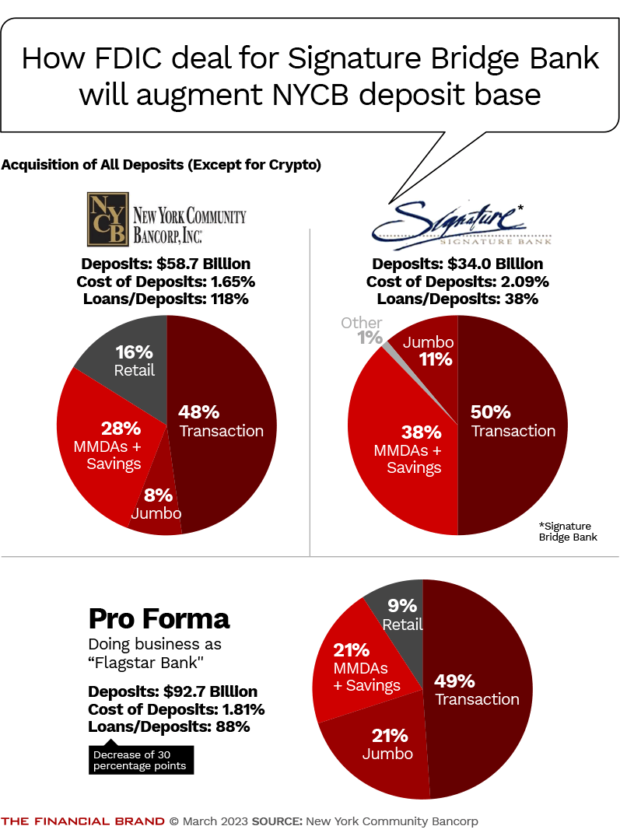

On March 20, 2023, New York Community Bancorp agreed to purchase $38.3 billion of Signature Bank's assets, while $60 billion remained in receivership with the FDIC. Signature Bank's branches currently operate under a subsidiary of New York Community Bank known as Flagstar Bank.Signature Bank was shut down by federal regulators on March 12, 2023. The bank's failure resulted from regulator concern about depositors withdrawing large amounts of money after the failure of Silicon Valley Bank (SVB) and the fear of continued contagion.On March 12, 2023, Signature Bank, New York, NY, was closed by the New York State Department of Financial Services and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. No advance notice is given to the public when a financial institution is closed.

Who is the owner of Signature Bank : Alex Otti

Alex Otti, the founder of the bank said that the Bank will do things differently in a bid to redefine the industry and impact on the lives of customers through seamless access to financial services, while leveraging flexible digital solutions and tailor-made services. Dr.

Who is next after Signature Bank

Flagstar Bank

After the failure of Signature Bank on March 12, the FDIC temporarily took over the bank's deposits and worked to find a new institution to acquire it. The FDIC announced today that Flagstar Bank, a subsidiary of New York Community Bancorp., will acquire Signature's deposits and branches.

When did Signature Bank shut down : Regulators closed Signature on March 12, two days after Silicon Valley Bank was shuttered following $42 billion in deposit outflows in a single day.

All depositors of the institution will be made whole.

The transfer of all Signature Bank deposits to Signature Bridge Bank, N.A. was completed, and full-service banking activities, including online banking, were resumed at Signature Bridge Bank, N.A. (www.signatureny.com) on Monday, March 13, 2023. SBNY was the 29th largest bank in the country, and its failure constituted the third largest bank failure in United States history. As of March 19, 2023, the FDIC estimated the cost of SBNY's failure to the Deposit Insurance Fund (DIF) to be approximately $2.5 billion.

What happens to SBNY stock holders

New York state regulators took control of Signature Bank Sunday, effectively wiping out shareholders. All depositors will be made whole, but shareholders and some unsecured debt-holders will not be protected, according to a statement by federal regulators.The average one-year price target for Signature Bank is $147.9. The forecasts range from a low of $146.45 to a high of $152.25. A stock's price target is the price at which analysts consider it fairly valued with respect to its projected earnings and historical earnings.Total debt on the balance sheet as of December 2022 : $12.13 B. The collapse of Signature Bank was due to “poor management,” according to a report from the Federal Deposit Insurance Corporation released Friday. Bank management “did not always heed FDIC examiner concerns, and was not always responsive or timely in addressing FDIC supervisory recommendations,” the report said.

Why did SVB fail : The collapse happened for multiple reasons, including a lack of diversification and a classic bank run, where many customers withdrew their deposits simultaneously due to fears of the bank's solvency. Many of SVB's depositors were startup companies.

Why shut down Signature Bank : The bank's connections with cryptocurrency seem to have spooked depositors after Silicon Valley Bank collapsed, prompting a run on the bank's deposits which, in turn, prompted action from regulators. Signature was taken over by New York Department of Banking Services on Sunday.

How stable is Signature Bank

In its Material Loss Review, Cotton determined: • Signature Bank failed due to insufficient liquidity and contingency funding mechanisms and inadequate risk management practices by bank management; • The FDIC missed opportunities to downgrade Signature Bank's Management component rating and further escalate supervisory … The news: Last Friday, Pennsylvania financial regulators seized and shut down Philadelphia-based Republic First Bank in the first FDIC-insured bank failure of 2024.For the most part, if you keep your money at an institution that's FDIC-insured, your money is safe — at least up to $250,000 in accounts at the failing institution. You're guaranteed that $250,000, and if the bank is acquired, even amounts over the limit may be smoothly transferred to the new bank.

Is my Signature Bank stock worthless : The Nasdaq-listed stock traded at just 1 cent. In case you don't remember, Signature Bank had gotten shipwrecked in March 2023, alongside the other infamous "crypto-deposit banks", Silvergate Bank and First Republic Bank. Its stock had to be considered worthless, at least by conventional wisdom.

Antwort Does Signature Bank still exist? Weitere Antworten – What is Signature Bank now called

On March 20, 2023, New York Community Bancorp agreed to purchase $38.3 billion of Signature Bank's assets, while $60 billion remained in receivership with the FDIC. Signature Bank's branches currently operate under a subsidiary of New York Community Bank known as Flagstar Bank.Signature Bank was shut down by federal regulators on March 12, 2023. The bank's failure resulted from regulator concern about depositors withdrawing large amounts of money after the failure of Silicon Valley Bank (SVB) and the fear of continued contagion.On March 12, 2023, Signature Bank, New York, NY, was closed by the New York State Department of Financial Services and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. No advance notice is given to the public when a financial institution is closed.

Who is the owner of Signature Bank : Alex Otti

Alex Otti, the founder of the bank said that the Bank will do things differently in a bid to redefine the industry and impact on the lives of customers through seamless access to financial services, while leveraging flexible digital solutions and tailor-made services. Dr.

Who is next after Signature Bank

Flagstar Bank

After the failure of Signature Bank on March 12, the FDIC temporarily took over the bank's deposits and worked to find a new institution to acquire it. The FDIC announced today that Flagstar Bank, a subsidiary of New York Community Bancorp., will acquire Signature's deposits and branches.

When did Signature Bank shut down : Regulators closed Signature on March 12, two days after Silicon Valley Bank was shuttered following $42 billion in deposit outflows in a single day.

All depositors of the institution will be made whole.

The transfer of all Signature Bank deposits to Signature Bridge Bank, N.A. was completed, and full-service banking activities, including online banking, were resumed at Signature Bridge Bank, N.A. (www.signatureny.com) on Monday, March 13, 2023.

SBNY was the 29th largest bank in the country, and its failure constituted the third largest bank failure in United States history. As of March 19, 2023, the FDIC estimated the cost of SBNY's failure to the Deposit Insurance Fund (DIF) to be approximately $2.5 billion.

What happens to SBNY stock holders

New York state regulators took control of Signature Bank Sunday, effectively wiping out shareholders. All depositors will be made whole, but shareholders and some unsecured debt-holders will not be protected, according to a statement by federal regulators.The average one-year price target for Signature Bank is $147.9. The forecasts range from a low of $146.45 to a high of $152.25. A stock's price target is the price at which analysts consider it fairly valued with respect to its projected earnings and historical earnings.Total debt on the balance sheet as of December 2022 : $12.13 B.

The collapse of Signature Bank was due to “poor management,” according to a report from the Federal Deposit Insurance Corporation released Friday. Bank management “did not always heed FDIC examiner concerns, and was not always responsive or timely in addressing FDIC supervisory recommendations,” the report said.

Why did SVB fail : The collapse happened for multiple reasons, including a lack of diversification and a classic bank run, where many customers withdrew their deposits simultaneously due to fears of the bank's solvency. Many of SVB's depositors were startup companies.

Why shut down Signature Bank : The bank's connections with cryptocurrency seem to have spooked depositors after Silicon Valley Bank collapsed, prompting a run on the bank's deposits which, in turn, prompted action from regulators. Signature was taken over by New York Department of Banking Services on Sunday.

How stable is Signature Bank

In its Material Loss Review, Cotton determined: • Signature Bank failed due to insufficient liquidity and contingency funding mechanisms and inadequate risk management practices by bank management; • The FDIC missed opportunities to downgrade Signature Bank's Management component rating and further escalate supervisory …

The news: Last Friday, Pennsylvania financial regulators seized and shut down Philadelphia-based Republic First Bank in the first FDIC-insured bank failure of 2024.For the most part, if you keep your money at an institution that's FDIC-insured, your money is safe — at least up to $250,000 in accounts at the failing institution. You're guaranteed that $250,000, and if the bank is acquired, even amounts over the limit may be smoothly transferred to the new bank.

Is my Signature Bank stock worthless : The Nasdaq-listed stock traded at just 1 cent. In case you don't remember, Signature Bank had gotten shipwrecked in March 2023, alongside the other infamous "crypto-deposit banks", Silvergate Bank and First Republic Bank. Its stock had to be considered worthless, at least by conventional wisdom.