Quantitative Requirements: To be listed on the NASDAQ National Market, a company must have net tangible assets of $6 million and net income in the latest fiscal year or two of the past three fiscal years of $1 million.Selection criteria

Those standards include: Being listed exclusively on Nasdaq in either the Global Select or Global Market tiers. Being publicly offered on an established American market for at least three months. Having average daily volume of 200,000 shares.Nasdaq Capital Market companies are required to meet a net income standard of at least $750,000, a minimum public float of 1,000,000 shares, at least 300 shareholders, and a share bid price of at least $4 (with certain exceptions).

What is the Nasdaq $1 dollar rule : Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.

How hard is it to list on Nasdaq

General Nasdaq Listing Rules

For example, the Nasdaq minimum share price or bid price for inclusion is $4. It's possible to qualify with a bid price below that amount but that may entail meeting additional requirements. Companies must also have at least 1.25 million publicly traded shares outstanding.

Can anyone list on Nasdaq : The Nasdaq has four sets of listing requirements. Each company must meet at least one of the four requirement sets, as well as the main rules for all companies. In addition to these requirements, companies must meet all of the criteria under a particular set of standards.

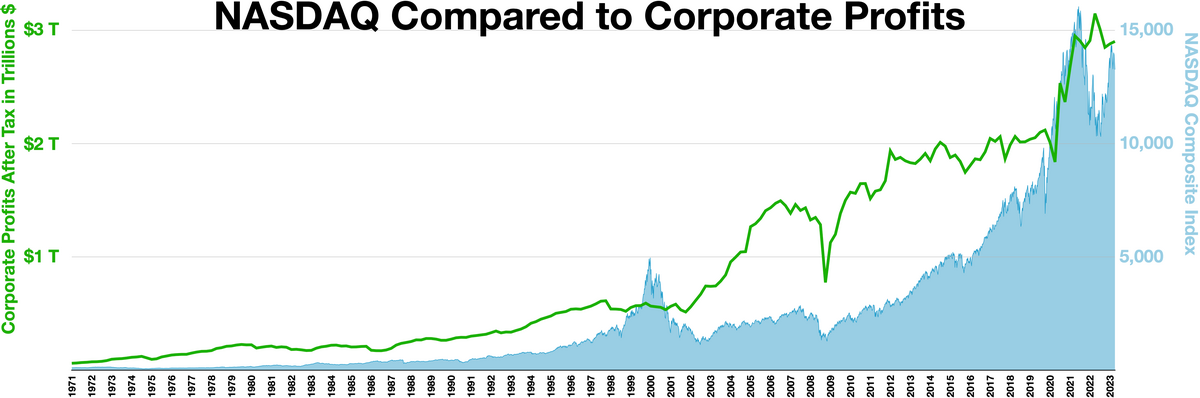

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%. Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.

How much is 1 tick in Nasdaq

For most stocks, the tick size is $0.01, but fractions of a cent may also occur. "Pips" and basis points (bps) are tick sizes used in currency and fixed-income markets.If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.Nasdaq markets, including the U.S., are open to companies around the world. The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.

Do most investors beat the S&P 500 : Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed.

What happens if you own more than 20% of a public company : An investor subject to U.S. GAAP that owns 20% or more of the company's voting stock (but not control of the company) is presumed to have significant influence over the company and is generally required to account for its investment on the equity method by including its proportionate share of the company's net income/ …

How long is 2000 ticks

A Conversion Table Between Tick, Time and Renko

Tick Chart

Time Chart (Approx.)

Renko Chart (Approx. Brick Size)

300

5-minute

10

500

8-minute (estimation)

20

1,000

10-minute

30

2,000

15-minute

50

100,000 units

While 1 lot represents a transaction of 100,000 units of the currency mentioned first in a currency pair, the value of 1 micro lot is 1,000 units. If you are interested in the relationship between lots, micro-lots, leverage, and margin, we recommend reading the article about micro-lots we wrote on the subject.A failure to meet the continued listing requirement for Market Value of Publicly Held Shares shall be determined to exist only if the deficiency continues for a period of 30 consecutive business days.

How much does it cost to list on Nasdaq : The entry fee ranges from US$50,000 to US$75,000 depending on the number of outstanding shares and includes an application fee of US$5,000. The entry fee on any Nasdaq tier for a SPAC is US$80,000, which includes a US$5,000 application fee. All Nasdaq-listed companies are subject to Nasdaq's all-inclusive fee program.

Antwort How are companies selected for Nasdaq? Weitere Antworten – How do companies get listed on the Nasdaq

Quantitative Requirements: To be listed on the NASDAQ National Market, a company must have net tangible assets of $6 million and net income in the latest fiscal year or two of the past three fiscal years of $1 million.Selection criteria

Those standards include: Being listed exclusively on Nasdaq in either the Global Select or Global Market tiers. Being publicly offered on an established American market for at least three months. Having average daily volume of 200,000 shares.Nasdaq Capital Market companies are required to meet a net income standard of at least $750,000, a minimum public float of 1,000,000 shares, at least 300 shareholders, and a share bid price of at least $4 (with certain exceptions).

:max_bytes(150000):strip_icc()/nasdaqcompositeindex.asp-final-e8cce3b4c11b413995fd46775924171b.png)

What is the Nasdaq $1 dollar rule : Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.

How hard is it to list on Nasdaq

General Nasdaq Listing Rules

For example, the Nasdaq minimum share price or bid price for inclusion is $4. It's possible to qualify with a bid price below that amount but that may entail meeting additional requirements. Companies must also have at least 1.25 million publicly traded shares outstanding.

Can anyone list on Nasdaq : The Nasdaq has four sets of listing requirements. Each company must meet at least one of the four requirement sets, as well as the main rules for all companies. In addition to these requirements, companies must meet all of the criteria under a particular set of standards.

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.

How much is 1 tick in Nasdaq

For most stocks, the tick size is $0.01, but fractions of a cent may also occur. "Pips" and basis points (bps) are tick sizes used in currency and fixed-income markets.If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.Nasdaq markets, including the U.S., are open to companies around the world.

The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.

Do most investors beat the S&P 500 : Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed.

What happens if you own more than 20% of a public company : An investor subject to U.S. GAAP that owns 20% or more of the company's voting stock (but not control of the company) is presumed to have significant influence over the company and is generally required to account for its investment on the equity method by including its proportionate share of the company's net income/ …

How long is 2000 ticks

A Conversion Table Between Tick, Time and Renko

100,000 units

While 1 lot represents a transaction of 100,000 units of the currency mentioned first in a currency pair, the value of 1 micro lot is 1,000 units. If you are interested in the relationship between lots, micro-lots, leverage, and margin, we recommend reading the article about micro-lots we wrote on the subject.A failure to meet the continued listing requirement for Market Value of Publicly Held Shares shall be determined to exist only if the deficiency continues for a period of 30 consecutive business days.

How much does it cost to list on Nasdaq : The entry fee ranges from US$50,000 to US$75,000 depending on the number of outstanding shares and includes an application fee of US$5,000. The entry fee on any Nasdaq tier for a SPAC is US$80,000, which includes a US$5,000 application fee. All Nasdaq-listed companies are subject to Nasdaq's all-inclusive fee program.