Analysts suggest that the short-term dynamic is less favourable, and that the relationship between equity prices and inflation is (quite frequently) an inverse correlation – ie as inflation rises, stock prices fall, or as inflation falls, stock prices rise.How Does Inflation Affect Stocks Inflation hurts stocks overall because consumer spending drops. Value stocks may do well because their prices haven't kept up with their peers. Growth stocks tend to be shunned by investors.As inflation in a country rises, the central banks increase the interest rates to gain control. Higher interest rates erode market liquidity, resulting in a bearish condition with reduced stock prices. In such a scenario, most investors sell off their stocks to avoid huge losses.

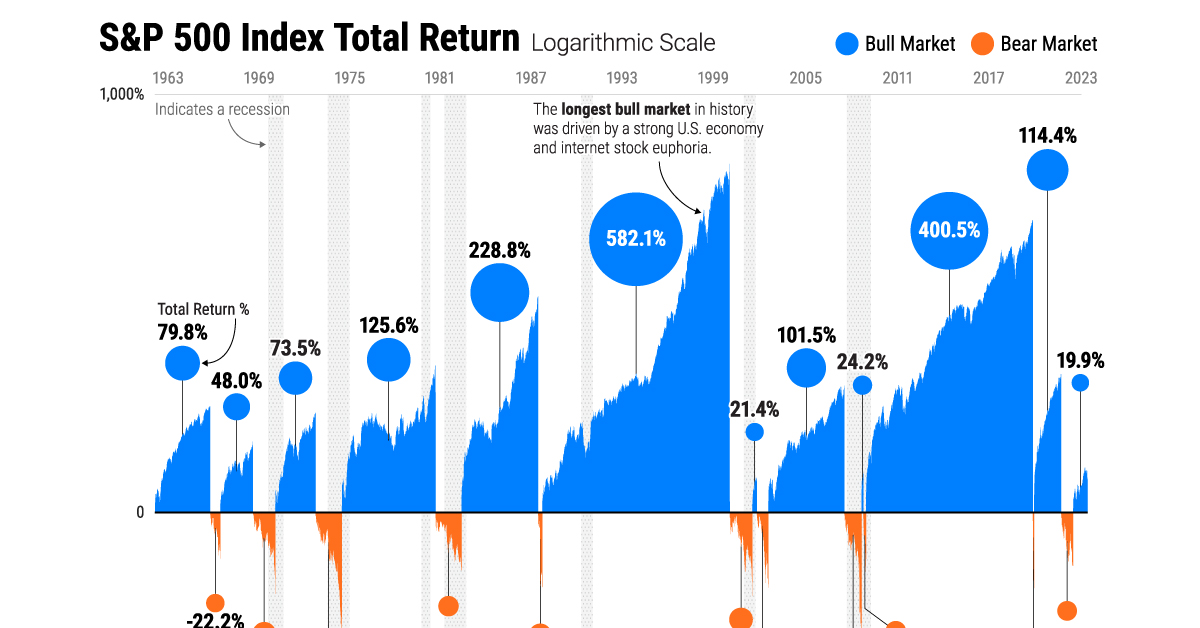

Does the stock market outpace inflation : So even though there may be market volatility caused by rising inflation in the short term, the stock market returns generally beat out the rate of inflation over the long run.

What are the worst investments during inflation

Cash, fixed-rate bonds and certain types of stocks are generally seen as poor investment choices during high inflation.

Cash.

Fixed-rate bonds.

Companies with weak pricing power.

TIPS.

Real estate or REITs.

Stocks with high pricing power.

Commodities.

How does inflation affect investing : The rate of inflation represents how quickly investments lose their real value and how quickly prices increase over time. Inflation also tells investors exactly how much of a return (in percentage terms) their investments need to make for them to maintain their standard of living.

What are the benefits of investing. Despite the recent stock market turbulence, history suggests that investing in assets such as shares has been a reliable way to grow your savings faster than inflation over the long term. So while money market accounts are safe investments, they really don't safeguard you from inflation.

What stock sectors do well in inflation

Energy, equity REITs,1 and financials are some of the equity sectors that could stand to benefit in an inflationary environment.By not just beating inflation and actually making a high return on your money, you can rest assured you have enough money for retirement, for a house deposit, and for the next generation. The stock market is the best place to beat inflation.Inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers. When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders. When there is inflation, people having stocks or shares of companies will benefit. Inflation is a situation where the money will be able to buy fewer goods than it was able to do so as the value of money comes down. People who have to repay their large debts will benefit from inflation.

Is it better to invest when inflation is high : So, in periods of high inflation, it really isn't worth holding cash. The returns on other investments such as stocks and bonds, however, can outpace inflation. Investing in these assets can generate significant wealth in the long term, so they should be seen as a viable alternative to cash.

How do you profit from inflation : Several asset classes perform well in inflationary environments. Tangible assets, like real estate and commodities, have historically been seen as inflation hedges. Some specialized securities can maintain a portfolio's buying power, including certain sector stocks, inflation-indexed bonds, and securitized debt.

Is it good to invest during inflation

Equities generally offer a reliable haven during inflationary times. That's because stocks historically tend to produce total returns that exceed inflation. And some stocks do better than others at fending off inflation. The middle class typically benefits from inflation because the middle class typically has a lot of debt. Think of someone who owes $100,000 on a $200,000 home. Inflation makes the home more valuable and the debt relatively less onerous. But Biden-era very high inflation is less helpful to the middle class.For investors, returns on investments should be at least as high as the inflation rate. Otherwise, their investments are losing money even if they gain in dollar value. Similarly, individuals should ensure that their salaries keep pace with inflation; otherwise, they are losing buying power.

Where should you put your money during inflation : Where to invest during high inflation

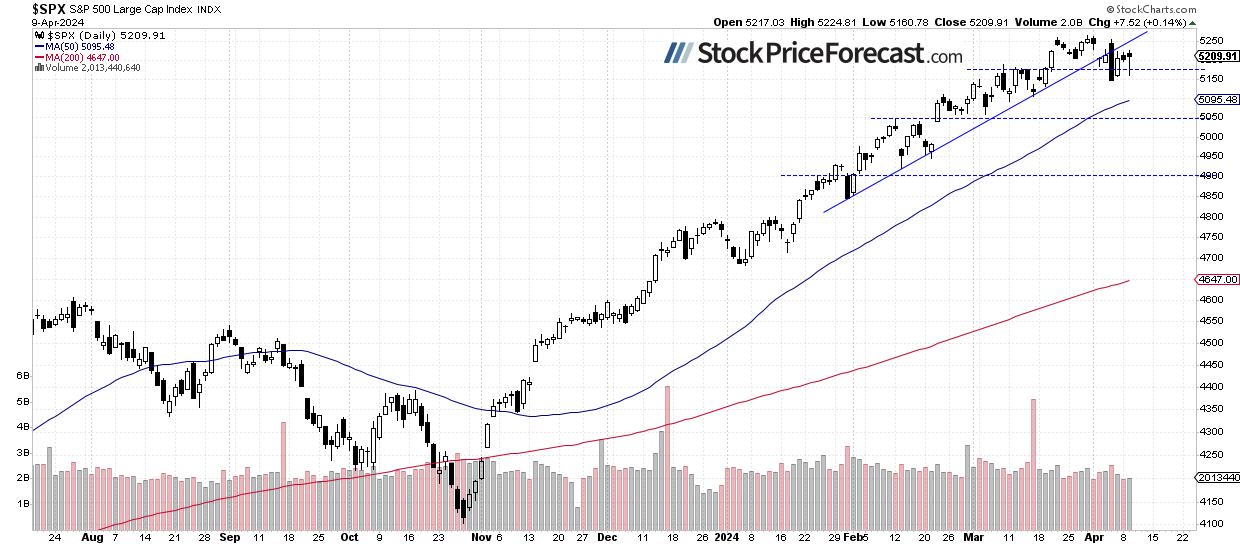

Stocks. Stocks have historically outpaced inflation—annualized returns have averaged about 10% historically.

Antwort Do stocks go up or down during high inflation? Weitere Antworten – Do stocks increase with inflation

Analysts suggest that the short-term dynamic is less favourable, and that the relationship between equity prices and inflation is (quite frequently) an inverse correlation – ie as inflation rises, stock prices fall, or as inflation falls, stock prices rise.How Does Inflation Affect Stocks Inflation hurts stocks overall because consumer spending drops. Value stocks may do well because their prices haven't kept up with their peers. Growth stocks tend to be shunned by investors.As inflation in a country rises, the central banks increase the interest rates to gain control. Higher interest rates erode market liquidity, resulting in a bearish condition with reduced stock prices. In such a scenario, most investors sell off their stocks to avoid huge losses.

Does the stock market outpace inflation : So even though there may be market volatility caused by rising inflation in the short term, the stock market returns generally beat out the rate of inflation over the long run.

What are the worst investments during inflation

Cash, fixed-rate bonds and certain types of stocks are generally seen as poor investment choices during high inflation.

How does inflation affect investing : The rate of inflation represents how quickly investments lose their real value and how quickly prices increase over time. Inflation also tells investors exactly how much of a return (in percentage terms) their investments need to make for them to maintain their standard of living.

What are the benefits of investing. Despite the recent stock market turbulence, history suggests that investing in assets such as shares has been a reliable way to grow your savings faster than inflation over the long term.

So while money market accounts are safe investments, they really don't safeguard you from inflation.

What stock sectors do well in inflation

Energy, equity REITs,1 and financials are some of the equity sectors that could stand to benefit in an inflationary environment.By not just beating inflation and actually making a high return on your money, you can rest assured you have enough money for retirement, for a house deposit, and for the next generation. The stock market is the best place to beat inflation.Inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers. When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders.

When there is inflation, people having stocks or shares of companies will benefit. Inflation is a situation where the money will be able to buy fewer goods than it was able to do so as the value of money comes down. People who have to repay their large debts will benefit from inflation.

Is it better to invest when inflation is high : So, in periods of high inflation, it really isn't worth holding cash. The returns on other investments such as stocks and bonds, however, can outpace inflation. Investing in these assets can generate significant wealth in the long term, so they should be seen as a viable alternative to cash.

How do you profit from inflation : Several asset classes perform well in inflationary environments. Tangible assets, like real estate and commodities, have historically been seen as inflation hedges. Some specialized securities can maintain a portfolio's buying power, including certain sector stocks, inflation-indexed bonds, and securitized debt.

Is it good to invest during inflation

Equities generally offer a reliable haven during inflationary times. That's because stocks historically tend to produce total returns that exceed inflation. And some stocks do better than others at fending off inflation.

The middle class typically benefits from inflation because the middle class typically has a lot of debt. Think of someone who owes $100,000 on a $200,000 home. Inflation makes the home more valuable and the debt relatively less onerous. But Biden-era very high inflation is less helpful to the middle class.For investors, returns on investments should be at least as high as the inflation rate. Otherwise, their investments are losing money even if they gain in dollar value. Similarly, individuals should ensure that their salaries keep pace with inflation; otherwise, they are losing buying power.

Where should you put your money during inflation : Where to invest during high inflation