A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.The S&P 500 has generated an annualized total return of 16% over the past five years, compared with a 30-year annual average of 10%. The top 10 stocks have accounted for more than a third of that gain.One strategy, the T. Rowe Price Blue Chip Growth ETF (TCHP), has done just that. The active ETF has proved itself as one of the top active ETFs in 2024, outperforming the S&P 500 in 2023 and so far year-to-date (YTD). TCHP has returned 11.7% YTD per YCharts, compared to 7.4% for the S&P 500.

What’s better than S&P500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Will S&P 500 hit $10,000 : The S&P 500 could approach or exceed the 10,000 level by the early to mid-2030s. Many investors take it as a given that—since returns on the S&P 500 have been strong for 10-plus years—stocks are expensive and over-owned.

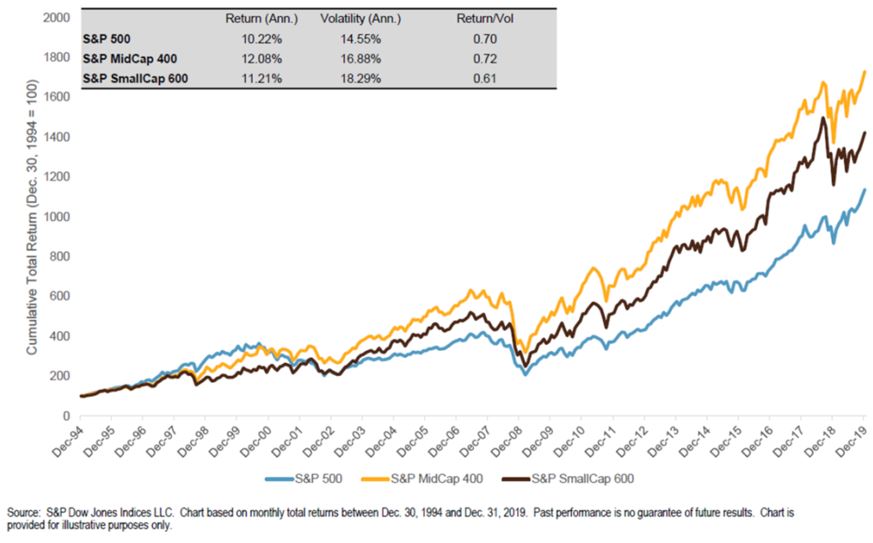

Yet mid-caps have outperformed large- and small-caps, historically: the S&P MidCap 400 has beaten the S&P 500® and the S&P SmallCap 600® by an annualized rate of 2.03% and 0.92%, respectively, since December 1994. Berkshire Hathaway

A big cash pile protects the above-average core operations of this stellar company. Warren Buffett has an incredible track record of outperforming the S&P 500. At the start of every Berkshire Hathaway (BRK. A 0.68%) (BRK.

What is beating the S&P 500

The phrase "beating the market" means earning an investment return that exceeds the performance of the Standard & Poor's 500 index. Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance.Now, let's consider how our calculations change if the time horizon is 10 years. If you are starting from scratch, you will need to invest about $4,757 at the end of every month for 10 years. Suppose you already have $100,000. Then you will only need $3,390 at the end of every month to become a millionaire in 10 years.You would have more than doubled your money, with a total investment worth of $2,029.55. That's a 103% return, or a 7.23% annual rate of return. Interestingly, despite Coke's dominance on the world stage, investing in Coke's main rival, Pepsi, 10 years ago would have given you more pop for your buck. Stock market forecast for the next decade

Year

Price

2027

6200

2028

6725

2029

7300

2030

8900

Is it possible to beat the S&P 500 : Key Points. Beating the S&P 500 consistently is no easy task, and most funds fail. One ETF that is focused on growth and value has achieved this feat. This fund also trades at a cheaper valuation than the S&P 500 right now.

Has any hedge fund beat the S&P 500 : Valley Forge's hedge fund has returned nearly 15% annually since inception in 2007, beating the S&P 500 by more than five percentage points a year, according to a person familiar with the performance.

What is the 10 year return on Berkshire Hathaway

Ten Year Stock Price Total Return for Berkshire Hathaway is calculated as follows: Last Close Price [ 416.94 ] / Adj Prior Close Price [ 127.13 ] (-) 1 (=) Total Return [ 228.0% ] Prior price dividend adjustment factor is 1.00. Contrary to what many believe, the S&P 500 index can be beaten with minimal added risk. The fact that many investors underperform the S&P 500 is often a poorly understood part of investing.Around the U.S., a $1 million nest egg can cover an average of 18.9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states.

How to turn 100k into 1 million : There are two approaches you could take. The first is increasing the amount you invest monthly. Bumping up your monthly contributions to $200 would put you over the $1 million mark. The other option would be to try to exceed a 7% annual return with your investments.

Antwort Does the S&P 400 outperform S&P 500? Weitere Antworten – What ETF is better than the S&P 500

A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.The S&P 500 has generated an annualized total return of 16% over the past five years, compared with a 30-year annual average of 10%. The top 10 stocks have accounted for more than a third of that gain.One strategy, the T. Rowe Price Blue Chip Growth ETF (TCHP), has done just that. The active ETF has proved itself as one of the top active ETFs in 2024, outperforming the S&P 500 in 2023 and so far year-to-date (YTD). TCHP has returned 11.7% YTD per YCharts, compared to 7.4% for the S&P 500.

What’s better than S&P500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Will S&P 500 hit $10,000 : The S&P 500 could approach or exceed the 10,000 level by the early to mid-2030s. Many investors take it as a given that—since returns on the S&P 500 have been strong for 10-plus years—stocks are expensive and over-owned.

Yet mid-caps have outperformed large- and small-caps, historically: the S&P MidCap 400 has beaten the S&P 500® and the S&P SmallCap 600® by an annualized rate of 2.03% and 0.92%, respectively, since December 1994.

Berkshire Hathaway

A big cash pile protects the above-average core operations of this stellar company. Warren Buffett has an incredible track record of outperforming the S&P 500. At the start of every Berkshire Hathaway (BRK. A 0.68%) (BRK.

What is beating the S&P 500

The phrase "beating the market" means earning an investment return that exceeds the performance of the Standard & Poor's 500 index. Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance.Now, let's consider how our calculations change if the time horizon is 10 years. If you are starting from scratch, you will need to invest about $4,757 at the end of every month for 10 years. Suppose you already have $100,000. Then you will only need $3,390 at the end of every month to become a millionaire in 10 years.You would have more than doubled your money, with a total investment worth of $2,029.55. That's a 103% return, or a 7.23% annual rate of return. Interestingly, despite Coke's dominance on the world stage, investing in Coke's main rival, Pepsi, 10 years ago would have given you more pop for your buck.

Stock market forecast for the next decade

Is it possible to beat the S&P 500 : Key Points. Beating the S&P 500 consistently is no easy task, and most funds fail. One ETF that is focused on growth and value has achieved this feat. This fund also trades at a cheaper valuation than the S&P 500 right now.

Has any hedge fund beat the S&P 500 : Valley Forge's hedge fund has returned nearly 15% annually since inception in 2007, beating the S&P 500 by more than five percentage points a year, according to a person familiar with the performance.

What is the 10 year return on Berkshire Hathaway

Ten Year Stock Price Total Return for Berkshire Hathaway is calculated as follows: Last Close Price [ 416.94 ] / Adj Prior Close Price [ 127.13 ] (-) 1 (=) Total Return [ 228.0% ] Prior price dividend adjustment factor is 1.00.

Contrary to what many believe, the S&P 500 index can be beaten with minimal added risk. The fact that many investors underperform the S&P 500 is often a poorly understood part of investing.Around the U.S., a $1 million nest egg can cover an average of 18.9 years worth of living expenses, GoBankingRates found. But where you retire can have a profound impact on how far your money goes, ranging from as a little as 10 years in Hawaii to more than than 20 years in more than a dozen states.

How to turn 100k into 1 million : There are two approaches you could take. The first is increasing the amount you invest monthly. Bumping up your monthly contributions to $200 would put you over the $1 million mark. The other option would be to try to exceed a 7% annual return with your investments.