No matter the method, money laundering is a serious criminal activity punishable by state and federal law. These serious allegations can impact every aspect of your life negatively.Anyone convicted of money laundering could be sentenced to up to 20 years of incarceration and fines of up to $500,000 or twice the value of the property that was involved in the transaction, whichever amount is greater.Approximately $300 billion is laundered through the United States each year. Worldwide, criminals launder between $800 million and $2 trillion each year.

How big is the problem of money laundering : Money laundering contributes to wars, drug trade, human trafficking, and political corruption – the cancer of modern society. Money laundering is a global issue which affects economies across the world. It is estimated that up to 5% of global GDP is laundered each year, amounting to $2 trillion.

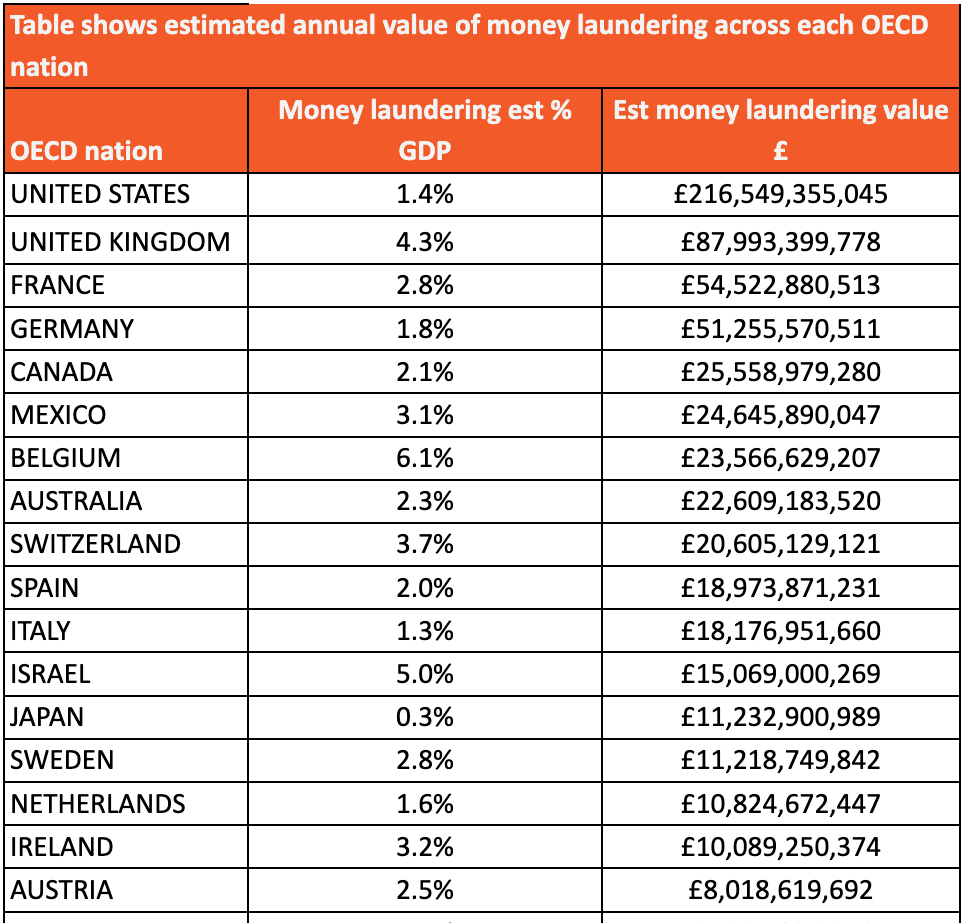

Which country has the most money laundering

The Top 10 Countries With The Highest Money Laundering Risk

JURISDICTION

OVERALL SCORE

Haiti

8.25

Chad

8.14

Myanmar

8.13

The Democratic Republic Of The Congo

8.10

Is 5000 considered money laundering : The total amount of the transaction(s) must be more than $5,000 in a seven day period OR more than $25,000 in a 30 day period. The transaction(s) was made with the intent to promote criminal activity or the defendant knew that the funds involved were from the proceeds of criminal activity.

Because money laundering allows criminals to evade economic institutions, it can impact both exchange rates and interest rates. When these rates are negatively affected it can lead to increased inflation and unemployment rates. Other evidence of money laundering may pertain to the bad character of the defendant; the contamination of cash; the packaging of proceeds; the denomination of banknotes; lies by the defendant; inferences from silence; intrusive surveillance and the interception of communications; false identities, addresses, and …

Which country has the highest money laundering

The Top 10 Countries With The Highest Money Laundering Risk

How to spot a money laundering business or individual

Complicated business structures or the inability to identify the actual owner of a business.

Unusual transaction history, including frequent high-volume transactions, short dwell times of money in a bank account, or selling assets below market value.

We know that criminals manipulate financial systems in the United States and abroad to further a wide range of illicit activities. Left unchecked, money laundering can erode the integrity of our nation's financial institutions.

Which Country is in blacklist : This list is often externally referred to as the black list.

Democratic People's Republic of Korea.

Iran.

Myanmar.

What is the $3000 rule : The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000. 40 Recommendations A set of guidelines issued by the FATF to assist countries in the fight against money. laundering. Bank Secrecy Act.

What is the minimum money laundering

It is also an offence to fail to report knowledge or suspicion of money laundering. An offence can also be committed by prejudicing an investigation into money laundering. There is no minimum financial threshold for money laundering offences, they can apply to money laundering involving any amount. According to the United States Treasury Department: Money laundering is the process of making illegally-gained proceeds (i.e., "dirty money") appear legal (i.e., "clean"). Typically, it involves three steps: placement, layering, and integration.They do this by breaking up large amounts into smaller deposits in multiple bank accounts. The second stage is layering, which involves moving the money around to distance it from the fraudsters. The final stage is called integration, where the money is brought back to the perpetrators as clean money.

How do banks find money laundering : Cash Transaction Reports – Most bank information service providers offer reports that identify cash activity and/or cash activity greater than $10,000. These reports assist bankers with filing currency transaction reports (CTRs) and in identifying suspicious cash activity.

Antwort How bad is money laundering in the US? Weitere Antworten – How serious is money laundering

No matter the method, money laundering is a serious criminal activity punishable by state and federal law. These serious allegations can impact every aspect of your life negatively.Anyone convicted of money laundering could be sentenced to up to 20 years of incarceration and fines of up to $500,000 or twice the value of the property that was involved in the transaction, whichever amount is greater.Approximately $300 billion is laundered through the United States each year. Worldwide, criminals launder between $800 million and $2 trillion each year.

How big is the problem of money laundering : Money laundering contributes to wars, drug trade, human trafficking, and political corruption – the cancer of modern society. Money laundering is a global issue which affects economies across the world. It is estimated that up to 5% of global GDP is laundered each year, amounting to $2 trillion.

Which country has the most money laundering

The Top 10 Countries With The Highest Money Laundering Risk

Is 5000 considered money laundering : The total amount of the transaction(s) must be more than $5,000 in a seven day period OR more than $25,000 in a 30 day period. The transaction(s) was made with the intent to promote criminal activity or the defendant knew that the funds involved were from the proceeds of criminal activity.

Because money laundering allows criminals to evade economic institutions, it can impact both exchange rates and interest rates. When these rates are negatively affected it can lead to increased inflation and unemployment rates.

Other evidence of money laundering may pertain to the bad character of the defendant; the contamination of cash; the packaging of proceeds; the denomination of banknotes; lies by the defendant; inferences from silence; intrusive surveillance and the interception of communications; false identities, addresses, and …

Which country has the highest money laundering

The Top 10 Countries With The Highest Money Laundering Risk

Biggest Money Laundering Cases of All Time

How to spot a money laundering business or individual

We know that criminals manipulate financial systems in the United States and abroad to further a wide range of illicit activities. Left unchecked, money laundering can erode the integrity of our nation's financial institutions.

Which Country is in blacklist : This list is often externally referred to as the black list.

What is the $3000 rule : The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000. 40 Recommendations A set of guidelines issued by the FATF to assist countries in the fight against money. laundering. Bank Secrecy Act.

What is the minimum money laundering

It is also an offence to fail to report knowledge or suspicion of money laundering. An offence can also be committed by prejudicing an investigation into money laundering. There is no minimum financial threshold for money laundering offences, they can apply to money laundering involving any amount.

According to the United States Treasury Department: Money laundering is the process of making illegally-gained proceeds (i.e., "dirty money") appear legal (i.e., "clean"). Typically, it involves three steps: placement, layering, and integration.They do this by breaking up large amounts into smaller deposits in multiple bank accounts. The second stage is layering, which involves moving the money around to distance it from the fraudsters. The final stage is called integration, where the money is brought back to the perpetrators as clean money.

How do banks find money laundering : Cash Transaction Reports – Most bank information service providers offer reports that identify cash activity and/or cash activity greater than $10,000. These reports assist bankers with filing currency transaction reports (CTRs) and in identifying suspicious cash activity.