Footnotes / references Financials as of February 5, 2024

Pure Storage has a market cap or net worth of $19.14 billion as of May 17, 2024. Its market cap has increased by 170.92% in one year.Earnings Overview

For the full year, Pure generated revenue of $2.8 billion, a 3% increase from the previous year. The company also reported an operating margin of approximately 16% for fiscal 2024, above its original guidance of 15%.

What is the revenue of Pure Storage in 2024 : US$2.83b

Pure Storage (NYSE:PSTG) Full Year 2024 Results

Revenue: US$2.83b (up 2.8% from FY 2023). Net income: US$61.3m (down 16% from FY 2023). Profit margin: 2.2% (down from 2.7% in FY 2023). EPS: US$0.20 (down from US$0.24 in FY 2023).

Is Pure Storage a unicorn

Like a number of other unicorns, Pure Storage's later funding rounds have drawn investors who more typically operate in the public equity market.

Is Pure Storage better than NetApp : Price to Value Only NetApp FabricPool automatically balances and optimizes your production all-flash capacity with efficient cloud storage. Pure's inefficient approach to data placement requires separate storage arrays and can't leverage cost-effective HDD storage media.

Charles H. Giancarlo (Aug 2017–)Pure Storage / CEO

Charles Giancarlo is Chairman and CEO of Pure Storage, the data storage company that…

Competitors and Alternatives to Pure Storage

Hewlett Packard Enterprise (HPE)

NetApp.

Dell Technologies.

IBM.

Hitachi Vantara.

Fujitsu.

Huawei.

Oracle.

Is Pure Storage a good stock to buy

The average price target represents -4.97% Decrease from the current price of $59.15. What do analysts say about Pure Storage Pure Storage's analyst rating consensus is a Strong Buy.NetApp

Company type

Public company

Revenue

US$6.36 billion (2023)

Operating income

US$1.02 billion (2023)

Net income

US$1.27 billion (2023)

Total assets

US$9.82 billion (2023)

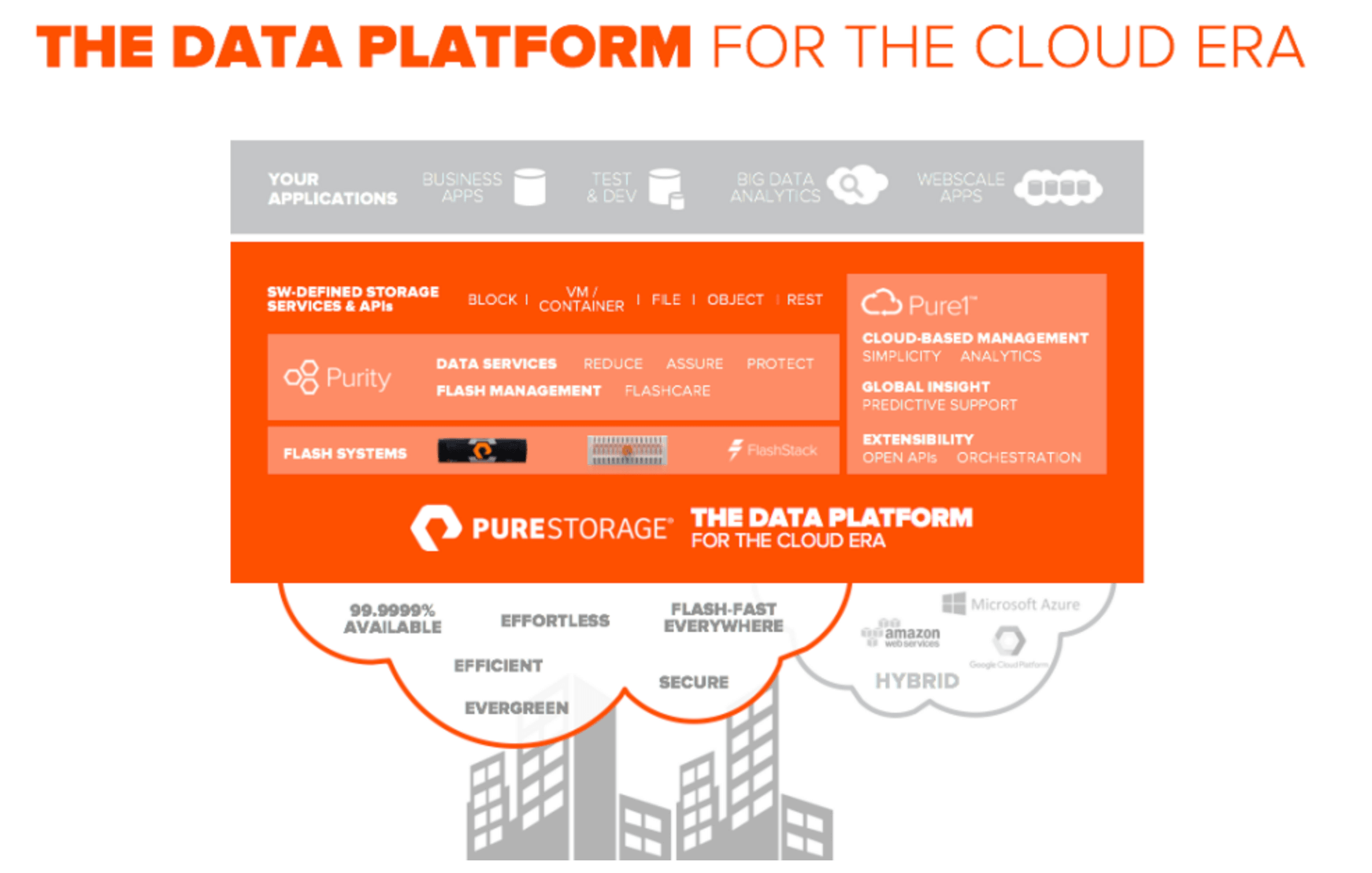

Pure provides built-in data replication and space-efficient, immutable snapshots, providing protection against human error and malicious intent. With Safemode™ enabled, ransomware can't eradicate, modify, or encrypt snapshots, even with admin credentials.

2.83 billion USD (2024)Pure Storage / Revenue

Pure Storage annual revenue for 2024 was $2.831B, a 2.8% increase from 2023. Pure Storage annual revenue for 2023 was $2.753B, a 26.26% increase from 2022. Pure Storage annual revenue for 2022 was $2.181B, a 29.49% increase from 2021.

Is Pure Storage overvalued : Compared to the current market price of 54.41 USD, Pure Storage Inc is Overvalued by 25%.

What is the smartest stock to buy : The 9 Best Stocks To Buy Now

Company (Ticker)

Forward P/E Ratio

Fidelity National Information Services, Inc. (FIS)

13.2

Intuitive Surgical, Inc. (ISRG)

52.2

The Kraft Heinz Company (KHC)

12.3

The Progressive Corporation (PGR)

18.2

Does Google use NetApp

SAN JOSE, Calif. –(BUSINESS WIRE)–Apr. 10, 2024– NetApp® (NASDAQ: NTAP), the intelligent data infrastructure company, today announced an expansion of its partnership with Google Cloud to make it easier for organizations to leverage their data for generative AI (GenAI) and other hybrid cloud workloads.

Competitors and Alternatives to NetApp

Hewlett Packard Enterprise (HPE)

Dell Technologies.

IBM.

Hitachi Vantara.

Oracle.

Nutanix.

Supermicro.

Broadcom (VMware)

PSTG boasts a Growth Style Score of A and VGM Score of B, and holds a Zacks Rank #3 (Hold) rating. Its bottom-line is projected to rise 9.2% year-over-year for 2025, while Wall Street anticipates its top line to improve by 10.5%.

Will Pure Storage stock go up : PSTG Stock 12 Month Forecast

Based on 18 Wall Street analysts offering 12 month price targets for Pure Storage in the last 3 months. The average price target is $55.61 with a high forecast of $66.00 and a low forecast of $44.00. The average price target represents a 12.43% change from the last price of $49.46.

Antwort How big is pure storage? Weitere Antworten – How big is Pure Storage company

Pure Storage

Pure Storage has a market cap or net worth of $19.14 billion as of May 17, 2024. Its market cap has increased by 170.92% in one year.Earnings Overview

For the full year, Pure generated revenue of $2.8 billion, a 3% increase from the previous year. The company also reported an operating margin of approximately 16% for fiscal 2024, above its original guidance of 15%.

What is the revenue of Pure Storage in 2024 : US$2.83b

Pure Storage (NYSE:PSTG) Full Year 2024 Results

Revenue: US$2.83b (up 2.8% from FY 2023). Net income: US$61.3m (down 16% from FY 2023). Profit margin: 2.2% (down from 2.7% in FY 2023). EPS: US$0.20 (down from US$0.24 in FY 2023).

Is Pure Storage a unicorn

Like a number of other unicorns, Pure Storage's later funding rounds have drawn investors who more typically operate in the public equity market.

Is Pure Storage better than NetApp : Price to Value Only NetApp FabricPool automatically balances and optimizes your production all-flash capacity with efficient cloud storage. Pure's inefficient approach to data placement requires separate storage arrays and can't leverage cost-effective HDD storage media.

Charles H. Giancarlo (Aug 2017–)Pure Storage / CEO

Charles Giancarlo is Chairman and CEO of Pure Storage, the data storage company that…

Competitors and Alternatives to Pure Storage

Is Pure Storage a good stock to buy

The average price target represents -4.97% Decrease from the current price of $59.15. What do analysts say about Pure Storage Pure Storage's analyst rating consensus is a Strong Buy.NetApp

Pure provides built-in data replication and space-efficient, immutable snapshots, providing protection against human error and malicious intent. With Safemode™ enabled, ransomware can't eradicate, modify, or encrypt snapshots, even with admin credentials.

2.83 billion USD (2024)Pure Storage / Revenue

Pure Storage annual revenue for 2024 was $2.831B, a 2.8% increase from 2023. Pure Storage annual revenue for 2023 was $2.753B, a 26.26% increase from 2022. Pure Storage annual revenue for 2022 was $2.181B, a 29.49% increase from 2021.

Is Pure Storage overvalued : Compared to the current market price of 54.41 USD, Pure Storage Inc is Overvalued by 25%.

What is the smartest stock to buy : The 9 Best Stocks To Buy Now

Does Google use NetApp

SAN JOSE, Calif. –(BUSINESS WIRE)–Apr. 10, 2024– NetApp® (NASDAQ: NTAP), the intelligent data infrastructure company, today announced an expansion of its partnership with Google Cloud to make it easier for organizations to leverage their data for generative AI (GenAI) and other hybrid cloud workloads.

Competitors and Alternatives to NetApp

PSTG boasts a Growth Style Score of A and VGM Score of B, and holds a Zacks Rank #3 (Hold) rating. Its bottom-line is projected to rise 9.2% year-over-year for 2025, while Wall Street anticipates its top line to improve by 10.5%.

Will Pure Storage stock go up : PSTG Stock 12 Month Forecast

Based on 18 Wall Street analysts offering 12 month price targets for Pure Storage in the last 3 months. The average price target is $55.61 with a high forecast of $66.00 and a low forecast of $44.00. The average price target represents a 12.43% change from the last price of $49.46.