In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco.A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.1. Invesco (QQQ) QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.

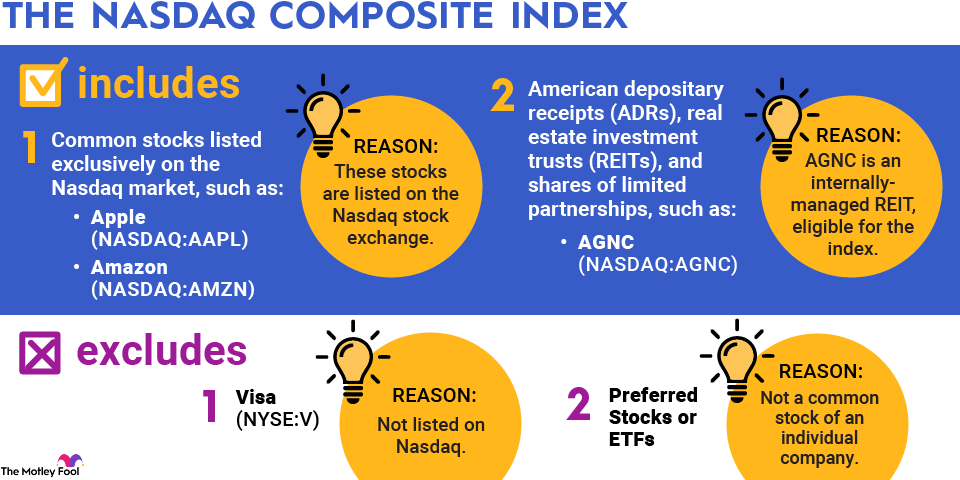

What is the difference between the Nasdaq and the Nasdaq-100 : The Nasdaq-100 is frequently confused with the Nasdaq Composite Index. The latter index (often referred to simply as "The Nasdaq") includes the stock of every company that is listed on Nasdaq (more than 3,000 altogether). The Nasdaq-100 is a modified capitalization-weighted index.

Is QQQ a Nasdaq ETF

The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index. Because it passively follows the index, the QQQ share price goes up and down along with the tech-heavy Nasdaq 100. Passive management keeps fees low, and investors are rewarded with the full gains of the volatile index if it rises.

How do I buy Nasdaq QQQ : How to buy shares in Invesco QQQ Trust

Open a brokerage account. Choose from our top broker picks or compare brokers in depth.

Fund your account. Add money to your account via bank transfer, debit card or credit card.

Search the platform by ticker symbol. QQQ in this case.

Choose an order type.

Submit the order.

There is no minimum amount of shares you must purchase when buying stocks, however, considering broker commissions and fees, most people are best off buying a minimum of $500-1000 worth of shares when investing. S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

Is Nasdaq-100 a good ETF

The most popular index is the Standard & Poor's 500, which includes stocks across every major industry. Funds from the S&P 500 and the Nasdaq-100 regularly rank among the best ETFs, offering high returns and low cost.How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).NASDAQ Mutual Funds Was One of the Best-Performing Indices in 2023 With 55% Returns. Should You Invest In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. It's not too late to invest in the Nasdaq-100. You've got time before 2024 starts, and after the year is underway.

Does QQQ follow S&P 500 : Invesco QQQ — the ETF that tracks the Nasdaq-100 index — has beaten the S&P 500 nine out of the last 10 years. Source: Morningstar Inc. Data begins 10 years prior to the ending date.

Can I buy QQQ stock : You can typically invest in as little as a single share of QQQ or other ETFs through online brokers. Some brokers even allow investors to purchase a fraction of an ETF share.

Is Nasdaq ETF a good buy

The most popular index is the Standard & Poor's 500, which includes stocks across every major industry. Funds from the S&P 500 and the Nasdaq-100 regularly rank among the best ETFs, offering high returns and low cost. Invesco QQQ's total expense ratio is 0.20%. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. Looking at the 55% eye-popping returns in 2023, many Indian investors are looking at ways of investing in the NASDAQ out of sheer FOMO (Fear of Missing Out).

Is QQQ better than Spy : Average Return. In the past year, QQQ returned a total of 39.07%, which is significantly higher than SPY's 30.74% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.91% for SPY. These numbers are adjusted for stock splits and include dividends.

Antwort How can I buy Nasdaq ETF? Weitere Antworten – Is there an ETF for Nasdaq

The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco.A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.1. Invesco (QQQ) QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.

What is the difference between the Nasdaq and the Nasdaq-100 : The Nasdaq-100 is frequently confused with the Nasdaq Composite Index. The latter index (often referred to simply as "The Nasdaq") includes the stock of every company that is listed on Nasdaq (more than 3,000 altogether). The Nasdaq-100 is a modified capitalization-weighted index.

Is QQQ a Nasdaq ETF

The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index. Because it passively follows the index, the QQQ share price goes up and down along with the tech-heavy Nasdaq 100. Passive management keeps fees low, and investors are rewarded with the full gains of the volatile index if it rises.

How do I buy Nasdaq QQQ : How to buy shares in Invesco QQQ Trust

There is no minimum amount of shares you must purchase when buying stocks, however, considering broker commissions and fees, most people are best off buying a minimum of $500-1000 worth of shares when investing.

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

Is Nasdaq-100 a good ETF

The most popular index is the Standard & Poor's 500, which includes stocks across every major industry. Funds from the S&P 500 and the Nasdaq-100 regularly rank among the best ETFs, offering high returns and low cost.How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).NASDAQ Mutual Funds Was One of the Best-Performing Indices in 2023 With 55% Returns. Should You Invest In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices.

It's not too late to invest in the Nasdaq-100. You've got time before 2024 starts, and after the year is underway.

Does QQQ follow S&P 500 : Invesco QQQ — the ETF that tracks the Nasdaq-100 index — has beaten the S&P 500 nine out of the last 10 years. Source: Morningstar Inc. Data begins 10 years prior to the ending date.

Can I buy QQQ stock : You can typically invest in as little as a single share of QQQ or other ETFs through online brokers. Some brokers even allow investors to purchase a fraction of an ETF share.

Is Nasdaq ETF a good buy

The most popular index is the Standard & Poor's 500, which includes stocks across every major industry. Funds from the S&P 500 and the Nasdaq-100 regularly rank among the best ETFs, offering high returns and low cost.

Invesco QQQ's total expense ratio is 0.20%. Investment returns and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. Looking at the 55% eye-popping returns in 2023, many Indian investors are looking at ways of investing in the NASDAQ out of sheer FOMO (Fear of Missing Out).

Is QQQ better than Spy : Average Return. In the past year, QQQ returned a total of 39.07%, which is significantly higher than SPY's 30.74% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.91% for SPY. These numbers are adjusted for stock splits and include dividends.