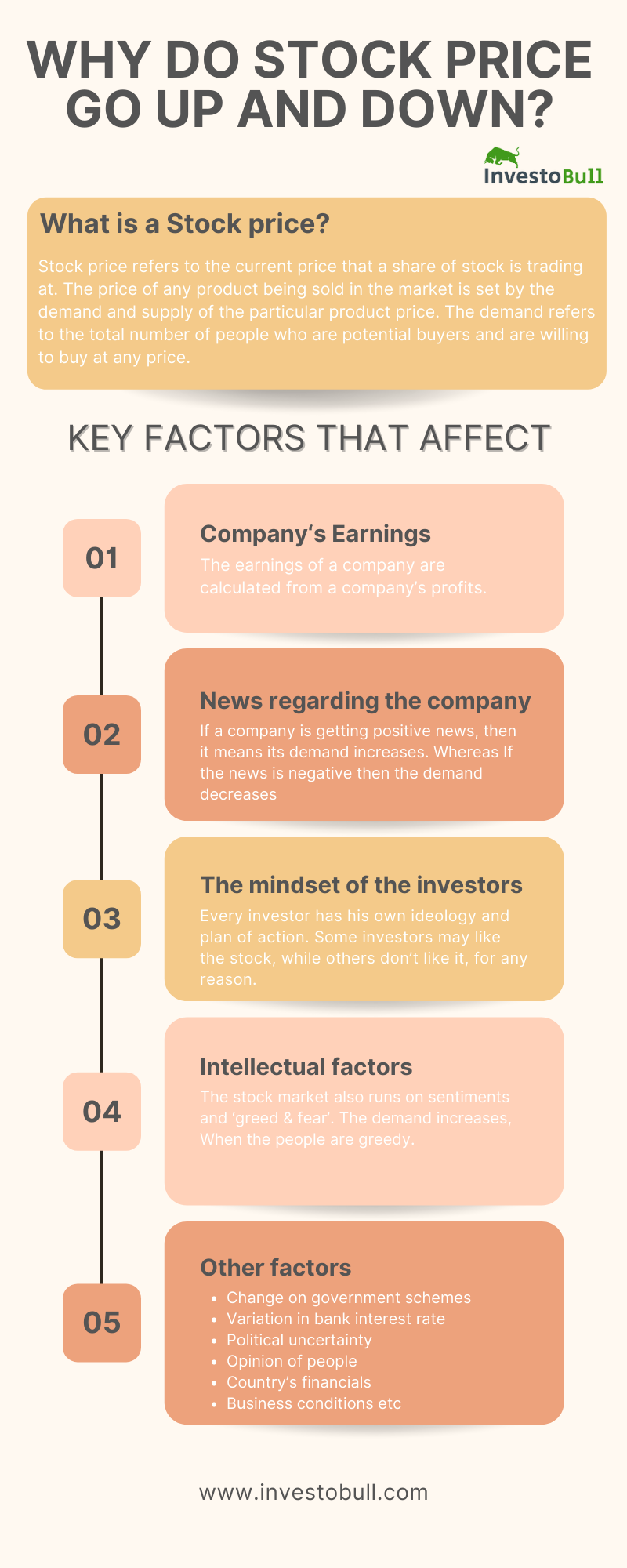

If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.For each share they buy, an investor owns a piece of that company. In large part, supply and demand dictate the per-share price of a stock. If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.Many different forces can affect stock prices, including company news and performance, industry performance, investor sentiment, and economic factors.

What events can cause the price of a stock to increase or decrease : Key Takeaways. Stock prices are driven by a variety of factors, but ultimately the price at any given moment is due to the supply and demand at that point in time in the market. Fundamental factors drive stock prices based on a company's earnings and profitability from producing and selling goods and services.

Why are stocks falling

According to the astute observations of our esteemed stock market experts, the ongoing Lok Sabha elections, FIIs' selling, bounce back in the US dollar rates, hawkish US Fed fueling treasury yields, unimpressive Q4 results 2024 season and rising India VIX Index are some of the primary reasons that have been dragging …

Why do stocks go down overnight : Why Are Stock Prices More Volatile in After-Hours Trading The number of participants in after-hours trading is a fraction of those during regular market hours. Fewer participants means lower trading volumes and liquidity, and hence, wider bid-ask spreads and more volatility.

When a company releases an earnings report, a fundamental reaction is often the most common. As such, good earnings that miss expectations can result in a downgrade of value. If a firm issues an earnings report that does not meet Street expectations, the stock's price will usually drop. When a share's price decreases in value, that change in value is not redistributed among any parties – the value of the company simply shrinks. The stock market is governed by the forces of supply and demand.

What happens if a stock price goes to zero

Stock prices can fall all the way down to zero. That means the stock loses all of its value and a shareholder's earnings are typically worthless. In this case, the investor loses what they invested in the stock.Taking the loss could allow you to get your portfolio back on track more quickly—and potentially offset capital gains and/or ordinary income.Some traders follow something called the "10 a.m. rule." The stock market opens for trading at 9:30 a.m., and the time between 9:30 a.m. and 10 a.m. often has significant trading volume. Traders that follow the 10 a.m. rule think a stock's price trajectory is relatively set for the day by the end of that half-hour. It is not a hard and fast rule, but rather a guideline that has been observed by many traders over the years. The logic behind this rule is that if the market has not reversed by 11 am EST, it is less likely to experience a significant trend reversal during the remainder of the trading day.

Why did my stock shares decrease : The opposite occurs when a stock price decreases, which simply results from low demand in relation to supply. Just as a high number of buyers creates value, a high number of sellers erodes value.

Do stocks usually go down after earnings : When a company releases an earnings report, a fundamental reaction is often the most common. As such, good earnings that miss expectations can result in a downgrade of value. If a firm issues an earnings report that does not meet Street expectations, the stock's price will usually drop.

Has a stock ever come back from $0

Can a stock ever rebound after it has gone to zero Yes, but unlikely. A more typical example is the corporate shell gets zeroed and a new company is vended [sold] into the shell (the legal entity that remains after the bankruptcy) and the company begins trading again. Sometimes a company will be forced into bankruptcy and its stock fall to zero as the result of an accounting scandal or fraud. Take the famous case of Enron, a large and influential energy and trading company in the 1990s.When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. The New York Stock exchange (NYSE), for instance, will remove stocks if the share price remains below one dollar for 30 consecutive days.

What is the biggest cause of stock loss : Invest in Inventory Management

As revealed above, theft is the biggest contributor to stock loss and people stealing your inventory can be your customers as well as your employees.

Antwort How does stock price decrease? Weitere Antworten – How do stock prices go up and down

If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.For each share they buy, an investor owns a piece of that company. In large part, supply and demand dictate the per-share price of a stock. If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.Many different forces can affect stock prices, including company news and performance, industry performance, investor sentiment, and economic factors.

What events can cause the price of a stock to increase or decrease : Key Takeaways. Stock prices are driven by a variety of factors, but ultimately the price at any given moment is due to the supply and demand at that point in time in the market. Fundamental factors drive stock prices based on a company's earnings and profitability from producing and selling goods and services.

Why are stocks falling

According to the astute observations of our esteemed stock market experts, the ongoing Lok Sabha elections, FIIs' selling, bounce back in the US dollar rates, hawkish US Fed fueling treasury yields, unimpressive Q4 results 2024 season and rising India VIX Index are some of the primary reasons that have been dragging …

Why do stocks go down overnight : Why Are Stock Prices More Volatile in After-Hours Trading The number of participants in after-hours trading is a fraction of those during regular market hours. Fewer participants means lower trading volumes and liquidity, and hence, wider bid-ask spreads and more volatility.

When a company releases an earnings report, a fundamental reaction is often the most common. As such, good earnings that miss expectations can result in a downgrade of value. If a firm issues an earnings report that does not meet Street expectations, the stock's price will usually drop.

When a share's price decreases in value, that change in value is not redistributed among any parties – the value of the company simply shrinks. The stock market is governed by the forces of supply and demand.

What happens if a stock price goes to zero

Stock prices can fall all the way down to zero. That means the stock loses all of its value and a shareholder's earnings are typically worthless. In this case, the investor loses what they invested in the stock.Taking the loss could allow you to get your portfolio back on track more quickly—and potentially offset capital gains and/or ordinary income.Some traders follow something called the "10 a.m. rule." The stock market opens for trading at 9:30 a.m., and the time between 9:30 a.m. and 10 a.m. often has significant trading volume. Traders that follow the 10 a.m. rule think a stock's price trajectory is relatively set for the day by the end of that half-hour.

It is not a hard and fast rule, but rather a guideline that has been observed by many traders over the years. The logic behind this rule is that if the market has not reversed by 11 am EST, it is less likely to experience a significant trend reversal during the remainder of the trading day.

Why did my stock shares decrease : The opposite occurs when a stock price decreases, which simply results from low demand in relation to supply. Just as a high number of buyers creates value, a high number of sellers erodes value.

Do stocks usually go down after earnings : When a company releases an earnings report, a fundamental reaction is often the most common. As such, good earnings that miss expectations can result in a downgrade of value. If a firm issues an earnings report that does not meet Street expectations, the stock's price will usually drop.

Has a stock ever come back from $0

Can a stock ever rebound after it has gone to zero Yes, but unlikely. A more typical example is the corporate shell gets zeroed and a new company is vended [sold] into the shell (the legal entity that remains after the bankruptcy) and the company begins trading again.

:max_bytes(150000):strip_icc()/how-bonds-affect-the-stock-market-3305603_color-dd04df1c2e714e8880b03f044d8a8cd3.gif)

Sometimes a company will be forced into bankruptcy and its stock fall to zero as the result of an accounting scandal or fraud. Take the famous case of Enron, a large and influential energy and trading company in the 1990s.When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. The New York Stock exchange (NYSE), for instance, will remove stocks if the share price remains below one dollar for 30 consecutive days.

What is the biggest cause of stock loss : Invest in Inventory Management

As revealed above, theft is the biggest contributor to stock loss and people stealing your inventory can be your customers as well as your employees.