Do you still get points if you pay your credit card early Yes. If you have a rewards card that earns points based on your spending, those points won't be lost if you pay your credit card bill early.Option 1: Block or cancel your card via Raiffeisen Smart Mobile

Log in to Raiffeisen Smart Mobile.

Click on “Manage my cards”

Select the card you would like to manage.

Select “Block this card” to temporarily block it or to “Unblock this card” to unblock it.

What is the 15/3 rule The 15/3 rule, a trending credit card repayment method, suggests paying your credit card bill in two payments—both 15 days and 3 days before your payment due date. Proponents say it helps raise credit scores more quickly, but there's no real proof.

Is it smart to pay with rewards : If the rewards you earn per dollar charged are only worth 2 cents each, then, no, you should not generally pay with your credit card. It's typically only worth paying a fee if the value you're earning on rewards credit card is more than the fee paid. But that math can get a little more involved on some cards.

How did my card get blocked

Your card may be declined for a number of reasons: the card has expired; you're over your credit limit; the card issuer sees suspicious activity that could be a sign of fraud; or a hotel, rental car company, or other business placed a block (or hold) on your card for its estimated total of your bill.

How can I unblock my card : Submit An Application To the Bank

You may have blocked the card willingly when you have realised you misplaced or lost it. However, you found the card later and need to use it. You can directly approach your bank or its branch and submit a written application, requesting an automatic unblock of the ATM card.

Credit card payments are due the same day and time every month, often 5 p.m. or later. A credit card payment can't be considered late if it was received by 5 p.m. on the day that it was due, according to the CARD Act. Some card issuers may set a later due date if you pay your bill online, giving you even more time pay. Bottom line. Paying your credit card bill early is not intrinsically good or bad, but it can help you avoid negative habits such as high credit utilization and late payments. Paying your credit card early won't directly influence your credit score, but it can help in creating good financial habits down the line.

Is 1.5% rewards good

If your spending on the flat-rate card is low because you use it only as the "everything else" card in conjunction with a bonus-category rewards card, the 1.5% card might be the better choice because you get that cash bonus quickly, assuming you earn the bonus by spending enough on the card soon after you get it.Many rewards credit cards offer cash back, and you may even find some debit cards that offer cash back on certain purchases. Cash back is not free money, but rather a reward for making purchases on expenses like gas, groceries, restaurant meals or even streaming services.These situations sometimes resolve themselves; for example, cards that are blocked due to daily limits, or due to excessive PIN entry attempts, will typically be unblocked within 24 hours. In cases of expired cards, activating and using the replacement card will solve the problem. Reduce the time your card is blocked.

Paying your bill with that same card means your final charge will most likely replace the block in a day or two. But if you pay that bill with a different card — or with cash or a check — the block may last up to 15 days.

Does your card lock after 3 attempts : After typing 3 wrong pins (it doesn't have to be on the same day) the chip of your card will be blocked. To unblock your chip, you can go to an ATM from a major bank. You should be able to see a new 'PIN Unlock' option or you can otherwise view your remaining amount.

Is it bad to pay before due date : Paying early could help your credit

Generally, the lower your utilization, the better, and utilization above 30% could be damaging to your credit scores.

What if you pay on the 30th day is it late

When is a payment marked late on credit reports A payment will typically need to be 30 days late before it's reported to the credit reporting bureaus. An overlooked bill won't hurt your credit as long as you pay before that 30-day mark, although you may have to pay a late fee. Paying your balance more than once per month makes it more likely that you'll have a lower credit utilization rate when the bureaus receive your information. And paying multiple times can also help you keep track of your spending and cut back on any overspending before you fall into debt.If you are looking to maximize rewards, a 5% cash-back card can be a great asset. Oftentimes, they have standard interest rates and no annual fee. However, these rotating category cards aren't for everyone. Trying to optimize your usage can be a lot of work, and many people don't want the hassle.

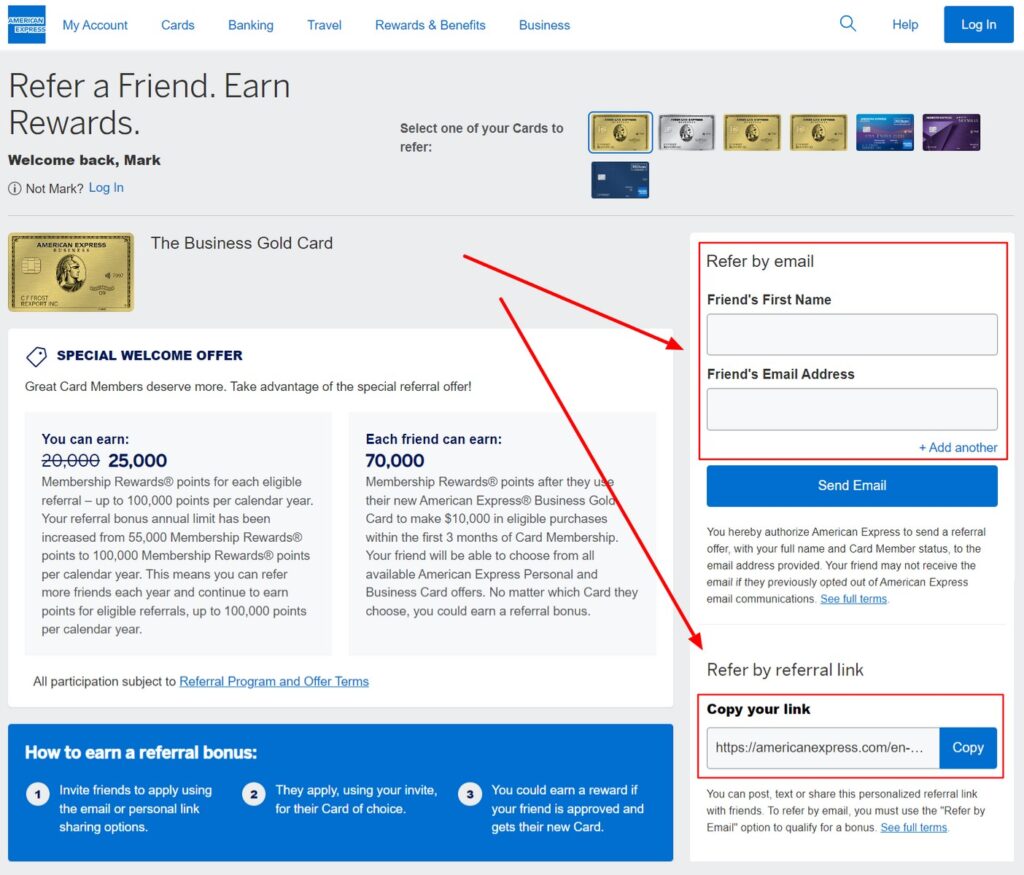

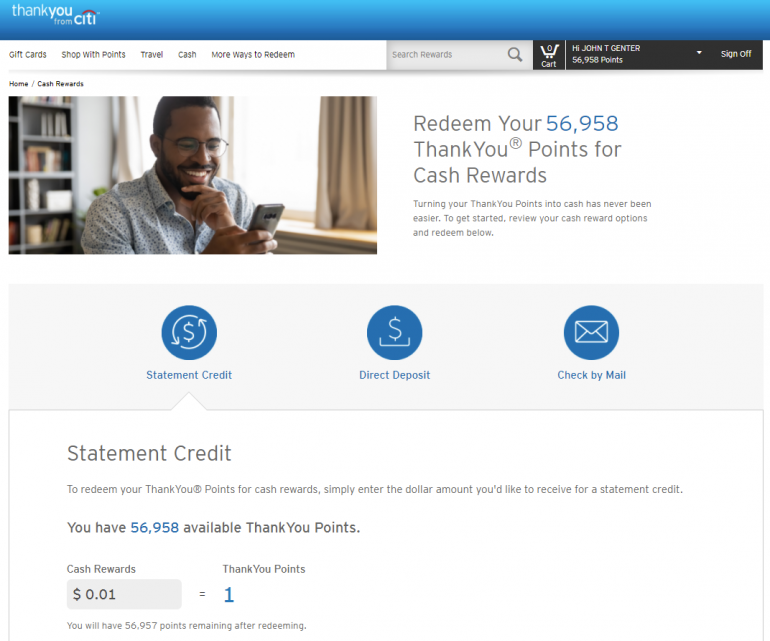

Is 100 points 1 dollar : In other words, 100 points equals $1 (or other currency). Important: Once redemptions have occurred, the Points-to-Currency Ratio shouldn't be changed because doing so will affect reporting and what you've set up for Rewards.

Antwort How long does it take for rewards to post to your account? Weitere Antworten – Will I still earn rewards points if I pay off my card early

Do you still get points if you pay your credit card early Yes. If you have a rewards card that earns points based on your spending, those points won't be lost if you pay your credit card bill early.Option 1: Block or cancel your card via Raiffeisen Smart Mobile

What is the 15/3 rule The 15/3 rule, a trending credit card repayment method, suggests paying your credit card bill in two payments—both 15 days and 3 days before your payment due date. Proponents say it helps raise credit scores more quickly, but there's no real proof.

Is it smart to pay with rewards : If the rewards you earn per dollar charged are only worth 2 cents each, then, no, you should not generally pay with your credit card. It's typically only worth paying a fee if the value you're earning on rewards credit card is more than the fee paid. But that math can get a little more involved on some cards.

How did my card get blocked

Your card may be declined for a number of reasons: the card has expired; you're over your credit limit; the card issuer sees suspicious activity that could be a sign of fraud; or a hotel, rental car company, or other business placed a block (or hold) on your card for its estimated total of your bill.

How can I unblock my card : Submit An Application To the Bank

You may have blocked the card willingly when you have realised you misplaced or lost it. However, you found the card later and need to use it. You can directly approach your bank or its branch and submit a written application, requesting an automatic unblock of the ATM card.

Credit card payments are due the same day and time every month, often 5 p.m. or later. A credit card payment can't be considered late if it was received by 5 p.m. on the day that it was due, according to the CARD Act. Some card issuers may set a later due date if you pay your bill online, giving you even more time pay.

Bottom line. Paying your credit card bill early is not intrinsically good or bad, but it can help you avoid negative habits such as high credit utilization and late payments. Paying your credit card early won't directly influence your credit score, but it can help in creating good financial habits down the line.

Is 1.5% rewards good

If your spending on the flat-rate card is low because you use it only as the "everything else" card in conjunction with a bonus-category rewards card, the 1.5% card might be the better choice because you get that cash bonus quickly, assuming you earn the bonus by spending enough on the card soon after you get it.Many rewards credit cards offer cash back, and you may even find some debit cards that offer cash back on certain purchases. Cash back is not free money, but rather a reward for making purchases on expenses like gas, groceries, restaurant meals or even streaming services.These situations sometimes resolve themselves; for example, cards that are blocked due to daily limits, or due to excessive PIN entry attempts, will typically be unblocked within 24 hours. In cases of expired cards, activating and using the replacement card will solve the problem.

Reduce the time your card is blocked.

Paying your bill with that same card means your final charge will most likely replace the block in a day or two. But if you pay that bill with a different card — or with cash or a check — the block may last up to 15 days.

Does your card lock after 3 attempts : After typing 3 wrong pins (it doesn't have to be on the same day) the chip of your card will be blocked. To unblock your chip, you can go to an ATM from a major bank. You should be able to see a new 'PIN Unlock' option or you can otherwise view your remaining amount.

Is it bad to pay before due date : Paying early could help your credit

Generally, the lower your utilization, the better, and utilization above 30% could be damaging to your credit scores.

What if you pay on the 30th day is it late

When is a payment marked late on credit reports A payment will typically need to be 30 days late before it's reported to the credit reporting bureaus. An overlooked bill won't hurt your credit as long as you pay before that 30-day mark, although you may have to pay a late fee.

Paying your balance more than once per month makes it more likely that you'll have a lower credit utilization rate when the bureaus receive your information. And paying multiple times can also help you keep track of your spending and cut back on any overspending before you fall into debt.If you are looking to maximize rewards, a 5% cash-back card can be a great asset. Oftentimes, they have standard interest rates and no annual fee. However, these rotating category cards aren't for everyone. Trying to optimize your usage can be a lot of work, and many people don't want the hassle.

Is 100 points 1 dollar : In other words, 100 points equals $1 (or other currency). Important: Once redemptions have occurred, the Points-to-Currency Ratio shouldn't be changed because doing so will affect reporting and what you've set up for Rewards.