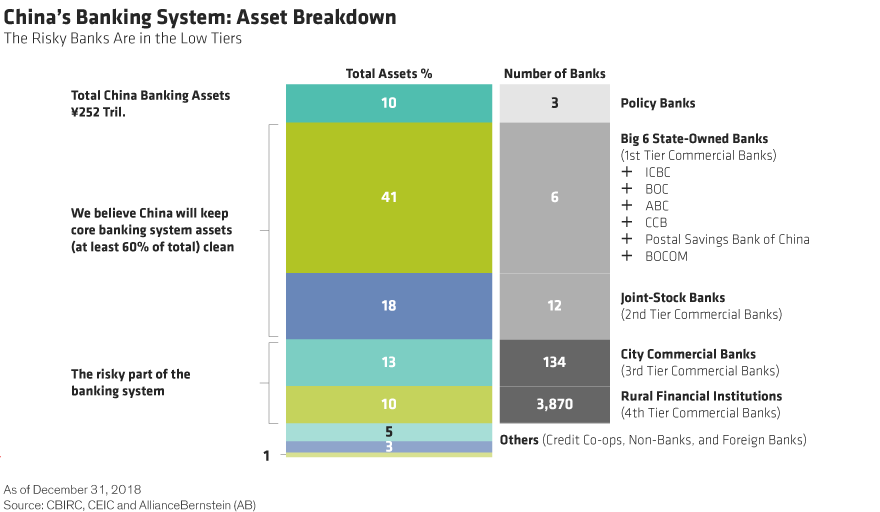

China has six state-owned commercial banks. These banks are ranked by their Tier 1 capital amount as of 2018. Banks with asterisks (*) are the four major state-owned banks (i.e. the "Big Four" banks). Bank of Communications was founded in 1908.The 2021 Chinese Private Banks Report provides a comprehensive overview of the 19 private banks currently approved for operation in mainland China. China launched trials for the establishment and operation of private banks in 2014, as part of broader reforms of the state-dominated banking system.It is owned by the Hongkong and Shanghai Banking Corporation Limited, the founding member of the HSBC Group, which was established in Hong Kong and Shanghai in 1865. HSBC China incorporated the previous Mainland offices of its parent.

What are the big 4 banks of China : In the People's Republic of China, the "Big Four" banks (四大银行) are:

Industrial and Commercial Bank of China.

Bank of China.

China Construction Bank.

Agricultural Bank of China.

Bank of Communications ("Big Five")

Postal Savings Bank of China ("Big Six")

Does China own Bank of America

No, Bank of America is not partly owned by China. It is an American bank.

How big is China’s bank assets : Total assets stood at P1. 4 trillion, up 15% and still the fourth largest among private domestic banks. Net loans rose by 11% to P726 billion on stronger demand from the consumer sector, up 20%, and the business sector, up 8%.

At the end of 2023, Chinese banking institutions in China and abroad hold total assets of RMB 409.8 trillion, according to the National Financial Regulatory Administration. This statistic shows the number of foreign banks in China from 2006 to 2016. In 2016, there were 1031 foreign banking institutions in China.

Is HSBC exposed to China

HSBC's offshore exposure to mainland China commercial real estate has dropped more than $3 billion from 2022 to $6.2 billion, said Elhedery. "We believe we are well provisioned where we are today. And we certainly have less concerns around our exposure going into 2024."Citi's locally incorporated entity is known as Citibank (China) Co Ltd, which is wholly owned by Citibank N.A. Today Citi is a leading international bank in China with footprint in twelve cities across China (Beijing, Changsha, Chengdu, Chongqing, Dalian, Guangzhou, Guiyang, Hangzhou, Nanjing, Shanghai, Shenzhen, …When China's economy reformed, they split the one bank up into a central bank, and four big commercial banks. Because there was no stock or bond market, the banks did pretty much everything, so they were huge. The People's Bank of China (officially PBC and unofficially PBOC) is the central bank of the People's Republic of China. It is responsible for carrying out monetary policy as determined by the People's Bank Law and the Commercial Bank Law.

Does China belong to World bank : China originally joined the World Bank Group (WBG) on December 27, 1945.

Does China own US companies : These are large multinational companies like Smithfield Foods, Syngenta, or the Walton International Group, which are all either owned by another Chinese company or Chinese investors. There are some individuals who do own this land, though, and they've owned it for decades, since the '70s and even the '80s.

Why Chinese banks are so big

When China's economy reformed, they split the one bank up into a central bank, and four big commercial banks. Because there was no stock or bond market, the banks did pretty much everything, so they were huge. Size. According to the PBOC, China's banking sector had total assets worth RMB406. 25 trillion as of the end of Q2 2023.Which of the Big Four is the best bank for saving

Rank

Big Four Bank

Household deposits (billion)

1

CBA

$388.466

2

Westpac

$301.516

3

NAB

$201.982

4

ANZ

$171.563

22. 4. 2024

Is HSBC linked to Russia : In Russia, the HSBC Group operates through OOO HSBC Bank (RR), a subsidiary of HSBC Bank plc. HSBC provides a wide range of corporate banking, investment banking and financial markets products and services to multinational and domestic corporate and institutional customers in Russia.

Antwort How many banks does China own? Weitere Antworten – How many banks are owned by China

China has six state-owned commercial banks. These banks are ranked by their Tier 1 capital amount as of 2018. Banks with asterisks (*) are the four major state-owned banks (i.e. the "Big Four" banks). Bank of Communications was founded in 1908.The 2021 Chinese Private Banks Report provides a comprehensive overview of the 19 private banks currently approved for operation in mainland China. China launched trials for the establishment and operation of private banks in 2014, as part of broader reforms of the state-dominated banking system.It is owned by the Hongkong and Shanghai Banking Corporation Limited, the founding member of the HSBC Group, which was established in Hong Kong and Shanghai in 1865. HSBC China incorporated the previous Mainland offices of its parent.

What are the big 4 banks of China : In the People's Republic of China, the "Big Four" banks (四大银行) are:

Does China own Bank of America

No, Bank of America is not partly owned by China. It is an American bank.

How big is China’s bank assets : Total assets stood at P1. 4 trillion, up 15% and still the fourth largest among private domestic banks. Net loans rose by 11% to P726 billion on stronger demand from the consumer sector, up 20%, and the business sector, up 8%.

At the end of 2023, Chinese banking institutions in China and abroad hold total assets of RMB 409.8 trillion, according to the National Financial Regulatory Administration.

This statistic shows the number of foreign banks in China from 2006 to 2016. In 2016, there were 1031 foreign banking institutions in China.

Is HSBC exposed to China

HSBC's offshore exposure to mainland China commercial real estate has dropped more than $3 billion from 2022 to $6.2 billion, said Elhedery. "We believe we are well provisioned where we are today. And we certainly have less concerns around our exposure going into 2024."Citi's locally incorporated entity is known as Citibank (China) Co Ltd, which is wholly owned by Citibank N.A. Today Citi is a leading international bank in China with footprint in twelve cities across China (Beijing, Changsha, Chengdu, Chongqing, Dalian, Guangzhou, Guiyang, Hangzhou, Nanjing, Shanghai, Shenzhen, …When China's economy reformed, they split the one bank up into a central bank, and four big commercial banks. Because there was no stock or bond market, the banks did pretty much everything, so they were huge.

The People's Bank of China (officially PBC and unofficially PBOC) is the central bank of the People's Republic of China. It is responsible for carrying out monetary policy as determined by the People's Bank Law and the Commercial Bank Law.

Does China belong to World bank : China originally joined the World Bank Group (WBG) on December 27, 1945.

Does China own US companies : These are large multinational companies like Smithfield Foods, Syngenta, or the Walton International Group, which are all either owned by another Chinese company or Chinese investors. There are some individuals who do own this land, though, and they've owned it for decades, since the '70s and even the '80s.

Why Chinese banks are so big

When China's economy reformed, they split the one bank up into a central bank, and four big commercial banks. Because there was no stock or bond market, the banks did pretty much everything, so they were huge.

Size. According to the PBOC, China's banking sector had total assets worth RMB406. 25 trillion as of the end of Q2 2023.Which of the Big Four is the best bank for saving

22. 4. 2024

Is HSBC linked to Russia : In Russia, the HSBC Group operates through OOO HSBC Bank (RR), a subsidiary of HSBC Bank plc. HSBC provides a wide range of corporate banking, investment banking and financial markets products and services to multinational and domestic corporate and institutional customers in Russia.