This means for every dollar you spend, you'll earn at least 1.5% or $0.015. This adds up to $15 in cash back for every $1,000 spent.Cashback is a rewards program where customers can earn back a percentage of the money they spend while shopping. Originally a credit card feature, some debit card accounts now offer cashback rewards too, as well as stores, online retailers, and more. Open bank account.Cash back is a form of credit card rewards you earn by making purchases with your credit card. You can redeem those rewards for statement credits, account deposits or purchases. In some cases, you can convert the cash back rewards into points and use them for other types of redemptions.

How does the cashback app work : Spend to save — to spend

This is how they typically work: a user makes a purchase via the app, the app earns a commission on the sale from the retailer, then the app shares some of that commission with the consumer — or gives the user cash back.

How does 100% cash back work

100% cashback means you'll get the whole money what you've paid for. But actually it doesn't happen as if you follow then you can see a star (*) mark which also present after the sentence “100% Cashback”. It means there's some condition(s) in the cashback offer. You can see the conditions in the con…

Is 5% cash back good : If you are looking to maximize rewards, a 5% cash-back card can be a great asset. Oftentimes, they have standard interest rates and no annual fee. However, these rotating category cards aren't for everyone. Trying to optimize your usage can be a lot of work, and many people don't want the hassle.

Cash back isn't technically free money. However, earning cash back from spending is not taxable. The IRS considers cash back to be a “rebate” for your spending. On a related note, any cash back that isn't earned from spending is usually taxable. The cash back is typically issued at the end of the statement period or billing cycle and you can redeem it as a deposit into a bank account, statement credit, check, gift card, and potentially other options, depending on the credit card. Cash-back credit cards come in different forms.

How do I redeem my cash back rewards

The cash back is typically issued at the end of the statement period or billing cycle and you can redeem it as a deposit into a bank account, statement credit, check, gift card, and potentially other options, depending on the credit card. Cash-back credit cards come in different forms.Get cash back at stores that offer it when you use your Cash App Card as a debit card. Just enter your Cash PIN and choose a cash-back amount. Receiving cash back does count towards your ATM withdrawal limits.Three percent cash back is another way of saying that you will earn $3 in rewards for every $100 spent. The more that you use your cash-back rewards programs, the more money that you stand to earn. There are a few drawbacks to a cash-back rewards card, including a higher-than-usual APR, having to wait to access your cash-back funds, and a cap on how much you can earn each year.

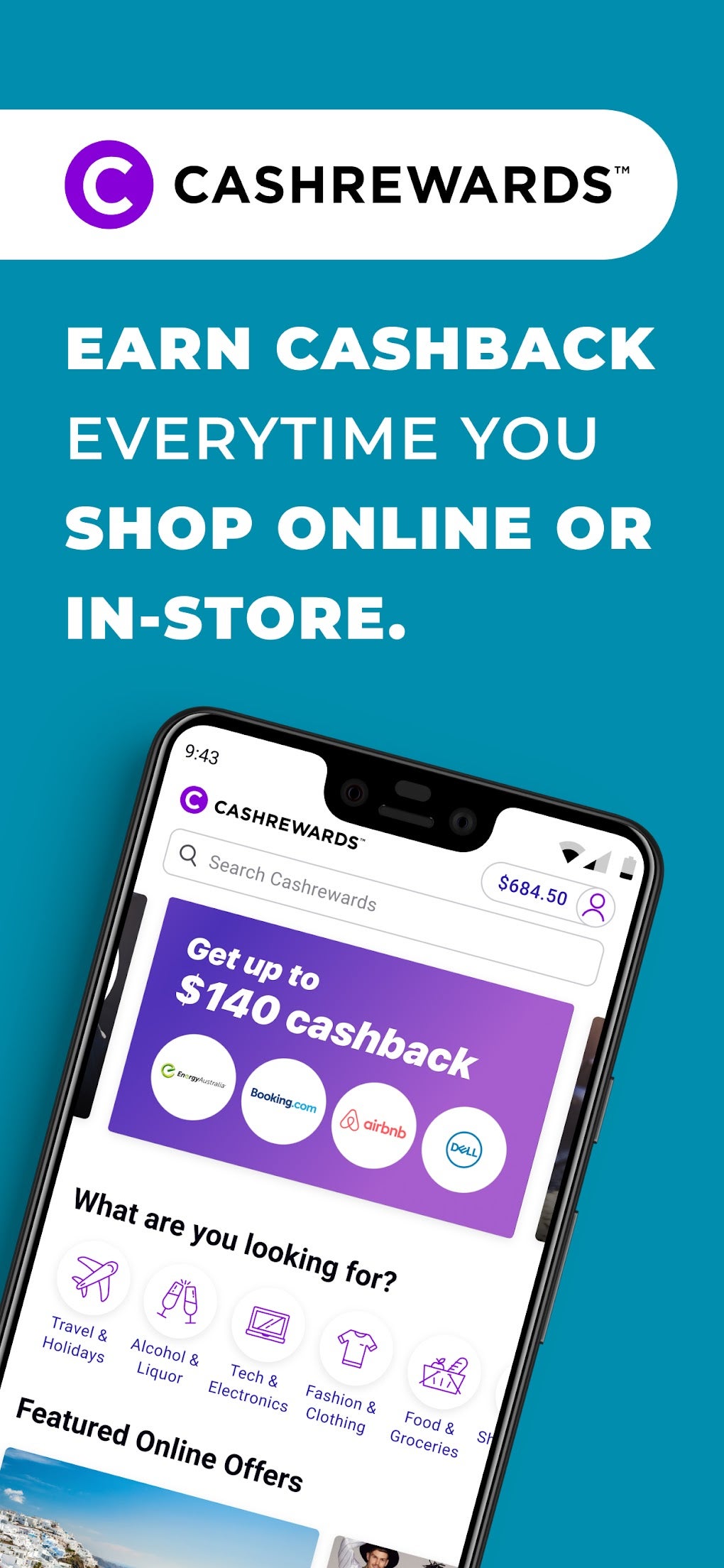

Is Cashrewards free : It's free and easy, sign up to Cashrewards. The way it works is simple, purchase from one of the retailers on Cashrewards and that retailer pays Cashrewards a commission and they split that with you (see video explainer above).

How do I cash out my cashback : We'll email you to confirm your cash is on its way Click Click Cash Rewards.

Does cash back mean I get money back

What does cash back mean Cash back is a type of credit card reward that lets you earn cash rewards for the money you spend on your credit card. So, you'll receive a percentage of your credit card purchases back as cash. Some cash back credit cards offer a standard percentage of cash back on all purchases. Cashback is what you earn when you make a purchase with your cashback credit card. For example, if your cashback credit card offers 1% cashback on every purchase you make, you'll earn £1 when you make a purchase of £100 with that card.Multiply 3 by 1000 and divide both sides by 100. Hence, 3% of 1000 is 30.

Is 5% cash back worth it : If you are looking to maximize rewards, a 5% cash-back card can be a great asset. Oftentimes, they have standard interest rates and no annual fee. However, these rotating category cards aren't for everyone. Trying to optimize your usage can be a lot of work, and many people don't want the hassle.

Antwort How do I get cash back rewards? Weitere Antworten – How much is 1.5 cash back on $1000

$15

This means for every dollar you spend, you'll earn at least 1.5% or $0.015. This adds up to $15 in cash back for every $1,000 spent.Cashback is a rewards program where customers can earn back a percentage of the money they spend while shopping. Originally a credit card feature, some debit card accounts now offer cashback rewards too, as well as stores, online retailers, and more. Open bank account.Cash back is a form of credit card rewards you earn by making purchases with your credit card. You can redeem those rewards for statement credits, account deposits or purchases. In some cases, you can convert the cash back rewards into points and use them for other types of redemptions.

How does the cashback app work : Spend to save — to spend

This is how they typically work: a user makes a purchase via the app, the app earns a commission on the sale from the retailer, then the app shares some of that commission with the consumer — or gives the user cash back.

How does 100% cash back work

100% cashback means you'll get the whole money what you've paid for. But actually it doesn't happen as if you follow then you can see a star (*) mark which also present after the sentence “100% Cashback”. It means there's some condition(s) in the cashback offer. You can see the conditions in the con…

Is 5% cash back good : If you are looking to maximize rewards, a 5% cash-back card can be a great asset. Oftentimes, they have standard interest rates and no annual fee. However, these rotating category cards aren't for everyone. Trying to optimize your usage can be a lot of work, and many people don't want the hassle.

Cash back isn't technically free money. However, earning cash back from spending is not taxable. The IRS considers cash back to be a “rebate” for your spending. On a related note, any cash back that isn't earned from spending is usually taxable.

The cash back is typically issued at the end of the statement period or billing cycle and you can redeem it as a deposit into a bank account, statement credit, check, gift card, and potentially other options, depending on the credit card. Cash-back credit cards come in different forms.

How do I redeem my cash back rewards

The cash back is typically issued at the end of the statement period or billing cycle and you can redeem it as a deposit into a bank account, statement credit, check, gift card, and potentially other options, depending on the credit card. Cash-back credit cards come in different forms.Get cash back at stores that offer it when you use your Cash App Card as a debit card. Just enter your Cash PIN and choose a cash-back amount. Receiving cash back does count towards your ATM withdrawal limits.Three percent cash back is another way of saying that you will earn $3 in rewards for every $100 spent.

The more that you use your cash-back rewards programs, the more money that you stand to earn. There are a few drawbacks to a cash-back rewards card, including a higher-than-usual APR, having to wait to access your cash-back funds, and a cap on how much you can earn each year.

Is Cashrewards free : It's free and easy, sign up to Cashrewards. The way it works is simple, purchase from one of the retailers on Cashrewards and that retailer pays Cashrewards a commission and they split that with you (see video explainer above).

How do I cash out my cashback : We'll email you to confirm your cash is on its way Click Click Cash Rewards.

Does cash back mean I get money back

What does cash back mean Cash back is a type of credit card reward that lets you earn cash rewards for the money you spend on your credit card. So, you'll receive a percentage of your credit card purchases back as cash. Some cash back credit cards offer a standard percentage of cash back on all purchases.

Cashback is what you earn when you make a purchase with your cashback credit card. For example, if your cashback credit card offers 1% cashback on every purchase you make, you'll earn £1 when you make a purchase of £100 with that card.Multiply 3 by 1000 and divide both sides by 100. Hence, 3% of 1000 is 30.

Is 5% cash back worth it : If you are looking to maximize rewards, a 5% cash-back card can be a great asset. Oftentimes, they have standard interest rates and no annual fee. However, these rotating category cards aren't for everyone. Trying to optimize your usage can be a lot of work, and many people don't want the hassle.