Here's my list of the 10 best investments for a 10% ROI.

How to Get 10% Return on Investment: 10 Proven Ways.

High-End Art (on Masterworks)

Invest in the Private Credit Market.

Paying Down High-Interest Loans.

Stock Market Investing via Index Funds.

Stock Picking.

Junk Bonds.

Buy an Existing Business.

about 10% per year

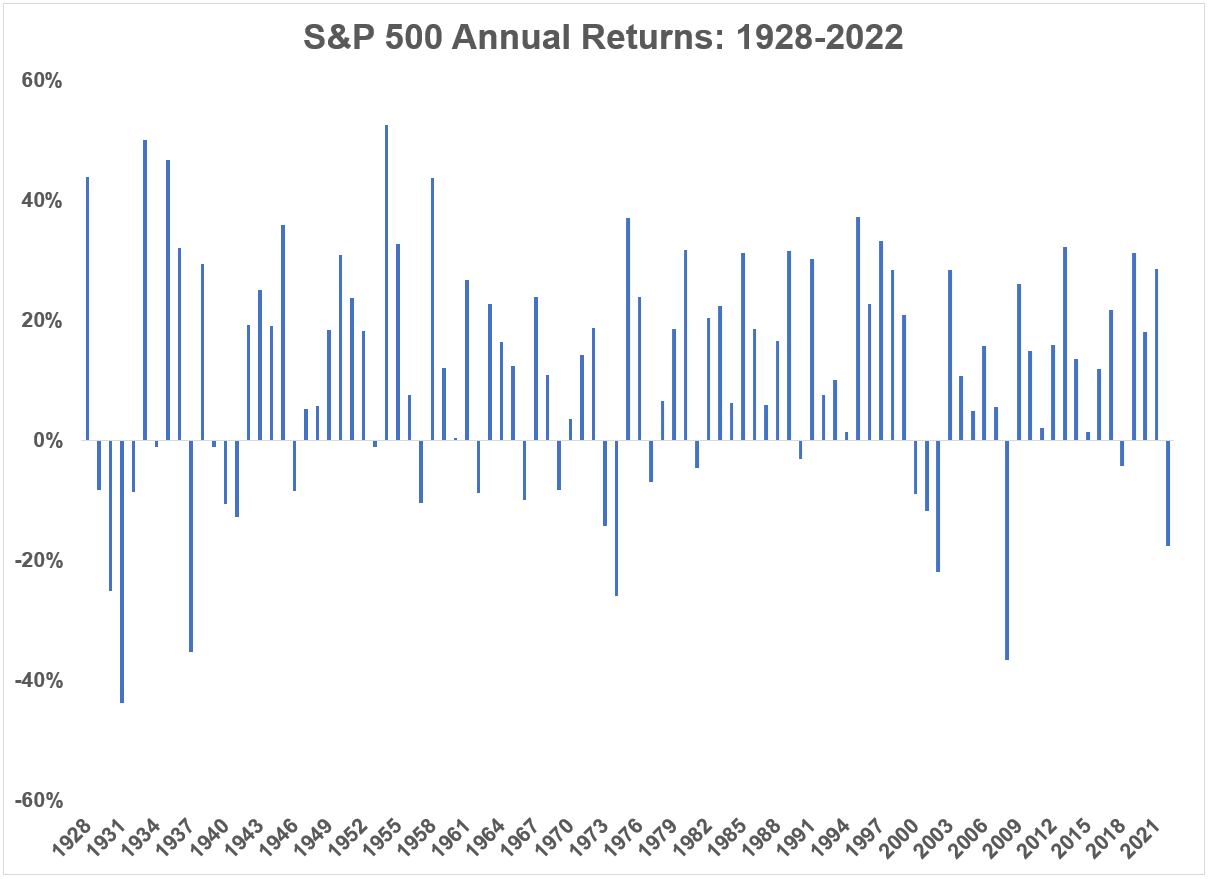

The average stock market return is about 10% per year for nearly the last century, as measured by the S&P 500 index. In some years, the market returns more than that, and in other years it returns less.Meaning of the 15-15-15 rule in Mutual Funds

The Investment: You should invest Rs 15,000 per month. The Tenure: The total of your investment should be 15 years. It means that you will invest Rs 15,000 every month for the next 15 years. The Return: Your expected returns on your investment should be 15%

When you are investing, asset allocation is simply : Asset allocation is an investment portfolio technique that aims to balance risk by dividing assets among major categories such as cash, bonds, stocks, real estate, and derivatives. Each asset class has different levels of return and risk, so each will behave differently over time.

What is the S&P 500 10 year return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is a good rate of return on investments over 10 years : A good return on investment is generally considered to be around 7% per year, based on the average historic return of the S&P 500 index, adjusted for inflation. The average return of the U.S. stock market is around 10% per year, adjusted for inflation, dating back to the late 1920s.

Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%. Overall, the S&P 500 grew at a compound annual growth rate of 13.8% over the last 15 years. Adjusting for inflation, the index grew 11.2% per year during that period.

Is 20% return possible

Relatively safer investments may see less volatility in an average year, but if you have a long enough timeline, you have the potential to earn that 20% return eventually.General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.This is a rule that aims to aid diversification in an investment portfolio. It states that one should not hold more than 5% of the total value of the portfolio in a single security. For example, there's the rule of 110. This rule says to subtract your age from 110, then use that number as a guideline for investing in stocks. So if you're 30 years old you'd invest 80% of your portfolio in stocks (110 – 30 = 80).

What is the lowest 10 year return on the stock market : The worst 10 year annual return was a loss of almost 5% per year ending in the summer of 1939. That was bad enough for a 10 year total return of -40%.

What is the 10 year return on spy stock : Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498. The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Average returns

Period

Average annualised return

Total return

Last year

35.7%

35.7%

Last 5 years

19.3%

141.7%

Last 10 years

21.0%

574.9%

What is the S&P 500 10-year average return : The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

Antwort Has the S&P 500 ever lost money over a 10 year period? Weitere Antworten – How to get 10% return on investment

Here's my list of the 10 best investments for a 10% ROI.

about 10% per year

The average stock market return is about 10% per year for nearly the last century, as measured by the S&P 500 index. In some years, the market returns more than that, and in other years it returns less.Meaning of the 15-15-15 rule in Mutual Funds

The Investment: You should invest Rs 15,000 per month. The Tenure: The total of your investment should be 15 years. It means that you will invest Rs 15,000 every month for the next 15 years. The Return: Your expected returns on your investment should be 15%

When you are investing, asset allocation is simply : Asset allocation is an investment portfolio technique that aims to balance risk by dividing assets among major categories such as cash, bonds, stocks, real estate, and derivatives. Each asset class has different levels of return and risk, so each will behave differently over time.

What is the S&P 500 10 year return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is a good rate of return on investments over 10 years : A good return on investment is generally considered to be around 7% per year, based on the average historic return of the S&P 500 index, adjusted for inflation. The average return of the U.S. stock market is around 10% per year, adjusted for inflation, dating back to the late 1920s.

Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

Overall, the S&P 500 grew at a compound annual growth rate of 13.8% over the last 15 years. Adjusting for inflation, the index grew 11.2% per year during that period.

Is 20% return possible

Relatively safer investments may see less volatility in an average year, but if you have a long enough timeline, you have the potential to earn that 20% return eventually.General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.This is a rule that aims to aid diversification in an investment portfolio. It states that one should not hold more than 5% of the total value of the portfolio in a single security.

For example, there's the rule of 110. This rule says to subtract your age from 110, then use that number as a guideline for investing in stocks. So if you're 30 years old you'd invest 80% of your portfolio in stocks (110 – 30 = 80).

What is the lowest 10 year return on the stock market : The worst 10 year annual return was a loss of almost 5% per year ending in the summer of 1939. That was bad enough for a 10 year total return of -40%.

What is the 10 year return on spy stock : Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

:max_bytes(150000):strip_icc()/k53KU-s-p-500-biggest-gains-and-losses-2023-08-07T164950.533-886e506c956345668dcafa65df7af8b5.png)

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Average returns

What is the S&P 500 10-year average return : The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.