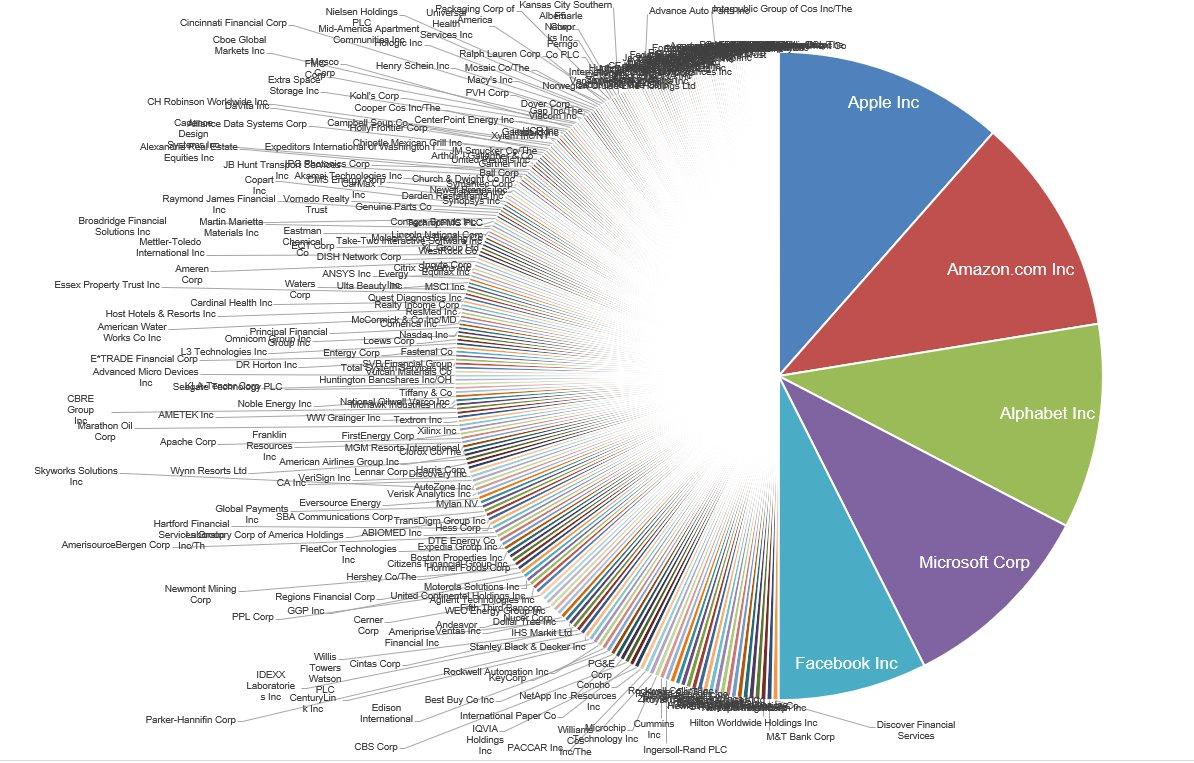

The S&P sectors constitute a method of sorting publicly traded companies into 11 sectors and 24 industry groups.The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

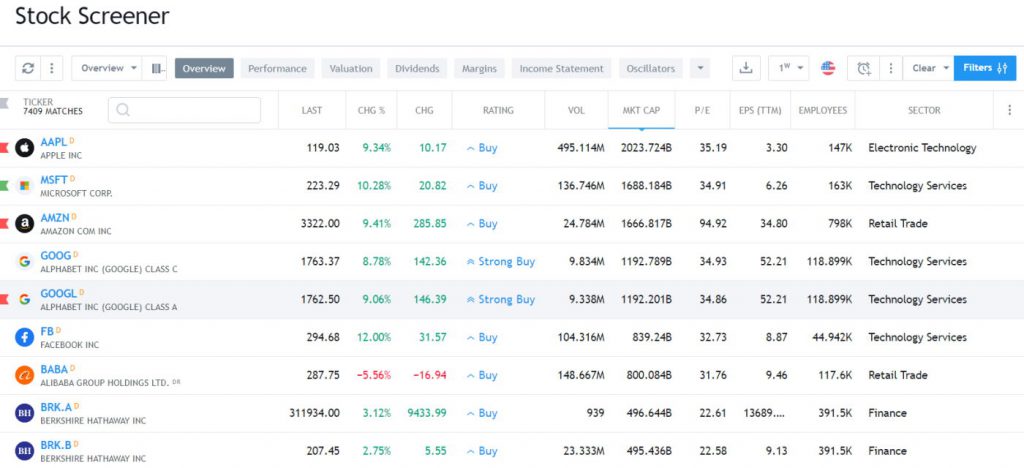

What companies are under S and P 500 : S&P 500 ETF Components

#

Company

Symbol

1

Microsoft Corp

MSFT

2

Apple Inc.

AAPL

3

Nvidia Corp

NVDA

4

Amazon.com Inc

AMZN

Are there only 500 companies in the S&P 500

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

How many companies are in the S&P 400 : 401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

There are 11 stock market sectors, as classified by GICS, which stands for Global Industry Classification Standard. These sectors include healthcare, materials, real estate, consumer staples, consumer discretionary, utilities, energy, industrials, consumer services, financials, and technology. S&P 1500

Foundation

May 18, 1995

Constituents

1,506

Type

Small, Medium and Large cap

Market cap

US$46.0 trillion (as of December 29, 2023)

Weighting method

Market value-weighted

How many of the Nasdaq 100 companies are also in the S&P 500

The Nasdaq-100 is quite different than the S&P 500

In fact, around 80% of the companies in the Nasdaq-100 are also in the S&P 500 (Chart 1, note that dual-class shares mean there are more than 100 tickers in the Nasdaq 100 index).

Top Sectors in the S&P 500

Information Technology

30.30%

Financials

12.58%

Health Care

12.22%

Consumer Discretionary

10.37%

The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. The Dow tracks 30 companies on US exchanges including blue-chip corporations such as Coca-Cola Co., Nike Inc., and McDonald's Corp. Almost all Dow stocks are included in the S&P 500, where they generally make up 25% to 30% of its market value.

Is S&P 400 better than S&P 500 : Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks. 2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500.

How many companies are in S&P 100 : The S&P 100, a sub-set of the S&P 500®, is designed to measure the performance of large-cap companies in the United States and comprises 100 major blue chip companies across multiple industry groups. Individual stock options are listed for each index constituent.

What is the 12th sector of SMP

Crypto is going to become the 12th sector of the S&P 500. 11 different stock

There are 11 different stock market sectors, according to the most commonly used classification system, known as the Global Industry Classification Standard (GICS). We categorize stocks into sectors to make it easy to compare companies that have similar business models.25 industry groups

The GICS structure consists of 11 sectors, 25 industry groups, 74 industries and 163 sub-industries into which S&P has categorized all major public companies.

How many companies are in spy : SPY Holdings Information

SPY has a total of 504 holdings. The top 10 holdings account for 33.04%. Amazon.Com, Inc. Meta Platforms, Inc.

Antwort How many industries are in the S&P 500? Weitere Antworten – How many industries are in the S&P 500

11 sectors

The S&P sectors constitute a method of sorting publicly traded companies into 11 sectors and 24 industry groups.The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

What companies are under S and P 500 : S&P 500 ETF Components

Are there only 500 companies in the S&P 500

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

How many companies are in the S&P 400 : 401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

There are 11 stock market sectors, as classified by GICS, which stands for Global Industry Classification Standard. These sectors include healthcare, materials, real estate, consumer staples, consumer discretionary, utilities, energy, industrials, consumer services, financials, and technology.

S&P 1500

How many of the Nasdaq 100 companies are also in the S&P 500

The Nasdaq-100 is quite different than the S&P 500

In fact, around 80% of the companies in the Nasdaq-100 are also in the S&P 500 (Chart 1, note that dual-class shares mean there are more than 100 tickers in the Nasdaq 100 index).

The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

:max_bytes(150000):strip_icc()/SP-500-Index-d04148d29bca4307b412f4fd91741e17.jpg)

The Dow tracks 30 companies on US exchanges including blue-chip corporations such as Coca-Cola Co., Nike Inc., and McDonald's Corp. Almost all Dow stocks are included in the S&P 500, where they generally make up 25% to 30% of its market value.

Is S&P 400 better than S&P 500 : Mid-cap stocks tend to offer investors greater growth potential than large-cap stocks but with less volatility and risk than small-cap stocks. 2023 has been a year dominated by seven mega-cap names. The S&P 400 (a U.S. mid-cap index) is up only 5.6% YTD vs 19% for the S&P 500.

How many companies are in S&P 100 : The S&P 100, a sub-set of the S&P 500®, is designed to measure the performance of large-cap companies in the United States and comprises 100 major blue chip companies across multiple industry groups. Individual stock options are listed for each index constituent.

What is the 12th sector of SMP

Crypto is going to become the 12th sector of the S&P 500.

11 different stock

There are 11 different stock market sectors, according to the most commonly used classification system, known as the Global Industry Classification Standard (GICS). We categorize stocks into sectors to make it easy to compare companies that have similar business models.25 industry groups

The GICS structure consists of 11 sectors, 25 industry groups, 74 industries and 163 sub-industries into which S&P has categorized all major public companies.

How many companies are in spy : SPY Holdings Information

SPY has a total of 504 holdings. The top 10 holdings account for 33.04%. Amazon.Com, Inc. Meta Platforms, Inc.