The S&P 500 consists of 500 companies that have issued a total of 503 stocks.All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.S&P 100 STOCKS

Name

Latest Price Previous Close

1 Year +/- %

American International Group (AIG) Inc.

73.82 72.24

26.59 50.83%

Amgen Inc.

289.20 290.05

91.16 40.00%

Apple Inc.

174.06 174.68

17.65 10.26%

AT&T Inc. (AT & T Inc.)

16.00 15.97

0.80 4.84%

What is the total market cap of S&P 500 companies : $44.471 trillion dollars

Data Details. The S&P 500 has a market capitalization of $44.471 trillion dollars. The total market cap is calculated by summing the market capitalization of every company in the index. Each company's calculated market cap is based on the outstanding float share count.

Are there only 500 companies in the S&P 500

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

How many companies are in S&P 100 : The S&P 100, a sub-set of the S&P 500®, is designed to measure the performance of large-cap companies in the United States and comprises 100 major blue chip companies across multiple industry groups. Individual stock options are listed for each index constituent.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization. McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

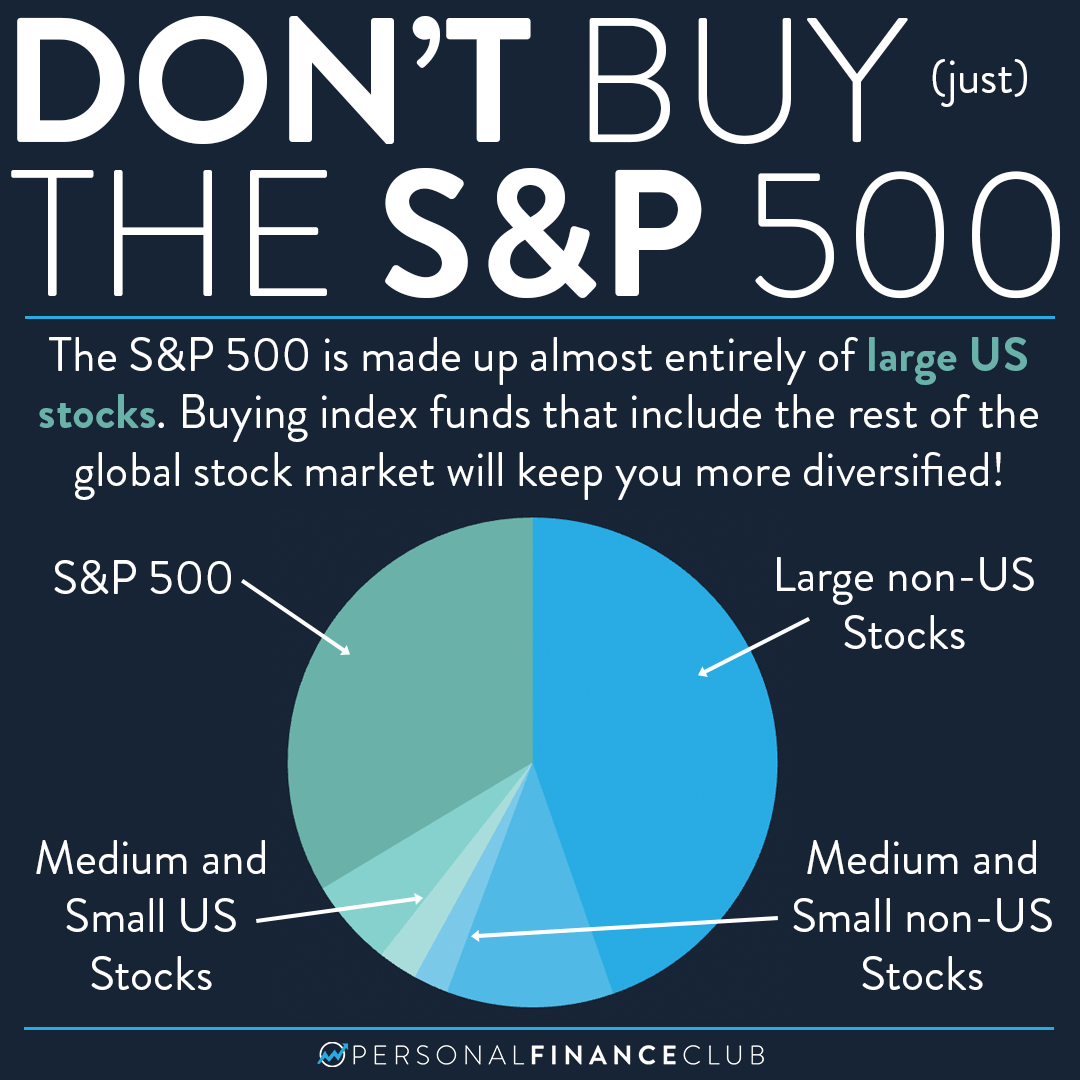

Is S&P only large-cap

Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing. Individuals cannot invest directly in any index.S&P 500 Index.

The S&P 500 is considered the benchmark for the U.S. stock market, even though it focuses exclusively on the large-cap market. This index tracks the performance of the 500 largest U.S. publicly traded companies across 11 different sectors.That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee. The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

How many companies are in the S&P 400 : 401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

How many companies does S&P 500 own

The S&P 500 is a stock index tracking around 500 large companies, including those listed on the Dow Jones Industrial Average (DJIA), another index that tracks only 30 companies. The S&P 500 comprises about 80% of the total U.S. equity market capitalization. However, while both the Russell 1000 Growth and S&P 500 Growth performance reflected large cap growth's banner year, the return difference between the two indexes tracking the same market segment was significant. As shown, the Russell 1000 Growth returned 42.68% in 2023, compared with 30.03% for the S&P 500 Growth.The S&P 500 is used for large cap. Russell MidCap is used for mid cap. Russell 2000 is used for small cap. All data are as of January 19, 2024.

Is S&P overvalued : Bottom Line: The S&P, on a capitalization-weighted perspective, is expensive. However, most of the overvaluation is concentrated in a handful of high-quality, mega-cap technology companies, many of which could benefit from innovations in artificial intelligence.

Antwort How many companies does S&P cover? Weitere Antworten – How many companies are in the S and P index

500 companies

The S&P 500 consists of 500 companies that have issued a total of 503 stocks.All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.S&P 100 STOCKS

What is the total market cap of S&P 500 companies : $44.471 trillion dollars

Data Details. The S&P 500 has a market capitalization of $44.471 trillion dollars. The total market cap is calculated by summing the market capitalization of every company in the index. Each company's calculated market cap is based on the outstanding float share count.

Are there only 500 companies in the S&P 500

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

How many companies are in S&P 100 : The S&P 100, a sub-set of the S&P 500®, is designed to measure the performance of large-cap companies in the United States and comprises 100 major blue chip companies across multiple industry groups. Individual stock options are listed for each index constituent.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization.

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

Is S&P only large-cap

Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing. Individuals cannot invest directly in any index.S&P 500 Index.

The S&P 500 is considered the benchmark for the U.S. stock market, even though it focuses exclusively on the large-cap market. This index tracks the performance of the 500 largest U.S. publicly traded companies across 11 different sectors.That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee.

The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

How many companies are in the S&P 400 : 401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

How many companies does S&P 500 own

The S&P 500 is a stock index tracking around 500 large companies, including those listed on the Dow Jones Industrial Average (DJIA), another index that tracks only 30 companies. The S&P 500 comprises about 80% of the total U.S. equity market capitalization.

However, while both the Russell 1000 Growth and S&P 500 Growth performance reflected large cap growth's banner year, the return difference between the two indexes tracking the same market segment was significant. As shown, the Russell 1000 Growth returned 42.68% in 2023, compared with 30.03% for the S&P 500 Growth.The S&P 500 is used for large cap. Russell MidCap is used for mid cap. Russell 2000 is used for small cap. All data are as of January 19, 2024.

Is S&P overvalued : Bottom Line: The S&P, on a capitalization-weighted perspective, is expensive. However, most of the overvaluation is concentrated in a handful of high-quality, mega-cap technology companies, many of which could benefit from innovations in artificial intelligence.