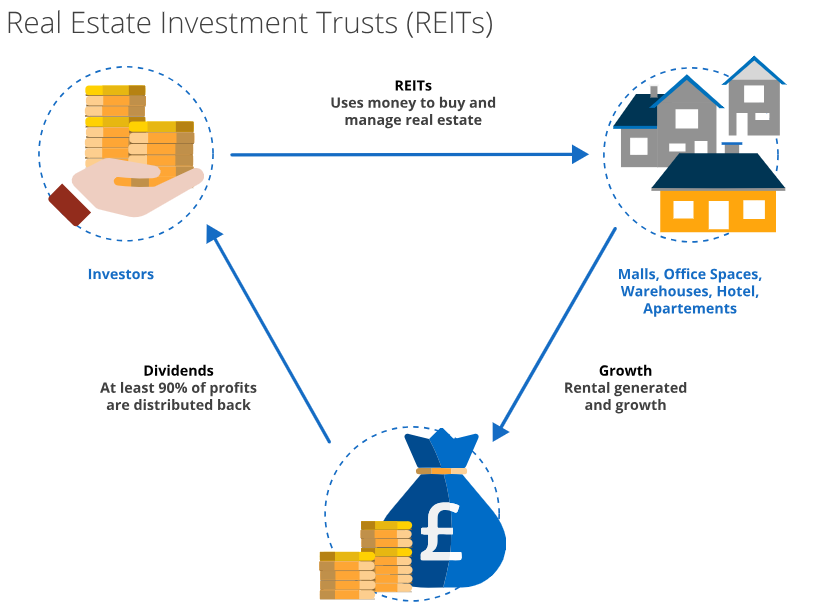

Properties can generate rental income, which, after collecting fees for property management, provides income to its investors. These REITs generate income from renting real estate to tenants. After paying expenses for operation, equity REITs pay out dividends to their shareholders on a yearly basis.Cons of REITs

Dividend Taxes. REIT dividends can be a great source of passive income, but the money you receive is subject to your ordinary income tax rate, which will depend on your tax bracket.

Interest Rate Risk.

Market Volatility.

You Have Little Control.

Some Charge High Fees.

Are REITs Good Investments Investing in REITs is a great way to diversify your portfolio outside of traditional stocks and bonds and can be attractive for their strong dividends and long-term capital appreciation.

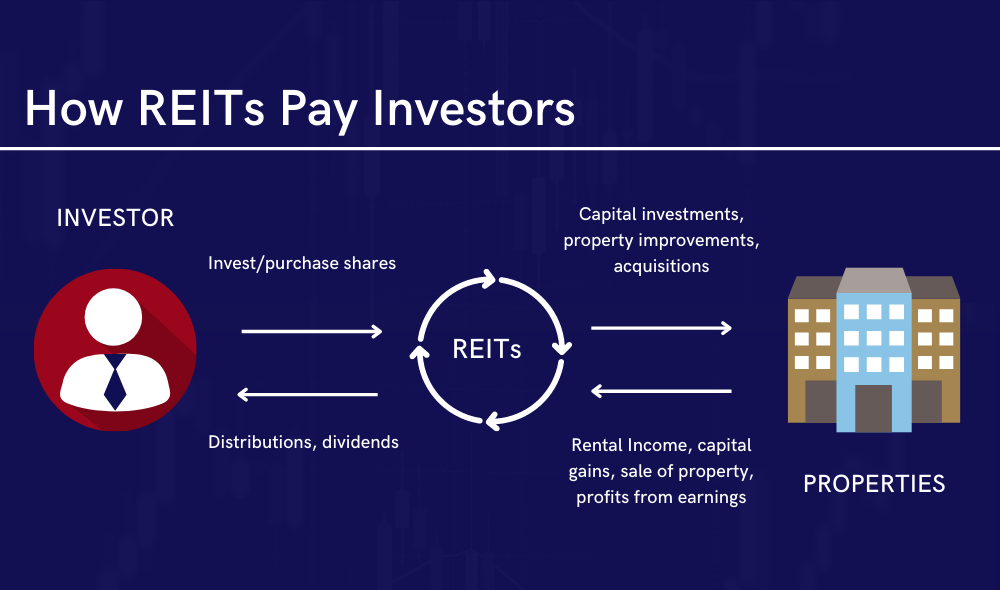

How does REIT pay you : REITs can be paid out in cash or a combination of cash and stock but must operate within specific requirements for REIT payouts. This includes the provision that each stockholder elects whether they receive their dividend distribution in all cash or a combination of cash and stock.

Can I invest $1000 in a REIT

It's possible to find REITs that allow you to invest with as little as $1,000 and some may have a minimum investment that's even lower. Keep in mind, however, that private or non-traded REITs may require much larger minimum investments of $10,000 or even $50,000 to buy in.

Does a REIT pay monthly : For investors seeking a steady stream of monthly income, real estate investment trusts (REITs) that pay dividends on a monthly basis emerge as a compelling financial strategy. In this article, we unravel two REITs that pay monthly dividends and have yields up to 8%.

By law, a REIT must pay at least 90% of its income to its shareholders, providing investors with a passive income option that can be helpful during recessions. Typically, the upfront costs of investing in a REIT are low, while their risk-adjusted returns tend to be high. Investing in REITs is generally less risky than regular stocks due to the regular stream of cash flows from the dividends. However, REITs can still lose value as interest rates rise, and prices depend on market supply and demand, especially when bought after the offer period.

Do REITs beat S&P 500

REITs are also attractive thanks to their market-beating returns. During the past 25 years, REITs have delivered an 11.4% annual return, crushing the S&P 500's 7.6% annualized total return in the same period. Image source: Getty Images. One reason for REITs' outperformance is their dividends.REITs and stocks can both pay dividends, usually on a monthly, quarterly, or yearly basis. Some investments will also offer special dividends, but they're unpredictable.Since most non-traded REITs are illiquid, there are often restrictions to redeeming and selling shares. While a REIT is still open to public investors, investors may be able to sell their shares back to the REIT. However, this sale usually comes at a discount; leaving only about 70% to 95% of the original value. To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

How much money do I need to invest in REITs : The Cheapest Option: REITs—$1,000 to $25,000 or more

These are securities and are traded on major exchanges like stocks. They invest in real estate directly, either through property purchases or through mortgage investments.

Why do REITs pay 90 percent : The Securities and Exchange Commission (SEC) has set out the guidelines for the 90% rule for REITs: “To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90% of its taxable income to shareholders annually in the form of dividends.”

Why are REITs high risk

REITs closely follow the overall real estate market and are subject to much of the same risks, including fluctuations in property value, leasing occupancy, and geographic demand. Real estate is typically very sensitive to changes in interest rates, which can affect property values and occupancy demand. The FTSE Nareit All Equity index, consisting of REITs that exclude mortgages, generated a 15.9% annualized return during recessions and 22.7% in the year following the end of a downturn, according to the National Association of Real Estate Investment Trusts.How to Qualify as a REIT To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

Why do REITs have to pay 90% : The Securities and Exchange Commission (SEC) has set out the guidelines for the 90% rule for REITs: “To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90% of its taxable income to shareholders annually in the form of dividends.”

Antwort How does a REIT work? Weitere Antworten – How do you make money on a REIT

Equity REITs

Properties can generate rental income, which, after collecting fees for property management, provides income to its investors. These REITs generate income from renting real estate to tenants. After paying expenses for operation, equity REITs pay out dividends to their shareholders on a yearly basis.Cons of REITs

Are REITs Good Investments Investing in REITs is a great way to diversify your portfolio outside of traditional stocks and bonds and can be attractive for their strong dividends and long-term capital appreciation.

How does REIT pay you : REITs can be paid out in cash or a combination of cash and stock but must operate within specific requirements for REIT payouts. This includes the provision that each stockholder elects whether they receive their dividend distribution in all cash or a combination of cash and stock.

Can I invest $1000 in a REIT

It's possible to find REITs that allow you to invest with as little as $1,000 and some may have a minimum investment that's even lower. Keep in mind, however, that private or non-traded REITs may require much larger minimum investments of $10,000 or even $50,000 to buy in.

Does a REIT pay monthly : For investors seeking a steady stream of monthly income, real estate investment trusts (REITs) that pay dividends on a monthly basis emerge as a compelling financial strategy. In this article, we unravel two REITs that pay monthly dividends and have yields up to 8%.

By law, a REIT must pay at least 90% of its income to its shareholders, providing investors with a passive income option that can be helpful during recessions. Typically, the upfront costs of investing in a REIT are low, while their risk-adjusted returns tend to be high.

Investing in REITs is generally less risky than regular stocks due to the regular stream of cash flows from the dividends. However, REITs can still lose value as interest rates rise, and prices depend on market supply and demand, especially when bought after the offer period.

Do REITs beat S&P 500

REITs are also attractive thanks to their market-beating returns. During the past 25 years, REITs have delivered an 11.4% annual return, crushing the S&P 500's 7.6% annualized total return in the same period. Image source: Getty Images. One reason for REITs' outperformance is their dividends.REITs and stocks can both pay dividends, usually on a monthly, quarterly, or yearly basis. Some investments will also offer special dividends, but they're unpredictable.Since most non-traded REITs are illiquid, there are often restrictions to redeeming and selling shares. While a REIT is still open to public investors, investors may be able to sell their shares back to the REIT. However, this sale usually comes at a discount; leaving only about 70% to 95% of the original value.

To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

How much money do I need to invest in REITs : The Cheapest Option: REITs—$1,000 to $25,000 or more

These are securities and are traded on major exchanges like stocks. They invest in real estate directly, either through property purchases or through mortgage investments.

Why do REITs pay 90 percent : The Securities and Exchange Commission (SEC) has set out the guidelines for the 90% rule for REITs: “To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90% of its taxable income to shareholders annually in the form of dividends.”

Why are REITs high risk

REITs closely follow the overall real estate market and are subject to much of the same risks, including fluctuations in property value, leasing occupancy, and geographic demand. Real estate is typically very sensitive to changes in interest rates, which can affect property values and occupancy demand.

The FTSE Nareit All Equity index, consisting of REITs that exclude mortgages, generated a 15.9% annualized return during recessions and 22.7% in the year following the end of a downturn, according to the National Association of Real Estate Investment Trusts.How to Qualify as a REIT To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

Why do REITs have to pay 90% : The Securities and Exchange Commission (SEC) has set out the guidelines for the 90% rule for REITs: “To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90% of its taxable income to shareholders annually in the form of dividends.”