What is QQQ QQQ is the ticker for the Invesco exchange-traded fund (ETF) that tracks the NASDAQ 100 Index. It gives investors, primarily in the U.S., access to the Nasdaq's 100 largest non-financial companies in a single investment.The QQQ ETF offers buy-and-hold investors low expenses and long-term growth potential with enough diversification to avoid the risks of betting on one company. On the downside, long-term investors in QQQ must deal with sector risk, possible overvaluation, and the absence of small caps.With a small expense ratio of 0.2%, QQQ gives investors exposure to the best of American innovation, growth and profitability now, and on an ongoing basis into the future.

Is QQQ better than S&P : The QQQ gained 18.1% annually over the past 10 years. That tops all of the nearly 300 ETFs in the category. That easily outpaces the 12.6% average annual gain of the SPDR S&P 500 ETF Trust (SPY) — the cornerstone of most investors' portfolios. And the QQQ is cheap, only charging 0.2%.

Does QQQ mimic Nasdaq

QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.

Does QQQ match the Nasdaq : Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.

Risk 1: Market risk

Although QQQ and other ETFs have helped democratize investing, the benefits of the ETF structure don't remove any of the inherent risks of investing in stocks, bonds, real estate, and other asset classes. A history of outperformance. Invesco QQQ — the ETF that tracks the Nasdaq-100 index — has beaten the S&P 500 nine out of the last 10 years. Source: Morningstar Inc.

Is QQQ overpriced

The price-to-earnings ratio of the average company in the Invesco QQQ Trust is 34.4. That's on the expensive side.A history of outperformance. Invesco QQQ — the ETF that tracks the Nasdaq-100 index — has beaten the S&P 500 nine out of the last 10 years. Source: Morningstar Inc. Data begins 10 years prior to the ending date.The Nasdaq-100® is one of the most well-known indexes in the investing world. Representing the largest non-Financial listings on the Nasdaq exchange, the Nasdaq-100® Index (NDX) has futures and exchange-traded funds (ETFs) with significant liquidity and investor interest. Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.

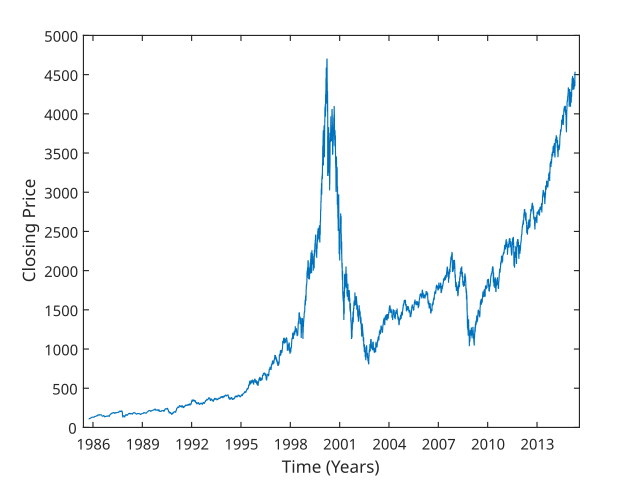

Is QQQ Nasdaq or S&P 500 : An investor cannot invest directly in an index. Index returns do not represent Fund returns. The S&P has certainly been around longer, launching in 1957 while the Nasdaq-100 was first calculated in 1985. Invesco QQQ, which launched in March of 1999, has tracked that Nasdaq-100 over 24 years.

Should I hold QQQ long-term : Invesco QQQ Trust (QQQ)

For investors who care less about broad swaths of the stock market and prefer to veer towards the high-flying technology sector in pursuit of long-term growth, the Invesco QQQ Trust is a solid option to consider.

Where will QQQ be in 5 years

Invesco QQQ stock price stood at $424.59

According to the latest long-term forecast, Invesco QQQ price will hit $450 by the end of 2024 and then $500 by the middle of 2025. Invesco QQQ will rise to $600 within the year of 2027, $700 in 2028, $800 in 2029, $900 in 2032 and $1000 in 2034. QQQ has a dividend yield of 0.58% and paid $2.64 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Mar 18, 2024.Since the beginning of the year, the performance of the fund that tracks the S&P 500's efficiency has been higher than that of QQQ. The latter leads in annualized returns over periods longer than a year. The table presents a comparison SPY vs QQQ in terms of yield according to etf.com as of 03.04. 2024.

Is QQQ the best performing ETF : Invesco (QQQ)

Invesco QQQ offers an annualized return of 9.5% since its inception in 1999. It also has a five-year annualized return of 22.4%, beating S&P 500 funds over the same timeframe.

Antwort How is QQQ different from Nasdaq? Weitere Antworten – Why is QQQ different than Nasdaq

What is QQQ QQQ is the ticker for the Invesco exchange-traded fund (ETF) that tracks the NASDAQ 100 Index. It gives investors, primarily in the U.S., access to the Nasdaq's 100 largest non-financial companies in a single investment.The QQQ ETF offers buy-and-hold investors low expenses and long-term growth potential with enough diversification to avoid the risks of betting on one company. On the downside, long-term investors in QQQ must deal with sector risk, possible overvaluation, and the absence of small caps.With a small expense ratio of 0.2%, QQQ gives investors exposure to the best of American innovation, growth and profitability now, and on an ongoing basis into the future.

Is QQQ better than S&P : The QQQ gained 18.1% annually over the past 10 years. That tops all of the nearly 300 ETFs in the category. That easily outpaces the 12.6% average annual gain of the SPDR S&P 500 ETF Trust (SPY) — the cornerstone of most investors' portfolios. And the QQQ is cheap, only charging 0.2%.

Does QQQ mimic Nasdaq

QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.

Does QQQ match the Nasdaq : Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.

Risk 1: Market risk

Although QQQ and other ETFs have helped democratize investing, the benefits of the ETF structure don't remove any of the inherent risks of investing in stocks, bonds, real estate, and other asset classes.

A history of outperformance. Invesco QQQ — the ETF that tracks the Nasdaq-100 index — has beaten the S&P 500 nine out of the last 10 years. Source: Morningstar Inc.

Is QQQ overpriced

The price-to-earnings ratio of the average company in the Invesco QQQ Trust is 34.4. That's on the expensive side.A history of outperformance. Invesco QQQ — the ETF that tracks the Nasdaq-100 index — has beaten the S&P 500 nine out of the last 10 years. Source: Morningstar Inc. Data begins 10 years prior to the ending date.The Nasdaq-100® is one of the most well-known indexes in the investing world. Representing the largest non-Financial listings on the Nasdaq exchange, the Nasdaq-100® Index (NDX) has futures and exchange-traded funds (ETFs) with significant liquidity and investor interest.

Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.

Is QQQ Nasdaq or S&P 500 : An investor cannot invest directly in an index. Index returns do not represent Fund returns. The S&P has certainly been around longer, launching in 1957 while the Nasdaq-100 was first calculated in 1985. Invesco QQQ, which launched in March of 1999, has tracked that Nasdaq-100 over 24 years.

Should I hold QQQ long-term : Invesco QQQ Trust (QQQ)

For investors who care less about broad swaths of the stock market and prefer to veer towards the high-flying technology sector in pursuit of long-term growth, the Invesco QQQ Trust is a solid option to consider.

Where will QQQ be in 5 years

Invesco QQQ stock price stood at $424.59

According to the latest long-term forecast, Invesco QQQ price will hit $450 by the end of 2024 and then $500 by the middle of 2025. Invesco QQQ will rise to $600 within the year of 2027, $700 in 2028, $800 in 2029, $900 in 2032 and $1000 in 2034.

QQQ has a dividend yield of 0.58% and paid $2.64 per share in the past year. The dividend is paid every three months and the last ex-dividend date was Mar 18, 2024.Since the beginning of the year, the performance of the fund that tracks the S&P 500's efficiency has been higher than that of QQQ. The latter leads in annualized returns over periods longer than a year. The table presents a comparison SPY vs QQQ in terms of yield according to etf.com as of 03.04. 2024.

Is QQQ the best performing ETF : Invesco (QQQ)

Invesco QQQ offers an annualized return of 9.5% since its inception in 1999. It also has a five-year annualized return of 22.4%, beating S&P 500 funds over the same timeframe.