The S&P 500 consists of 500 companies that have issued a total of 503 stocks.86 original

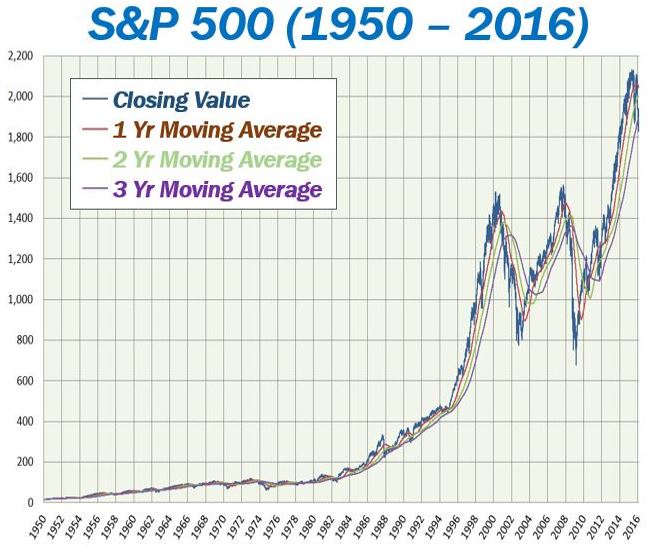

S&P Index Services has compiled a list of 86 original components of the S&P 500 that have survived through time. The companies are listed in alphabetical order below: Fifty years is an eternity in the fast-moving world of business.The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The index actually has 503 components because three of them have two share classes listed.

Are all Fortune 500 companies in the S&P 500 : No, the Fortune 500 and S&P 500 are not the same thing. The Fortune 500 is a list of the highest-ranking companies in the United States by revenue. The S&P 500, on the other hand, is a stock-market index composed of the top 500 companies by market capitalization.

How many of the Nasdaq 100 companies are also in the S&P 500

The Nasdaq-100 is quite different than the S&P 500

In fact, around 80% of the companies in the Nasdaq-100 are also in the S&P 500 (Chart 1, note that dual-class shares mean there are more than 100 tickers in the Nasdaq 100 index).

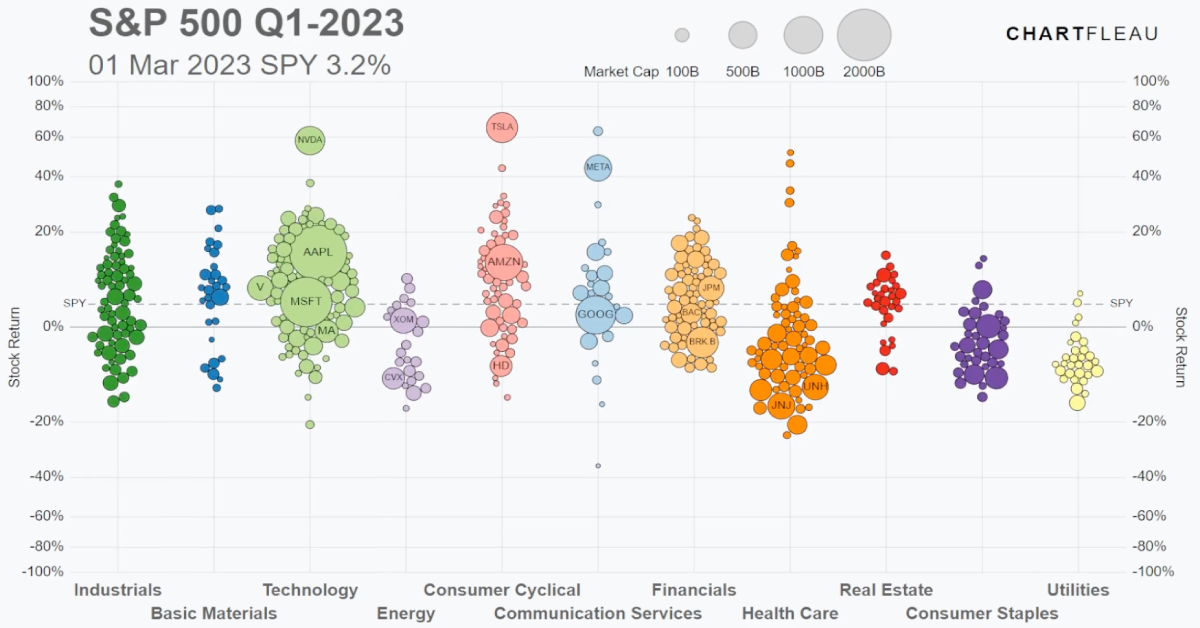

What are the 11 S&P 500 sectors : The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.

Today, there are a large number of S&P 500 ETFs to choose from in addition to the ones highlighted here. Here are a few of the most popular S&P 500 ETFs: SPY: The State Street SPDR S&P 500 ETF was the original exchange-traded fund and remains one of the most liquid S&P ETFs. Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

Why are there 505 companies in the S&P 500

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index.If you search for S&P 500 ETFs, you may come across dozens of funds. Just because S&P 500 is in a fund's name doesn't necessarily mean it tracks the index as a whole. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index.Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.

10 Smallest Companies in the S&P500 Index. Business & Books. ·

495. Comerica Inc. ($CMA)

496. Mohawk Industries Inc. ($MHK)

497. Organon & Co ($OGN) Sector: Healthcare.

498. Ralph Lauren Corp ($RL) Sector: Consumer Cyclical.

499. Zions Bancorp ($ZION)

500. Fox Corp Class B ($FOX)

501. Lincoln National Corp ($LNC)

How many companies are in the S&P 400 : 401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

How many companies are in S&P 100 : The S&P 100, a sub-set of the S&P 500®, is designed to measure the performance of large-cap companies in the United States and comprises 100 major blue chip companies across multiple industry groups. Individual stock options are listed for each index constituent.

What are the 11 sector

There are 11 stock market sectors, as classified by GICS, which stands for Global Industry Classification Standard. These sectors include healthcare, materials, real estate, consumer staples, consumer discretionary, utilities, energy, industrials, consumer services, financials, and technology. 11 different stock

There are 11 different stock market sectors, according to the most commonly used classification system, known as the Global Industry Classification Standard (GICS). We categorize stocks into sectors to make it easy to compare companies that have similar business models.Over the long run, they do compound—those fee differences—and investors have been putting a lot more money into VOO versus SPY. That is the reason why we view VOO slightly better than SPY. And that is just the basic approach, which is the lower the investor can pay, the better the investment is.

Can you buy the entire S&P 500 : The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

Antwort How many companies are in the S&P 500 *? Weitere Antworten – How many companies are in the S&P 500

500 companies

The S&P 500 consists of 500 companies that have issued a total of 503 stocks.86 original

S&P Index Services has compiled a list of 86 original components of the S&P 500 that have survived through time. The companies are listed in alphabetical order below: Fifty years is an eternity in the fast-moving world of business.The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The index actually has 503 components because three of them have two share classes listed.

:max_bytes(150000):strip_icc()/weighting-of-SP-64bd20169a194e8f91a0499a1ecd4705.jpg)

Are all Fortune 500 companies in the S&P 500 : No, the Fortune 500 and S&P 500 are not the same thing. The Fortune 500 is a list of the highest-ranking companies in the United States by revenue. The S&P 500, on the other hand, is a stock-market index composed of the top 500 companies by market capitalization.

How many of the Nasdaq 100 companies are also in the S&P 500

The Nasdaq-100 is quite different than the S&P 500

In fact, around 80% of the companies in the Nasdaq-100 are also in the S&P 500 (Chart 1, note that dual-class shares mean there are more than 100 tickers in the Nasdaq 100 index).

What are the 11 S&P 500 sectors : The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.

Today, there are a large number of S&P 500 ETFs to choose from in addition to the ones highlighted here. Here are a few of the most popular S&P 500 ETFs: SPY: The State Street SPDR S&P 500 ETF was the original exchange-traded fund and remains one of the most liquid S&P ETFs.

Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

Why are there 505 companies in the S&P 500

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index.If you search for S&P 500 ETFs, you may come across dozens of funds. Just because S&P 500 is in a fund's name doesn't necessarily mean it tracks the index as a whole. Rather, many of these ETFs track sub-components, say value or growth stocks, within the broader index.Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.

How many companies are in the S&P 400 : 401 stocks

Although called the S&P 400, the index contains 401 stocks because it includes two share classes of stock from 1 of its component companies.

How many companies are in S&P 100 : The S&P 100, a sub-set of the S&P 500®, is designed to measure the performance of large-cap companies in the United States and comprises 100 major blue chip companies across multiple industry groups. Individual stock options are listed for each index constituent.

What are the 11 sector

There are 11 stock market sectors, as classified by GICS, which stands for Global Industry Classification Standard. These sectors include healthcare, materials, real estate, consumer staples, consumer discretionary, utilities, energy, industrials, consumer services, financials, and technology.

11 different stock

There are 11 different stock market sectors, according to the most commonly used classification system, known as the Global Industry Classification Standard (GICS). We categorize stocks into sectors to make it easy to compare companies that have similar business models.Over the long run, they do compound—those fee differences—and investors have been putting a lot more money into VOO versus SPY. That is the reason why we view VOO slightly better than SPY. And that is just the basic approach, which is the lower the investor can pay, the better the investment is.

Can you buy the entire S&P 500 : The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.