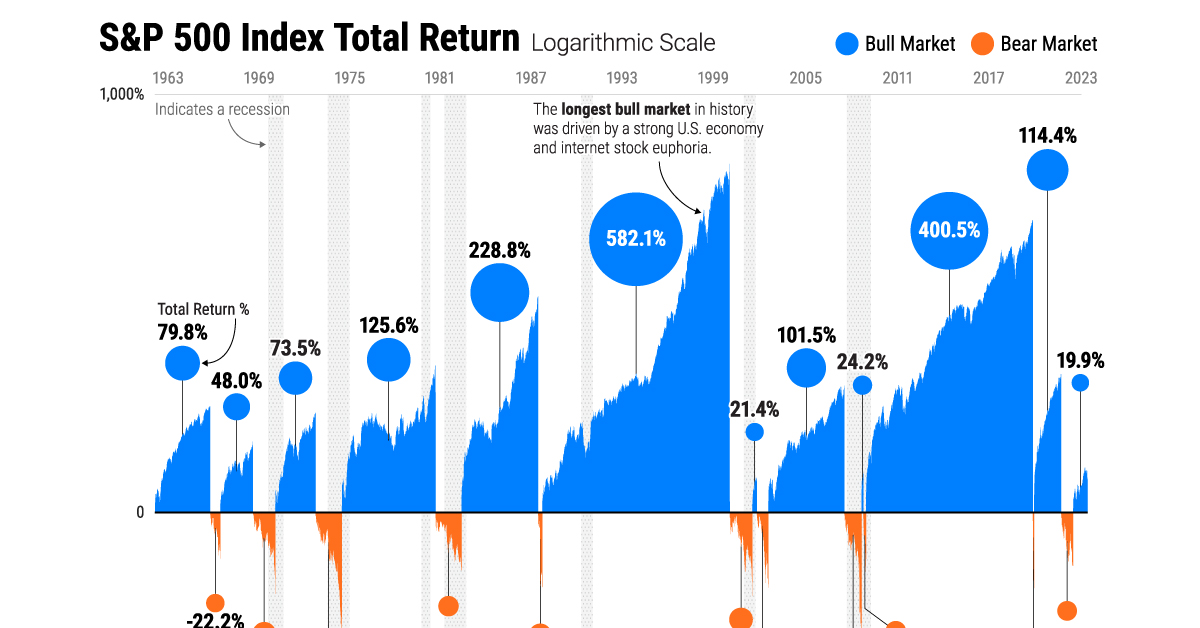

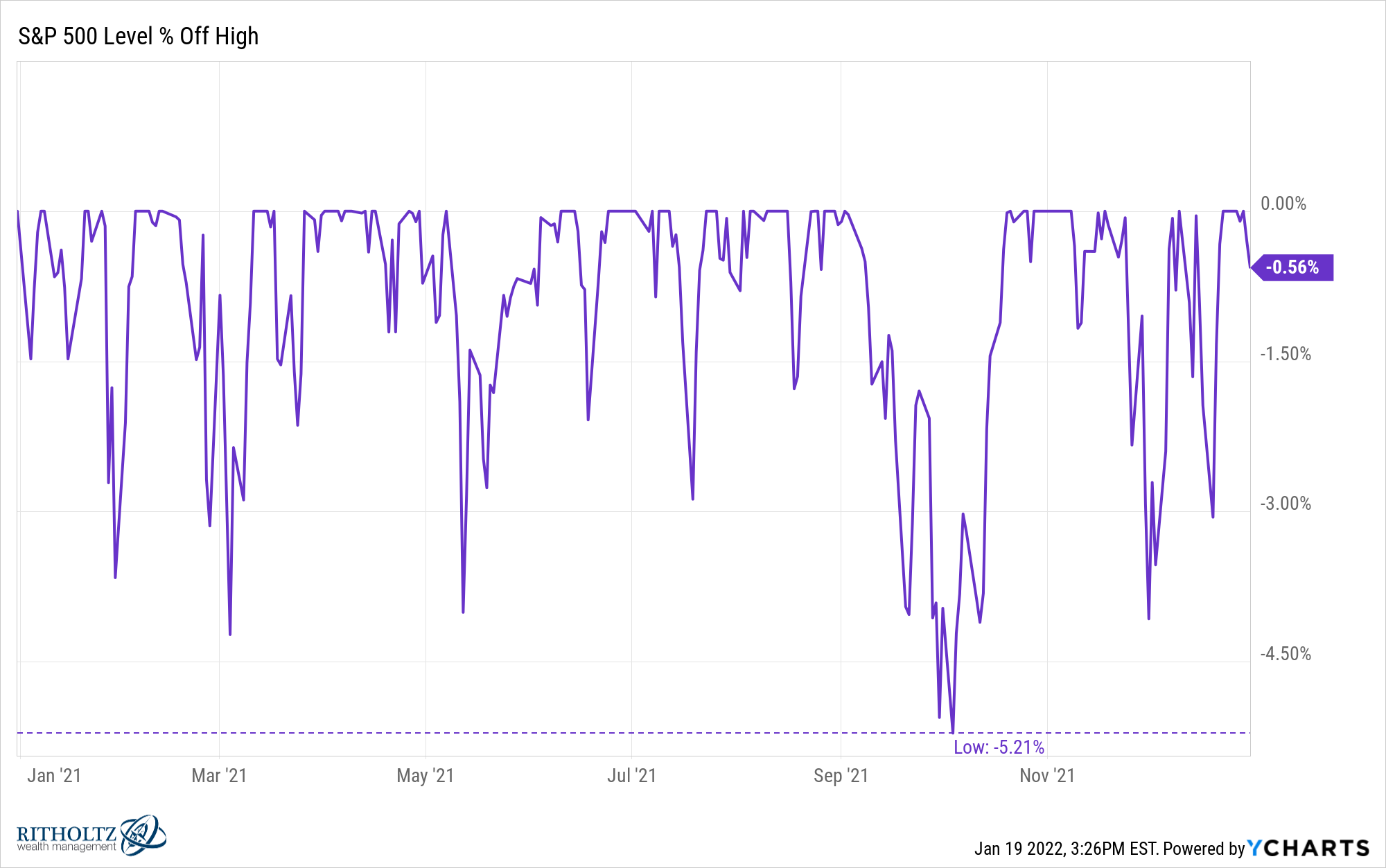

Just about every year since 1980, the market has experienced a temporary decline of 5% or more. On average, a 5% decline in stock market prices has occurred 4.5 times a year over the same period.As you increase the time period length, the fraction of losing periods drops to about 1 in 8 for 5 years, 1 in 20 for 10 years, and none at all for rolling 20-year periods.The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

Has the stock market ever been down over a 10 year period : There are two general periods where stocks realized a negative return over a 10-year span: one during the Great Depression in the 1930s and the other during the Great Recession in 2008.

Do 90% of people lose money in the stock market

About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Can stocks go to zero : When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

Long-term investments almost always give you more gains and profits and they outperform the market when the investors try and hold on to their investments and time them accordingly. Secondly, the biggest advantage of holding a stock for the long term is that it is less costly. The U.S. equity strategist now expects the S & P 500 will rise to 5,400 by the second quarter of 2025. He previously said the index would slide to 4,500 by the end of this year. The new outlook represents roughly a 2% rise from Friday's close of 5,303.27.

How much will the S&P 500 be worth in 2025

That suggests the S&P 500 could trade to 6,000 by August 2025, and to as high as 6,150 by November 2025. But in the short-term, amid the ongoing weakness in stocks, Suttmeier said investors should keep an eye on potential support levels for the S&P 500 at 5,000 as well as a range from 4,600 to 4,800.How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%. When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

Do 97 day traders lose money : However, the harsh reality is that the vast majority of day traders lose money. In fact, studies have shown that a staggering 97% of day traders end up in the red. This statistic is not only staggering, but it's also incredibly disheartening for those who are considering day trading as a means of making a living.

Should I hold a losing stock : An investor may also continue to hold if the stock pays a healthy dividend. Generally, though, if the stock breaks a technical marker or the company is not performing well, it is better to sell at a small loss than to let the position tie up your money and potentially fall even further.

What happens if stock stays below $1

For example, on the New York Stock Exchange (NYSE), if a security's price closed below $1.00 for 30 consecutive trading days, that exchange would initiate the delisting process. The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade.Holding stocks for a longer duration will eventually give you profit only. And also, if you do not need urgent money, you should not sell a stock. If you cannot hold the stock you are buying today for 10 years, you should not buy that stock.

How much will stocks grow in 10 years : 5-year, 10-year, 20-year and 30-year S&P 500 returns

Antwort Does the stock market crash every 7 years? Weitere Antworten – How often does the stock market crash

Just about every year since 1980, the market has experienced a temporary decline of 5% or more. On average, a 5% decline in stock market prices has occurred 4.5 times a year over the same period.As you increase the time period length, the fraction of losing periods drops to about 1 in 8 for 5 years, 1 in 20 for 10 years, and none at all for rolling 20-year periods.The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

Has the stock market ever been down over a 10 year period : There are two general periods where stocks realized a negative return over a 10-year span: one during the Great Depression in the 1930s and the other during the Great Recession in 2008.

Do 90% of people lose money in the stock market

About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Can stocks go to zero : When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

Long-term investments almost always give you more gains and profits and they outperform the market when the investors try and hold on to their investments and time them accordingly. Secondly, the biggest advantage of holding a stock for the long term is that it is less costly.

The U.S. equity strategist now expects the S & P 500 will rise to 5,400 by the second quarter of 2025. He previously said the index would slide to 4,500 by the end of this year. The new outlook represents roughly a 2% rise from Friday's close of 5,303.27.

How much will the S&P 500 be worth in 2025

That suggests the S&P 500 could trade to 6,000 by August 2025, and to as high as 6,150 by November 2025. But in the short-term, amid the ongoing weakness in stocks, Suttmeier said investors should keep an eye on potential support levels for the S&P 500 at 5,000 as well as a range from 4,600 to 4,800.How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

Do 97 day traders lose money : However, the harsh reality is that the vast majority of day traders lose money. In fact, studies have shown that a staggering 97% of day traders end up in the red. This statistic is not only staggering, but it's also incredibly disheartening for those who are considering day trading as a means of making a living.

Should I hold a losing stock : An investor may also continue to hold if the stock pays a healthy dividend. Generally, though, if the stock breaks a technical marker or the company is not performing well, it is better to sell at a small loss than to let the position tie up your money and potentially fall even further.

What happens if stock stays below $1

For example, on the New York Stock Exchange (NYSE), if a security's price closed below $1.00 for 30 consecutive trading days, that exchange would initiate the delisting process.

The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade.Holding stocks for a longer duration will eventually give you profit only. And also, if you do not need urgent money, you should not sell a stock. If you cannot hold the stock you are buying today for 10 years, you should not buy that stock.

How much will stocks grow in 10 years : 5-year, 10-year, 20-year and 30-year S&P 500 returns