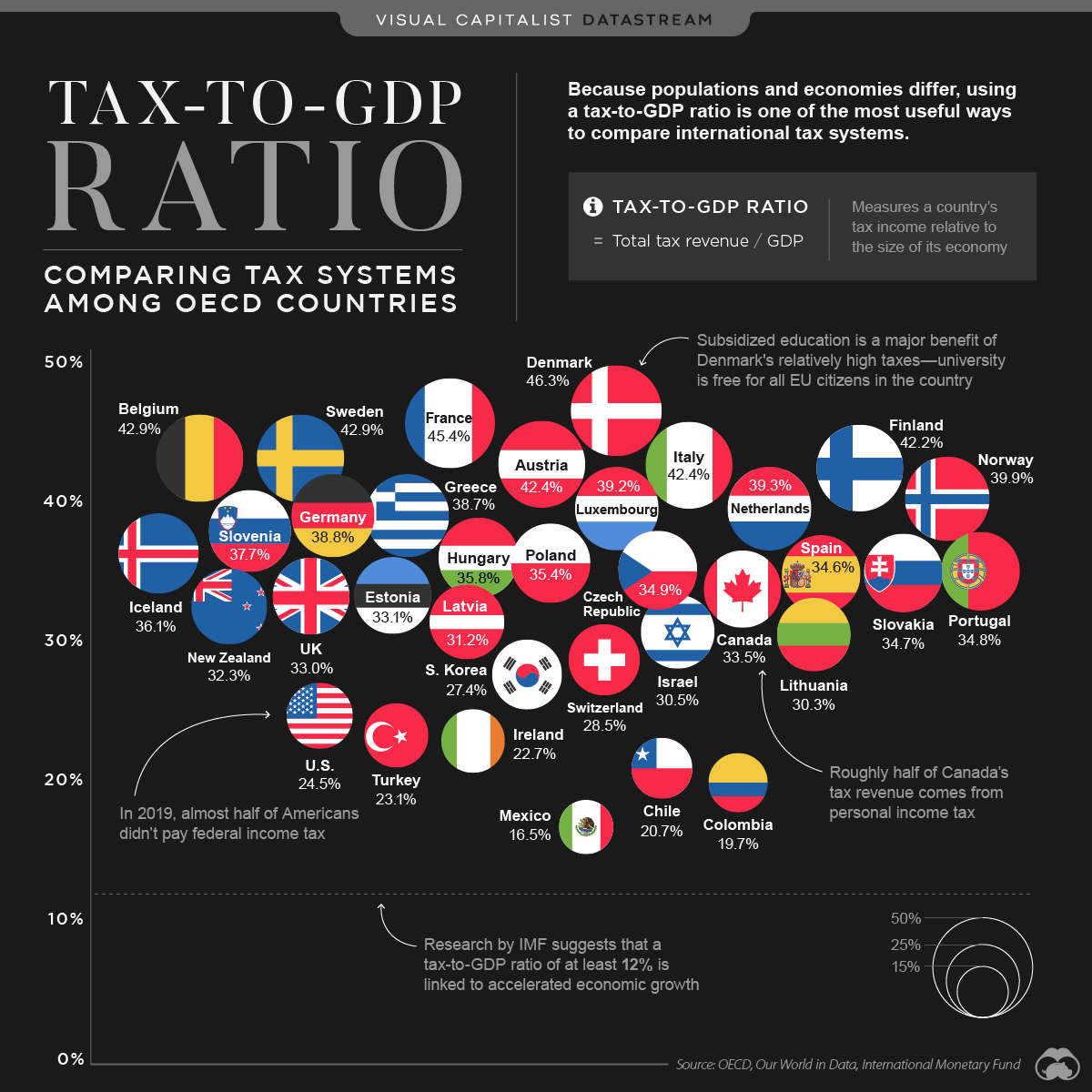

the USA ones may look unreasonable. In contrast to the US combined rate of 15.3%, European rates range between 13.97% (not including medical insurance and pension contributions) in Switzerland and a whopping 65-68% in France, based on the 2022 table by Trading Economics. Speaking about European taxes vs.Summary of the Forecast. Last year, the Czech economy teetered on the edge of recession. Gross domestic product fell by 0.3% in 2023, but is forecast to grow by 1.4% this year and 2.6% next year. Inflation will stay below 3% for most of 2024, before falling towards 2% in 2025.Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates.

How much money does the Czech Republic have : Economy of the Czech Republic

Country group

Advanced economy High-income economy Diversified European (EU) economy

How Cost of Living in Each State Compares to European Countries – 2023 Study. While the Euro has long been more valuable than the American dollar, the cost of living in the United States is significantly higher than across Europe on average.

Are taxes higher in Germany or the USA : Tax rate in Germany compared to the US. The tax rates in Germany are generally higher than those in the US. For example, the top marginal income tax rate in Germany is 45%, compared to 37% in the US. However, there are a number of deductions and credits available in Germany that can reduce the overall tax burden.

The Czech Republic is a unitary parliamentary republic and developed country with an advanced, high-income social market economy. It is a welfare state with a European social model, universal health care and free-tuition university education. It ranks 32nd in the Human Development Index. Using GDP per capita at purchasing power parity (PPP), Bloomberg calculated that Czechia is close to catching up with the likes of Italy and Spain, whose GDP per capita at PPP is USD 56,905 (CZK 1.3 million) and USD 52,012 respectively. Czechia's current rate is USD 50,475.

Which EU country has the lowest taxes

Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.Ivory Coast

1. Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.Expatistan's cost of living calculator estimates that the Czech Republic is 42% cheaper to live in than the United States, 45% cheaper than the United Kingdom, 30% cheaper than Austria and 56% cheaper than Hong Kong. With a cost of living index of 28.2 on a scale that goes to 100, Hungary is the cheapest European country to live in — on our list for sure, and one of the cheapest on the whole continent. You're not going to find yourself stressing over rent like you might in Berlin, where you'd be forking out around €1,300.

Do you make more money in the US or Europe : Because Americans are also more productive per hour worked than most Europeans, their average incomes are higher than in all European countries bar Luxembourg, Ireland, Norway and Switzerland. Earning more is, in part, an American choice that is not shared by other nations.

Is the Czech Republic rich or poor : The Czech Republic is considered an advanced economy with high living standards. The country compares favorably to the rest of the world for inequality-adjusted human development, according to the United Nations.

Is Czechia a 2nd world country

Czechia is, according to Moody's Rating of the development of countries, a first world country. During communism, we were a second world country. And again, up until communism, we were a first world country. The Czech Republic is considered an advanced economy with high living standards. The country compares favorably to the rest of the world for inequality-adjusted human development, according to the United Nations.Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Which country has the highest tax : Ivory Coast

The long-troubled West African country, Ivory Coast, has the highest income tax rate in the world. People living there are giving away a whopping 60% of their income to the government. That doesn't have to be the case.

Antwort Does Europe have higher taxes than US? Weitere Antworten – What is the tax rate in Europe compared to the US

the USA ones may look unreasonable. In contrast to the US combined rate of 15.3%, European rates range between 13.97% (not including medical insurance and pension contributions) in Switzerland and a whopping 65-68% in France, based on the 2022 table by Trading Economics. Speaking about European taxes vs.Summary of the Forecast. Last year, the Czech economy teetered on the edge of recession. Gross domestic product fell by 0.3% in 2023, but is forecast to grow by 1.4% this year and 2.6% next year. Inflation will stay below 3% for most of 2024, before falling towards 2% in 2025.Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates.

How much money does the Czech Republic have : Economy of the Czech Republic

Is it cheaper to live in Europe than America

How Cost of Living in Each State Compares to European Countries – 2023 Study. While the Euro has long been more valuable than the American dollar, the cost of living in the United States is significantly higher than across Europe on average.

Are taxes higher in Germany or the USA : Tax rate in Germany compared to the US. The tax rates in Germany are generally higher than those in the US. For example, the top marginal income tax rate in Germany is 45%, compared to 37% in the US. However, there are a number of deductions and credits available in Germany that can reduce the overall tax burden.

The Czech Republic is a unitary parliamentary republic and developed country with an advanced, high-income social market economy. It is a welfare state with a European social model, universal health care and free-tuition university education. It ranks 32nd in the Human Development Index.

Using GDP per capita at purchasing power parity (PPP), Bloomberg calculated that Czechia is close to catching up with the likes of Italy and Spain, whose GDP per capita at PPP is USD 56,905 (CZK 1.3 million) and USD 52,012 respectively. Czechia's current rate is USD 50,475.

Which EU country has the lowest taxes

Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.Ivory Coast

1. Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.Expatistan's cost of living calculator estimates that the Czech Republic is 42% cheaper to live in than the United States, 45% cheaper than the United Kingdom, 30% cheaper than Austria and 56% cheaper than Hong Kong.

With a cost of living index of 28.2 on a scale that goes to 100, Hungary is the cheapest European country to live in — on our list for sure, and one of the cheapest on the whole continent. You're not going to find yourself stressing over rent like you might in Berlin, where you'd be forking out around €1,300.

Do you make more money in the US or Europe : Because Americans are also more productive per hour worked than most Europeans, their average incomes are higher than in all European countries bar Luxembourg, Ireland, Norway and Switzerland. Earning more is, in part, an American choice that is not shared by other nations.

Is the Czech Republic rich or poor : The Czech Republic is considered an advanced economy with high living standards. The country compares favorably to the rest of the world for inequality-adjusted human development, according to the United Nations.

Is Czechia a 2nd world country

Czechia is, according to Moody's Rating of the development of countries, a first world country. During communism, we were a second world country. And again, up until communism, we were a first world country.

The Czech Republic is considered an advanced economy with high living standards. The country compares favorably to the rest of the world for inequality-adjusted human development, according to the United Nations.Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Which country has the highest tax : Ivory Coast

The long-troubled West African country, Ivory Coast, has the highest income tax rate in the world. People living there are giving away a whopping 60% of their income to the government. That doesn't have to be the case.