Over 120 years later, the Dow, as it is often called, is one of the most-cited indices in the world and is often considered a barometer of the US economy.No. The Dow represents only a narrow slice of the economy. Professional investors tend to look at broader measures of the market, such as the S&P 500 index, which has nearly 17 times the number of companies within it.S&P Dow Jones Indices

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

What is the Dow Jones vs Nasdaq : The Dow does include stocks on both the NYSE as well as the Nasdaq, whereas any Nasdaq indexes will include only stocks listed on Nasdaq exchanges. Investors can gain exposure to both the Dow and the Nasdaq by investing in index funds that track the indexes. S&P Dow Jones Indices.

Can the Dow hit $40,000

The Dow crossed its latest 10,000 point threshold briefly on Thursday and closed above 40,000 Friday — at 40,003.59 to be exact. It took about three and a half years to make the leap from 30,000 points, which it first crossed in November 2020.

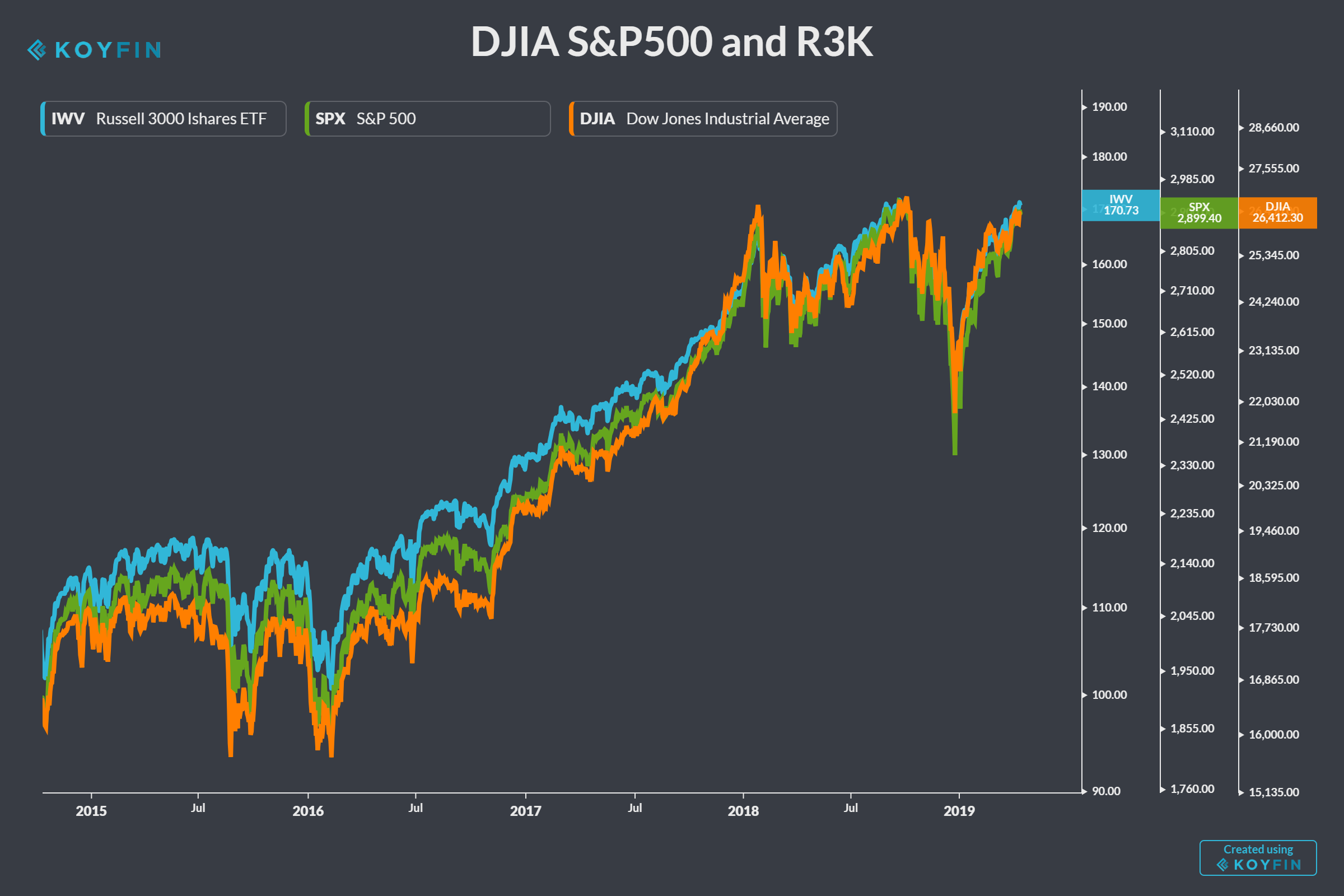

Why is S&P better than Dow : Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks. S&P Global

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

Why is it called Nasdaq

The Nasdaq Stock Market, or simply Nasdaq, is the second-largest stock exchange in the world for investors looking to buy and sell shares of stock. Nasdaq was initially an acronym, NASDAQ, which stands for the National Association of Securities Dealers Automated Quotations.The S&P 500 tracks top companies in leading industries in the large-cap segment of the market as well. All of the stocks in The Dow are typically included in the S&P 500, where they generally make up between 25% and 30% of its market value.Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies. Dow All-Time Highs

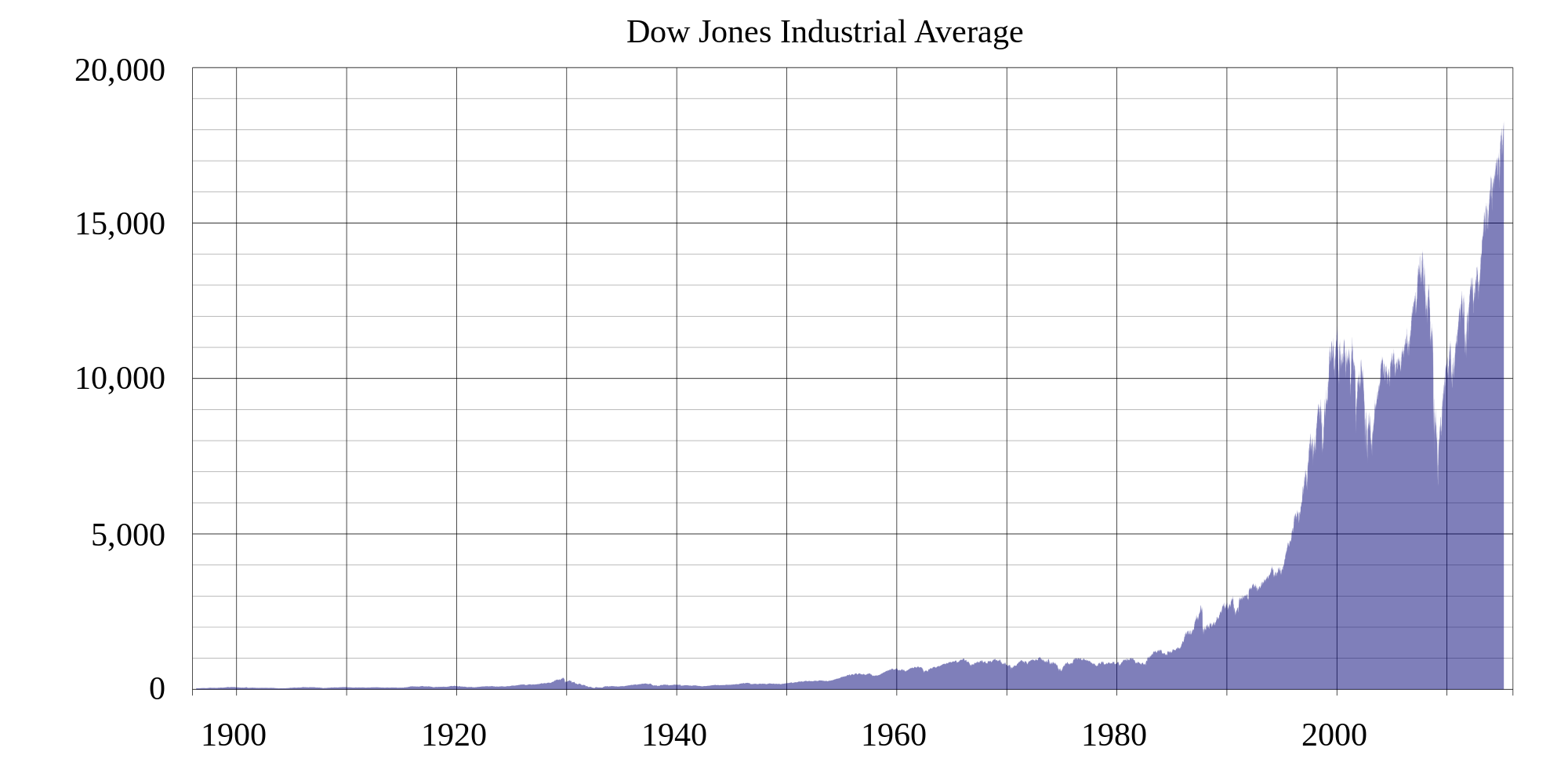

By the end of 2023, the previous high, registered in January 2022, had been surpassed, and the 37,000 mark had been breached. The Dow then climbed above 38,000 in January 2024. 1 The index reached a new all-time high on May 16, 2024, surpassing 40,000 for the first time.

When did Dow hit $5,000 : 1995: Dow cracks 5,000

But the Dow didn't officially close above it until Nov. 21 of that year. With a gain of more than 33%, 1995 marked the Dow's best year since 1975 and is still its sixth best in history. At this point, the stock market crash of 1987 known as Black Monday was almost a decade in the past.

Is Dow safer than S&P : They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Should I invest in S&P 500 or Dow

Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies. However, its bankruptcy following the financial crisis led to its removal. Since then, the Dow has gone more than a decade without representation from the auto industry. Many investors note that Tesla's potential goes well beyond its vehicle manufacturing. For now, though, Tesla is squarely focused on cars and trucks.Key Takeaways. The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

What is the Dow vs S&P 500 : A key difference between The Dow and the S&P 500 is the method used to weight the constituent stocks of each index. The Dow is price-weighted. This means that price changes in the highest-priced stocks have greater impact on the index level than price changes in the lower-priced stocks.

Antwort Does Dow Jones still exist? Weitere Antworten – Is the Dow still relevant

Over 120 years later, the Dow, as it is often called, is one of the most-cited indices in the world and is often considered a barometer of the US economy.No. The Dow represents only a narrow slice of the economy. Professional investors tend to look at broader measures of the market, such as the S&P 500 index, which has nearly 17 times the number of companies within it.S&P Dow Jones Indices

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

What is the Dow Jones vs Nasdaq : The Dow does include stocks on both the NYSE as well as the Nasdaq, whereas any Nasdaq indexes will include only stocks listed on Nasdaq exchanges. Investors can gain exposure to both the Dow and the Nasdaq by investing in index funds that track the indexes. S&P Dow Jones Indices.

Can the Dow hit $40,000

The Dow crossed its latest 10,000 point threshold briefly on Thursday and closed above 40,000 Friday — at 40,003.59 to be exact. It took about three and a half years to make the leap from 30,000 points, which it first crossed in November 2020.

Why is S&P better than Dow : Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.

:max_bytes(150000):strip_icc()/understanding-the-dow-jones-industrial-average-djia-357912_FINAL2-890e2a00a02e42cd82a803fec71d62fa.png)

S&P Global

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

Why is it called Nasdaq

The Nasdaq Stock Market, or simply Nasdaq, is the second-largest stock exchange in the world for investors looking to buy and sell shares of stock. Nasdaq was initially an acronym, NASDAQ, which stands for the National Association of Securities Dealers Automated Quotations.The S&P 500 tracks top companies in leading industries in the large-cap segment of the market as well. All of the stocks in The Dow are typically included in the S&P 500, where they generally make up between 25% and 30% of its market value.Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

Dow All-Time Highs

By the end of 2023, the previous high, registered in January 2022, had been surpassed, and the 37,000 mark had been breached. The Dow then climbed above 38,000 in January 2024. 1 The index reached a new all-time high on May 16, 2024, surpassing 40,000 for the first time.

When did Dow hit $5,000 : 1995: Dow cracks 5,000

But the Dow didn't officially close above it until Nov. 21 of that year. With a gain of more than 33%, 1995 marked the Dow's best year since 1975 and is still its sixth best in history. At this point, the stock market crash of 1987 known as Black Monday was almost a decade in the past.

Is Dow safer than S&P : They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Should I invest in S&P 500 or Dow

Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

However, its bankruptcy following the financial crisis led to its removal. Since then, the Dow has gone more than a decade without representation from the auto industry. Many investors note that Tesla's potential goes well beyond its vehicle manufacturing. For now, though, Tesla is squarely focused on cars and trucks.Key Takeaways. The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

What is the Dow vs S&P 500 : A key difference between The Dow and the S&P 500 is the method used to weight the constituent stocks of each index. The Dow is price-weighted. This means that price changes in the highest-priced stocks have greater impact on the index level than price changes in the lower-priced stocks.