There are multiple ways (such as ETFs, mutual funds, options, futures and annuities) that are accessible for investors at all levels to invest in Nasdaq-100®.S&P 500 Index Versus Nasdaq 100 Performance

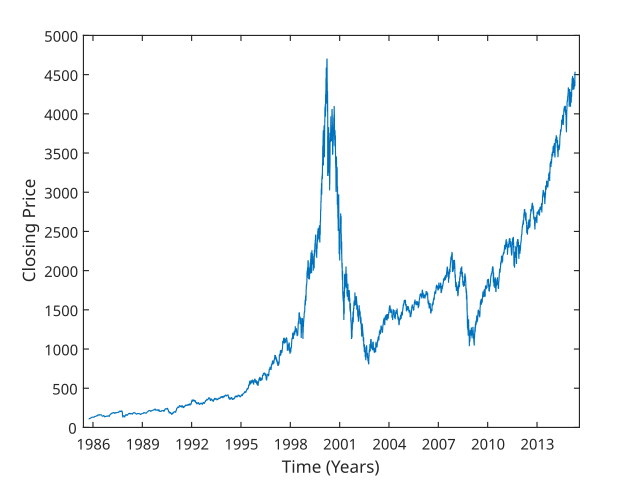

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco.

Is there a Nasdaq-100 Index fund : The Nasdaq-100 Index composed of 100 of the largest nonfinancial domestic and international companies listed on The Nasdaq Stock Market based on market capitalization. The fund is non-diversified. Growth stocks can perform differently from the market as a whole and can be more volatile than other types of stocks.

What is the best Nasdaq ETF

Invesco QQQ Trust (QQQ)

Invesco Nasdaq 100 ETF (QQQM)

Direxion Nasdaq-100 Equal Weighted ETF (QQQE)

Invesco ESG Nasdaq 100 ETF (QQMG)

ProShares Ultra QQQ (QLD)

ProShares UltraPro QQQ (TQQQ)

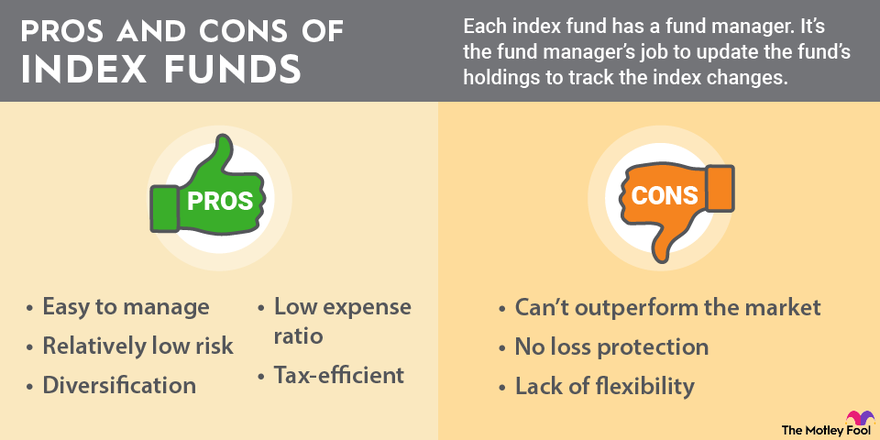

Is Qqq an index fund : Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies. For more information on the companies that make up the Nasdaq-100 Index, click here.

About half of the NASDAQ index does not pay a dividend. The companies that do offer shareholders a dividend tend to offer low yielding dividends. In comparison, the S&P 500 has over 400 companies that pay dividends and all 30 components of the Dow pay a dividend. Here is an overview of the NASDAQ dividend yield. Average Return. In the past year, QQQ returned a total of 39.07%, which is significantly higher than SPY's 30.74% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.91% for SPY. These numbers are adjusted for stock splits and include dividends.

Is QQQ a Nasdaq ETF

The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index. Because it passively follows the index, the QQQ share price goes up and down along with the tech-heavy Nasdaq 100. Passive management keeps fees low, and investors are rewarded with the full gains of the volatile index if it rises.How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).5 Best Nasdaq ETFs To Invest In

Invesco (QQQ)

Invesco Nasdaq 100 ETF (QQQM)

Fidelity Nasdaq Composite Index ETF (ONEQ)

Direxion Nasdaq-100 Equal Weighted Index Shares (QQQE)

Invesco Nasdaq Next Gen 100 ETF (QQQJ)

The Nasdaq 100 index has done well in recent years when compared to Indian equity markets. Nasdaq 100 TRI index has delivered a CAGR of 34.6% over the past 5 years, while the NIFTY 50 TRI index has delivered a CAGR of 18.8%.

What is the European equivalent of QQQ : The world's most actively traded ETF – based on the NASDAQ-100 index and known by its ticker QQQ – is now available in Europe. The Nasdaq stock market said it has registered the NASDAQ-100 European Tracker – EQQQ — for sale in the UK, Belgium and Ireland. The ETF is designed to follow the NASDAQ-100 index.

Is Nasdaq an ETF or index fund : Two popular ETFs are the Standard and Poor's depositary receipt (SPDR) launched in 1993 and the NASDAQ-100 Index Tracking Stock (QQQ) which was launched in 1999. These vehicles are popular for hedging as well as investment. Also known as ETF.

Is QQQ high risk

The Invesco QQQ ETF deserves consideration if you can afford to take a relatively high level of risk. However, due to its heavy concentration in the tech sector, it's not a substitute for an S&P 500 ETF or a total stock market index fund, both of which provide a lot more diversification. Top 100 Highest Dividend Yield ETFs

Symbol

Name

Dividend Yield

TSL

GraniteShares 1.25x Long Tesla Daily ETF

98.48%

NVD

GraniteShares 2x Short NVDA Daily ETF

71.04%

CONY

YieldMax COIN Option Income Strategy ETF

69.53%

TSLY

YieldMax TSLA Option Income Strategy ETF

58.21%

The Nasdaq-100® is one of the world's preeminent large-cap growth indexes.

Should I buy QQQ or S&P : QQQ is better to buy for investments of a year or more. The NASDAQ-100 index dynamics are more volatile compared to the S&P 500. With a shorter investment horizon, there's a high risk of a decrease in value.

Antwort How do I buy a Nasdaq index fund? Weitere Antworten – How can I buy the Nasdaq index

There are multiple ways (such as ETFs, mutual funds, options, futures and annuities) that are accessible for investors at all levels to invest in Nasdaq-100®.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco.

Is there a Nasdaq-100 Index fund : The Nasdaq-100 Index composed of 100 of the largest nonfinancial domestic and international companies listed on The Nasdaq Stock Market based on market capitalization. The fund is non-diversified. Growth stocks can perform differently from the market as a whole and can be more volatile than other types of stocks.

What is the best Nasdaq ETF

Is Qqq an index fund : Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies. For more information on the companies that make up the Nasdaq-100 Index, click here.

About half of the NASDAQ index does not pay a dividend. The companies that do offer shareholders a dividend tend to offer low yielding dividends. In comparison, the S&P 500 has over 400 companies that pay dividends and all 30 components of the Dow pay a dividend. Here is an overview of the NASDAQ dividend yield.

Average Return. In the past year, QQQ returned a total of 39.07%, which is significantly higher than SPY's 30.74% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.91% for SPY. These numbers are adjusted for stock splits and include dividends.

Is QQQ a Nasdaq ETF

The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index. Because it passively follows the index, the QQQ share price goes up and down along with the tech-heavy Nasdaq 100. Passive management keeps fees low, and investors are rewarded with the full gains of the volatile index if it rises.How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).5 Best Nasdaq ETFs To Invest In

The Nasdaq 100 index has done well in recent years when compared to Indian equity markets. Nasdaq 100 TRI index has delivered a CAGR of 34.6% over the past 5 years, while the NIFTY 50 TRI index has delivered a CAGR of 18.8%.

What is the European equivalent of QQQ : The world's most actively traded ETF – based on the NASDAQ-100 index and known by its ticker QQQ – is now available in Europe. The Nasdaq stock market said it has registered the NASDAQ-100 European Tracker – EQQQ — for sale in the UK, Belgium and Ireland. The ETF is designed to follow the NASDAQ-100 index.

Is Nasdaq an ETF or index fund : Two popular ETFs are the Standard and Poor's depositary receipt (SPDR) launched in 1993 and the NASDAQ-100 Index Tracking Stock (QQQ) which was launched in 1999. These vehicles are popular for hedging as well as investment. Also known as ETF.

Is QQQ high risk

The Invesco QQQ ETF deserves consideration if you can afford to take a relatively high level of risk. However, due to its heavy concentration in the tech sector, it's not a substitute for an S&P 500 ETF or a total stock market index fund, both of which provide a lot more diversification.

Top 100 Highest Dividend Yield ETFs

The Nasdaq-100® is one of the world's preeminent large-cap growth indexes.

Should I buy QQQ or S&P : QQQ is better to buy for investments of a year or more. The NASDAQ-100 index dynamics are more volatile compared to the S&P 500. With a shorter investment horizon, there's a high risk of a decrease in value.