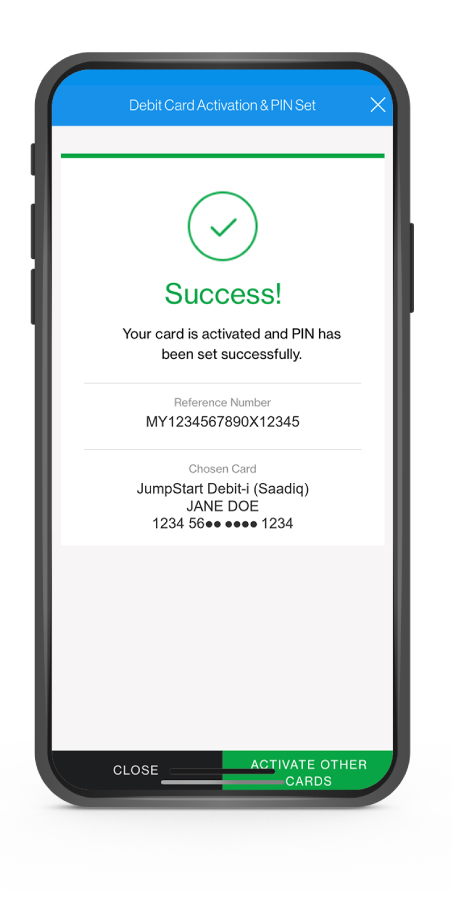

No matter where you bank, the process is similar. You can call the automated number on the card to activate it and set up your PIN number. Or, you can activate the card through your bank, by using it at an ATM, or by making a purchase anywhere Visa is accepted.Non-activated debit cards will have a white sticker across the top with a number to call to activate the card. Instructions on the sticker usually state to remove the sticker once the card has been activated. Assume that if there is no sticker on the card that it was activated.Before you can use a new credit card, you'll have to activate it. This usually cannot be done until you receive the card in the mail, unless you're using a virtual card. Once delivered, you'll want to open the envelope with your new credit card and follow the included instructions to activate it.

How long does it take for a credit card to activate : Whether you opt for Customer Care assistance, Internet Banking or iMobile Pay, you can activate your Credit Card easily in just five minutes and unlock its potential for various transactions.

Do new cards need to be activated

Note that you'll still need to activate your credit card first, for security purposes, using your credit card number and your date of birth. You can normally do this either online, through mobile banking or over the phone.

What happens if new card is not activated : You usually have 45-60 days to activate a new credit card before your credit card issuer sends you a message or cancels your account. Not activating may affect your credit score because your credit utilization ratio or credit mix may be impacted if your card issuer closes the account.

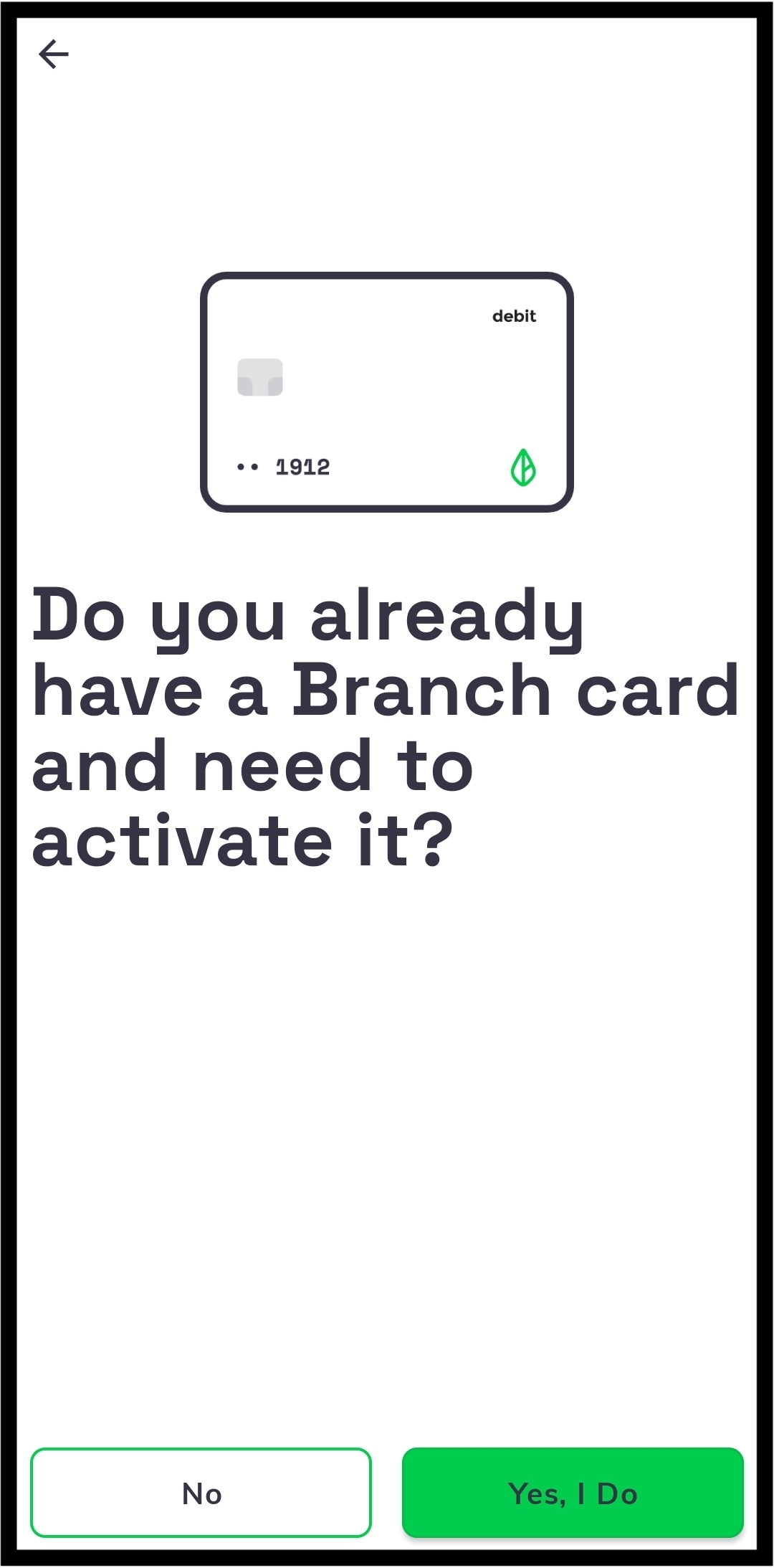

Yes, activating your debit card as soon as you receive it in the mail is a necessary step for you to use your card, and an important step to help protect yourself from fraud. Call customer service: You can call the phone number on the back of your credit card to reach customer service. You'll be able to check the status of your card and, if it is deactivated, you can ask about reactivation. Make a purchase: Another way to check if a card is active is to try and use it to make a purchase.

Can I use my card if its not activated

You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it.Yes, activating your debit card as soon as you receive it in the mail is a necessary step for you to use your card, and an important step to help protect yourself from fraud.You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it. And if you can't use it, you can't cash in on any introductory bonus offers tied to spending. Then, you need to activate your card within a specified period. Otherwise, the PIN becomes invalid, and you cannot make any transactions on the card until you generate a new PIN by visiting the Online SBI portal, ATM or bank branch.

Can a card be used without activation : You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it.

Can you use an unactivated card : If you don't activate your credit card, you won't be able to use it to make purchases.

Can an unactivated debit card be used

Unactivated cards may still work

If a new card arrives at your door unactivated, that doesn't necessarily mean it won't work. Unactivated cards can sometimes be used to make purchases. This is still the case today and cardholder experiences may vary between issuing banks. You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it.No, you can't use your credit card if you haven't activated it. This is a common question among new cardholders. The answer is straightforward: a credit card must be activated before use as a security measure. This ensures the person using the card is indeed the cardholder.

What happens if you use an unactivated card : This could have a negative affect on your credit score, since it is likely to reduce your available credit and increase your credit utilization ratio. In some cases, a credit card issuer will close an unactivated credit card on their own.

Antwort Does a card need to be activated? Weitere Antworten – How to activate a new card

No matter where you bank, the process is similar. You can call the automated number on the card to activate it and set up your PIN number. Or, you can activate the card through your bank, by using it at an ATM, or by making a purchase anywhere Visa is accepted.Non-activated debit cards will have a white sticker across the top with a number to call to activate the card. Instructions on the sticker usually state to remove the sticker once the card has been activated. Assume that if there is no sticker on the card that it was activated.Before you can use a new credit card, you'll have to activate it. This usually cannot be done until you receive the card in the mail, unless you're using a virtual card. Once delivered, you'll want to open the envelope with your new credit card and follow the included instructions to activate it.

How long does it take for a credit card to activate : Whether you opt for Customer Care assistance, Internet Banking or iMobile Pay, you can activate your Credit Card easily in just five minutes and unlock its potential for various transactions.

Do new cards need to be activated

Note that you'll still need to activate your credit card first, for security purposes, using your credit card number and your date of birth. You can normally do this either online, through mobile banking or over the phone.

What happens if new card is not activated : You usually have 45-60 days to activate a new credit card before your credit card issuer sends you a message or cancels your account. Not activating may affect your credit score because your credit utilization ratio or credit mix may be impacted if your card issuer closes the account.

Yes, activating your debit card as soon as you receive it in the mail is a necessary step for you to use your card, and an important step to help protect yourself from fraud.

Call customer service: You can call the phone number on the back of your credit card to reach customer service. You'll be able to check the status of your card and, if it is deactivated, you can ask about reactivation. Make a purchase: Another way to check if a card is active is to try and use it to make a purchase.

Can I use my card if its not activated

You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it.Yes, activating your debit card as soon as you receive it in the mail is a necessary step for you to use your card, and an important step to help protect yourself from fraud.You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it. And if you can't use it, you can't cash in on any introductory bonus offers tied to spending.

Then, you need to activate your card within a specified period. Otherwise, the PIN becomes invalid, and you cannot make any transactions on the card until you generate a new PIN by visiting the Online SBI portal, ATM or bank branch.

Can a card be used without activation : You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it.

Can you use an unactivated card : If you don't activate your credit card, you won't be able to use it to make purchases.

Can an unactivated debit card be used

Unactivated cards may still work

If a new card arrives at your door unactivated, that doesn't necessarily mean it won't work. Unactivated cards can sometimes be used to make purchases. This is still the case today and cardholder experiences may vary between issuing banks.

You won't be able to use the card

This may sound obvious, but if you don't activate your new credit card, you can't use it.No, you can't use your credit card if you haven't activated it. This is a common question among new cardholders. The answer is straightforward: a credit card must be activated before use as a security measure. This ensures the person using the card is indeed the cardholder.

What happens if you use an unactivated card : This could have a negative affect on your credit score, since it is likely to reduce your available credit and increase your credit utilization ratio. In some cases, a credit card issuer will close an unactivated credit card on their own.