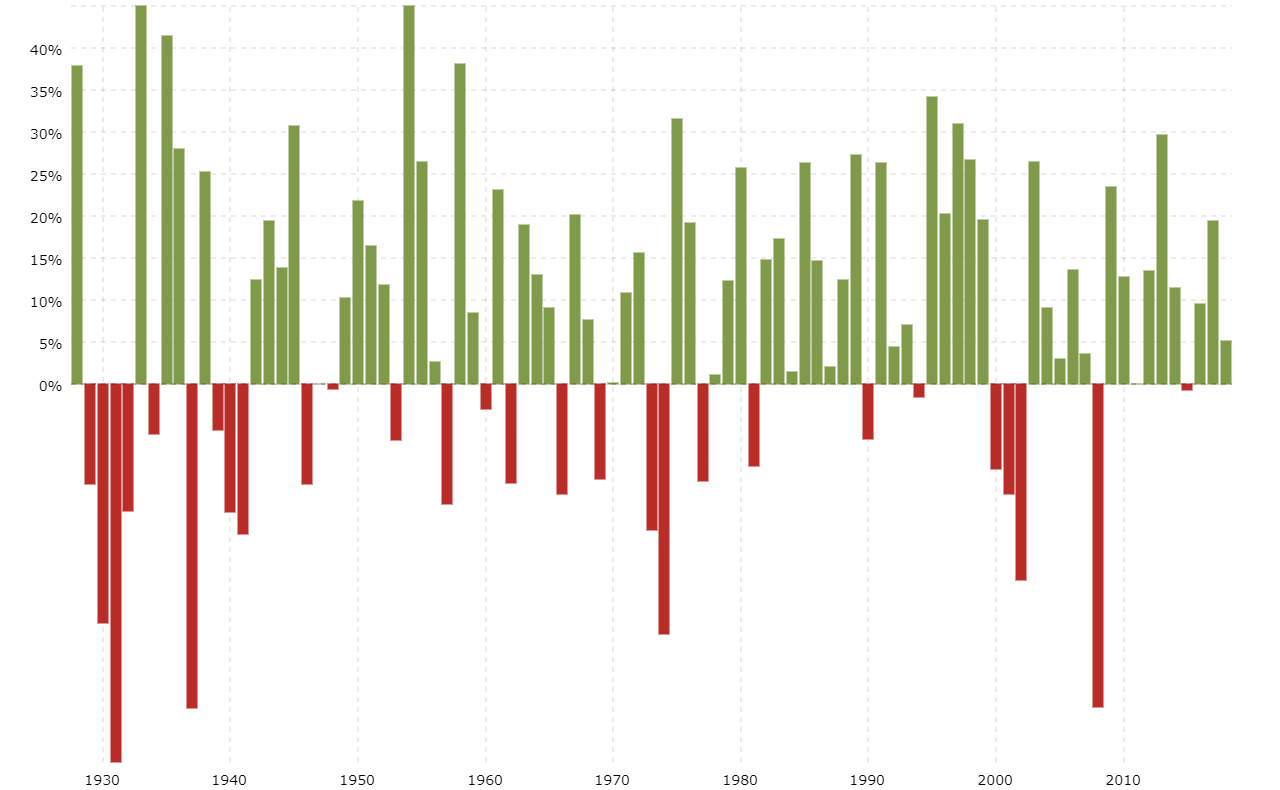

The average yearly return of the S&P 500 is 10.62% over the last 100 years, as of the end of April 2024. This assumes dividends are reinvested. Dividends account for about 40% of the total gain over this period. Adjusted for inflation, the 100-year average stock market return (including dividends) is 7.44%.Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.S&P 500 Return Details

Return Year

Price Return

Dividend Return

2021

26.89

1.82

2020

16.26

2.14

2019

28.88

2.61

2018

-6.24

1.86

Does the S&P 500 index include dividends : Does the S&P 500 Pay Dividends The S&P 500 is an index, so it does not pay dividends; however, there are mutual funds and exchange-traded funds (ETFs) that track the index, which you can invest in. If the companies in these funds pay dividends, you'll receive yours based on how many shares of the funds you hold.

Is the S&P 500 compounded annually

The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's 500® (S&P 500®) for the 10 years ending December 31st 2023, had an annual compounded rate of return of 15.2%, including reinvestment of dividends.

How much money can you make from stocks in a month : Well, there is no limit to how much you can make from stocks in a month. The money you can make by trading can run into thousands, lakhs, or even higher. A few key things that intraday profits depend on: How much capital are you putting in the markets daily

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498. Since 1926, the average annual total return for the S&P 500, an unmanaged index of large U.S. stocks, has been about 10%. Investments that offer the potential for higher rates of return also come with a higher degree of risk.

How much would I have earned if I invested in the S&P 500

Enter your expected rate of return. For a point of reference, the S&P 500 has a historical average annual total return of about 10%, not accounting for inflation. This doesn't mean you can expect 10% growth every year; you could experience a gain one year and a loss the next.S&P 500 Monthly Total Return is at -4.08%, compared to 3.22% last month and 1.56% last year. This is lower than the long term average of 0.70%. The S&P 500 Monthly Total Return is the investment return received each month, including dividends, when holding the S&P 500 index.A dividend is paid per share of stock. U.S. companies usually pay dividends quarterly, monthly or semiannually. The company announces when the dividend will be paid, the amount and the ex-dividend date. What happens when you invest $500 a month

Rate of return

10 years

20 years

4%

$72,000

$178,700

6%

$79,000

$220,700

8%

$86,900

$274,600

10%

$95,600

$343,700

15. 11. 2023

What if I invested $100 a month in S&P 500 : If you're still investing $100 per month, you'd have a total of around $518,000 after 35 years, compared to $325,000 in that time period with a 10% return. There are never any guarantees in the stock market, but with the right strategy, a little cash can go a long way.

Can you make $1,000 a month with stocks : Over time you'll find that your investment portfolio's base capital can, indeed, grow to hit your target. Making $1,000 per month in dividends will take patient investing – whether you're buying stocks or funds – or a lot of up-front capital. But with the right mix of yield and patience, you can get there.

How much to invest to make $1,000,000 in 10 years

In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%. Ten years ago, at market close on March 28, 2014, Tesla's stock was trading at $14.16 per share. This means that $10,000 invested in Tesla in March 2014 would be worth about $124,145 today. This means that if you had invested $120,954.87 in Tesla stock in 2014, you may have been able to sell it today and retire.One way to become a millionaire

Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time. $500 a month, for example, is less than 10% of the median U.S. household's monthly income.

What will 100k be worth in 30 years : Answer and Explanation: The amount of $100,000 will grow to $432,194.24 after 30 years at a 5% annual return. The amount of $100,000 will grow to $1,006,265.69 after 30 years at an 8% annual return.

Antwort Does S&P 500 pay me annually? Weitere Antworten – What is the average return of the S&P 500

10.62%

The average yearly return of the S&P 500 is 10.62% over the last 100 years, as of the end of April 2024. This assumes dividends are reinvested. Dividends account for about 40% of the total gain over this period. Adjusted for inflation, the 100-year average stock market return (including dividends) is 7.44%.Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.S&P 500 Return Details

Does the S&P 500 index include dividends : Does the S&P 500 Pay Dividends The S&P 500 is an index, so it does not pay dividends; however, there are mutual funds and exchange-traded funds (ETFs) that track the index, which you can invest in. If the companies in these funds pay dividends, you'll receive yours based on how many shares of the funds you hold.

Is the S&P 500 compounded annually

The actual rate of return is largely dependent on the types of investments you select. The Standard & Poor's 500® (S&P 500®) for the 10 years ending December 31st 2023, had an annual compounded rate of return of 15.2%, including reinvestment of dividends.

How much money can you make from stocks in a month : Well, there is no limit to how much you can make from stocks in a month. The money you can make by trading can run into thousands, lakhs, or even higher. A few key things that intraday profits depend on: How much capital are you putting in the markets daily

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Since 1926, the average annual total return for the S&P 500, an unmanaged index of large U.S. stocks, has been about 10%. Investments that offer the potential for higher rates of return also come with a higher degree of risk.

How much would I have earned if I invested in the S&P 500

Enter your expected rate of return. For a point of reference, the S&P 500 has a historical average annual total return of about 10%, not accounting for inflation. This doesn't mean you can expect 10% growth every year; you could experience a gain one year and a loss the next.S&P 500 Monthly Total Return is at -4.08%, compared to 3.22% last month and 1.56% last year. This is lower than the long term average of 0.70%. The S&P 500 Monthly Total Return is the investment return received each month, including dividends, when holding the S&P 500 index.A dividend is paid per share of stock. U.S. companies usually pay dividends quarterly, monthly or semiannually. The company announces when the dividend will be paid, the amount and the ex-dividend date.

What happens when you invest $500 a month

15. 11. 2023

What if I invested $100 a month in S&P 500 : If you're still investing $100 per month, you'd have a total of around $518,000 after 35 years, compared to $325,000 in that time period with a 10% return. There are never any guarantees in the stock market, but with the right strategy, a little cash can go a long way.

Can you make $1,000 a month with stocks : Over time you'll find that your investment portfolio's base capital can, indeed, grow to hit your target. Making $1,000 per month in dividends will take patient investing – whether you're buying stocks or funds – or a lot of up-front capital. But with the right mix of yield and patience, you can get there.

How much to invest to make $1,000,000 in 10 years

In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

Ten years ago, at market close on March 28, 2014, Tesla's stock was trading at $14.16 per share. This means that $10,000 invested in Tesla in March 2014 would be worth about $124,145 today. This means that if you had invested $120,954.87 in Tesla stock in 2014, you may have been able to sell it today and retire.One way to become a millionaire

Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time. $500 a month, for example, is less than 10% of the median U.S. household's monthly income.

What will 100k be worth in 30 years : Answer and Explanation: The amount of $100,000 will grow to $432,194.24 after 30 years at a 5% annual return. The amount of $100,000 will grow to $1,006,265.69 after 30 years at an 8% annual return.