The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).What is the S&P 500 The S&P 500 is a stock index tracking around 500 large companies, including those listed on the Dow Jones Industrial Average (DJIA), another index that tracks only 30 companies. The S&P 500 comprises about 80% of the total U.S. equity market capitalization.The S&P 500

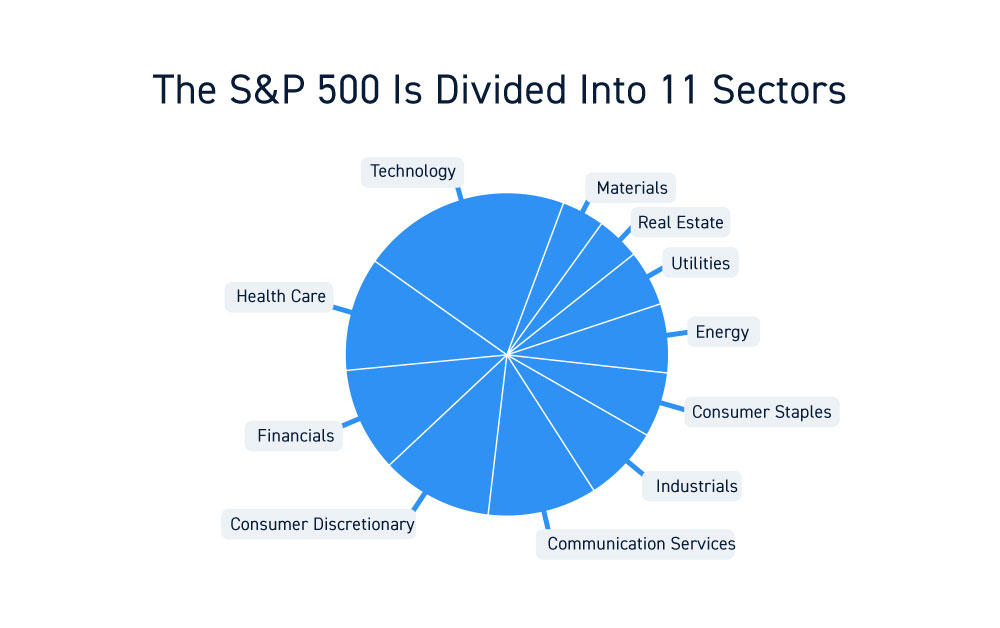

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

What companies make up the S&P 500 : S&P 500 companies by weight

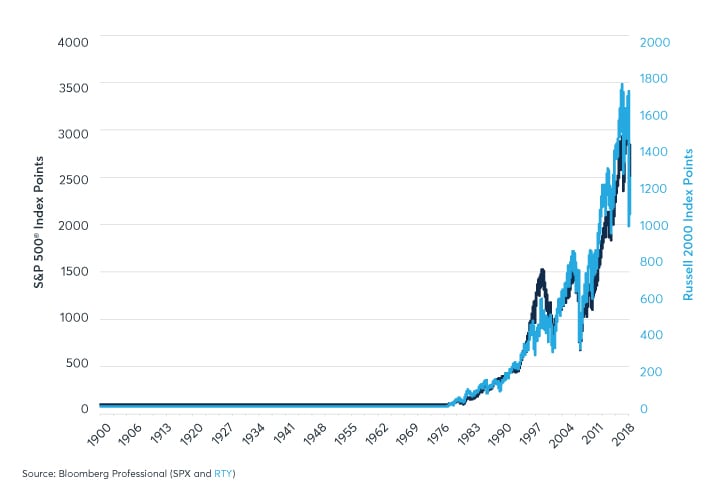

Key points. The S&P 500 index is often used as a proxy for the broader U.S. stock market.

Microsoft (MSFT) Index weight: 7.09%

Apple (AAPL) Index weight: 5.65%

Nvidia Corp. (NVDA)

Amazon.com Inc (AMZN)

Meta Platforms Class A (META)

Alphabet Class A (GOOGL)

Berkshire Hathaway Class B (BRK.B)

How is the S&P 500 measured

The S&P 500's value is calculated by multiplying the market capitalization of each constituent company by the total number of shares outstanding. Market cap equals each company's share price multiplied by the total number of its shares outstanding. Shares outstanding are the stock that is held by shareholders.

Why are there more than 500 companies in the S&P 500 : The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The index actually has 503 components because three of them have two share classes listed.

The mega-cap leaders dubbed the “Magnificent Seven” have outperformed the stock market for several years. However, 2023 was quite impressive for the seven tech-focused US companies—Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla. The S&P 500 is a stock market index that is meant to track the U.S. equity market. The index is made up of 500 of the largest public companies. It is float-adjusted and calculated using a proprietary index divisor developed by Standard & Poor's. A downside to the index is that it is weighted toward large-cap stocks.

Is the S&P 500 the top 500 companies

What Is the S&P 500 Index The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities. No, the Fortune 500 and S&P 500 are not the same thing. The Fortune 500 is a list of the highest-ranking companies in the United States by revenue. The S&P 500, on the other hand, is a stock-market index composed of the top 500 companies by market capitalization.

How many companies are in the Dow Jones : 30

The DJIA is one of the oldest and most commonly followed equity indexes. Many professionals consider it to be an inadequate representation of the overall U.S. stock market compared to a broader market index such as the S&P 500. The DJIA includes only 30 large companies.

How often does the S&P 500 change companies : quarterly

The frequency of index rebalancing depends on the index in question. Some indexes, like the S&P 500, are rebalanced quarterly, while others are adjusted semiannually or annually.

Why are there 505 companies in the S&P 500

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index. And technically, the index includes 503 constituents, not 500. This is because some companies have multiple types of share classes that are included in the S&P 500.Dubbed the Magnificent Seven stocks, Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla lived up to their name in 2023 with big gains. But the early part of the second quarter of 2024 showed a big divergence of returns.

What is the Big 7 stock : These seven companies — Meta Platforms, Amazon, Apple, Netflix, Alphabet, Microsoft and Nvidia — all “have monopolistic/oligopolistic positions, pricing power, secular earnings power, balance sheets that can finance AI and so on,” Hartnett explained.

Antwort How many companies does the S&P 500 measure? Weitere Antworten – How many companies does the S&P 500 measure

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).What is the S&P 500 The S&P 500 is a stock index tracking around 500 large companies, including those listed on the Dow Jones Industrial Average (DJIA), another index that tracks only 30 companies. The S&P 500 comprises about 80% of the total U.S. equity market capitalization.The S&P 500

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

:max_bytes(150000):strip_icc()/weighting-of-SP-64bd20169a194e8f91a0499a1ecd4705.jpg)

What companies make up the S&P 500 : S&P 500 companies by weight

How is the S&P 500 measured

The S&P 500's value is calculated by multiplying the market capitalization of each constituent company by the total number of shares outstanding. Market cap equals each company's share price multiplied by the total number of its shares outstanding. Shares outstanding are the stock that is held by shareholders.

Why are there more than 500 companies in the S&P 500 : The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The index actually has 503 components because three of them have two share classes listed.

The mega-cap leaders dubbed the “Magnificent Seven” have outperformed the stock market for several years. However, 2023 was quite impressive for the seven tech-focused US companies—Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

The S&P 500 is a stock market index that is meant to track the U.S. equity market. The index is made up of 500 of the largest public companies. It is float-adjusted and calculated using a proprietary index divisor developed by Standard & Poor's. A downside to the index is that it is weighted toward large-cap stocks.

Is the S&P 500 the top 500 companies

What Is the S&P 500 Index The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.

:max_bytes(150000):strip_icc()/dotdash-what-history-sp-500-Final1-61c82a0cd2314bc281817c30498e4994.jpg)

No, the Fortune 500 and S&P 500 are not the same thing. The Fortune 500 is a list of the highest-ranking companies in the United States by revenue. The S&P 500, on the other hand, is a stock-market index composed of the top 500 companies by market capitalization.

How many companies are in the Dow Jones : 30

The DJIA is one of the oldest and most commonly followed equity indexes. Many professionals consider it to be an inadequate representation of the overall U.S. stock market compared to a broader market index such as the S&P 500. The DJIA includes only 30 large companies.

How often does the S&P 500 change companies : quarterly

The frequency of index rebalancing depends on the index in question. Some indexes, like the S&P 500, are rebalanced quarterly, while others are adjusted semiannually or annually.

Why are there 505 companies in the S&P 500

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index.

And technically, the index includes 503 constituents, not 500. This is because some companies have multiple types of share classes that are included in the S&P 500.Dubbed the Magnificent Seven stocks, Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla lived up to their name in 2023 with big gains. But the early part of the second quarter of 2024 showed a big divergence of returns.

What is the Big 7 stock : These seven companies — Meta Platforms, Amazon, Apple, Netflix, Alphabet, Microsoft and Nvidia — all “have monopolistic/oligopolistic positions, pricing power, secular earnings power, balance sheets that can finance AI and so on,” Hartnett explained.