The mere act of closing a bank account won't hurt your credit. But it might if your account isn't in good standing. If your account balance is negative, this information will show up on your ChexSystems report. ChexSystems gathers data about consumers' banking activity and sells it to financial institutions.As a regulated financial institution, 100% of your deposits are safeguarded.Your credit score is not directly affected by your checking and savings account activity. That includes account closures.

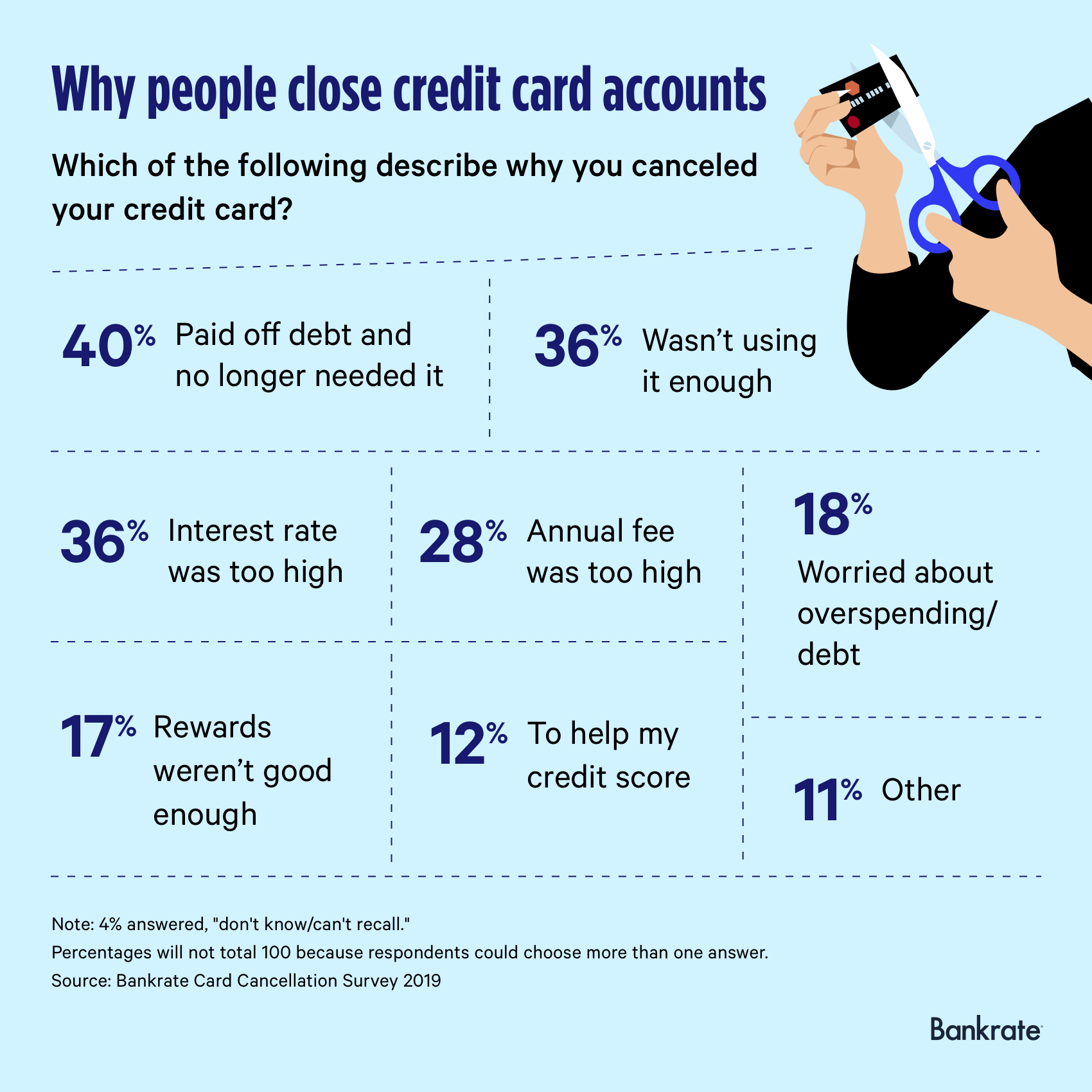

What happens when you close a credit card : Highlights: Closing a credit card could change your debt to credit utilization ratio, which may impact credit scores. Closing a credit card account you've had for a long time may impact the length of your credit history. Paid-off credit cards that aren't used for a certain period of time may be closed by the lender.

Is my money safe if Revolut goes bust

Safeguarding helps protect you. It means if we became insolvent (unable to pay our debts), you'll get your money first. Our customers' claims would be paid out from our dedicated client money bank and asset accounts, before anyone else's claims are paid out.

Can I trust Revolut : As a regulated bank, we secure your money through the Lithuanian State Company Deposit and Investment Insurance. It's a mouthful. Consider us your money's suit of armour.

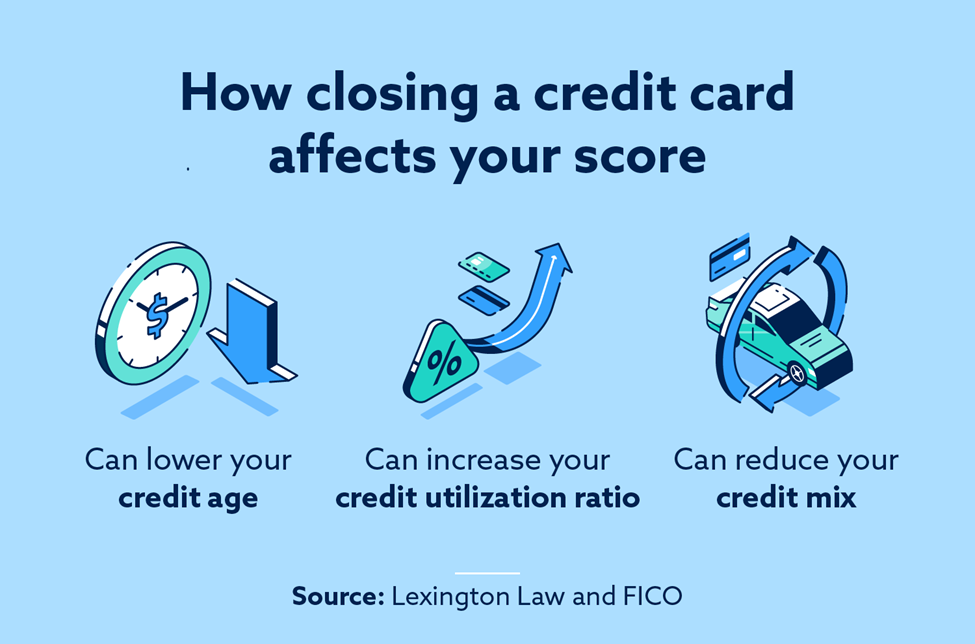

Closing a credit card could change your debt to credit utilization ratio, which may impact credit scores. Closing a credit card account you've had for a long time may impact the length of your credit history. Paid-off credit cards that aren't used for a certain period of time may be closed by the lender. Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.

Is it better to cancel unused credit cards or keep them

Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.Your credit utilization ratio goes up

By closing a credit card account with zero balance, you're removing all of that card's available balance from the ratio, in turn, increasing your utilization percentage. The higher your balance-to-limit ratio, the more it can hurt your credit.Nikolay Storonsky (born 21 July 1984) is a Russian-born British businessman. He is the co-founder and CEO of the financial technology company Revolut. When transferring substantial sums from your bank to your Revolut account, check your bank's payment limits for compliance and safety. Notably, funds held in Revolut are FDIC-insured. It provides coverage up to the legal maximum of 250,000 USD.

What are the disadvantages of Revolut : Revolut: Pros and Cons

Pros

Cons

Standard account with no subscription fee Spend in over 150 currencies Early direct deposit on Revolut Account ATM network access

Mobile app only Access to certain features depends on your plan Monthly fees for Premium and Metal ($9.99 and $16.99) Limited customer support

19. 1. 2024

Is it harmful to close a credit card : Closing a charge card won't affect your credit history (history is a factor in your overall credit score). Closing a credit card could hurt your credit score by increasing your credit utilization if you don't pay off all your balances.

Is it bad to close a credit card

Key takeaways: Closing a credit card can hurt your scores because it lowers your available credit and can lead to a higher credit utilization, meaning the gap between your spending and the amount of credit you can borrow narrows. Canceling a card can also decrease the average age of your accounts. Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.FCA investigating Revolut over transactions from 'suspicious' accounts. The Financial Conduct Authority (FCA) is reportedly looking into whether Revolut should have allowed transactions from suspicious accounts.

Is Wise or Revolut better : Customer ratings. Both money transfer companies are regarded highly by their users. Wise gets 4.3 out of 5 on Trustpilot from more than 218,000 reviews. Revolut has a rating of 4.2 out of 5 from 152,000 reviews.

Antwort Does closing a card hurt credit? Weitere Antworten – What happens when you close a checking account

The mere act of closing a bank account won't hurt your credit. But it might if your account isn't in good standing. If your account balance is negative, this information will show up on your ChexSystems report. ChexSystems gathers data about consumers' banking activity and sells it to financial institutions.As a regulated financial institution, 100% of your deposits are safeguarded.Your credit score is not directly affected by your checking and savings account activity. That includes account closures.

What happens when you close a credit card : Highlights: Closing a credit card could change your debt to credit utilization ratio, which may impact credit scores. Closing a credit card account you've had for a long time may impact the length of your credit history. Paid-off credit cards that aren't used for a certain period of time may be closed by the lender.

Is my money safe if Revolut goes bust

Safeguarding helps protect you. It means if we became insolvent (unable to pay our debts), you'll get your money first. Our customers' claims would be paid out from our dedicated client money bank and asset accounts, before anyone else's claims are paid out.

Can I trust Revolut : As a regulated bank, we secure your money through the Lithuanian State Company Deposit and Investment Insurance. It's a mouthful. Consider us your money's suit of armour.

Closing a credit card could change your debt to credit utilization ratio, which may impact credit scores. Closing a credit card account you've had for a long time may impact the length of your credit history. Paid-off credit cards that aren't used for a certain period of time may be closed by the lender.

Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.

Is it better to cancel unused credit cards or keep them

Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.Your credit utilization ratio goes up

By closing a credit card account with zero balance, you're removing all of that card's available balance from the ratio, in turn, increasing your utilization percentage. The higher your balance-to-limit ratio, the more it can hurt your credit.Nikolay Storonsky (born 21 July 1984) is a Russian-born British businessman. He is the co-founder and CEO of the financial technology company Revolut.

When transferring substantial sums from your bank to your Revolut account, check your bank's payment limits for compliance and safety. Notably, funds held in Revolut are FDIC-insured. It provides coverage up to the legal maximum of 250,000 USD.

What are the disadvantages of Revolut : Revolut: Pros and Cons

19. 1. 2024

Is it harmful to close a credit card : Closing a charge card won't affect your credit history (history is a factor in your overall credit score). Closing a credit card could hurt your credit score by increasing your credit utilization if you don't pay off all your balances.

Is it bad to close a credit card

Key takeaways: Closing a credit card can hurt your scores because it lowers your available credit and can lead to a higher credit utilization, meaning the gap between your spending and the amount of credit you can borrow narrows. Canceling a card can also decrease the average age of your accounts.

Credit experts advise against closing credit cards, even when you're not using them, for good reason. “Canceling a credit card has the potential to reduce your score, not increase it,” says Beverly Harzog, credit card expert and consumer finance analyst for U.S. News & World Report.FCA investigating Revolut over transactions from 'suspicious' accounts. The Financial Conduct Authority (FCA) is reportedly looking into whether Revolut should have allowed transactions from suspicious accounts.

Is Wise or Revolut better : Customer ratings. Both money transfer companies are regarded highly by their users. Wise gets 4.3 out of 5 on Trustpilot from more than 218,000 reviews. Revolut has a rating of 4.2 out of 5 from 152,000 reviews.