

How many stocks does S&P 400 have

401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

Is the S&P 500 all equity : It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)

Is it OK to only invest in S&P 500

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)Ever since the S&P 500 index was devised, it has built an impeccable track record of earning positive returns over time. In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook.S&P 500 Index.

The S&P 500 is considered the benchmark for the U.S. stock market, even though it focuses exclusively on the large-cap market. This index tracks the performance of the 500 largest U.S. publicly traded companies across 11 different sectors.

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index.

Is S&P 400 better than S&P 500 : Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks. 2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500.

How many SP 500 stocks pay dividends : Standard & Poor's debuted its first equity index in 1923, although the S&P 500 as we know it today didn't hit the street until 1957. Of the 500 constituents, more than 400 companies in the S&P 500 are dividend payers. Not all of the components, however, offer stellar yields or consecutive dividend increases.

What is the S&P 500 made up of

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 0.66%) and Alphabet Class A (GOOGL 0.49%) stock are both included in the S&P 500 index.

The NASDAQ Composite is an index of more than 3,000 common equities listed on the NASDAQ stock market. The index is one of the most followed indices in the United States, alongside the Dow Jones Industrial Average and the S&P 500.Although called the S&P 500, the index contains 503 stocks because it includes two share classes of stock from 3 of its component companies.

What index is better than S&P 500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.