The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.The Dow takes the total price of its 30 stocks and divides it by an adjusted divisor. This change accounts for stock splits and dividends, preventing these actions from skewing the index. The Nasdaq: This index includes over 3,000 stocks of both tech and non-tech companies.The S&P 500 represents a much fewer number of companies and is weighted based on company stock prices, while the DJIA represents a much larger number of companies and its index is market cap weighted.

Does the S&P 500 include the Nasdaq : How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).

Why is S&P better than Dow

Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

Does S&P own Dow Jones : The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100. The Dow provides a much broader representation of the stock market than the S&P 500 does. The S&P 500 provides data on 500 companies, and the Dow provides data on only 300 companies. The Dow tracks the price of the stock, whereas the S&P 500 weighs the stock prices by the market value of the company.

Is the Dow 30 included in the S&P 500

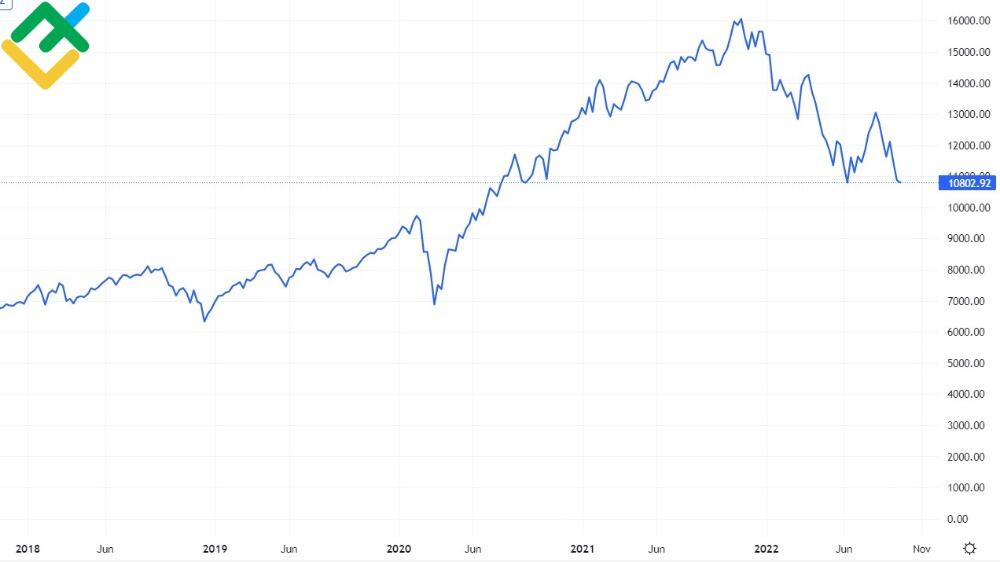

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100. So why does the S&P 500 index, and lots of index funds that track it, tend to outperform funds where well-paid professionals are trying hard to beat it A commonly cited reason is simply: fees. Fees can make a huge difference in your long-term returns.

Is Dow Jones part of S&P Global : The company also manages the oldest index in use, the Dow Jones Transportation Index, created in 1882 by Charles Dow, the founder of The Wall Street Journal. S&P Global (formerly McGraw Hill Financial, Inc.), owner of Standard & Poor's, controls 73% of the joint venture, CME Group owns 24.4% through its affiliates.

Is Dow part of S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

What is a major difference between the S&P 500 index and the Dow Jones Industrial Average quizlet

The DJIA is based on the price of stocks for 30 large companies; the S&P 500 is based on the price of stocks for 500 companies. The 30 stocks which make up the Dow Jones Industrial Average are: 3M, American Express, Amgen, Apple, Boeing, Caterpillar, Chevron, Cisco Systems, Coca-Cola, Disney, Dow, Goldman Sachs, Home Depot, Honeywell, IBM, Intel, Johnson & Johnson, JP Morgan Chase, McDonald's, Merck, Microsoft, Nike, Procter & Gamble, …In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.

Should I invest in Total market or S&P 500 : You can't go wrong with either the Vanguard Total Stock Market ETF or the Vanguard S&P 500 ETF. Both offer very low expense ratios and turnover rates, and the difference in their tracking errors is negligible. The overlap in their holdings ensures that you'll get very similar returns going forward.

Antwort How is Dow different from S&P? Weitere Antworten – What is the difference between S and P and Dow Jones

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.The Dow takes the total price of its 30 stocks and divides it by an adjusted divisor. This change accounts for stock splits and dividends, preventing these actions from skewing the index. The Nasdaq: This index includes over 3,000 stocks of both tech and non-tech companies.The S&P 500 represents a much fewer number of companies and is weighted based on company stock prices, while the DJIA represents a much larger number of companies and its index is market cap weighted.

Does the S&P 500 include the Nasdaq : How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).

Why is S&P better than Dow

Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

Does S&P own Dow Jones : The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

The Dow provides a much broader representation of the stock market than the S&P 500 does. The S&P 500 provides data on 500 companies, and the Dow provides data on only 300 companies. The Dow tracks the price of the stock, whereas the S&P 500 weighs the stock prices by the market value of the company.

Is the Dow 30 included in the S&P 500

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

So why does the S&P 500 index, and lots of index funds that track it, tend to outperform funds where well-paid professionals are trying hard to beat it A commonly cited reason is simply: fees. Fees can make a huge difference in your long-term returns.

Is Dow Jones part of S&P Global : The company also manages the oldest index in use, the Dow Jones Transportation Index, created in 1882 by Charles Dow, the founder of The Wall Street Journal. S&P Global (formerly McGraw Hill Financial, Inc.), owner of Standard & Poor's, controls 73% of the joint venture, CME Group owns 24.4% through its affiliates.

Is Dow part of S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

What is a major difference between the S&P 500 index and the Dow Jones Industrial Average quizlet

The DJIA is based on the price of stocks for 30 large companies; the S&P 500 is based on the price of stocks for 500 companies.

The 30 stocks which make up the Dow Jones Industrial Average are: 3M, American Express, Amgen, Apple, Boeing, Caterpillar, Chevron, Cisco Systems, Coca-Cola, Disney, Dow, Goldman Sachs, Home Depot, Honeywell, IBM, Intel, Johnson & Johnson, JP Morgan Chase, McDonald's, Merck, Microsoft, Nike, Procter & Gamble, …In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.

Should I invest in Total market or S&P 500 : You can't go wrong with either the Vanguard Total Stock Market ETF or the Vanguard S&P 500 ETF. Both offer very low expense ratios and turnover rates, and the difference in their tracking errors is negligible. The overlap in their holdings ensures that you'll get very similar returns going forward.