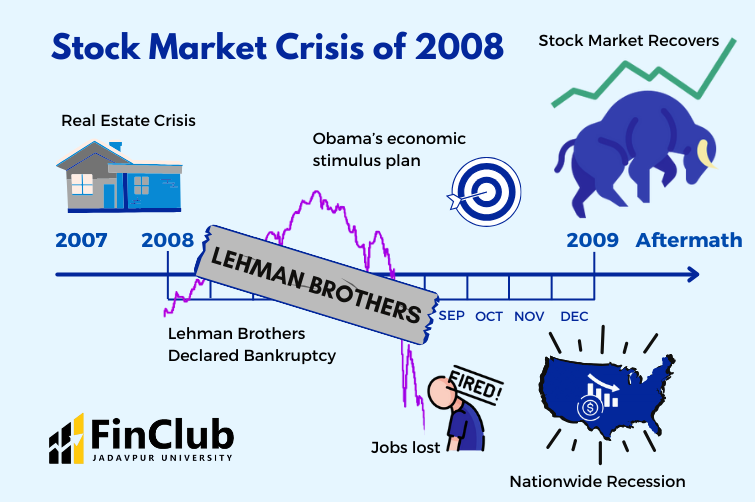

Starting with the “tech wreck” in 2000, inflation totaled 35.7%, prolonging the real recovery in purchasing power an additional seven years and nine months. The bounce-back from the 2008 crash took five and a half years, but an additional half year to regain your purchasing power.In response, the DJIA dropped 777.68 points, or 6.98%, then the largest point drop in history. The S&P 500 Index fell 8.8% and the Nasdaq Composite fell 9.1%. Several stock market indices worldwide fell 10%.6 Some of the largest banks to fail were investment banks, including Lehman Brothers and Bear Stearns. JPMorgan Chase, Goldman Sachs, Morgan Stanley, and Bank of America were all bailed out by the federal government and did not fail.

How long does it take to recover from a stock market crash : It typically takes five months to reach the “bottom” of a correction. However, once the market starts to turn, it can recover quickly. The average recovery time for a correction is just four months! That's why investors with truly diversified portfolios may consider staying investing for the long-term.

Are we in a recession in 2024

A recession is unlikely in 2024, but the risk of inflation still looms.

Will the market correct in 2024 : The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024. ITR Economics is forecasting that a macroeconomic recession will begin in late 2023 and persist throughout 2024. Business leaders recently had to lead their companies through the recession during the COVID-19 pandemic, and some were even in leadership positions back in 2008, during the Great Recession.

Who got rich from the Great Depression

Not everyone, however, lost money during the worst economic downturn in American history. Business titans such as William Boeing and Walter Chrysler actually grew their fortunes during the Great Depression.In the mid-2000s, Burry was famous for placing a wager against the housing market and profited handsomely from the subprime lending crisis and the collapse of numerous major financial entities in 2008.Do you lose all the money if the stock market crashes No, a stock market crash only indicates a fall in prices where a majority of investors face losses but do not completely lose all the money. The money is lost only when the positions are sold during or after the crash. The research of the Federal Reserve Bank of New York, currently puts the probability of a U.S. recession before February 2025 at 58%, that's about as high as a forward-looking recession probability has been on this model since the 1980s.

How does a recession end : A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough.” Consistent with this definition, the Committee focuses on a comprehensive set of measures—including not only GDP, but also employment, income, sales, and industrial production—to analyze the trends in economic …

Will market bounce back in 2024 : Heading into 2024, investors are optimistic the same macroeconomic tailwinds that fueled the stock market's 2023 rally will propel the S&P 500 to new all-time highs in 2024.

Should I pull my money out of the stock market in 2024

Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough.” Consistent with this definition, the Committee focuses on a comprehensive set of measures—including not only GDP, but also employment, income, sales, and industrial production—to analyze the trends in economic …Economists predict another year of slow growth around the world in 2024. While the risk of a global recession is lower in the year ahead, two G7 economies dipped into recession at the end of 2023.

Will recession last into 2024 : “Respondents on average perceive a 7% probability of global recession in 2024, down from 18% in October,” he wrote. “They also see only a minimal chance – less than 1-in-100 – of an economic slump on the scale experienced in 2009 during the global financial crisis.”

Antwort How long did the 2008 market crash last? Weitere Antworten – How long did the market take to recover from 2008

five and a half years

Starting with the “tech wreck” in 2000, inflation totaled 35.7%, prolonging the real recovery in purchasing power an additional seven years and nine months. The bounce-back from the 2008 crash took five and a half years, but an additional half year to regain your purchasing power.In response, the DJIA dropped 777.68 points, or 6.98%, then the largest point drop in history. The S&P 500 Index fell 8.8% and the Nasdaq Composite fell 9.1%. Several stock market indices worldwide fell 10%.6 Some of the largest banks to fail were investment banks, including Lehman Brothers and Bear Stearns. JPMorgan Chase, Goldman Sachs, Morgan Stanley, and Bank of America were all bailed out by the federal government and did not fail.

How long does it take to recover from a stock market crash : It typically takes five months to reach the “bottom” of a correction. However, once the market starts to turn, it can recover quickly. The average recovery time for a correction is just four months! That's why investors with truly diversified portfolios may consider staying investing for the long-term.

Are we in a recession in 2024

A recession is unlikely in 2024, but the risk of inflation still looms.

Will the market correct in 2024 : The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024.

ITR Economics is forecasting that a macroeconomic recession will begin in late 2023 and persist throughout 2024. Business leaders recently had to lead their companies through the recession during the COVID-19 pandemic, and some were even in leadership positions back in 2008, during the Great Recession.

Who got rich from the Great Depression

Not everyone, however, lost money during the worst economic downturn in American history. Business titans such as William Boeing and Walter Chrysler actually grew their fortunes during the Great Depression.In the mid-2000s, Burry was famous for placing a wager against the housing market and profited handsomely from the subprime lending crisis and the collapse of numerous major financial entities in 2008.Do you lose all the money if the stock market crashes No, a stock market crash only indicates a fall in prices where a majority of investors face losses but do not completely lose all the money. The money is lost only when the positions are sold during or after the crash.

:max_bytes(150000):strip_icc()/fredgraph-8530b0bb38ec43b1bd84d7fa96c12b23.png)

The research of the Federal Reserve Bank of New York, currently puts the probability of a U.S. recession before February 2025 at 58%, that's about as high as a forward-looking recession probability has been on this model since the 1980s.

How does a recession end : A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough.” Consistent with this definition, the Committee focuses on a comprehensive set of measures—including not only GDP, but also employment, income, sales, and industrial production—to analyze the trends in economic …

Will market bounce back in 2024 : Heading into 2024, investors are optimistic the same macroeconomic tailwinds that fueled the stock market's 2023 rally will propel the S&P 500 to new all-time highs in 2024.

Should I pull my money out of the stock market in 2024

Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough.” Consistent with this definition, the Committee focuses on a comprehensive set of measures—including not only GDP, but also employment, income, sales, and industrial production—to analyze the trends in economic …Economists predict another year of slow growth around the world in 2024. While the risk of a global recession is lower in the year ahead, two G7 economies dipped into recession at the end of 2023.

Will recession last into 2024 : “Respondents on average perceive a 7% probability of global recession in 2024, down from 18% in October,” he wrote. “They also see only a minimal chance – less than 1-in-100 – of an economic slump on the scale experienced in 2009 during the global financial crisis.”